Cold Chain Market Size 2025-2029

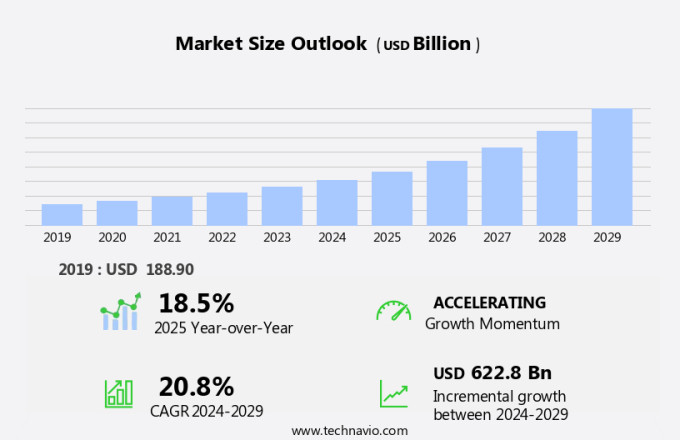

The cold chain market size is forecast to increase by USD 622.8 billion at a CAGR of 20.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends and factors. One such trend is the increasing adoption of Radio Frequency Identification (RFID) technology in cold chain logistics to enhance supply chain visibility and efficiency. Another trend is the rising number of mergers and acquisitions (M&A) activities among market players to expand their footprint and strengthen their market position.

- However, the lack of proper logistics and transportation infrastructure in developing countries poses a major challenge to the market growth. This report provides an in-depth analysis of these trends and growth factors, offering valuable insights into the current state and future direction of the market.

What will be the Cold Chain Market Size During the Forecast Period?

- The market plays a crucial role in ensuring the quality and safety of convenience food products, particularly those with a short shelf life, such as ready-to-eat food items and protein-rich foods. Retail chains have a significant impact on this market, as they require reliable and efficient cold chain infrastructure to maintain the freshness and quality of perishable items. Trade liberalization has led to an increase in cross-border commerce, expanding the market for cold chain solutions beyond domestic boundaries. The rise of online groceries and the digital food industry has further fueled the demand for refrigerated transportation and cold storage logistics.

- Similarly, spoilage and contamination are major concerns in the market, and energy-efficient technologies, such as refrigerated vehicles and advanced warehouse management systems, are being adopted to minimize these risks. Rising fuel costs have also led to the development of energy-efficient technologies, including IoT-enabled monitoring systems and cloud computing solutions. The refrigerated storage market is expected to grow significantly due to the increasing popularity of quick-frozen foods, bakery products, and carbohydrate-rich diets. Inventory management and warehouse optimization are essential aspects of cold chain logistics, and the use of advanced technologies, such as RFID tags and automated storage and retrieval systems, is becoming increasingly common.

-

In conclusion, the cold chain infrastructure is essential for maintaining the quality and safety of a wide range of perishable items, from food products to pharmaceuticals. The market for cold chain solutions is dynamic and constantly evolving, driven by factors such as changing consumer preferences, technological advancements, and regulatory requirements.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Refrigerated warehouse

- Refrigerated transportation

- Application

- Meat fish and seafood

- Fruits vegetables and beverages

- Dairy and frozen desserts

- Bakery and confectionery

- Healthcare

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

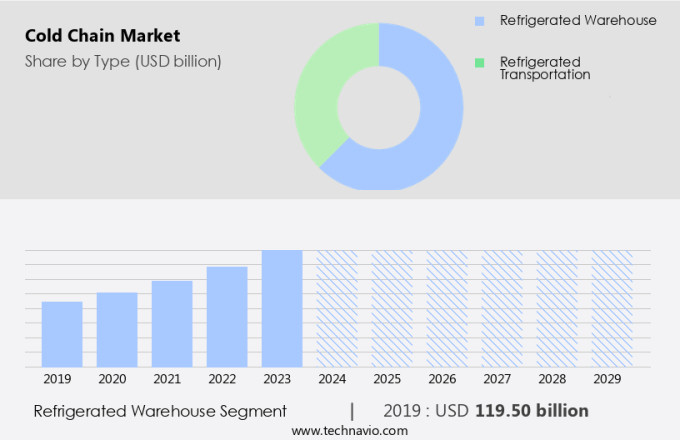

- The refrigerated warehouse segment is estimated to witness significant growth during the forecast period.

