APAC Completion Equipment And Services Market Size 2024-2028

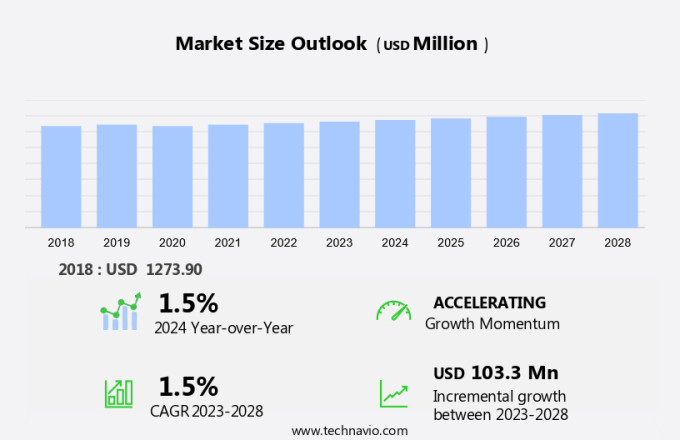

The APAC completion equipment and services market size is forecast to increase by USD 103.3 million at a CAGR of 1.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for oil and gas, leading to a rise in deep water and ultradeep water well exploration. This trend is driven by the depletion of conventional reserves and the need to tap into harder-to-reach reserves. However, environmental concerns are becoming a major challenge for the market, with stricter regulations being imposed to reduce the carbon footprint of well completion services. In addition, advanced completion technologies, efficient recovery methods, and sustainable practices are key trends, with a focus on digital solutions, smart technologies, automation, and productivity. Digital transformation, data analytics, real-time monitoring, and integrated solutions are also critical to enhancing oil and gas production while minimizing environmental impact. The market is expected to grow at a steady pace, with innovations in green technologies and the adoption of digitalization offering potential solutions to address these challenges. The increasing focus on cost optimization and efficiency gains is also expected to drive market growth. Overall, the market presents significant opportunities for players, particularly those offering sustainable and cost-effective solutions.

What will be the size of the APAC Completion Equipment And Services Market during the forecast period?

- The completion equipment and services market In the Asia-Pacific (APAC) region is experiencing significant growth due to increased production from both conventional and unconventional resources. However, market expansion is restrained by factors such as weak lithologies and high well-maintenance costs. Technological advancements in well completion technology, including self-adaptive inflow control and multilateral wells, are driving innovation and productivity. Onshore and offshore exploration activities continue to fuel demand for completion services.

- Moreover, environmental impact and the integration of renewable energy sources are also becoming increasingly important in hybrid projects. Emerging markets in APAC offer significant investment opportunities, particularly in areas with high exploration potential and a growing demand for energy.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- Offshore

- Onshore

- Geography

- APAC

- China

- India

- APAC

By Deployment Insights

- The offshore segment is estimated to witness significant growth during the forecast period.

Offshore completion equipment and services play a crucial role in transforming drilled offshore wells into productive ones. Key factors influencing this market include water depth, well completion type, reservoir management, daily rental rates for completion equipment, and logistics costs. The offshore completion process faces challenges due to corrosive water environments, space constraints, and complex support and logistics requirements, leading to higher exploration and production (E&P) costs and investment costs compared to onshore segments. Despite these challenges, the offshore segment is anticipated to grow faster than the onshore segment due to new field discoveries and offshore oilfield redevelopment activities. Companies providing offshore completion equipment and services include OEG Offshore, among others. The market is expected to experience significant growth, particularly In the Asia Pacific region, driven by the fastest-growing shale plays and unconventional reservoir wells. Crude oil production targets continue to rise, making efficient and cost-effective completion solutions essential.

Get a glance at the market share of various segments Request Free Sample

The offshore segment was valued at USD 760.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of APAC Completion Equipment And Services Market?

Increase in oil and gas demand is the key driver of the market.

- The market is experiencing significant growth due to the increasing energy consumption In the region. With the rapid industrialization and urbanization in countries like India and China, the demand for oil and gas is surging. In 2023, natural gas consumption in APAC reached approximately 935 billion cubic meters (BCM), marking a notable increase compared to previous years. This trend is expected to continue, with natural gas demand projected to expand by nearly 5% in 2024. The industrial and power sectors are the primary drivers of this growth. The expansion of conventional and unconventional resources, such as shale plays and unconventional reservoir wells, is also contributing to the market growth.

- Moreover, technological advancements in well completion technology, including self-adaptive inflow control, intelligent well completion, and downhole sensors, are lowering well-maintenance costs and improving operational efficiency. However, market growth restraints include weak lithologies and challenging geological conditions, which can increase drilling and completion costs. In addition, environmental concerns and the shift towards renewable energy sources and eco-friendly practices are influencing the market. Advanced completion technologies, such as multilateral wells, horizontal wells, and smart completion technology, are gaining popularity in both onshore and offshore applications. These technologies offer enhanced oil and natural gas recovery, productivity, and environmental sustainability. Major players In the market include Weatherford, National Oilwell Varco, and Oceaneering International.

What are the market trends shaping the APAC Completion Equipment And Services Market?

Rise in deep water and ultradeep water well exploration is the upcoming trend In the market.

- The market has experienced significant growth due to the increased production from both conventional and unconventional resources. The focus on lower well-maintenance costs and the adoption of advanced completion technologies, such as self-adaptive inflow control, intelligent well completion, and downhole sensors, have been key market growth drivers. However, the high costs associated with multilateral wells and horizontal wells, as well as the challenges of weak lithologies in some regions, present market growth restraints. Technological advancements in well completion technology, reservoir monitoring technology, and multilayer completions have been instrumental in improving operational efficiency and enhancing oil and natural gas production. The offshore rig count In the fastest-growing shale plays and unconventional reservoir wells has been a significant contributor to the market's growth.

- Moreover, the market is expected to continue growing due to the production target of major oil and gas companies, distribution agreements, and exploration activities in Onshore and Offshore applications. The integration of digital solutions, smart technologies, automation, and productivity in completion equipment and services is also driving market growth. Additionally, sustainable practices, such as eco-friendly practices, carbon footprint reduction, water-efficient techniques, alternative materials, and digital transformation, are becoming increasingly important In the market. The market is expected to continue its growth trajectory, driven by energy security, infrastructure development, and the adoption of efficient recovery methods and enhanced oil recovery technologies. Companies like Weatherford, National Oilwell Varco, and Oceaneering International are at the forefront of providing advanced completion technologies and services to meet the evolving needs of the market.

What challenges does APAC Completion Equipment And Services Market face during the growth?

Environmental concerns associated with well completion services is a key challenge affecting the market growth.

- The market is experiencing significant growth due to increased production from both conventional and unconventional resources. Technological advancements, such as self-adaptive inflow control, intelligent well completion, and downhole sensors, are lowering well-maintenance costs and improving operational efficiency. However, market growth is restrained by weak lithologies and the high cost of drilling and completing wells, particularly in unconventional reservoir wells. In the APAC region, shale plays and unconventional reservoir wells are the fastest-growing areas for oil production and natural gas production. Crude oil production and production targets are driving the demand for advanced completion technologies and efficient recovery methods. Companies such as OEG Offshore, Weatherford, National Oilwell Varco, and Oceaneering International are providing distribution agreements and exploration activities for onshore and offshore applications.

- In addition, sustainable practices, digital solutions, smart technologies, automation, and productivity are essential In the Completion Equipment and Services market. Environmental impact, renewable energy sources, hybrid projects, and eco-friendly practices are becoming increasingly important as the industry focuses on reducing its carbon footprint and water usage through water-efficient techniques and alternative materials. The market for Completion Equipment and Services in APAC is expected to grow significantly due to infrastructure development, energy security, and the need for operational efficiency.

Exclusive APAC Completion Equipment And Services Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- China Oilfield Services Ltd.

- China Petrochemical Corp.

- Completion Oil Tools Pvt. Ltd.

- Destini Berhad

- Encod Softech Pvt. Ltd.

- Forum Energy Technologies Inc.

- Halliburton Co.

- Hot-Hed International

- Naseem Bukhari Pvt Ltd.

- NOV Inc.

- Schlumberger Ltd.

- Superior Energy Services Inc.

- Weatherford International Plc

- Wellcare Oil Tools Pvt. Ltd.

- Welltec International ApS

- Wild Well Control Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The completion equipment and services market In the Asia Pacific (APAC) region have witnessed significant growth in recent years due to the increasing focus on conventional and unconventional resources. The market's expansion can be attributed to several factors, including the need for lower well-maintenance costs and technological advancements in well completion technology. Conventional resources continue to dominate the APAC oil and gas industry, with countries like China, India, and Australia being major contributors. However, the unconventional resources sector, particularly shale plays, has gained considerable attention due to their potential for increased production and efficiency. Market growth In the APAC region, however, faces certain restraints.

In addition, weak lithologies and geological complexities pose challenges to drilling and completion activities, particularly in offshore applications. Nevertheless, technological innovations continue to address these challenges, with self-adaptive inflow control systems and intelligent well completion technologies gaining popularity. Well intervention and multilateral wells have become essential components of the APAC completion market, enabling operators to optimize production from existing wells and improve reservoir understanding. Horizontal wells, which are increasingly being adopted for unconventional reservoir wells, offer significant advantages in terms of productivity and recovery efficiency. Advanced completion technologies, such as downhole sensors and digital solutions, have revolutionized the industry by providing real-time monitoring capabilities and enabling data analytics.

In addition, automation and smart technologies have further enhanced operational efficiency, contributing to energy security and infrastructure development In the region. The environmental impact of oil and gas production remains a critical concern, with renewable energy sources and hybrid projects gaining traction. Eco-friendly practices, such as water-efficient techniques and the use of alternative materials, are becoming increasingly important In the APAC market. The offshore rig count In the APAC region has seen a steady increase, with the fastest-growing markets being In the South China Sea, the Bay of Bengal, and the Eastern Mediterranean. Onshore applications, particularly in countries like China and India, continue to dominate the market due to their large reserves and production targets.

Furthermore, the APAC completion equipment market comprises a diverse range of products, including packers, sands control tools, completion tools, wellhead equipment, and subsea completion equipment. Companies operating In the region include Weatherford, National Oilwell Varco, and Oceaneering International, among others. Therefore, the completion equipment and services market In the APAC region is poised for continued growth, driven by increasing production targets, technological advancements, and the need for operational efficiency and sustainability. The market's future success will depend on the ability of companies to address the challenges of weak lithologies and geological complexities while adopting eco-friendly practices and digital solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.5% |

|

Market growth 2024-2028 |

USD 103.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch