Digital Commerce Software Market Size 2024-2028

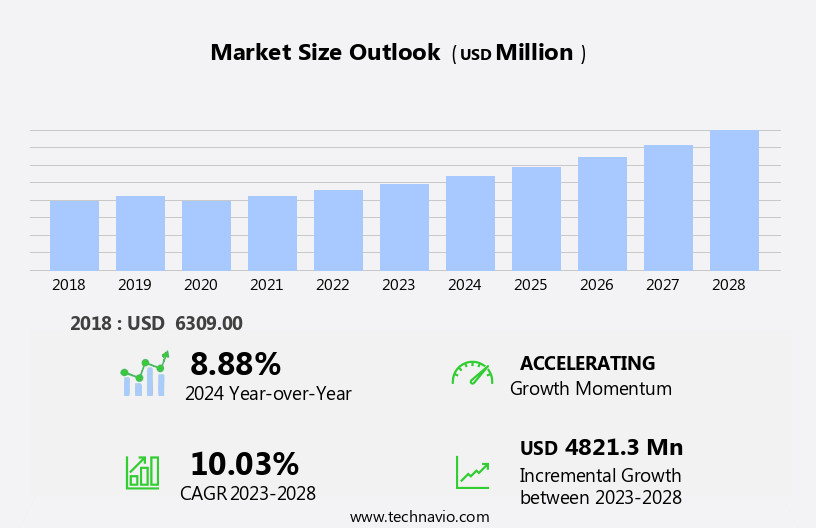

The digital commerce software market size is forecast to increase by USD 4.82 billion at a CAGR of 10.03% between 2023 and 2028.

What will be the Size of the Digital Commerce Software Market During the Forecast Period?

How is this Digital Commerce Software Industry segmented and which is the largest segment?

The digital commerce software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Deployment Insights

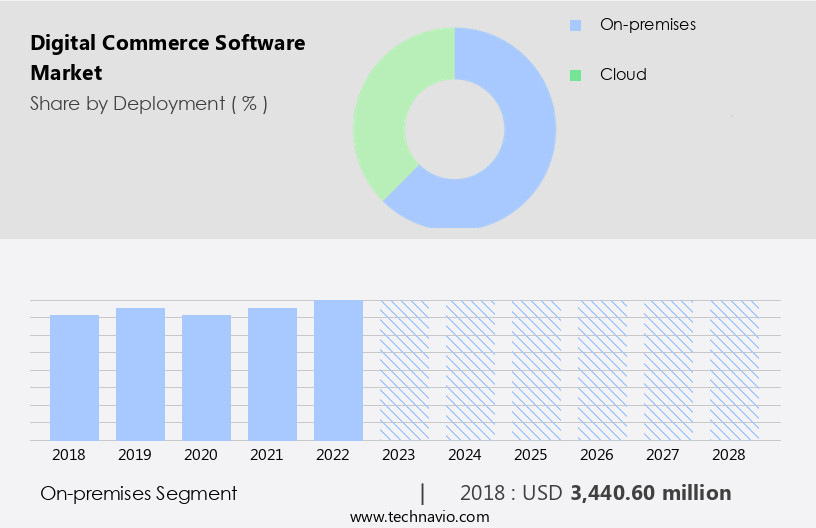

- The on-premises segment is estimated to witness significant growth during the forecast period.

Digital commerce software enables businesses to establish an online presence and facilitate transactions through e-commerce platforms, mobile commerce (m-commerce), and online marketplaces. The market encompasses various sectors, including electronics, healthcare, automotive, and retail. High-speed internet and smartphones have fueled the growth of this industry, with increasing internet penetration rates and mobile users. E-commerce software caters to both B2B and B2C businesses, offering cloud-based deployment and omni-channel strategies. On-premises digital commerce software is installed on a business's native IT infrastructure, providing physical control over the system. However, integration with existing business management software like ERP can pose challenges, such as duplicate data entries, interface issues, and customization expenses.

Despite these challenges, on-premises solutions offer benefits like increased control and security. Other digital commerce trends include advanced security features, AI integration, and IoT applications. The e-commerce market continues to evolve, with cloud computing, big data analytics, and blockchain technology shaping the industry's future.

Get a glance at the Digital Commerce Software Industry report of share of various segments Request Free Sample

The On-premises segment was valued at USD 3.44 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

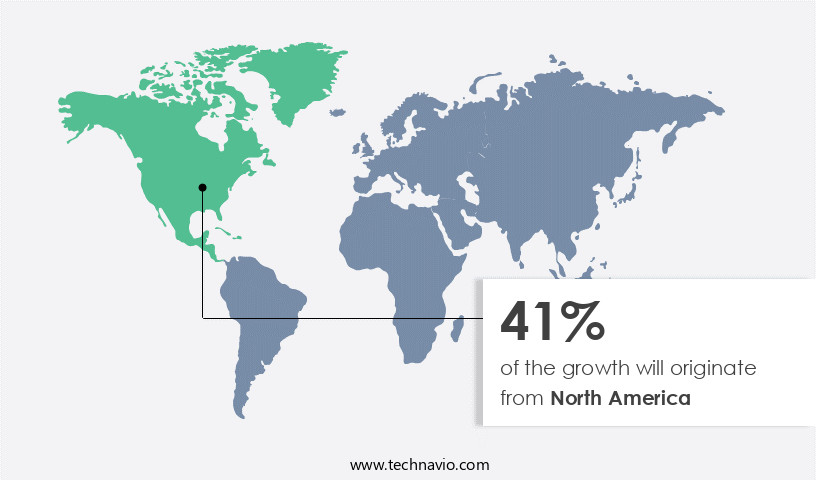

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The e-commerce software market in North America is experiencing substantial growth due to the rising number of online shopping transactions. Major digital commerce software companies, including Adobe, Oracle, Salesforce, IBM, Blue Yonder, Shopify, and Pitney Bowes, headquartered In the region, facilitate easy access and strong distribution networks for customers. The proliferation of high-speed internet, smartphones, and e-commerce platforms have transformed industries such as electronics, healthcare, automotive, and retail, leading to an increase in daily inventory management for retailers. Cloud-based deployment, omni-channel strategies, and mobile apps are key trends driving the market. Customer information security is a critical concern, necessitating advanced security features, such as AI and IoT, to mitigate data security issues.

Small businesses, grocery stores, and brick-and-mortar stores are also embracing digital platforms, leading to an increase in e-commerce sales and m-commerce. The integration of cloud technology, big data analytics, and network infrastructure is essential for the continued growth of the e-commerce market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Digital Commerce Software Industry?

Growth of the e-commerce industry is the key driver of the market.

What are the market trends shaping the Digital Commerce Software Industry?

Evolving role of social media in e-commerce is the upcoming market trend.

What challenges does the Digital Commerce Software Industry face during its growth?

Data privacy and security concerns is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The digital commerce software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital commerce software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital commerce software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Adobe Inc. - A configurable e-commerce platform enables businesses to sell goods and services online on a global scale. This solution caters to various industries, providing customizable features to accommodate diverse product offerings and customer requirements. By leveraging advanced technology, businesses can streamline their online sales processes, manage inventory, and analyze customer data to optimize their digital commerce strategies. This flexible platform empowers companies to expand their customer base and reach new markets, ultimately driving growth and revenue.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Chetu Inc.

- cleverbridge AG

- Digital River Inc.

- eBay Inc.

- HCL Technologies Ltd.

- International Business Machines Corp.

- Intershop Communications AG

- Kibo Software Inc.

- Kiva Logic

- Oracle Corp.

- PEPPERI Ltd.

- Salesforce Inc.

- SAP SE

- Sappi Ltd.

- Shopify Inc.

- Simbirsk Technology Ltd.Â

- Tata Consultancy Services Ltd.

- Vendio Services LLC

- Volusion LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The e-commerce software market encompasses a range of digital solutions that enable businesses to establish and manage online stores, process transactions, and engage with customers. These platforms facilitate the buying and selling of goods and services over the internet, with mobile commerce (m-commerce) playing an increasingly significant role due to the widespread use of smartphones and high-speed internet. E-commerce platforms offer various advantages to retailers, including the ability to reach a larger customer base, reduce operational costs, and provide a seamless shopping experience. The electronics sector, among others, has seen significant growth in e-commerce adoption, with many consumers preferring the convenience and accessibility of online shopping.

Cloud-based deployment has become a popular choice for e-commerce software due to its flexibility and scalability. This technology enables businesses to easily update and manage their online presence, as well as integrate various features such as omni-channel strategies, customer information security, and advanced security features. The healthcare sector is another area where e-commerce software has gained traction, with e-pharmacies and online platforms offering doorstep delivery services and cashless transactions. Digital infrastructure plays a crucial role In the success of these businesses, as they rely on reliable and secure networks to process sensitive customer information. The e-commerce industry is also impacted by various market dynamics, including the increasing penetration of high-speed internet and the growing number of mobile users.

Retailers are adopting various business strategies, such as offering gift cards, online support, and bulk buying options, to attract and retain customers. The use of artificial intelligence (AI) in e-commerce software is becoming more prevalent, with applications ranging from personalized product recommendations to fraud detection. However, data security issues remain a concern, with insecure modules, plugins, and plugins posing potential risks. The e-commerce market is characterized by a high level of competition, with various players offering a range of solutions catering to different industries and business sizes. Small businesses, grocery stores, and brick-and-mortar stores are increasingly adopting e-commerce platforms to stay competitive and reach new customers.

The automotive sector is another area where e-commerce is gaining traction, with online marketplaces and cross-border e-commerce enabling businesses to reach a global audience. The integration of IoT, blockchain, and AI technologies is expected to further transform the e-commerce landscape, offering new opportunities and challenges for businesses. In conclusion, the e-commerce software market is a dynamic and evolving industry that offers various benefits to businesses across different sectors. The use of cloud-based technology, AI, and other advanced features is driving innovation and growth, while data security remains a key concern. Retailers are adopting various strategies to attract and retain customers, and the integration of various channels and technologies is enabling them to offer a seamless shopping experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 4821.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, China, UK, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Commerce Software Market Research and Growth Report?

- CAGR of the Digital Commerce Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital commerce software market growth of industry companies

We can help! Our analysts can customize this digital commerce software market research report to meet your requirements.