Commercial Aircraft In-Seat Power Supply System Market Size 2025-2029

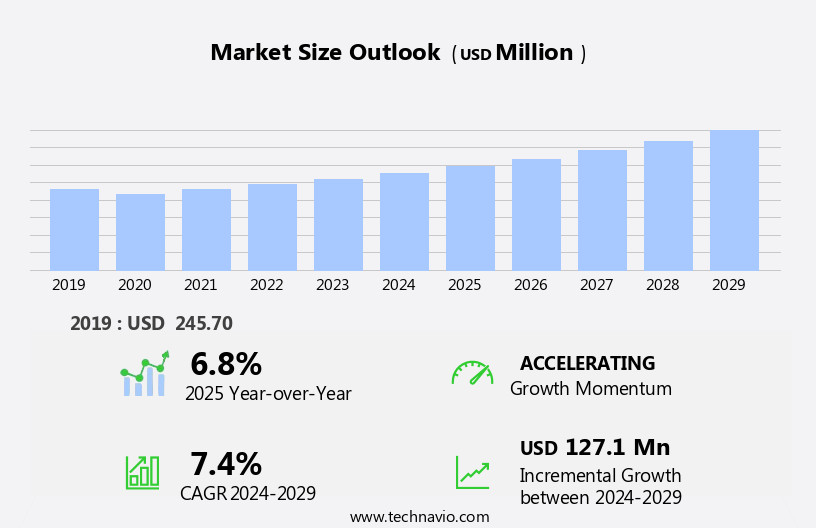

The commercial aircraft in-seat power supply system market size is forecast to increase by USD 127.1 million, at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing preference for cabin retrofitting to enhance passenger comfort. This trend is expected to continue as airlines prioritize providing a superior flying experience to maintain competitiveness. Additionally, the development of more electric aircraft is set to revolutionize the aviation industry, creating opportunities for in-seat power systems to become an essential component. However, the market faces challenges, including the presence of diverse customs regulations, which can complicate the implementation and adoption of these systems across different regions.

- Effective navigation of these regulatory complexities will be crucial for market players to capitalize on the growth potential and remain competitive. Companies seeking to capitalize on market opportunities should focus on developing innovative solutions that address both passenger comfort and regulatory compliance, while also ensuring cost-effectiveness and ease of installation.

What will be the Size of the Commercial Aircraft In-Seat Power Supply System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The in-seat power supply system market for commercial aircraft is a dynamic and evolving sector, characterized by continuous advancements and innovations. This market caters to the growing demand for advanced in-flight amenities, including electromagnetic compatibility (EMC) compliant power inverters, DC and AC power adapters, USB charging ports, and wireless charging solutions. The integration of these systems into cabin management systems necessitates rigorous testing procedures, ensuring compliance with FAA and EASA regulations. Environmental testing, durability testing, and reliability testing are crucial aspects of the development process. Power management and component integration are essential for optimizing energy consumption and reducing weight, while overcurrent protection, overvoltage protection, short circuit protection, and circuit breakers ensure safety.

Lithium-ion batteries, backup power systems, and emergency power supplies provide uninterrupted power during critical situations. In-flight connectivity, such as satellite communication and wi-fi systems, necessitate power management and technical support for seamless integration. Galley power supplies and repair and maintenance services are also integral components of the market. The market's complexity requires expert integration services and supply chain management, ensuring regulatory compliance and customer support. The ongoing focus on safety standards, power efficiency, and battery systems continues to drive market growth, with a growing emphasis on EMI/RFI filtering and aftermarket services.

How is this Commercial Aircraft In-Seat Power Supply System Industry segmented?

The commercial aircraft in-seat power supply system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Channel

