Germany Construction Market Size 2025-2029

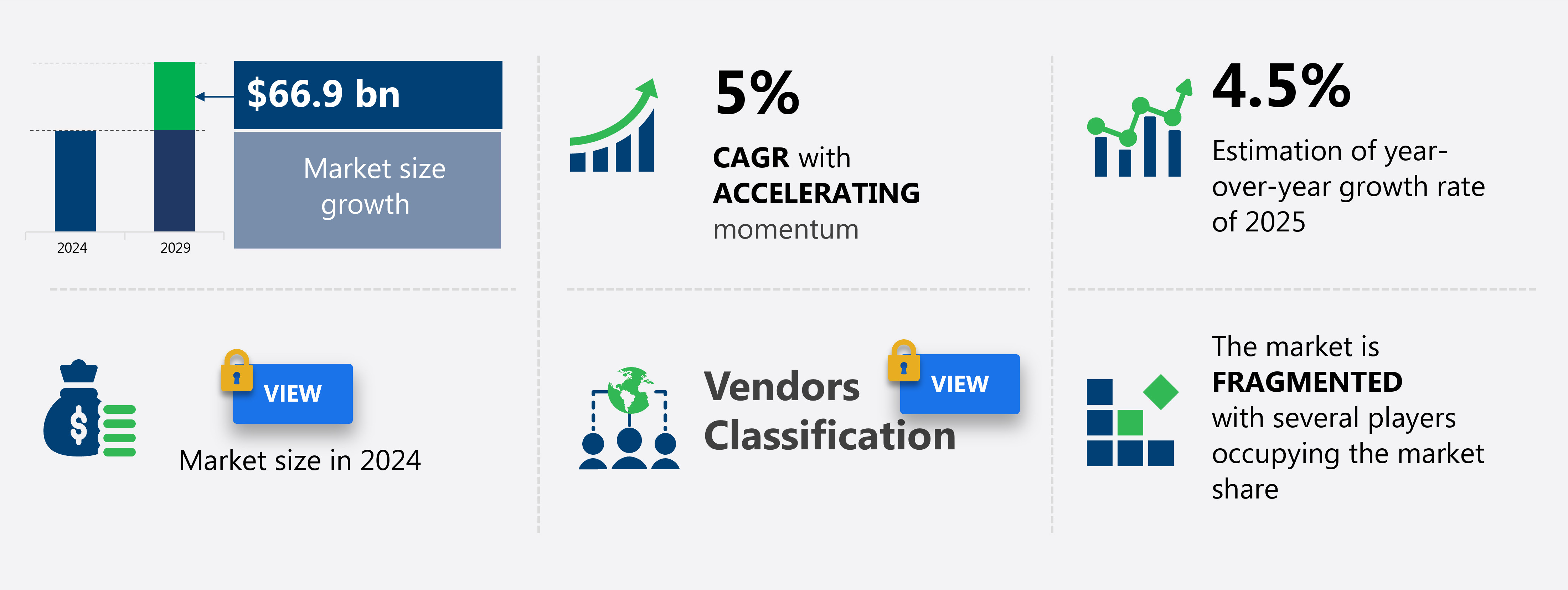

The Germany construction market size is forecast to increase by USD 66.9 billion at a CAGR of 5% between 2024 and 2029.

- The construction market is experiencing significant growth due to several key factors. The increasing demand for housing units, driven by population growth and urbanization, is a major trend In the industry. Another trend is the rising popularity of modular houses, which offer cost savings and faster construction times. In addition, industrialization and digitization have led to innovative technologies, such as drones for mapping and surveying, 3D printing, smart infrastructure, and performance optimization, which help improve construction techniques and sustainability measures. However, the market is also facing challenges, including the increasing cost of construction materials and labor. These factors are putting pressure on construction companies to find innovative solutions to reduce costs and improve efficiency. The market analysis report provides a comprehensive examination of these trends and challenges, offering insights into the future growth prospects of the construction industry.

What will be the Size of the market During the Forecast Period?

