Conversational Computing Platform Market Size 2024-2028

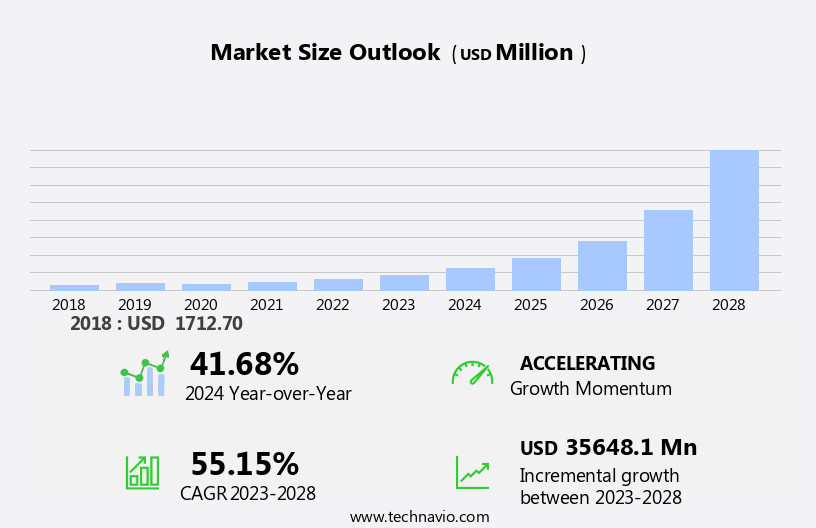

The conversational computing platform market size is forecast to increase by USD 35.65 billion at a CAGR of 55.15% between 2023 and 2028.

- The market is witnessing significant growth due to the reduction in time and cost required to develop these platforms. The integration of artificial intelligence (AI) and natural language processing (NLP) technologies is a key trend driving market growth. Conversational systems, such as chatbots, are increasingly being used in various industries, including travel, insurance, and digital services, to enhance customer engagement and streamline business processes. Big data and analytics are also playing a crucial role In the development of conversational computing platforms, enabling businesses to gain valuable insights from customer interactions. However, data security remains a major challenge, as conversational systems handle sensitive information. The use of blockchain technology and deep learning algorithms can help address data security concerns. Overall, the conversational computing platform market is expected to continue its digital transformation trajectory, offering numerous opportunities for businesses to leverage AI and NLP to create personalized and efficient conversational experiences for their customers.

What will be the Size of the Market During the Forecast Period?

- The conversational computing solutions market encompasses speech synthesis, recognition, and natural language understanding technologies that enable automated conversational techniques between businesses and their customers. This market is experiencing significant growth as businesses seek to enhance customer engagement and satisfaction through AI-based technology.

- Moreover, applications span various industries, including insurance, healthcare, and digital marketing, where conversational AI is used to facilitate customer queries, provide instant insurance quotes, process claims inquiries, and offer personalized healthcare advice. Neural networks and generative AI power these systems, enabling them to understand and respond to complex customer requests. Conversational AI is also integrated into messaging services and platforms, streamlining customer service and information dissemination. The market's size and direction reflect a growing reliance on conversational computing for advertising, customer engagement, and business process automation.

How is this Conversational Computing Platform Industry segmented and which is the largest segment?

The conversational computing platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Virtual digital assistants

- Chatbots

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Type Insights

- The virtual digital assistants segment is estimated to witness significant growth during the forecast period.

Virtual digital assistants, powered by advanced technologies such as speech synthesis, speech recognition, neural networks, natural language understanding, and machine learning, enable users to interact with computers using natural language. These assistants can handle business processes, answer customer queries, provide insurance quotes and claims inquiries, and offer solutions in various sectors including healthcare, digital marketing, telecom, entertainment and media, travel and hospitality, and startups. AI-based conversational techniques enhance customer satisfaction and streamline operations for digital marketing managers. Natural language processing and voice recognition technologies facilitate information dissemination, advertising, and customer service. Consulting and training, support and maintenance, cloud services, and IoTs are integral to the market. Conversational AI, generative AI, computer vision, and blockchain are driving digital transformation in IT and telecom industries.

