Cold Brew Coffee Market Size 2025-2029

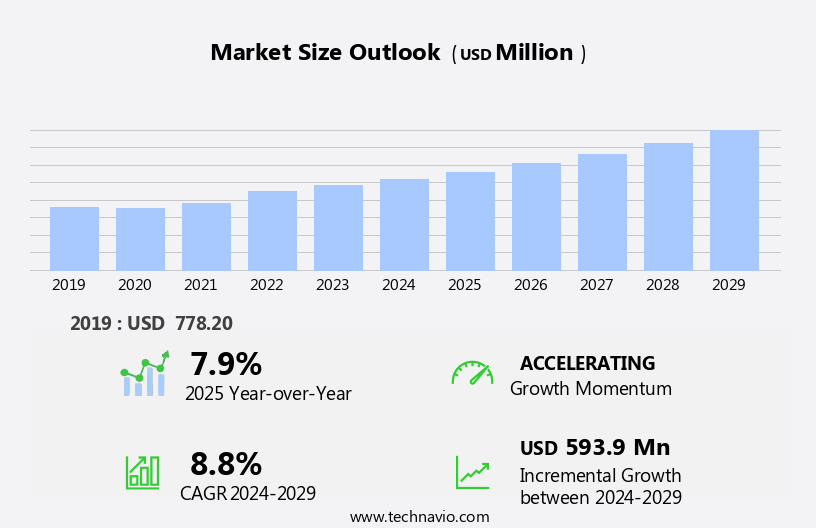

The cold brew coffee market size is forecast to increase by USD 593.9 million, at a CAGR of 8.8% between 2024 and 2029.

- The market witnesses several key trends and dynamics shaping its growth. Firstly, the increasing preference for instant coffee among millennials poses a significant challenge for cold brew coffee companies. This demographic shift towards convenience and on-the-go consumption patterns is driving the demand for instant coffee, which is often perceived as a more convenient alternative to traditional brewing methods. Secondly, the market is experiencing a surge in merger and acquisition activities between companies, reflecting the intensifying competition and consolidation efforts. This trend is expected to continue as companies seek to expand their product offerings, broaden their geographical reach, and enhance their market presence.

- Another notable trend in the market is the rising demand for substitute products, such as tea and kombucha, which are gaining popularity among health-conscious consumers. This shift towards alternative beverages poses a challenge for cold brew coffee companies, who must differentiate their offerings and cater to evolving consumer preferences to maintain their market share. In conclusion, the market is characterized by a dynamic and competitive landscape, with key trends including the increasing popularity of instant coffee among millennials, a surge in merger and acquisition activities, and the rising demand for substitute products. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of these trends and adapt their strategies accordingly.

What will be the Size of the Cold Brew Coffee Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by shifting consumer preferences and emerging trends. Premium coffee, with its rich, smooth flavor, has gained significant traction, leading to an increase in medium roast offerings. French press brewing, which allows for a fuller extraction of flavors, has also seen a resurgence in popularity. Direct trade and fair trade initiatives have become increasingly important, ensuring ethical sourcing and sustainable practices throughout the supply chain. Coffee packaging design plays a crucial role in maintaining the quality of cold brew coffee, with vacuum packaging and nitrogen infusion extending shelf life. Single-serve coffee solutions cater to the convenience-driven consumer, while sustainability initiatives, such as coffee waste management, reduce environmental impact.

Dark roast and flavored coffee variations offer unique taste profiles, catering to diverse consumer preferences. Coffee roasting techniques, including shade-grown and light roast, continue to influence the market. Sensory evaluation and supply chain management are key focus areas for ensuring consistent product quality. The market's ongoing dynamism is further reflected in the emergence of cold brew concentrate and coffee additives, as well as the adoption of milk alternatives and decaf coffee options. The coffee industry's continuous evolution is shaped by various factors, including extraction methods, seasonal coffee offerings, and the rise of specialty coffee shops and commercial coffee machines.

The market's adaptability and innovation ensure that it remains a vibrant and exciting sector.

How is this Cold Brew Coffee Industry segmented?

