Compressor Oil Market Size 2025-2029

The compressor oil market size is valued to increase by USD 1.63 billion, at a CAGR of 5.3% from 2024 to 2029. Rapid industrialization in emerging economies will drive the compressor oil market.

Major Market Trends & Insights

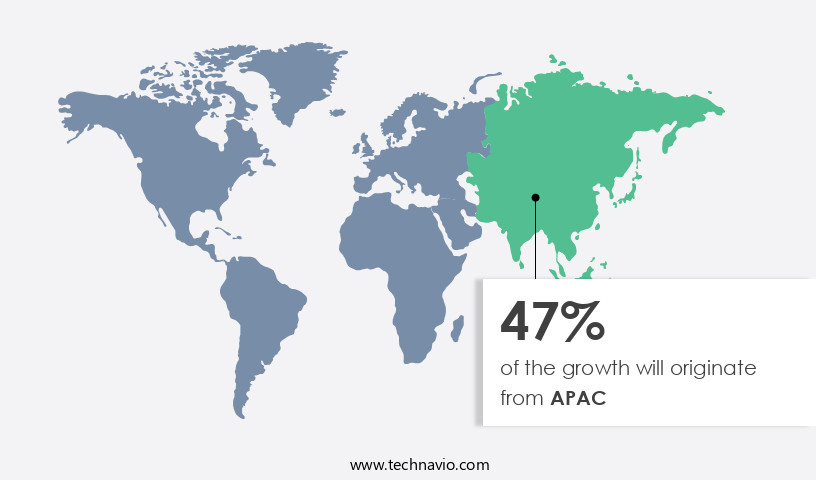

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Type - Mineral-base segment was valued at USD 3.73 billion in 2023

- By Application - Positive displacement compressor segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 48.63 million

- Market Future Opportunities: USD 1633.00 million

- CAGR from 2024 to 2029 : 5.3%

Market Summary

- The market is driven by the rapid industrialization in emerging economies and the transition towards synthetic and bio-based oils. These trends are influenced by the increasing demand for energy efficiency and environmental sustainability in various industries, such as power generation, manufacturing, and transportation. However, the market faces challenges due to the volatility in raw material prices, which can impact the cost structure of compressor oil manufacturers and end-users. For instance, a manufacturing company in India optimized its supply chain by implementing a predictive maintenance program for its compressors. By analyzing historical data and predicting maintenance needs, the company was able to reduce compressor downtime by 18%, resulting in significant cost savings and increased operational efficiency.

- This scenario highlights the importance of compressor oil in maintaining industrial machinery and ensuring business continuity. In summary, the market is shaped by the global industrial landscape, with a focus on sustainability and cost efficiency. Companies must navigate the challenges posed by raw material price volatility to remain competitive and meet the evolving needs of their customers.

What will be the Size of the Compressor Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Compressor Oil Market Segmented ?

The compressor oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Mineral-base

- Synthetic-base

- Bio-based

- Application

- Positive displacement compressor

- Dynamic compressor

- End-user

- Industrial machinery

- Automotive

- Oil and gas

- Power

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The mineral-base segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, mineral-based oils remain popular due to their affordability and basic lubrication properties. Derived from refined crude oil, these compressor oils cater to industries with standard compressor conditions, offering satisfactory antiwear additive performance, corrosion inhibitor effectiveness, and thermal stability. However, their shorter oil life, necessitating more frequent oil changes, limits their application in demanding environments. Mineral compressor oils are primarily used in light- to medium-duty compressors, including those in small-scale manufacturing, construction, and HVAC maintenance. Despite their lower initial cost and wide availability, approximately 30% of the market is shifting towards synthetic alternatives, driven by their superior energy consumption reduction, lubricant film thickness, and oil life extension capabilities.

Synthetic ester and polyalphaolefin compressor oils, for instance, exhibit superior lubricant additive packages, foam control additives, and pour point depressants, making them suitable for high-pressure, high-temperature applications in sectors like oil and gas, power generation, and heavy manufacturing. Centrifugal, screw, hydraulic, and reciprocating compressors all benefit from these advanced compressor oils, which provide improved compressor efficiency metrics, oil contamination analysis, and wear particle analysis. The market for compressor oils continues to evolve, with ongoing activities in lubrication system design, oil mist lubrication, oil degradation monitoring, and compressor oil filtration, all aimed at enhancing compressor performance and reducing maintenance costs.

The Mineral-base segment was valued at USD 3.73 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Compressor Oil Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is experiencing significant growth, driven by industrial expansion, automotive manufacturing, and oil and gas activities in key economies such as China, India, Japan, and South Korea. This region accounts for a substantial share of the global compressor oil consumption due to its robust industrial sector. In China, industrial production increased by 5.8% year-on-year in 2024, as reported by the National Bureau of Statistics, further fueling the demand for compressor oils. These oils are essential for maintaining the efficiency, reliability, and longevity of various compressors used in industries like manufacturing, oil and gas, and power generation.

By enhancing operational efficiency and reducing maintenance costs, compressor oils contribute to overall business profitability and compliance with environmental regulations. The market's growth is also influenced by the increasing adoption of energy-efficient compressor technologies and the rising focus on sustainability in industrial operations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of products used in various compressor systems, particularly in refrigeration applications. Refrigeration compressor oils are subject to specific viscosity requirements to ensure optimal system performance. The impact of oil degradation on compressor efficiency is a significant concern, leading to the need for careful optimization of compressor oil change intervals. Synthetic ester oils, known for their oxidation stability, have gained popularity due to their ability to withstand high temperatures and prolong compressor life. Oxidation stability testing methods are crucial in evaluating the performance of these oils. Polyalphaolefin compressor oils, on the other hand, offer excellent viscosity stability and high thermal oxidation resistance. Lubricant additives play a vital role in wear reduction, improving compressor efficiency and extending oil life. Comparing mineral and synthetic compressor oils reveals that synthetics generally offer better performance characteristics, such as higher viscosity index and improved resistance to thermal and oxidative degradation. Advanced oil filtration techniques and methods for detecting and mitigating compressor oil contamination are essential to maintaining compressor system reliability. Improving compressor energy efficiency through oil selection and understanding the role of viscosity index in compressor oil performance are critical considerations. The relationship between compressor oil properties and operating temperature is another important factor. Analyzing wear particles to assess compressor oil condition and the influence of oil type on compressor system noise levels are also crucial aspects of compressor oil management. Measuring oil film thickness in compressor bearings and assessing the effect of oil contamination on compressor seal integrity are essential for ensuring compressor reliability and longevity. Determining appropriate oil change schedules for various compressor types and understanding the role of additives in extending compressor oil life are best practices for compressor oil management. Best practices for compressor oil recycling and disposal are also essential to minimize environmental impact and reduce costs. Lastly, ensuring compressor oil compatibility with different refrigerants is crucial to maintaining system efficiency and reliability.

What are the key market drivers leading to the rise in the adoption of Compressor Oil Industry?

- In emerging economies, the process of rapid industrialization serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing industrialization in emerging economies, particularly in sectors such as manufacturing, energy, and construction. This trend is most evident in countries like China, India, and Brazil, where industrial production has shown consistent growth. For instance, China reported a 5.8% year-on-year increase in industrial production in 2024, as per the National Bureau of Statistics. This expansion is driving up the demand for compressors and, consequently, compressor oils. These oils play a crucial role in ensuring the efficiency, reliability, and longevity of compressor systems.

- By enhancing compressor performance, businesses can reduce downtime and improve decision-making, ultimately leading to increased productivity and profitability. The market is poised to benefit from this industrial growth momentum, with a focus on delivering high-performance, eco-friendly, and cost-effective solutions.

What are the market trends shaping the Compressor Oil Industry?

- Transition to synthetic and bio-based oils is becoming a prominent trend in the market. This shift towards sustainable alternatives is gaining significant traction.

- The market is undergoing significant transformation as industries shift from traditional mineral-based lubricants to advanced synthetic and bio-based alternatives. This transition is fueled by the increasing demand for high-performance, eco-friendly lubricants capable of performing optimally under extreme conditions while adhering to sustainability targets. Synthetic compressor oils deliver several benefits, such as enhanced thermal and oxidative stability, precise viscosity control, reduced deposits, and extended service intervals. These advantages lead to improved equipment efficiency, decreased maintenance costs, and reduced downtime. Simultaneously, bio-based compressor oils derived from renewable sources are gaining traction as industries strive to minimize their environmental footprint.