- The construction market encompasses a diverse range of sectors, including commercial and residential building activities. Key sectors include hotels, office buildings, outdoor leisure facilities, retail buildings, other commercial construction, and industrial projects such as warehouses, data centers, and industrial parks. Tourism and travel business activities are significant growth drivers, leading to the development of major hotel and infrastructure projects.

- Moreover, Green energy initiatives are also fueling construction activities, particularly In the industrialization sector. Participants In the construction market include contractors, suppliers, architects, engineers, and government agencies. Major projects span various development stages, from planning and design to execution and completion. Rapid urbanization, automation, and government investments in infrastructure projects further contribute to the market's growth. Population growth in developing regions is another key factor driving demand for construction services.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Buildings construction

- Heavy and civil engineering construction

- Land planning and development

- Specialty trade contractors

- End-user

- Residential

- Commercial

- Public

- Sector

- Private sector

- Public sector

- Geography

- Germany

By Type Insights

- The buildings construction segment is estimated to witness significant growth during the forecast period.

The German construction market experiences ongoing growth in building construction activities, driven by the expanding housing and infrastructure sectors. In 2024, Berlin approved over 5,100 subsidized housing units, marking a substantial increase from previous years. This increase in housing development stimulates the industry, motivating developers to undertake more projects and address housing shortages. Key sectors within building construction include commercial construction, such as office buildings, outdoor leisure facilities, retail buildings, and other commercial structures. Additionally, infrastructure projects, like transportation systems, energy grids, and communication networks, contribute significantly to the market's revenue possibilities. Industrial construction, including manufacturing plants, metal and material processing facilities, and waste processing plants, are also essential components.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Germany Construction Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Germany Construction Market?

Growing demand for housing units is the key driver of the market.

- The construction market in Europe, specifically in Germany, is experiencing significant growth due to several key factors. Population expansion, driven by both natural increase and immigration, is a primary driver of this trend. Germany's appeal as a destination for immigrants has resulted in a growing population, leading to increased demand for housing. Additionally, urbanization is contributing to the increase in demand for housing, as more individuals move to cities in pursuit of employment opportunities. Another significant factor fueling the growth of the market is the focus on infrastructure development. Transport infrastructure projects, such as rail and roadways, are essential for facilitating the movement of people and goods.

- Furthermore, the shift towards green energy is leading to the development of renewable energy projects, including solar farms and wind farms. These projects require substantial construction activities, contributing to the market's growth. Key sectors within the construction market, such as commercial construction, are also experiencing growth. Office buildings, hotels, retail buildings, and other commercial construction projects are in high demand, particularly in urban areas. Industrial construction, including warehouses, data centers, and industrial parks, is also experiencing significant growth due to the increasing importance of e-commerce and the digital economy. Government investments in infrastructure projects and institutional construction, such as educational buildings, healthcare buildings, and research facilities, are also contributing to the market's growth.

What are the market trends shaping the Germany Construction Market?

Growing demand for modular houses is the upcoming trend In the market.

- The construction market encompasses a range of key sectors, including hotels, green energy, transport infrastructure projects, and commercial construction. Commercial construction involves the development of office buildings, outdoor leisure facilities, retail buildings, and other commercial structures. Tourism and travel business activities are significant growth drivers In the hospitality sector, leading to an increase in hotel construction. In the industrial sector, participants focus on major projects such as warehouses, data centers, industrial parks, manufacturing plants, and waste processing plants. Industrialization and rapid urbanization necessitate infrastructure construction, including rail infrastructure, road infrastructure, electricity and power, oil and gas, telecommunications, water infrastructure, and renewable energy projects.

- In addition, government investments in public projects contribute to economic growth and job creation. Construction market trends include the use of drones for mapping, surveying, and 3D printing, smart infrastructure for performance optimization, and eco-friendly, adaptable, and digital technologies for sustainability measures and cost savings. The construction industry manufacturers provide surface technologies, terminal management solutions, and municipal energy utilities to support grid operators and organic solid-flow battery production. Urban development and sustainable construction practices are essential for the expansion of infrastructure and for addressing environmental concerns. Costs, regulatory pressures, and competitive risks are significant business challenges, while success factors include productivity, competitiveness, and innovation.

What challenges doesGermany Construction Market face during the growth?

Rise in cost of construction is a key challenge affecting the market growth.

- The construction market encompasses various sectors, including hotels, green energy, transport infrastructure projects, commercial construction, and industrial construction. Commercial construction involves the development of office buildings, retail buildings, other commercial structures, and institutional buildings such as educational, healthcare, and research facilities. Tourism and travel business activities contribute significantly to the demand for construction in sectors like hotels and outdoor leisure facilities. Industrialization and rapid urbanization necessitate the expansion of infrastructure, including warehouses, data centers, industrial parks, manufacturing plants, and waste processing plants. Government investments in infrastructure projects, such as rail infrastructure, road infrastructure, electricity and power, oil and gas, telecommunications, water infrastructure, and renewable energy projects, fuel market growth.

- In addition, key sectors like housing, particularly residential construction, including single family housing and multi family housing, face a housing deficit, driving project pipeline and projected spending. Major construction projects require collaboration among various participants, including leading contractors, consultants, and market opportunities. Strategies for success include cost management, regulatory pressures, competitive pressures, and competitive risk mitigation. Industrialization, developing regions, and urban development necessitate sustainable construction practices and cutting-edge materials to optimize performance and reduce environmental concerns. Construction market trends include the use of drones for mapping, surveying, and 3D printing, smart infrastructure, and performance optimization. Government spending on public projects, improved infrastructure, and transportation systems contribute to economic growth and job creation. Accessibility to financing, low interest rates, and streamlined project delivery enhance competitiveness and productivity.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

ARGON Hausbau GmbH and Co. KG - The company offers construction services such as construction of family homes and town villas.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- allkaufhaus GmbH

- BASF SE

- BAUER AG

- Bilfinger SE

- Building Radar GmbH

- CRH Plc

- GOLDBECK GmbH

- HOCHTIEF AG

- Lechner Massivhaus GmbH

- LEONHARD WEISS GmbH and Co. KG

- Max Bogl Bauservice GmbH and Co. KG

- PERI SE

- PORR AG

- Ronesans Holding

- RRI GmbH Rhein Ruhr International

- SchworerHaus KG

- STRABAG SE

- TRAPP Construction International GmbH

- WOLFF and MULLER Holding GmbH and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction market encompasses a broad range of activities and sectors, each with unique dynamics and growth drivers. Commercial construction, including office buildings, outdoor leisure facilities, retail buildings, and other commercial structures, is a significant component of the market. Tourism and travel business activities also play a crucial role, as the demand for hotels and other accommodations drives the need for new construction projects. Rapid urbanization and industrialization are major factors fueling the construction market's growth. Developing regions are witnessing an increase in infrastructure projects, such as roads, bridges, airports, and dams, to support economic growth and improve accessibility.

In addition, industrial construction, including warehouses, data centers, industrial parks, manufacturing plants, and waste processing plants, is another key sector experiencing strong expansion. Government investments in public projects, such as schools, hospitals, and other institutional buildings, contribute significantly to the construction market's demand. These projects often involve various development stages, from design and manufacturing to raw resources and produced items, internal processes, and site preparation. Permissions and approvals, excavation, foundation work, framing, interior and exterior work, and final inspections are all essential phases of a construction project. The construction market is subject to various costs, regulatory pressures, and competitive risks.

Furthermore, accessibility to financing and low interest rates can impact project delivery efficiency and productivity. Competitive pressures and success factors vary across sectors. In the residential construction market, addressing the housing deficit and providing affordable housing solutions are critical. In the commercial sector, e-commerce and distribution centers have emerged as significant revenue possibilities. Sustainability measures and cutting-edge materials are essential for construction businesses to remain competitive and adaptable in an increasingly digital and eco-friendly world.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 66.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Germany

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch