Commerce Cloud Market Size 2024-2028

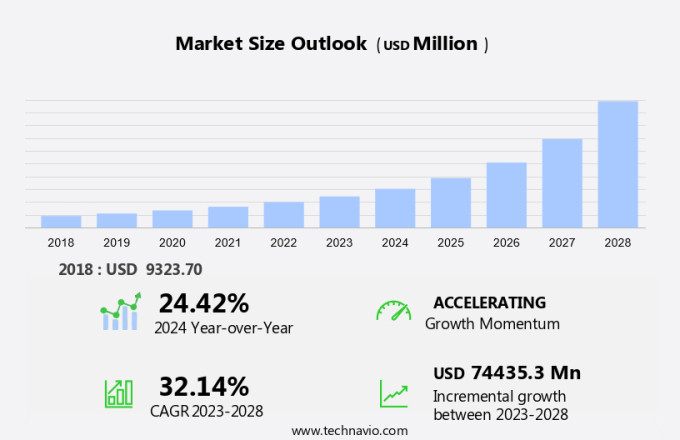

The commerce cloud market size is forecast to increase by USD 74.43 billion, at a CAGR of 32.14% between 2023 and 2028. Market growth hinges on several factors, notably the expanding reach of social media, which serves as a pivotal platform for businesses to engage with customers and drive sales. Concurrently, the imperative of optimizing operational efficiency drives innovation, prompting companies to streamline processes and enhance productivity. Furthermore, the burgeoning demand for e-commerce solutions underscores the shift towards digital transactions and online retail, reflecting changing consumer preferences and lifestyle patterns. As businesses adapt to these evolving trends, leveraging technology and data analytics to meet customer needs and stay competitive, the market landscape is poised for continued expansion. Embracing these factors enables companies to capitalize on opportunities in an increasingly digital-centric world, driving growth and fostering innovation across diverse sectors.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

In the market, key drivers include the rapid growth of the e-commerce industry and the increasing adoption of cloud computing solutions. The rollout of 5G technology further enhances connectivity, enabling seamless mobile payments and the proliferation of smart wallets. However, challenges such as ensuring data security and network security persist, prompting businesses to invest in solutions like Salesforce Commerce Cloud. Trends like Omnichannel commerce and leveraging Artificial Intelligence (AI)and ML for personalized customer experiences shape the market, emphasizing the importance of seamless commerce across digital channels while navigating complexities such as integrating the Internet of Things (IoT) and managing diverse customer profiles. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The need for optimizing operational efficiency is the key factor driving the growth of the market. In today's fast-paced business environment, organizations are constantly looking for ways to streamline their operations and reduce costs while at the same time improving customer experience. Commerce cloud solutions offer several benefits that can help organizations achieve these goals. Commerce cloud solutions provide real-time visibility into key business metrics, such as sales, inventory levels, and customer behavior. This enables organizations to make informed decisions quickly and efficiently based on up-to-date data.

The need for optimizing operational efficiency is driving the demand for commerce cloud solutions as organizations look for ways to improve their business processes, reduce costs, and improve customer experience. As a result, the market is expected to continue to grow as businesses of all sizes and across all industries adopt commerce cloud solutions to stay competitive in the fast-changing business environment. Such factors will increase the market growth during the forecast period.

Significant Market Trends

Adoption of blockchain and AI in business operations is the primary trend in market growth. Blockchain technology is being adopted by businesses to improve the security and transparency of their transactions. By creating a decentralized, tamper-proof ledger of all transactions, blockchain technology helps to prevent fraud, reduce the risk of data breaches, and improve trust between businesses and their customers. AI technology, on the other hand, is being used to automate and optimize various business processes, including customer service, inventory management, and marketing. By analyzing large amounts of data and learning from patterns and trends, AI algorithms can help businesses make more informed decisions and improve their overall efficiency and effectiveness.

Overall, the adoption of blockchain and AI in business operations is expected to continue driving the growth of the market as businesses look to leverage these technologies to gain a competitive edge and enhance their customer experience. Cloud providers that offer blockchain and AI-based solutions are likely to be well-positioned to capitalize on this trend and meet the evolving needs of businesses across industries. Hence, the market in focus is expected to grow during the forecast period.

Major Market Challenge

Skepticism in using cloud-based solutions is a major challenge impeding the growth of the market. One of the main concerns businesses have about the security of cloud-based solutions is the risk of data breaches and cyber-attacks. While cloud providers have implemented a range of security measures to protect their customers' data, businesses may still feel uneasy about storing their sensitive data on third-party servers. Another concern is the reliability and performance of cloud-based solutions. Businesses may worry about downtime, slow performance, and other issues that can impact their operations and customer experience.

However, some businesses may be hesitant to adopt cloud-based solutions due to a lack of understanding about how they work and how they can benefit their operations. Hence, skepticism might limit the growth of the market during the forecast period.

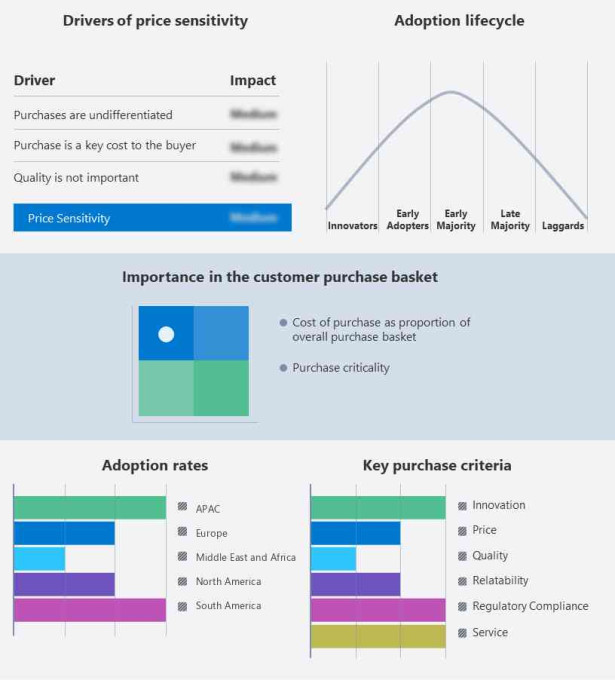

Key Market Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adobe Inc.: The company offers commerce cloud solutions such as Adobe Commerce.

The research report also includes detailed analyses of the competitive landscape of the market and information about 14 market companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Apttus Corp.

- BigCommerce Holdings Inc.

- commercetools GmbH

- Digital River Inc.

- Elastic Path Software Inc.

- International Business Machines Corp.

- Kibo Software Inc.

- Microsoft Corp.

- Optimizely Inc.

- Oracle Corp.

- Salesforce Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

In the realm of the market, the convergence of technology and commerce reshapes the landscape, driven by the rapid growth of the e-commerce industry. Businesses increasingly turn to cloud computing solutions to power their operations, leveraging the potential of 5G networks for faster transactions and enhanced mobile payments. Innovations like smart wallets and digital banking services redefine the CX (Customer Experience), while robust data security and network security measures safeguard transactions. Platforms like Salesforce Commerce Cloud offer a comprehensive cloud-based commerce solution, enabling brands to deliver seamless commerce experiences across digital channels

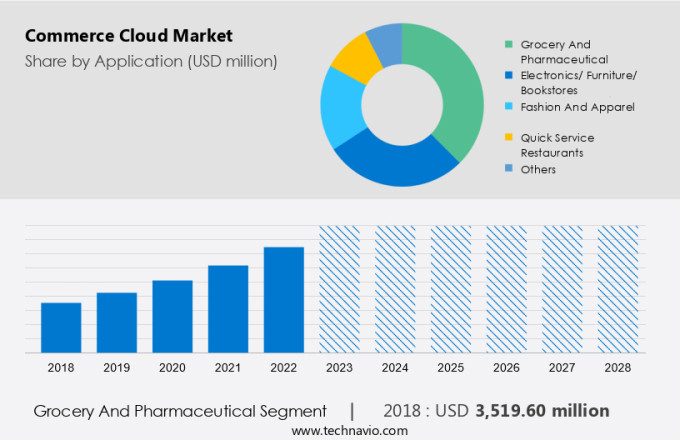

By Application

The market share growth by the grocery and pharmaceutical segment will be significant during the forecast period. The grocery and pharmaceutical industries have seen a significant increase in demand for online shopping in recent years, and this trend has been accelerated by COVID-19. As a result, the use of commerce cloud solutions has become increasingly popular in these industries.

Get a glance at the market contribution of various segments View the PDF Sample

The grocery and pharmaceutical segment was valued at USD 3.52 billion in 2018. Some factors contributing to the growth of grocery and pharmaceutical applications in the market such as convenience, inventory management, compliance, and Scalability. Overall, the growth of grocery and pharmaceutical applications in the market is expected to continue as more businesses in these industries recognize the benefits of online shopping and adopt cloud-based solutions to improve their operations and customer experience. Hence, the market in focus is expected to grow during the forecast period.

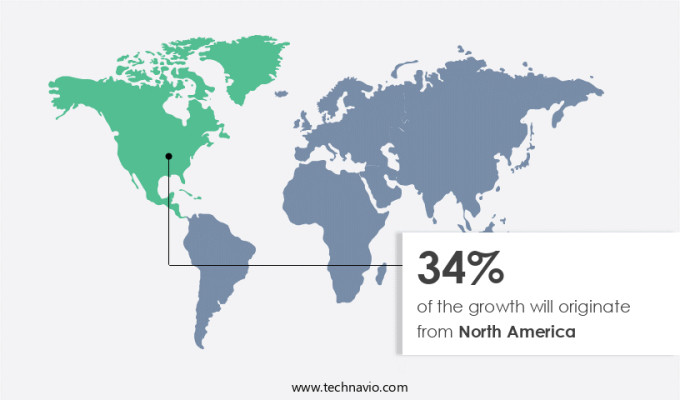

By Region

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America accounts for the highest share of the market. The demand in North America is majorly due to the rise in the adoption of public cloud services and the presence of key companies in the market. The growth of SMEs is another main reason for the rising demand for commerce cloud solutions in the region. The US, which is the major country in the region, has more than 31 million SMEs and contributes to more than 66% of private-sector jobs in North America.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Grocery and pharmaceutical

- Electronics/ furniture/ bookstores

- Fashion and apparel

- Quick service restaurants

- Others

- Component Outlook

- Platform

- Services

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in the below market reports

-

Digital Commerce Software Market: Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, UK, Japan, Germany - Size and Forecast

-

Retail E-Commerce Software Market: Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, Japan, Germany, UK - Size and Forecast

-

US E-commerce Logistics Market: by Service, Mode of Transportation and Type - Forecast and Analysis

Market Analyst Overview

In the dynamic landscape of the market, leading companies like Google Cloud, Amazon Web Services, and Accenture shape the industry, offering robust cloud-based commerce platforms that redefine the buying experience for enterprises and consumers alike. Leveraging technologies such as machine learning, artificial intelligence, and big data, businesses optimize their operations and enhance online retailing and e-commerce activities across web and portable devices like smartphones and tablets. Amidst the coronavirus pandemic, the market witnesses an increase in online sales and total retail sales, prompting retailers to embrace digital bank services and create immersive shopping experiences in virtual environments. With the advent of 5G wireless technology, stakeholders anticipate further growth in the US eCommerce market, driving demand for Unified Commerce Platforms that integrate B2B and B2C Commerce Cloud solutions, catering to diverse sectors, including grocery and pharmaceuticals retail processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.14% |

|

Market growth 2024-2028 |

USD 74.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.42 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adobe Inc., Alphabet Inc., Amazon.com Inc., Apttus Corp., BigCommerce Holdings Inc., commercetools GmbH, Digital River Inc., Elastic Path Software Inc., International Business Machines Corp., Kibo Software Inc., Microsoft Corp., Optimizely Inc., Oracle Corp., Salesforce Inc., SAP SE, Shopify Inc., Sitecore Holding II AS, and VTEX |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.