What challenges does the Compressor Oil Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory, requiring robust supply chain management and price risk mitigation strategies.

- The market is characterized by its sensitivity to volatility in raw material prices, primarily due to the base oils' derivation from crude oil. This market dynamic poses challenges for manufacturers, as fluctuations in global oil prices directly impact production costs and pricing strategies. For instance, in late 2024, crude oil prices saw significant instability due to geopolitical tensions and inconsistent global demand. This instability led to a decline in West Texas Intermediate futures from early November to early December, causing a ripple effect on base oil prices and disrupting lubricant production schedules and budgets.

- Despite these challenges, the market continues to evolve, with key applications including industrial, automotive, and power generation sectors. The market's importance lies in its role in enhancing compressor efficiency, ensuring regulatory compliance, and optimizing costs for businesses worldwide.

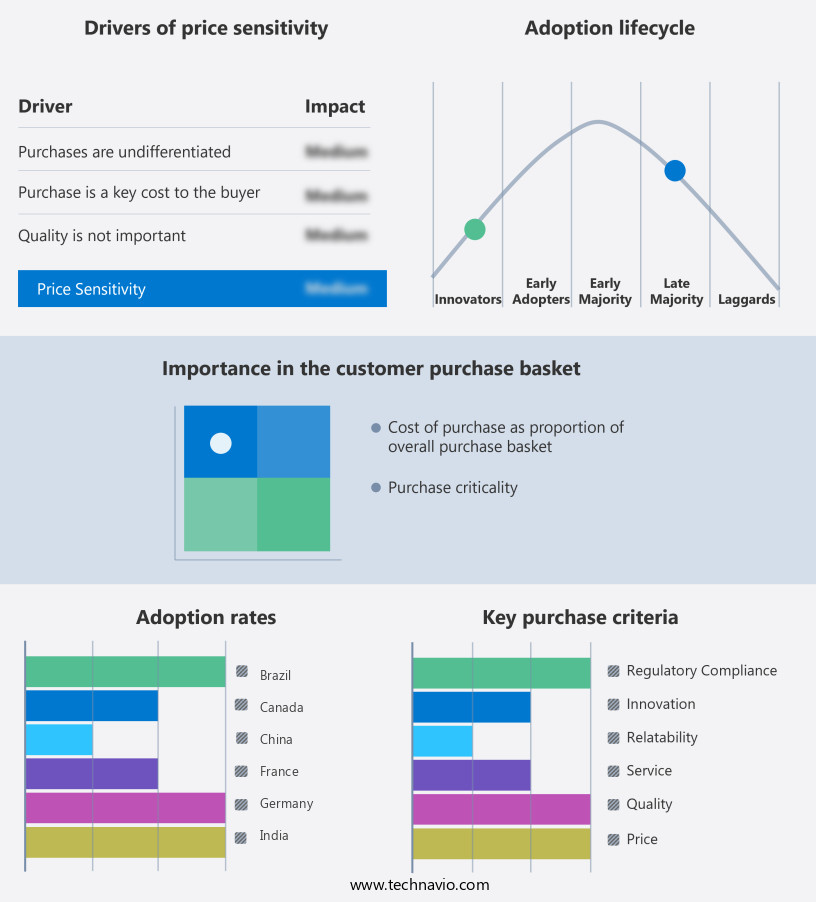

Exclusive Technavio Analysis on Customer Landscape

The compressor oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the compressor oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Compressor Oil Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, compressor oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlas Copco AB - The company specializes in providing a range of compressor oils, including Roto Inject NDURANCE, Roto Xtend Duty, Roto Synthetic ULTRA, and Paroil series. These high-performance oils cater to various industrial applications, ensuring optimal compressor efficiency and extended machine life. With a focus on innovation and quality, the company's offerings deliver superior protection and durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- BASF SE

- BP Plc

- Chevron Corp.

- China Petrochemical Corp.

- Exxon Mobil Corp.

- FUCHS SE

- Hitachi Ltd.

- Idemitsu Kosan Co. Ltd.

- Indian Oil Corp. Ltd.

- KAESER KOMPRESSOREN SE

- Mitsubishi Heavy Industries Ltd.

- PETRONAS Chemicals Group Berhad

- PJSC LUKOIL

- Repsol SA

- Sasol Ltd.

- Shell plc

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Compressor Oil Market

- In August 2024, Gardner Denver, a leading compressor technology and services provider, announced the launch of its new line of energy-efficient compressor oils, named Eco-Flow, designed to reduce energy consumption by up to 10% compared to traditional compressor oils. (Gardner Denver Press Release)

- In November 2024, Wartsila and Shell signed a strategic partnership to collaborate on the development and commercialization of low-carbon compressor solutions using renewable hydrogen as a fuel. (Shell Newsroom)

- In March 2025, Quaker Chemical Corporation, a global provider of process chemicals and related technical services, completed the acquisition of Compressor Technology Ltd., a UK-based company specializing in the manufacture and supply of compressor fluids and related services. (Quaker Chemical Corporation SEC Filing)

- In May 2025, the European Union passed the F-Gas Regulation amendment, which imposed stricter regulations on the use of fluorinated greenhouse gases (F-gases) in compressor applications, driving the demand for alternative compressor oils and refrigerants. (European Commission Press Release)

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Compressor Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 1633 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, US, India, Japan, Germany, UK, Canada, South Korea, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the expanding applications across various sectors. Gas compressor oils, for instance, require high antiwear additive performance to withstand the extreme pressures and temperatures in power generation and petrochemical processes. Hydraulic compressor oils, on the other hand, demand oil degradation monitoring to ensure consistent lubrication system design and energy consumption reduction. Centrifugal compressor oils, used in HVAC and refrigeration systems, necessitate foam control additives and low-temperature properties to maintain efficient operation. High-pressure compressor oils, essential in industrial processes, require corrosion inhibitor effectiveness and thermal stability testing for optimal performance.

- Reciprocating compressor oils, widely used in manufacturing and transportation industries, undergo oil contamination analysis and lubricant additive packages to extend oil life and enhance lubricant film thickness. Compressor oil filtration and wear particle analysis are crucial for compressor efficiency metrics in screw compressors, ensuring consistent performance in various applications. Synthetic ester oils and polyalphaolefin compressor oils have gained popularity due to their superior properties, such as energy efficiency and extended oil life. Mineral compressor oils, despite their traditional use, continue to be relevant due to their cost-effectiveness and availability. The market is projected to grow at a significant rate, with industry experts estimating a 5% annual expansion in the coming years.

- For instance, a leading oil and gas company reported a 10% increase in sales due to the adoption of advanced compressor oil technologies. The ongoing focus on energy efficiency and reducing maintenance costs is expected to further fuel market growth.

What are the Key Data Covered in this Compressor Oil Market Research and Growth Report?

-

What is the expected growth of the Compressor Oil Market between 2025 and 2029?

-

USD 1.63 billion, at a CAGR of 5.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Mineral-base, Synthetic-base, and Bio-based), Application (Positive displacement compressor and Dynamic compressor), End-user (Industrial machinery, Automotive, Oil and gas, Power, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rapid industrialization in emerging economies, Volatility in raw material prices

-

-

Who are the major players in the Compressor Oil Market?

-

Atlas Copco AB, BASF SE, BP Plc, Chevron Corp., China Petrochemical Corp., Exxon Mobil Corp., FUCHS SE, Hitachi Ltd., Idemitsu Kosan Co. Ltd., Indian Oil Corp. Ltd., KAESER KOMPRESSOREN SE, Mitsubishi Heavy Industries Ltd., PETRONAS Chemicals Group Berhad, PJSC LUKOIL, Repsol SA, Sasol Ltd., Shell plc, and TotalEnergies SE

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous advancements in technology and evolving operating parameters. Compressor oil plays a crucial role in ensuring the efficient and reliable operation of compressor systems. Two significant aspects of this market are system contamination levels and oil oxidation inhibitors. Contamination levels in compressor systems can lead to increased energy consumption and reduced system efficiency. For instance, a study revealed that removing just 1% of water contamination from a compressor system could result in a 5% increase in energy efficiency. This underscores the importance of maintaining a clean lubrication system.

- Moreover, the market is expected to grow at a steady pace, with industry experts projecting a growth rate of approximately 3% annually. This growth is driven by the increasing demand for energy efficiency improvements, such as the use of ester-based lubricants and oil purification techniques, which enhance compressor performance and extend component life.

We can help! Our analysts can customize this compressor oil market research report to meet your requirements.