- OEM

- Aftermarket

- End-user

- Economy class

- Business class

- Premium economy class

- First class

- Aircraft Type

- Narrow-body aircraft

- Wide-body aircraft

- Regional transport aircraft

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

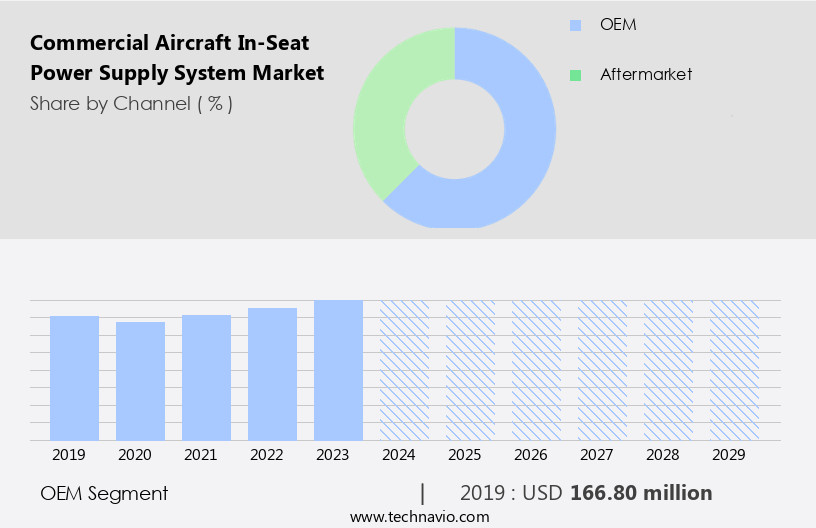

By Channel Insights

The OEM segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for in-flight connectivity and the need for longer battery life for personal electronic devices. Original equipment manufacturers (OEMs) lead the market, supplying power systems as part of new aircraft designs. Their expertise and industry knowledge enable them to meet stringent aviation safety regulations, such as those related to electromagnetic compatibility (EMC), power inverters, and voltage regulators. OEMs offer various power options, including AC and DC power adapters, USB charging ports, and even wireless charging. In-seat power supply systems also integrate with cabin management systems, allowing for power efficiency and cost savings through power management and component integration.

Maintenance costs are minimized through the use of durable lithium-ion batteries and backup power systems. Regulatory compliance with FAA and EASA regulations is ensured through rigorous testing procedures, including durability testing, overvoltage protection, short circuit protection, and ground fault protection. Additionally, OEMs provide technical support and aftermarket services to ensure the longevity of their systems. The market also includes retrofit kits for older aircraft, as well as the integration of in-seat power supply systems with wi-fi systems, satellite communication, and passenger entertainment systems. The focus on weight reduction and energy consumption continues to be a key trend in the market, with the development of lightweight and efficient power cables, power outlets, and battery systems.

The OEM segment was valued at USD 166.80 million in 2019 and showed a gradual increase during the forecast period.

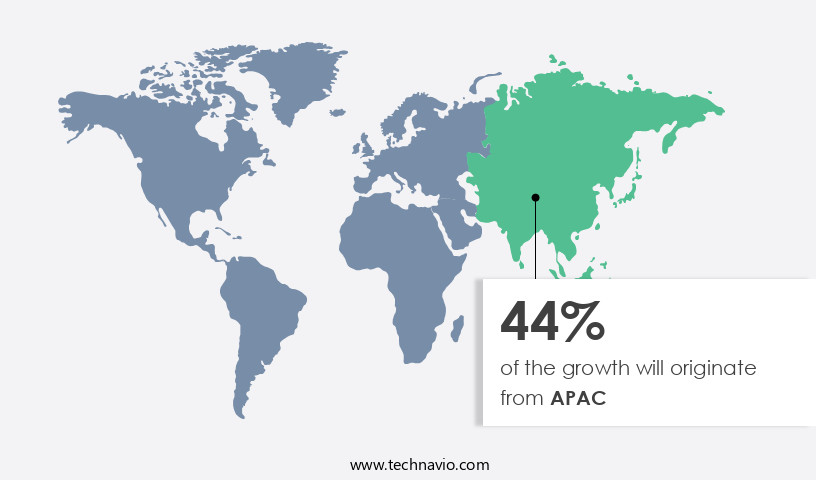

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the advanced aviation infrastructure and mature markets in the region, including the US and Canada. The increasing demand for aftermarket services, driven by the expansion of fleets and the need for more fuel-efficient aircraft, is a major factor fueling market growth. Additionally, strategic partnerships between aircraft seat suppliers and Original Equipment Manufacturers (OEMs) are expanding maintenance capabilities and promoting market expansion. The recent surge in oil prices has further accelerated the demand for cabin retrofitting services. The market is characterized by advanced technologies, including power management systems, voltage regulators, and lithium-ion batteries, which ensure power efficiency and reliability.

Components such as power inverters, USB charging ports, and AC power adapters are essential for providing passengers with a comfortable and productive in-flight experience. Safety standards, such as FAA regulations and EASA regulations, ensure the certification and reliability of these systems. The market also encompasses emergency power systems, backup power systems, and battery systems, which are crucial for ensuring safety and continuity of power supply. The integration of wireless charging, in-flight connectivity, and other advanced technologies is a key trend driving market growth. The market's focus on energy consumption, durability testing, and environmental testing ensures the long-term sustainability and efficiency of these systems.

The growth of the market is underpinned by a robust supply chain management system, which ensures the timely delivery of components and services. Overall, the market in North America is poised for continued growth, driven by the increasing demand for advanced in-flight amenities and the need for fuel efficiency and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant and growing segment within the aviation industry. This market encompasses the design, manufacturing, installation, and maintenance of electrical outlets and power distribution systems for passenger seats on commercial aircraft. Integral components of these systems include inverter technology, lithium-ion batteries, and power management systems. These advanced technologies enable passengers to charge their personal electronic devices during flights, enhancing their travel experience. Furthermore, the integration of these systems into aircraft seats promotes sustainability by reducing the need for disposable batteries and power adapters. The market is driven by increasing passenger demand for in-flight connectivity and convenience, as well as regulatory mandates for seat power supply systems. Additionally, advancements in wireless charging technology and modular design are expected to fuel market growth.

What are the key market drivers leading to the rise in the adoption of Commercial Aircraft In-Seat Power Supply System Industry?

- The increasing demand for cabin retrofitting to improve passenger comfort serves as the primary market driver.

- Commercial aircraft in-seat power supply systems have gained significant attention in the aviation industry due to the increasing demand for cabin connectivity and personalized entertainment systems. Lithium-ion batteries are increasingly being adopted for these power supply systems due to their lightweight and high energy density. Airline operators are investing in cabin retrofitting to meet the growing demand for in-flight conveniences, such as satellite communication, power management, component integration, short circuit protection, and mobile device charging. The integration of wi-fi systems, galley power supplies, and repair and maintenance facilities is also becoming essential for airlines. Technical support and aircraft certification are critical factors in ensuring the reliability of these systems.

- Circuit breakers and retrofit kits are important components of in-seat power supply systems, ensuring safety and ease of installation. In recent years, there has been a surge in the adoption of these systems in commercial jetliners, with many undergoing cabin modernization programs. Power management and weight reduction are key considerations in the design and implementation of these systems. Reliability testing and surge protection are also crucial to ensure the smooth operation of these systems during flight. In summary, the adoption of in-seat power supply systems is a crucial aspect of cabin modernization in the aviation industry. These systems enable airlines to offer a more comfortable and convenient flying experience, while also ensuring safety and reliability.

- The integration of various components, such as lithium-ion batteries, satellite communication, and power management systems, is essential to meet the evolving demands of passengers and airline operators.

What are the market trends shaping the Commercial Aircraft In-Seat Power Supply System Industry?

- The emerging market trend emphasizes the development of electric aircraft. This sector is poised for significant growth, with professionals and industry experts predicting increased innovation and production in electric aviation technology.

- The market has gained significant traction due to the increasing demand for advanced in-flight amenities. This system's architecture includes various components, such as environmental testing, quality control, wireless charging, in-flight connectivity, ground fault protection, thermal management, life cycle cost, and backup power systems. To ensure safety and reliability, these systems undergo rigorous environmental testing and quality control processes. Passenger comfort and convenience are prioritized through the integration of wireless charging and in-flight connectivity. Additionally, safety standards such as overcurrent protection, thermal management, and backup power systems are crucial elements of the system design. Nickel-cadmium batteries are commonly used as backup power sources due to their high energy density and long life cycle.

- However, energy consumption is a critical concern, leading to the exploration of alternative power sources and energy-efficient technologies. Supply chain management plays a vital role in ensuring the smooth delivery and installation of these systems. Customer support and after-sales services are essential for maintaining the functionality and longevity of the systems. Safety remains a top priority, with safety standards and regulations guiding the development and implementation of these systems. The market's growth is driven by the increasing demand for passenger entertainment systems and the need for improved in-flight experiences.

What challenges does the Commercial Aircraft In-Seat Power Supply System Industry face during its growth?

- The diverse customs regulations present a significant challenge to the industry's growth, necessitating extensive compliance efforts and potential delays in international trade transactions.

- The market is subject to various regulations, including those set by the European Union Aviation Safety Agency (EASA). These regulations ensure the safety and efficiency of power systems onboard commercial aircraft. The power supply system includes Integrated Function Electronics (IFE) power, emergency power, and power outlets for laptops and smartphones. Wiring harnesses and power cables are essential components of these systems, requiring regulatory compliance and certification processes. Power efficiency and fuse protection are critical factors in the design of these systems to minimize the risk of electrical fires. Battery systems and EMI/RFI filtering are also important to maintain power quality and minimize interference.

- Aftermarket services, such as installation, maintenance, and repair, are significant contributors to the market's growth. Airborne wi-fi and other in-flight entertainment systems are also driving the demand for in-seat power supply systems. Despite the benefits, the application of customs rules and duties on imported components and parts can pose challenges for maintenance providers. The WTO Agreement on Trade in civil aircraft exempts many civil aviation products and parts from import duties. However, inconsistencies in customs rules have resulted in additional costs and resources spent on negotiations and customs clearance. Ensuring regulatory compliance and airworthiness of imported parts is crucial to qualify for duty-free treatment.

Exclusive Customer Landscape

The commercial aircraft in-seat power supply system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the commercial aircraft in-seat power supply system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, commercial aircraft in-seat power supply system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Astrodyne TDI - The company specializes in providing advanced in-seat power solutions for commercial aircraft.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Astrodyne TDI

- Astronics Corp.

- Burrana Pty Ltd.

- IFPL Group Ltd.

- Imagik Corp.

- Inflight Canada Inc.

- KID Systeme GmbH

- Mid Continent Instrument Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Commercial Aircraft In-Seat Power Supply System Market

- In January 2024, Panasonic Avionics Corporation, a leading in-flight entertainment and connectivity solutions provider, announced the launch of its new in-seat power supply system, 'Panasonic Freedom Class,' for the Boeing 787 Dreamliner. This system offers passengers the ability to charge their personal electronic devices throughout the flight, enhancing passenger experience (Panasonic Avionics Corporation Press Release).

- In March 2024, Lufthansa Technik AG, a leading aircraft maintenance, repair, and overhaul provider, and HAECO Cabin Solutions, a global provider of cabin solutions, entered into a strategic partnership to jointly develop and offer in-seat power supply systems for commercial aircraft. This collaboration aims to provide airlines with a more comprehensive and cost-effective solution (Lufthansa Technik AG Press Release).

- In May 2025, Safran SA, a leading aircraft equipment supplier, announced the successful certification of its new in-seat power supply system, 'Safran Seat Power,' by the Federal Aviation Administration (FAA). This system is designed to provide passengers with the ability to charge their devices throughout the flight, improving passenger experience and reducing the need for in-seat power adapters (Safran SA Press Release).

- In the same month, Air New Zealand became the first airline to retrofit its Boeing 787-9 Dreamliners with the new in-seat power supply system from Collins Aerospace, a Raytheon Technologies business. This initiative aims to provide a more comfortable and convenient travel experience for passengers by allowing them to charge their devices throughout the flight (Air New Zealand Press Release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of fire-resistant materials and noise suppression technologies. Engineering design prioritizes fault tolerance and user experience, ensuring system reliability during transient voltage fluctuations. Fault-safe mechanisms and digital twin technology enable cost optimization through remote diagnostics and real-time power monitoring. Signal integrity and lightweight materials are essential for system efficiency, while electromagnetic interference mitigation and human factors engineering ensure a seamless in-flight experience. Contract manufacturing and material selection leverage value engineering to optimize supply chain costs. Certification bodies mandate rigorous testing and validation, incorporating high-temperature materials and power conversion technologies for improved power quality.

- Lean manufacturing and software updates ensure system reliability and adherence to industry standards. Firmware updates and data analytics enable predictive maintenance, further enhancing system reliability and reducing downtime. The market continues to evolve, with a focus on power conversion, composite materials, and system diagnostics to meet evolving passenger needs and regulatory requirements.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Commercial Aircraft In-Seat Power Supply System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 127.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Canada, Germany, France, China, Japan, UK, India, United Arab Emirates, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Commercial Aircraft In-Seat Power Supply System Market Research and Growth Report?

- CAGR of the Commercial Aircraft In-Seat Power Supply System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the commercial aircraft in-seat power supply system market growth of industry companies

We can help! Our analysts can customize this commercial aircraft in-seat power supply system market research report to meet your requirements.