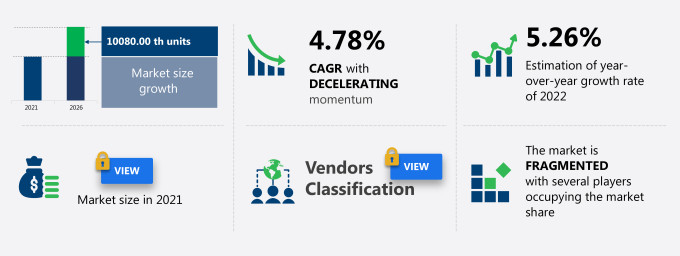

The compound feed market share in Vietnam is expected to increase by 10080.00 thousand units from 2021 to 2026, at a CAGR of 4.78%.

This compound feed market in Vietnam research report will help companies evaluate their business approaches. Furthermore, this report extensively covers the compound feed market in Vietnam segmentation by production type (domestic production and imports) and product type (poultry feed, cattle and buffaloes, and others). The compound feed market in Vietnam report also offers information on several market vendors, including Alltech Inc., Archer Daniels Midland Co., C.P. Pokphand Co. Ltd., Cargill Inc., De Heus Voeders BV, Emivest Feedmill Vietnam Co. Ltd., GreenFeed Vietnam Crop., Lai Thieu Feed Mill Co. Ltd., Mavin Group, and New Hope Group Co. Ltd. among others.

What will the Compound Feed Market Size in Vietnam be During the Forecast Period?

Download the Free Report Sample to Unlock the Compound Feed Market Size in Vietnam for the Forecast Period and Other Important Statistics

Compound Feed Market in Vietnam: Key Drivers, Trends, and Challenges

The demand for meat and meat-based products is notably driving the compound feed market growth in Vietnam, although factors such as competition from international vendors may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the compound feed industry in Vietnam. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Compound Feed Market Driver in Vietnam

One of the key factors driving the compound feed market growth in Vietnam is the high demand for meat and meat-based products. The demand for higher quality meat at lower prices has been increasing over the years, and economic progress has increased customers' spending power, the majority of which is oriented toward the consumption of cattle meat. In the past, the Vietnamese government, agencies, and ministries implemented many programs, such as the livestock development strategy, to boost the livestock industry, which resulted in increased output and meat consumption. Major foreign feed manufacturers are expanding into Vietnam by acquiring aquaculture and poultry feed businesses. Numerous government initiatives, such as the Livestock Development Strategy, have aided in the increase of domestic meat production and consumption. Poultry feed was the most consumed commodity due to the public predilection for white chicken and duck flesh. Hence, the regional market in focus is expected to grow during the forecast period.

Key Compound Feed Market Trend in Vietnam

Another key factor driving the compound feed market growth in Vietnam is the higher number of imports. According to the Ministry of Agriculture and Rural Development (MARD), the country has around 239.0 feed factories, with 61.0 owned by foreign-invested companies. Foreign investors control more than 50.0% of the market and intend to increase feed production to satisfy rising consumer demand. As a result, all of these reasons are propelling the country's compound feed business. Such factors are expected to drive the compound feed market growth in Vietnam during the same period.

Key Compound Feed Market in Vietnam Challenge

One of the key challenges to the compound feed market growth in Vietnam is the stiff competition from international vendors such as Cargill of the US, De Heus of Holland, and Charoen Pokphand Group of Thailand that dominate Vietnam's compound feed sector. Feed millers face considerable obstacles in the short term, including a lack of logistical capacity, which limits both import and export. It is expected that the smaller ones will either depart or be acquired by the larger ones during the forecast period. Some feed millers are not following the feed and farm strategy of building and operating farms. This method compels them to examine alternative strategies to compete with those who own farms, such as C.P., and can undertake internal sales of feed to their farms. This will act as a major challenge and will negatively impact the market in focus during the forecast period.

This compound feed market in Vietnam analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the compound feed market in Vietnam as a part of the global packaged foods and meats market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the compound feed market in Vietnam during the forecast period.

Who are the Major Compound Feed Market Vendors in Vietnam?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alltech Inc.

- Archer Daniels Midland Co.

- C.P. Pokphand Co. Ltd.

- Cargill Inc.

- De Heus Voeders BV

- Emivest Feedmill Vietnam Co. Ltd.

- GreenFeed Vietnam Crop.

- Lai Thieu Feed Mill Co. Ltd.

- Mavin Group

- New Hope Group Co. Ltd.

This statistical study of the compound feed market in Vietnam encompasses successful business strategies deployed by the key vendors. The compound feed market in Vietnam is fragmented and the vendors are deploying growth strategies such as product releases and collaborations to compete in the market.

Product Insights and News

- Alltech Inc. - The company offers compound feed product brands such as RIDLEY, Sweetlix, and Show RITE.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The compound feed market in Vietnam forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Compound Feed Market in Vietnam Value Chain Analysis

Our report provides extensive information on the value chain analysis for the compound feed market in Vietnam, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global packaged foods and meats market includes the following core components:

- Inputs

- Inbound logistics

- Primary processing

- Secondary and tertiary processing

- Outbound logistics

- End-customers

- Marketing and sales

- Services

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

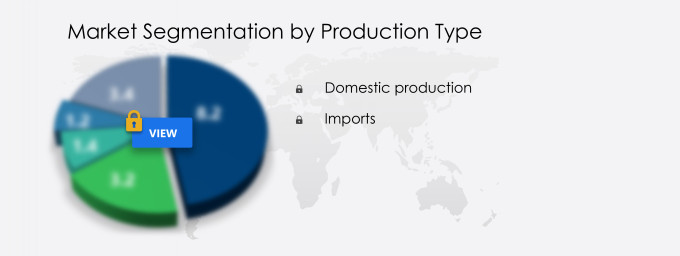

What are the Revenue-generating Production Type Segments in the Compound Feed Market in Vietnam?

To gain further insights on the market contribution of various segments Request for a FREE sample

The compound feed market share growth in Vietnam by the domestic production segment will be significant during the forecast period. The growth is attributed to the presence of several large facilities such as Dabaco, Masan, Greenfeed, Vina, and Lai Thieu.

This report provides an accurate prediction of the contribution of all the segments to the growth of the compound feed market size in Vietnam and actionable market insights on post COVID-19 impact on each segment.

You may be interested in:

Compound Feed market - The market share is expected to increase by USD 8.95 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 4.44%.

Animal Feed market - The market share is estimated to increase to USD 124.89 billion from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 4.79%.

Mexico Compound Feed market - The market share is expected to increase by USD 1.60 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 4.14%.

|

Compound Feed Market Scope in Vietnam |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 4.78% |

|

Market growth 2022-2026 |

10080.00 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.26 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alltech Inc., Archer Daniels Midland Co., C.P. Pokphand Co. Ltd. , Cargill Inc., De Heus Voeders BV, Emivest Feedmill Vietnam Co. Ltd., GreenFeed Vietnam Crop., Lai Thieu Feed Mill Co. Ltd., Mavin Group, and New Hope Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Compound Feed Market in Vietnam Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive the compound feed market growth in Vietnam during the next five years

- Precise estimation of the compound feed market size in Vietnam and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the compound feed industry in Vietnam

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of compound feed market vendors in Vietnam

We can help! Our analysts can customize this report to meet your requirements. Get in touch