The market encompasses insulated containers, storage equipment, deep freezers, refrigerators, vaccine carriers, off-grid storage systems, and RFID technology for the preservation of perishable items, including frozen foods, pharmaceuticals, and crops. With the rise of the foodservice sector, online groceries, and the digital food industry, the demand for efficient cold chain infrastructure has significantly increased. Refrigerated warehouses, such as blast chillers and freezers, play a crucial role in maintaining the quality and freshness of temperature-sensitive products, from quick-frozen foods to bakery products. As international trade expands, the need for reliable cold chain solutions becomes increasingly important for businesses to ensure product integrity and minimize spoilage.

Get a glance at the market report of share of various segments Request Free Sample

The refrigerated warehouse segment was valued at USD 119.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

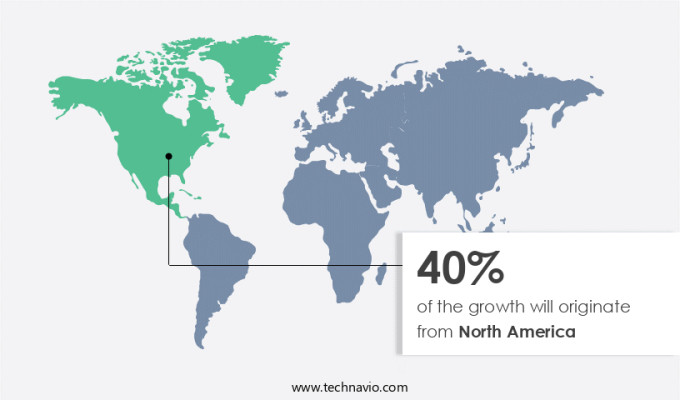

- North America is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Another region that dominated is North America, driven by the growth in imports and exports of perishable food products, including fruits, vegetables, and meat. The US, in particular, has witnessed a significant increase in the importation of asparagus, avocados, and other perishable items over the past decade.

Additionally, the rise in online grocery sales and the growing consumer preference for protein-rich diets have fueled market growth. Strict regulations governing food safety and quality compliance, as well as the implementation of advanced IT systems for real-time monitoring of temperature and humidity levels, location tracking, and product traceability, further bolster the market's expansion in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Cold Chain Market ?

The use of RFID in cold chain logistics is the key driver of the market.

- The market encompasses the logistics and transportation of perishable and temperature-sensitive goods, including convenience food items, protein-rich foods, and produce. These products, which also include dairy, seafood, and pharmaceuticals, require specialized handling and storage to maintain their quality and prevent spoilage and contamination. Convenience retailers, organized retail stores, and supermarkets rely on cold chain infrastructure to ensure product integrity and comply with strict regulations. Trade liberalization and the rise of e-commerce have increased the demand for cold chain services in the US. Cold storage systems, refrigerated vehicles, and insulated containers are essential for maintaining the shelf life of perishable items during transportation.

- Also, advanced technologies such as refrigerated packaging, RFID technology, and temperature monitoring systems enable real-time tracking and inventory management. Deep freezers, refrigerators, and vaccine carriers are critical components of cold chain infrastructure. Off-grid storage systems and alternative fuels are gaining popularity due to rising fuel costs. Temperature management is a significant concern in the market, as spoilage and contamination can lead to public health concerns and economic ramifications. The market is dynamic, with the transportation segment accounting for a significant share. Packaging products, such as crates and ice packs, are essential for maintaining product integrity during transportation. The foodservice sector, including quick-service restaurants (QSRs), is also a significant consumer of cold chain services.

-

Additionally, changing dietary patterns and lifestyles have led to an increased demand for convenience food and quick-frozen foods, bakery products, and other perishable items. Cold storage operators must ensure cost-efficiency, temperature monitoring, and tracking to meet the demands of the digital food industry and online grocery shopping. The market is subject to strict regulations and requires advanced technologies such as cloud computing, IoT, and RFID for real-time monitoring, temperature, and humidity levels, location tracking, and data analytics. The market is expected to grow due to the increasing demand for perishable commodities, fresh produce, and temperature-sensitive products.

What are the Cold Chain Market trends ?

A growing number of mergers and acquisitions activities is the upcoming trend in the market.

- The market is experiencing intense competition among companies, driven by the growing demand for cold chain solutions from various sectors, including convenience food, organized retail stores, and the foodservice sector. This competition has led to an increase in strategic alliances and merger and acquisition activities in recent years. companies are seeking to expand their market reach and customer base through these strategies. The market caters to the transportation and storage of perishable goods, such as food and pharmaceuticals, requiring temperature management to maintain product integrity and prevent spoilage and contamination. The market includes refrigerated vehicles, cold storage systems, insulated containers, and refrigerated packaging.

- Moreover, the use of advanced technologies, such as RFID technology, IoT sensors, and blockchain, is also increasing to enhance the efficiency and cost-effectiveness of cold chain logistics. Additionally, the rise of e-commerce and online grocery shopping has further fueled the demand for cold chain solutions. However, challenges such as rising fuel costs and public health concerns related to temperature management and product recalls persist. companies must comply with strict regulations and ensure real-time monitoring of temperature, humidity levels, and location tracking to maintain product quality and comply with food safety standards. The market also includes specialized services for vaccine carriers, off-grid storage systems, and deep freezers. Overall, the market is expected to continue growing due to changing dietary patterns, lifestyles, and the increasing importance of sustainability in the food industry.

What challenges does Cold Chain Market face during the growth?

The lack of proper logistics and transportation infrastructure in developing countries is a key challenge affecting market growth.

- The market in the US is witnessing significant growth due to the increasing demand for convenience food, particularly perishable items such as protein-rich foods, produce dairy products, and frozen meals. Organized retail stores, retail chains, and the foodservice sector are major consumers of cold chain infrastructure for the preservation and transportation of temperature-sensitive products. However, food wastage due to spoilage and contamination remains a challenge, leading to economic ramifications and public health concerns. The adoption of cold chain infrastructure, including refrigerated vehicles, cold storage systems, and insulated containers, is crucial for maintaining product integrity and ensuring compliance with strict regulations.

- However, e-commerce and online grocery shopping are also driving the demand for advanced temperature management solutions, such as refrigerated packaging, RFID technology, and real-time monitoring systems. Trade liberalization and the growth of cross-border commerce have further expanded the market for cold chain services, particularly for perishable commodities like seafood products and pharmaceuticals. The transportation segment, including intermodal transport and alternative fuels, is also undergoing significant changes to improve cost-efficiency and sustainability. The cold storage logistics market is expected to grow due to the increasing demand for specialized services and the need for real-time tracking and inventory management. Advanced technologies, such as cloud computing, IoT, and RFID, are being adopted to optimize warehouse management, refrigerated transportation, and temperature monitoring.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Americold Realty Trust Inc. - The company provides cold chain solutions such as Cold Storage Warehouses for storing perishable goods, maintaining quality, and ensuring safe distribution.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Americold Realty Trust Inc.

- AP Moller Maersk AS

- Burris Logistics Co.

- Cold Chain Technologies

- ColdEX Ltd.

- Congebec Logistics Inc.

- DHL Express Ltd.

- FedEx Corp.

- Frialsa Frigorificos SA de CV

- John Swire and Sons Ltd.

- Kuehne Nagel Management AG

- Lineage Inc

- NewCold Cooperatief UA

- Nichirei Corp.

- Orient Overseas Container Line Ltd.

- Snowman Logistics Limited

- Tippmann Group

- United Parcel Service Inc.

- VersaCold Logistics Services

- WH Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Development and News

- In October 2024, the global cold chain market continued to experience significant growth, driven by increasing demand for temperature-sensitive products across various industries.

- In January 2024, Snowman Logistics expanded its operations by leasing a new multi-temperature-controlled warehouse in Guwahati, Assam. The facility includes several temperature-controlled chambers and loading bays equipped with advanced infrastructure designed to handle a wide range of temperatures.

- In December 2024, Maersk highlighted emerging trends in the cold chain sector, underscoring the continued demand for temperature-controlled cargo and the expanding role of logistics providers in this space.

- In April 2023, Allana Cold Chain Solutions announced an investment to establish new storage facilities in multiple locations, aiming to strengthen its cold chain infrastructure and enhance service offerings.

Research Analyst Overview

The cold chain market encompasses a wide range of industries and technologies crucial for the preservation and transportation of temperature-sensitive perishable goods. This dynamic market is experiencing significant growth, driven by various factors such as evolving consumer preferences, advancements in technology, and the increasing demand for convenience and sustainability. One of the primary catalysts is the growing consumer demand for convenience food and the expansion of organized retail stores. As consumers increasingly seek fresh, high-quality produce, dairy, and protein-rich foods, there is a heightened need for robust cold chain storage solutions and efficient temperature-controlled transportation services.

The surge in e-commerce and online grocery shopping has further amplified the need for reliable cold chain logistics to ensure the quality and integrity of perishable goods during transportation and storage. Another key driver is the growing emphasis on reducing food wastage. According to the Food and Agriculture Organization (FAO), about one-third of food produced globally is lost or wasted. Cold chain innovations, such as refrigerated storage systems, advanced temperature monitoring technologies, and cold chain packaging solutions, are crucial for reducing spoilage and contamination, thus fostering a more sustainable food supply chain.

Additionally, trade liberalization and the growth of cross-border commerce have significantly impacted the cold chain supply chain market. As global trade continues to expand, the demand for specialized cold chain logistics to transport perishable commoditiesâsuch as pharmaceuticals and fresh produceâhas intensified. Public health concerns also shape the market, as stringent regulations are required to safeguard the quality and safety of perishable products. Pathogens like Listeria monocytogenes and Salmonella pose serious health risks when food is not maintained at appropriate temperatures, prompting regulatory bodies to implement rigorous guidelines to ensure the integrity of temperature-sensitive goods.

As the cold chain market experiences substantial CAGR and cold chain investment growth, these factors collectively drive the growth of the refrigerated storage market and the expansion of cold chain segments, such as temperature-controlled transportation services and cold chain monitoring technologies.

Rising fuel costs and the search for alternative fuels are also shaping the market. Temperature management, which accounts for a significant portion of the energy consumption in cold chain operations, is a major concern for cold storage operators. The adoption of advanced technologies, such as real-time monitoring, data analytics, and IoT sensors, is helping to improve energy efficiency and reduce fuel costs. Sustainability is another critical factor influencing the market. As consumers become more environmentally conscious, there is a growing demand for eco-friendly cold chain solutions. Off-grid storage systems, renewable energy sources, and the use of alternative fuels, such as hydrogen and biogas, are some of the emerging trends in the market.

In conclusion, the market is a complex and dynamic ecosystem that plays a vital role in ensuring the safe and efficient transportation and storage of temperature-sensitive perishable goods. Factors such as changing consumer preferences, advancements in technology, and the need for sustainability are driving the growth and evolution of this market. As the demand for convenience, quality, and safety continues to rise, the cold chain industry will continue to innovate and adapt to meet the evolving needs of businesses and consumers alike.

| Cold Chain Market Scope | |

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.8% |

|

Market growth 2025-2029 |

USD 622.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.5 |

|

Key countries |

US, China, UK, Canada, Germany, France, Brazil, Japan, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch