Europe Compound Chocolate Market Size and Trends

The Europe compound chocolate market size is forecast to increase by USD 2.56 billion, at a CAGR of 5.8% between 2023 and 2028. The market is experiencing significant growth due to increasing consumer preferences for indulgent treats. Transparency in ingredient labelling is a key trend, with consumers showing a strong interest in sugar-free and organic chocolate options. Milk compound chocolate remains popular, but there is a growing demand for coverts and hard fat chocolates as well. E-commerce and online platforms are driving sales, with consumers purchasing chocolate in various forms such as coverture, granola bars, trail mixes, and cocoa butter substitutes. Fluctuating raw material prices pose a challenge for manufacturers, requiring them to adapt and innovate to maintain profitability. Overall, the market is poised for continued growth, with manufacturers focusing on product innovation and sustainability to meet evolving consumer demands.

The market has witnessed significant growth in recent years due to evolving consumer preferences and advancements in chocolate production. This market caters to various industries, including bakeries and confectionery, retail stores, and food manufacturing. Compound chocolate, also known as chocolate coating mix or chocolate confectionery coating, is a ready-to-use chocolate product that contains cocoa solids, cocoa butter alternatives, and other ingredients. Its versatility makes it an essential ingredient for various applications, such as coating for confectionery items, toppings for baked goods, and inclusions in snack foods. One of the primary drivers for the compound chocolate market is the increasing demand for healthier lifestyles. Manufacturers are focusing on sugar reduction and protein fortification to cater to this trend. For instance, sugar-free compound chocolates and chocolate-flavored protein supplements are gaining popularity among health-conscious consumers.

Another trend in the market is the use of cocoa processing technologies that enhance the chocolate's heat resistance and bloom resistance. These properties are crucial for maintaining the chocolate's appearance and texture during production and storage. The market for compound chocolate also includes various product segments, such as hard fat, granola bars, trail mixes, and cocoa butter substitutes. Hard fat compound chocolates are widely used for coating confectionery items, while granola bars and trail mixes use compound chocolates as inclusions. Cocoa butter substitutes and equivalents are essential for manufacturers to maintain the functionality and cost-effectiveness of their chocolate products. Moreover, the market encompasses various types of chocolate, including dark chocolate, sugar-free chocolate, and certified chocolate. Dark chocolate, with its rich flavor and health benefits, is a popular choice among consumers. Certified chocolate, which adheres to specific production standards, is gaining traction due to increasing consumer awareness and demand for ethical and sustainable chocolate production.

Market Segmentation

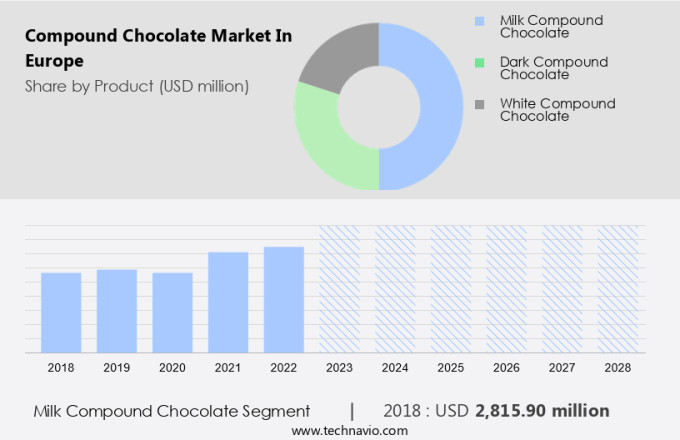

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Milk compound chocolate

- Dark compound chocolate

- White compound chocolate

- Geography

- Europe

- Germany

- France

- Italy

- Europe

By Product Insights

The milk compound chocolate segment is estimated to witness significant growth during the forecast period. Milk compound chocolate is a popular chocolate type consisting of sugar, milk, cocoa butter, and lecithin, without cocoa solids. According to the Food and Drug Administration (FDA), white chocolate must contain a minimum of 12% cocoa butter, 43% sugar, and 25% milk solids. However, the growing health consciousness among consumers and the awareness of health issues related to obesity and heart disease have led to a decreased demand for milk chocolates. One pound of milk chocolate contains approximately 2,300 calories, 140 grams of fat, and 100 milligrams of cholesterol. As a result, health-conscious consumers are seeking alternatives to milk chocolates. Several chocolate varieties cater to this demand, including sugar-free and organic chocolate. These options provide consumers with the taste of chocolate without the added sugars or harmful additives.

Get a glance at the market share of various segments Download the PDF Sample

The milk compound chocolate segment was valued at USD 2.82 billion in 2018. Additionally, milk compound chocolate is used in various food products such as granola bars, trail mixes, and cocoa butter substitutes. E-commerce platforms and online sales have made it easier for consumers to access these alternatives. Coverture chocolate, a type of chocolate used for coating confections, is also a popular choice for those seeking a lower-fat alternative to milk compound chocolate. In conclusion, the demand for milk compound chocolate has decreased due to health concerns, and consumers are turning to alternatives such as sugar-free, organic, and coverture chocolate. These options are available on various e-commerce platforms and are used in various food products. Milk compound chocolate remains a common variety, but consumers are making informed choices to meet their health needs.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Europe Compound Chocolate Market Driver

Increasing market indulgence is notably driving market growth. The market is experiencing significant growth due to the increasing preference for indulgent, high-quality confections. Consumers are increasingly seeking out premium chocolate products with desirable attributes such as heat resistance and bloom resistance. Furthermore, the trend towards plant-based and low-sugar chocolate options, driven by flexitarianism and veganism, is fueling innovation in the category.

Artisanal confectionery brands are responding to this demand by launching new products featuring cocoa grindings and unique flavor profiles. Online retail channels are also playing a key role in making these premium chocolate offerings more accessible to consumers. The popularity of compound chocolate is expected to continue its upward trajectory as consumers seek out superior chocolate experiences. Thus, such factors are driving the growth of the market during the forecast period.

Europe Compound Chocolate Market Trends

Transparency in ingredient labeling is the key trend in the market. The preference for transparent food labeling is gaining traction among American consumers. Transparent labeling signifies that a product is devoid of artificial additives and unrecognizable components. Consumers are increasingly knowledgeable and desirous of understanding the composition of their consumables. This trend, coupled with evolving food labeling regulations, necessitates more detailed disclosures regarding cocoa or chocolate products on food labels. Compound chocolate, a popular ingredient in bakeries and confectionery, is witnessing a shift towards clean labeling. Consumers are gravitating towards compound chocolate products that are free from artificial preservatives and additives. Chocolate-flavored protein supplements, a growing segment in the health and wellness industry, are also adopting clean labeling to cater to the health-conscious consumer base. Cocoa processing plays a crucial role in the production of compound chocolate. The sourcing of high-quality cocoa beans is essential to ensure the authenticity and taste of the final product. Retail stores are responding to this trend by stocking up on compound chocolate products with clean labels.

Dark chocolate, a favorite among health-conscious consumers, is also witnessing a rise in demand due to its numerous health benefits. In conclusion, the demand for clean labeled compound chocolate products is on the rise in the market. Consumers are seeking more information about the products they consume, and food companies are responding by providing more detailed labeling. The trend towards clean labeling is expected to continue, with a focus on natural and organic ingredients. This shift is likely to benefit both consumers and manufacturers, as it promotes healthier lifestyles and fosters trust in food products. Thus, such trends will shape the growth of the market during the forecast period.

Europe Compound Chocolate Market Challenge

Fluctuating the price of raw materials is the major challenge that affects the growth of the market. Compound chocolate, which includes white chocolate, chocolate coatings, and chocolate chips, is a significant market segment in the chocolate industry. The production costs of compound chocolates are higher than traditional chocolates due to the use of raw materials like cocoa beans, milk powder, and sugar. The volatile pricing of these ingredients poses a challenge for market growth. Consumers may face increased prices or smaller chocolate portions as a result. Manufacturers struggle to predict annual production costs due to cocoa bean price fluctuations. This uncertainty can lead to decreased consumer consumption.

White chocolate, a popular compound chocolate variant, offers health benefits such as antioxidants and essential minerals. Its taste and texture differ from those of dark chocolate, making it a versatile ingredient in various applications, including beverages. Cocoa butter alternatives, such as palm kernel oil and shea butter, are used in compound chocolate production. These alternatives can impact taste and texture, making it crucial for manufacturers to maintain consistency in their products. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AAK AB - The company offers compound chocolate that is used in bakery, chocolate and confectionery, dairy and ice cream, foodservice and retail, lecithin, plant-based foods, special nutrition, technical products, animal nutrition, personal care, candles.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Barry Callebaut AG

- Beryls Chocolate Malaysia

- Cargill Inc.

- Clasen Quality Coatings Inc.

- Fuji Oil Europe

- Mondelez International Inc.

- Nestle SA

- Palsgaard AS

- Puratos

- Santa Barbara Chocolate

- Sephra Europe Ltd.

- Unigra Srl

- Vermont Nut Free Chocolates

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is witnessing significant growth due to the increasing demand for chocolate-flavored products in various industries. Bakeries and confectionery businesses are incorporating compound chocolate in their offerings to cater to consumers' preferences for indulgent confectionery items. Cocoa processing techniques have advanced, enabling the production of sugar reduction and protein fortification options, including chocolate-flavored protein supplements. Healthier lifestyles have led to the development of sugar-free and organic compound chocolates, catering to consumers seeking healthier alternatives. Milk compound chocolate remains popular, while dark chocolate gains traction due to its health benefits. E-commerce and online platforms have made it easier for consumers to access a wide range of compound chocolate products, including coverts, hard fats, granola bars, trail mixes, and cocoa butter substitutes.

Cocoa mass and cocoa butter are essential ingredients in compound chocolate production, with vegetable oil and nutritious seeds used as alternatives for heat resistance and bloom resistance. The market also includes a variety of chocolate types, such as certified, fine flavor, gourmet, premium, plant-based, low-sugar, and vegan options. Beverages, ice creams, frozen desserts, and bakery items are some industries utilizing compound chocolate, contributing to its growing market size. The taste and texture of real chocolate are replicated effectively in compound chocolate, making it a versatile ingredient for various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market Growth 2024-2028 |

USD 2.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AAK AB, Archer Daniels Midland Co., Barry Callebaut AG, Beryls Chocolate Malaysia, Cargill Inc., Clasen Quality Coatings Inc., Fuji Oil Europe, Mondelez International Inc., Nestle SA, Palsgaard AS, Puratos, Santa Barbara Chocolate, Sephra Europe Ltd., Unigra Srl, Vermont Nut Free Chocolates, and Wilmar International Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.