The cold brew coffee industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Arabica-based cold brew coffee

- Robusta-based cold brew coffee

- Liberica-based cold brew coffee

- Distribution Channel

- Offline

- Online

- Consumer Segment

- Household

- Commercial

- Packaging

- Cans

- Bottles

- Kegs

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

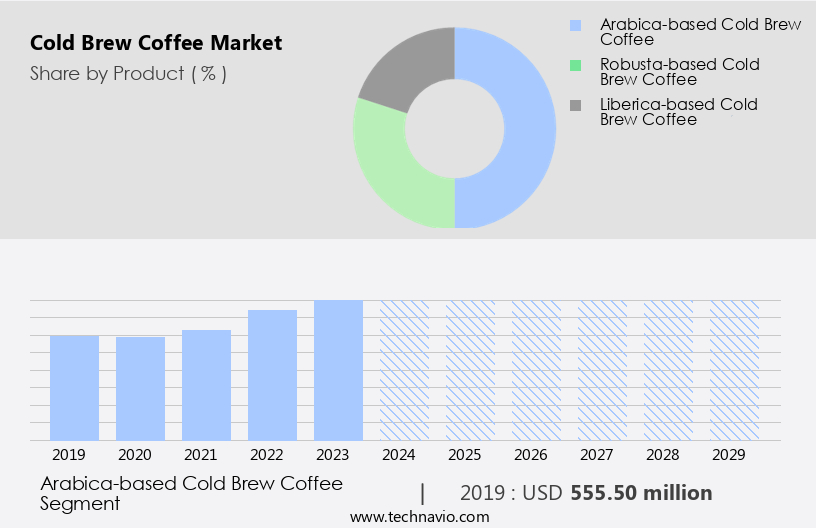

By Product Insights

The arabica-based cold brew coffee segment is estimated to witness significant growth during the forecast period.

The market is driven by the growing cafe culture and consumer preferences for high-quality, artisanal coffee beverages. Arabica beans, with their unique taste profile and lower caffeine content, dominate the market for cold brew coffee production. In 2024, the arabica-based cold brew coffee segment accounted for a significant market share. The market is moderately fragmented, with numerous regional players and a few global companies. Coffee packaging, from vacuum sealing to nitrogen infusion, plays a crucial role in preserving the coffee's freshness and flavor. Sustainability initiatives, such as fair trade and direct trade, are increasingly important to consumers and are prioritized by many companies.

Single-origin coffee, roasted to specific profiles like medium, dark, or light, adds complexity to the market. Commercial coffee machines, including French presses, pour-overs, and espresso machines, facilitate the production of cold brew coffee in various settings. Cold brew concentrate, coffee additives, and milk alternatives cater to diverse consumer preferences. Coffee retail, from specialty shops to mass market, offers various options for consumers. Coffee distribution channels, from wholesale to direct, ensure the coffee reaches consumers efficiently. Quality control, sensory evaluation, and supply chain management are essential for maintaining consistent product standards. Coffee roasting, from arabica to robusta, and bean sourcing influence the market dynamics.

Seasonal coffee offerings and organic coffee further enrich the market landscape.

The Arabica-based cold brew coffee segment was valued at USD 555.50 million in 2019 and showed a gradual increase during the forecast period.

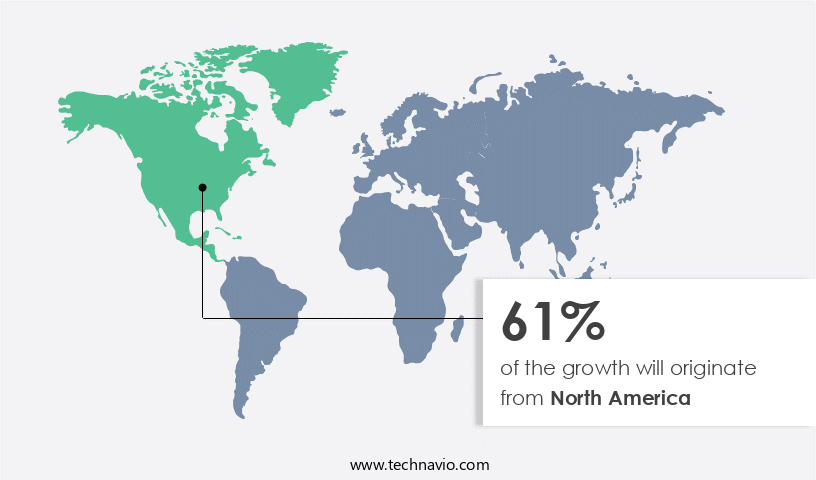

Regional Analysis

North America is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experiences significant growth due to the region's strong cafe culture and consumer preferences for this unique coffee brewing method. In 2024, the market was moderately fragmented, with numerous regional players and a few global companies. The US dominates this market, accounting for the largest revenue share. Key players in the North American the market include Califia Farms LLC, Station Cold Brew, HighBrew Coffee, Kohana Coffee, Starbucks Coffee Company, Nestle SA, and The Coca-Cola Co. These companies focus on various strategies such as quality control, sustainable coffee sourcing, and innovative coffee packaging designs to cater to evolving consumer preferences.

Cold brew coffee is often sold as a concentrate, which offers a longer shelf life due to its lower acidity compared to hot-brewed coffee. Vacuum packaging and nitrogen infusion are popular methods for preserving the coffee's freshness and flavor profile. Single-origin coffee beans and medium roast are popular choices among consumers, while direct trade and fair trade practices ensure ethical and sustainable bean sourcing. Premium coffee brands offer a wide range of coffee roasting profiles, including medium, dark, and light roasts, as well as flavored and decaf options. Commercial coffee machines, such as French presses and pour-overs, are commonly used for brewing cold brew coffee at home or in coffee shops.

Milk alternatives, such as oat milk and almond milk, are increasingly popular among consumers seeking plant-based options. Coffee shops and specialty coffee retailers offer a diverse range of cold brew coffee options, catering to various consumer preferences and sensitivities, including price sensitivity. Coffee marketing efforts focus on highlighting the benefits of cold brew coffee, such as its smooth taste and longer caffeine release. Cold brew coffee consumption continues to grow, with drip brewing and immersion brewing methods gaining popularity. In conclusion, the market in North America is dynamic and evolving, with a focus on innovation, sustainability, and consumer preferences.

Companies are investing in research and development to create new products and improve existing ones, while also implementing supply chain management strategies to ensure a consistent and high-quality product. Coffee roasting, bean sourcing, and coffee packaging design are essential aspects of the market, with a growing emphasis on sustainable and ethical practices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the thriving beverage industry, the market continues to gain popularity among consumers seeking a smooth, rich, and less acidic coffee experience. This market caters to coffee lovers who prefer a refreshing alternative to traditional hot brew methods. Cold brew coffee is made by steeping coarsely ground beans in cold water for an extended period, resulting in a concentrated and flavorful liquid. The cold brew coffee process preserves the beans' natural flavors and reduces bitterness. This method's versatility allows for various serving options, including diluted with water or milk, over ice, or as a base for coffee cocktails. Cold brew coffee's unique taste profile, convenience, and health benefits, such as lower acidity and potential caffeine boost, contribute to its growing demand. Consumers increasingly appreciate the market's wide range of offerings, from homemade to ready-to-drink products, and its accessibility in various retail channels. Cold brew coffee's distinctive taste and health advantages make it a compelling choice for coffee enthusiasts and health-conscious individuals alike.

What are the key market drivers leading to the rise in the adoption of Cold Brew Coffee Industry?

- The rising preference for convenience and on-the-go consumption among millennials is the primary factor fueling the increasing demand for instant coffee in the market.

- The market is experiencing significant growth due to the rising preference for this beverage among millennial consumers, particularly in major markets such as China and the US. Millennials have a higher spending power than baby boomers and are expected to increase their spending during the forecast period. Coffee consumption among millennials is on the rise, with instant coffee and flavored instant drinks being popular choices. In response, companies are introducing products that cater to this demographic. For instance, Starbucks offers three cold brew products globally: Nitro Cold Brew, Cold Brew Vanilla Sweet Cream, and Cappuccino Freddo.

- These offerings highlight the emphasis on quality and unique flavor profiles in the market. Coffee packaging plays a crucial role in maintaining the freshness and quality of cold brew coffee. Vacuum packaging and nitrogen infusion are common methods used to preserve the coffee's flavor. Commercial coffee machines and immersion brewing techniques are also essential for producing high-quality cold brew coffee. Despite the growing popularity of cold brew coffee, price sensitivity remains a key challenge for companies. Coffee advertising and marketing strategies are essential to attract and retain consumers in this competitive market. Overall, the market is expected to continue its growth trajectory due to evolving consumer preferences and innovative product offerings.

What are the market trends shaping the Cold Brew Coffee Industry?

- Market trends indicate a heightened frequency of mergers and acquisitions among market companies. This professional and knowledgeable observation underscores the current business landscape.

- The market is witnessing significant growth as companies seek to expand their product offerings and enter emerging markets. Mergers and acquisitions are a popular strategy for increasing market share, with larger companies acquiring smaller players to gain access to innovative cold brew coffee products at lower costs. For example, in 2023, Nestle SA announced the acquisition of a majority stake in a premium chocolate company in Brazil to expand its portfolio. Additionally, companies are growing their businesses through domestic and local expansion. Premium coffee brands are increasingly focusing on medium roast and dark roast options, as well as flavored and single-serve coffees, to cater to diverse consumer preferences.

- Sustainability initiatives, such as direct trade and fair trade, are also gaining popularity, as consumers demand more transparency in coffee sourcing and production. Coffee packaging design plays a crucial role in extending the shelf life of cold brew coffee, and companies are investing in nitrogen flushing and other preservation techniques to maintain the coffee's freshness. Shade-grown coffee, known for its rich flavor and sustainable farming practices, is also gaining traction in the market. Coffee roasting techniques, such as French press, are used to create unique and immersive coffee experiences for consumers. companies are prioritizing harmonious and striking coffee packaging designs to differentiate their products and appeal to consumers.

- Overall, the market is expected to continue its growth trajectory as consumers seek out high-quality, sustainable, and convenient coffee options.

What challenges does the Cold Brew Coffee Industry face during its growth?

- The surge in demand for substitute products poses a significant challenge to the industry's growth trajectory.

- The market has faced significant competition from various hot and cold beverages, including RTD coffees, espresso drinks, roast and ground coffee, soft drinks, carbonated drinks, nutritional and energy drinks, green tea, and iced tea. The increasing popularity of coffee pods and iced teas, as well as the proliferation of companies offering innovative flavors in the tea segments, have posed challenges to the growth of the market. However, there are several factors driving the market's expansion. The demand for decaf coffee and milk alternatives in coffee retail and specialty coffee shops is on the rise, and there is a growing trend towards sustainable coffee production and bean sourcing.

- Coffee marketing efforts emphasizing the immersive and harmonious experience of cold brew coffee brewing using various equipment, such as espresso machines and pour over methods, have also contributed to the market's growth. Sensory evaluation and supply chain management are crucial aspects of the market, ensuring the highest quality and consistency in the final product.

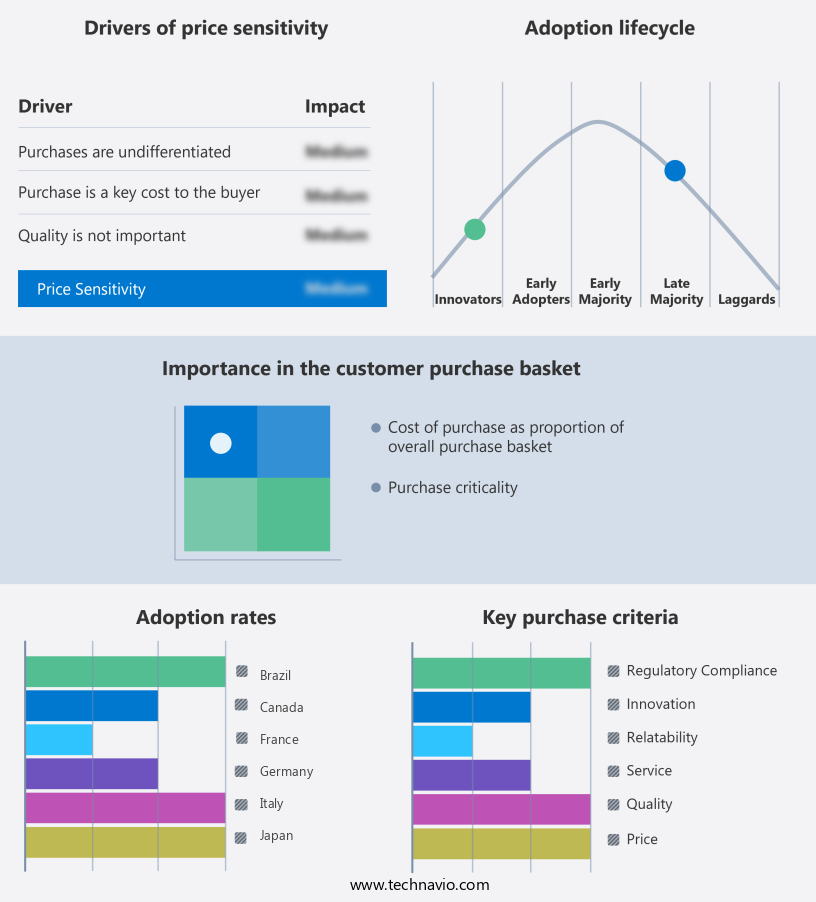

Exclusive Customer Landscape

The cold brew coffee market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cold brew coffee market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cold brew coffee market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Blue Bottle Coffee Inc. - This company specializes in premium cold brew coffee offerings, including Medium and Blonde roast Pure Black variants, Mocha with almondmilk, and Espresso with almondmilk. Our cold brew coffee selection caters to diverse tastes while maintaining a commitment to quality and originality, enhancing online visibility.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blue Bottle Coffee Inc.

- Califia Farms LLC

- Chameleon Cold-Brew

- Coca-Cola Company

- Counter Culture Coffee

- Dunkin' Brands Group Inc.

- High Brew Coffee

- JAB Holding Company

- Kohana Coffee

- La Colombe Coffee Roasters

- Nestlé S.A.

- Peet's Coffee

- PepsiCo Inc.

- RISE Brewing Co.

- Royal Cup Coffee

- Starbucks Corporation

- Stumptown Coffee Roasters

- The Coffee Bean & Tea Leaf

- Wandering Bear Coffee

- WhiteWave Foods (Danone)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cold Brew Coffee Market

- In January 2024, Starbucks Corporation, the world's largest coffeehouse chain, introduced its new cold brew nitro line in collaboration with Ball Corporation to expand its cold brew offerings (Starbucks Press Release, 2024). This strategic partnership aimed to capitalize on the growing demand for cold brew coffee, with Starbucks expecting to increase its cold brew sales by 20% (Starbucks Q3 2024 Earnings Call Transcript).

- In March 2024, JAB Holding Company, a leading consumer goods investment firm, acquired a majority stake in Peet's Coffee & Tea, a significant player in the specialty coffee market, for approximately USD1 billion (Peet's Coffee Press Release, 2024). This acquisition was part of JAB's ongoing efforts to strengthen its coffee portfolio, which includes Keurig Dr Pepper and Panera Brands.

- In April 2025, Dunkin' Brands, the parent company of Dunkin' Donuts and Baskin-Robbins, announced the launch of its new cold brew coffee on tap system in partnership with Kegstar, a keg leasing and supply chain solutions provider (Dunkin' Brands Press Release, 2025). This strategic move aimed to offer a more convenient and consistent cold brew experience for customers and increase sales during the summer months.

- In May 2025, Nestle, the world's largest food and beverage company, entered into a partnership with Blue Bottle Coffee, a leading specialty coffee roaster, to expand its Nescafe Dolce Gusto coffee capsule line with cold brew coffee offerings (Nestle Press Release, 2025). This collaboration aimed to tap into the growing demand for cold brew coffee and strengthen Nestle's presence in the single-serve coffee market.

Research Analyst Overview

- In the dynamic the market, profit margins remain substantial due to the unique production process and growing consumer preference. Brands strive to build loyalty through health benefits, such as lower acidity and higher antioxidant content, and various extraction methods like espresso and cold brew. Employee training and quality assurance are essential for customer satisfaction, driving the need for product development and innovation. Sustainability standards, harvesting techniques, and post-harvest processing are crucial factors in coffee production, influencing carbon footprint and energy consumption. New product launches, distribution channels, and digital marketing strategies are shaping the market, with online sales growing rapidly.

- Food safety and water usage are critical concerns, leading to market research on waste reduction and energy-efficient coffee processing plants. Pricing strategies and coffee regulations impact sales forecasts, while coffee certifications ensure ethical sourcing and transparency. Cafetière, Moka pot, and vacuum pot brewing methods continue to appeal to consumers, with caffeine content varying based on brewing time and coffee bean origin. Market trends include influencer marketing, content marketing, and the integration of technology in coffee production and distribution. Coffee farming and coffee imports face challenges due to changing weather patterns and increasing competition, necessitating innovation and collaboration.

- Drying methods, water usage, and quality assurance are essential aspects of coffee processing, with regulations and certifications ensuring compliance and consumer trust.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cold Brew Coffee Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 593.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cold Brew Coffee Market Research and Growth Report?

- CAGR of the Cold Brew Coffee industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cold brew coffee market growth of industry companies

We can help! Our analysts can customize this cold brew coffee market research report to meet your requirements.