Get a glance at the Conversational Computing Platform Industry report of share of various segments Request Free Sample

The virtual digital assistants segment was valued at USD 1.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

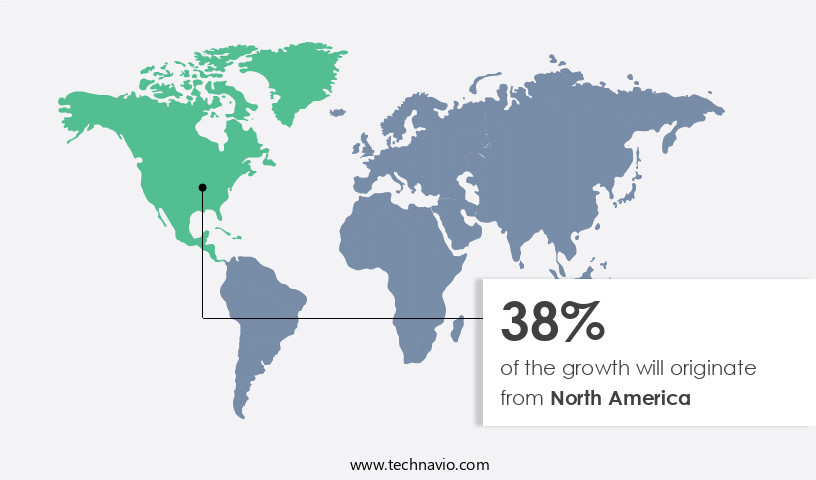

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Conversational computing platforms, which include solutions such as speech synthesis, speech recognition, neural networks, natural language understanding, and natural language processing, have gained significant traction In the business world. These technologies enable automated conversational techniques for handling customer queries, generating insurance quotes and claims inquiries, and providing information dissemination in various sectors like healthcare, digital marketing, and customer service. AI-based technology, such as machine learning and deep learning, powers conversational computing platforms to understand and respond to customer queries in a human-like manner. The North American region leads the adoption of conversational computing platforms due to the presence of major technology companies investing in chatbots, text assistants, and voice assistants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Conversational Computing Platform Industry?

Reduction in time and cost required to develop conversational computing platforms is the key driver of the market.

- Conversational computing solutions, driven by speech synthesis and recognition, neural networks, natural language understanding, and advanced technologies like AI, NLP, and machine learning, have gained significant traction in various industries. Previously, large-scale deployments were prohibitive due to development costs and time. However, recent advancements include the release of frameworks, development tools, and research data by tech giants like Microsoft, Google, and IBM. These resources have enabled the cost-effective creation of chatbots and virtual digital assistants. Deploying conversational AI In the cloud further reduces organizational investments. Business processes, including customer queries, insurance quotes, claims inquiries, and customer service, have been transformed through automated conversational techniques.

- Furthermore, industries such as healthcare, telecom, entertainment and media, travel and hospitality, start-ups, IT and telecom, and digital marketing have embraced conversational AI for information dissemination, advertising, and internal enterprise systems. The integration of conversational AI with big data, IoTs, blockchain, and bi data analytics is fueling digital transformation. Remote work and IT departments are also leveraging conversational AI for NLP, ML, voice recognition technologies, and natural language interfaces.

What are the market trends shaping the Conversational Computing Platform Industry?

Use of AI in conversational computing platforms is the upcoming market trend.

- Conversational computing solutions have evolved beyond responding to basic customer queries, thanks to the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML). AI enables chatbots and virtual digital assistants to perform complex tasks, such as determining customer needs from conversations and taking appropriate actions. Neural networks, natural language understanding, and natural language processing are key components of AI that facilitate this capability. Self-learning algorithms draw insights from every interaction, continuously improving subsequent interactions. Sentiment analysis helps understand customer moods, while real-time analytics enables identifying irate customers. These technologies are transforming business processes across industries, including insurance, healthcare, telecom, entertainment and media, travel and hospitality, and startups.

- Furthermore, AI-based conversational techniques are revolutionizing customer service, digital marketing, and information dissemination, enhancing customer satisfaction and streamlining business operations. Cloud-based conversational AI platforms offer scalability and flexibility, making them a popular choice for IT departments and remote work environments. Voice recognition technology, generative AI, computer vision, and bi data analytics are other advanced technologies complementing conversational computing solutions. Consulting and training, support and maintenance, and messaging services are essential services associated with conversational computing platforms.

What challenges does the Conversational Computing Platform Industry face during its growth?

Issues associated with data privacy is a key challenge affecting the industry growth.

- Conversational computing solutions, driven by speech synthesis and recognition, neural networks, natural language understanding, and AI-based technology, are revolutionizing business processes. These platforms enable automated conversational techniques to handle customer queries, provide insurance quotes, and manage claims inquiries in various sectors like healthcare, digital marketing, telecom, entertainment and media, travel and hospitality, and startups. Customer satisfaction is a significant benefit, as conversational AI can disseminate information, support advertising efforts, and provide personalized assistance through chatbots and voice assistants. Natural language processing, machine learning, and deep learning are integral to conversational computing platforms. These technologies enable platforms to understand and respond to customer queries effectively.

- However, data privacy remains a concern as conversational computing platforms collect and analyze user behavior data to improve their performance. Companies must ensure transparency and security to address these concerns. The conversational computing market is dynamic, with ongoing advancements in computer vision, voice recognition technology, AI chatbots, messaging services, and messaging platforms. The integration of conversational AI into internal enterprise systems, remote work, and IT departments is a growing trend. Big Data, IoTs, Blockchain, and bi data analytics are also influencing the conversational computing landscape. Consulting and training, support, and maintenance services are essential to optimize the performance of conversational computing platforms.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Amelia US LLC

- Artificial Solutions International AB

- Creative Virtual Ltd.

- Eudata

- Inbenta Holdings Inc.

- International Business Machines Corp.

- Jio Haptik Technologies Ltd.

- Kore.ai Inc.

- Liveperson Inc.

- Meta Platforms Inc.

- Microsoft Corp.

- onereach.ai

- Oracle Corp.

- Pypestream Inc.

- Rasa Technologies Inc.

- Rulai

- Salesforce Inc.

- SmarTek21 LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Conversational computing solutions have emerged as a significant trend In the technology landscape, offering businesses innovative ways to engage with their customers and streamline internal processes. These technologies encompass various components such as speech synthesis, speech recognition, natural language understanding, and neural networks. Speech synthesis and speech recognition technologies enable machines to understand and generate human language. They are crucial in conversational computing as they facilitate the exchange of information between humans and machines. Neural networks, a subset of machine learning, play a pivotal role in enabling machines to learn and improve from experience. Businesses across industries are leveraging conversational computing solutions to automate customer queries, provide insurance quotes, and handle claims inquiries.

In addition, the healthcare sector, in particular, has seen substantial growth In the adoption of conversational AI for scheduling appointments, providing medication reminders, and answering patient queries. Automated conversational techniques have become essential tools for digital marketing managers seeking to enhance customer satisfaction and engagement. These techniques enable businesses to disseminate information, provide advertising, and offer personalized recommendations to their customers. The conversational computing market is witnessing significant advancements in AI-based technology, including natural language processing, machine learning, and deep learning. These technologies enable conversational systems to understand and respond to complex queries, providing a more human-like interaction experience. Consulting and training services, support and maintenance, and cloud-based solutions are essential components of the conversational computing market.

Furthermore, telecom companies, entertainment and media organizations, startups, and IT and telecom firms are all investing in conversational AI to enhance their offerings and remain competitive. Conversational computing solutions have become increasingly relevant In the context of digital transformation, remote work, and internal enterprise systems. IT departments are adopting conversational AI to automate routine tasks, improve efficiency, and reduce costs. The conversational computing market is also witnessing significant advancements in generative AI, computer vision, voice recognition technology, and AI chatbots. Messaging services and messaging platforms are integrating conversational AI to provide more personalized and interactive experiences for their users. The conversational computing market is expected to continue growing as businesses seek to improve customer service, expand their customer bases, and streamline internal processes. The integration of conversational computing solutions with big data, IoT, blockchain, and bi data analytics is expected to further enhance their capabilities and value proposition.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 55.15% |

|

Market growth 2024-2028 |

USD 35.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

41.68 |

|

Key countries |

US, China, UK, Canada, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Conversational Computing Platform Market Research and Growth Report?

- CAGR of the Conversational Computing Platform industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the conversational computing platform market growth of industry companies

We can help! Our analysts can customize this conversational computing platform market research report to meet your requirements.