Cosmetic Ingredients Market Size 2025-2029

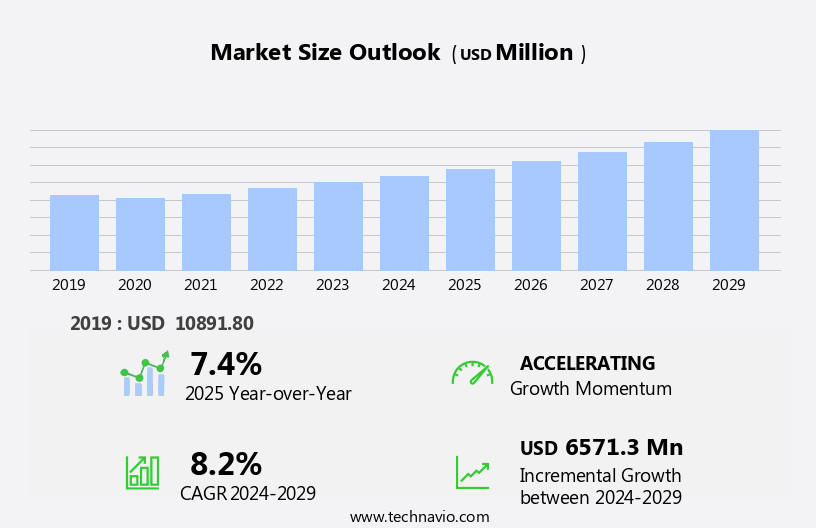

The cosmetic ingredients market size is forecast to increase by USD 6.57 billion at a CAGR of 8.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for natural and organic ingredients in cosmetic formulations. Consumers are increasingly seeking products with clean labels, free from synthetic additives, and this trend is expected to continue. However, the market is not without challenges. Stringent regulations governing the use of certain ingredients, particularly in regions like Europe and the United States, pose significant hurdles for manufacturers. Companies must navigate these regulations while also meeting consumer demand for high-quality, natural cosmetic offerings.

- To capitalize on this market opportunity, businesses must stay informed of regulatory changes and invest in research and development to bring innovative, natural, and compliant products to market. Additionally, strategic partnerships and collaborations can help companies overcome regulatory challenges and expand their reach in The market.

What will be the Size of the Cosmetic Ingredients Market during the forecast period?

- The market encompasses a broad range of substances used in the formulation of various personal care products, including body lotions, eyeliners, lipsticks, moisturizers, and more. Key ingredients include water, preservatives, emulsifiers, thickeners, lubricants, pigments, perfumes, and various additives such as antioxidants, anti-inflammatory agents, thickening agents, and moisturizing lipids. Natural sources, including plants, are increasingly popular in the market, with a growing demand for green cosmetics and a shift away from dangerous chemicals. Urbanization and changing consumer preferences drive the market, with an emphasis on natural cosmetic ingredients, skincare products, body care products, oral care products, and various forms of emollient oils and humectant agents.

- Innovations in the market include the use of antioxidant compounds, UV filters, skin peptides, hydrating polymers, exfoliating acids, pigment stabilizers, and fragrance fixatives. Silicone alternatives and anti-aging actives are also gaining traction. Overall, the market is dynamic and diverse, with a focus on enhancing texture, appearance, and functionality while addressing consumer concerns for safety and sustainability.

How is this Cosmetic Ingredients Industry segmented?

The cosmetic ingredients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Surfactants

- Emollients film-formers and moisturizers

- Single-use additives

- Carriers powders and colorants

- Others

- Application

- Hair care and skin care

- Perfumes and fragrance

- Color cosmetics

- Others

- Source

- Synthetic Ingredients

- Natural ingredients

- Plant extracts

- Minerals

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

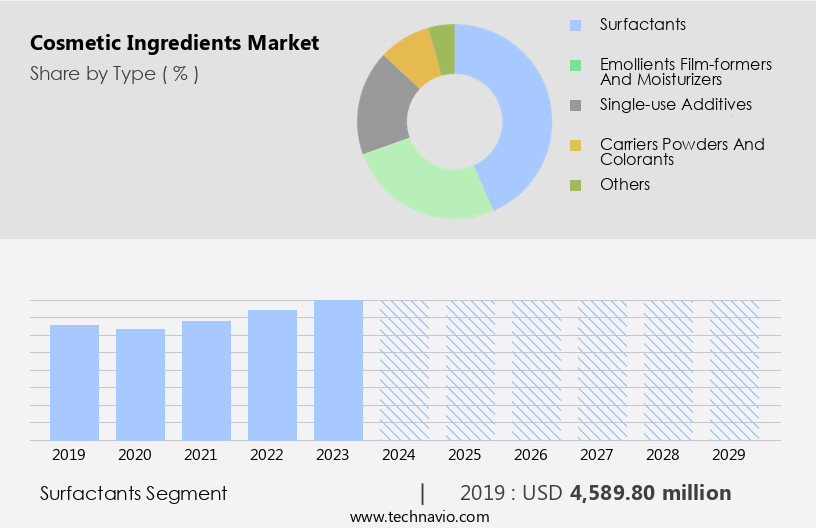

The surfactants segment is estimated to witness significant growth during the forecast period.

Surfactants are essential ingredients in cosmetics, reducing surface tension in liquid solutions for applications such as cleansing, solubilization, and conditioning. They consist of hydrophilic and lipophilic components that aid in breaking down oil and fat impurities on the skin. Commonly used surfactants in cosmetics include acyl isethionates, alkyl polyglycosides, sodium laureth sulfate, and ammonium laureth sulfate. However, there is a growing preference for naturally sourced surfactants derived from plants and vegetables, such as decyl glucoside, decyl polyglucoside, and stearyl alcohol, due to increasing health concerns regarding synthetic surfactants. These natural alternatives are found in various cosmetic products, including body lotions, moisturizers, eyeliners, lipsticks, and face washes.

The demand for green cosmetics and skincare products, free from dangerous chemicals, has led to the development of natural surfactants from renewable sources. Key natural sources include plants and their extracts, which provide antioxidant, anti-inflammatory, thickening, moisturizing, texture, and appearance benefits. These natural ingredients extend the shelf life of cosmetic products while ensuring consumer health and safety.

Get a glance at the market report of share of various segments Request Free Sample

The Surfactants segment was valued at USD 4.59 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

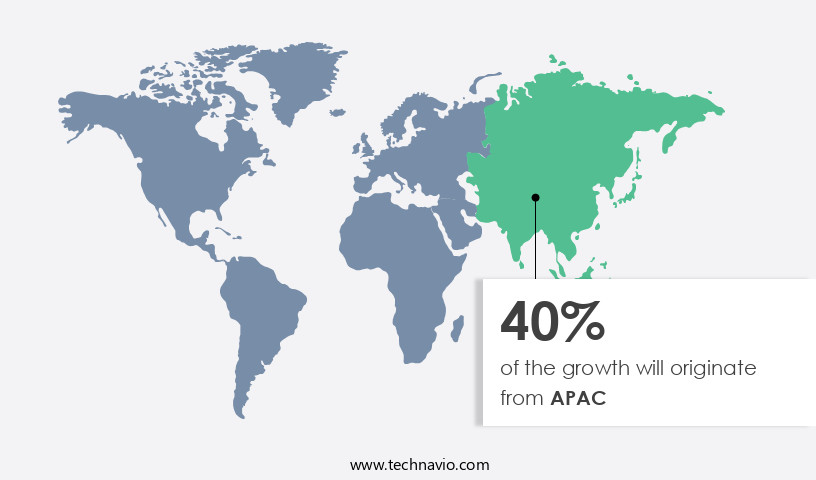

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The cosmetics industry in Asia Pacific has experienced a notable trend towards natural and organic cosmetics. Consumers in the region are growing increasingly conscious of the potential health risks associated with synthetic ingredients, such as preservatives and emulsifiers, commonly used in cosmetics. In response, there is a rising demand for cosmetic products formulated with organic and sustainable ingredients. This shift is driving companies to invest significantly in the development of natural additives and ingredients. The abundance of naturally sourced ingredients, including herbs and plants, in countries like China, India, and Southeast Asia, presents a substantial opportunity for market players to establish production units in the region.

Key natural ingredients include vitamins, fatty acids, antioxidants, and plant extracts. The market for cosmetics in the Asia Pacific region is expected to grow, driven by the demand for skincare products, body care products, oral care products, and color cosmetics, such as body lotions, eyeliners, lipsticks, moisturizers, and perfumes. Natural sources, including water and natural preservatives, thickeners, lubricants, pigments, and texture enhancers, are gaining popularity due to their potential health benefits and reduced hazardous effects. Green cosmetics, free from dangerous chemicals, are becoming increasingly preferred, particularly in urban areas. Skin problems, such as acne, hair issues, hair loss, split ends, and premature greying, are common concerns driving the demand for cosmetic solutions.

Natural cosmetic ingredients, including alpha hydroxy acids, beta hydroxy acids, retinol, hydroquinone, copper peptide, and kojic acid, offer effective solutions to these issues. The market for cosmetics in the Asia Pacific region is expected to grow, driven by increasing consumer awareness, rising disposable income, and the availability of innovative and effective natural cosmetic solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Cosmetic Ingredients Industry?

- Growing demand for natural and organic cosmetic ingredients is the key driver of the market.

- The cosmetics industry has witnessed a notable shift towards natural and organic ingredients in recent years. Consumers are increasingly conscious of the potential long-term health effects of cosmetics containing synthetic ingredients. As a result, established players in The market, including BASF SE and Croda International Plc, are expanding their portfolios to cater to this demand. Natural ingredients, such as coconut, bakuchiol, pumpkin, blue algae, avocado, argan, olive oil, antioxidants, hyaluronic acid, clay, jojoba, aloe vera, sunflower, and carrot seed extracts, are gaining popularity due to their benefits for skin and hair health.

- Companies are offering a range of skin care and hair care products featuring these ingredients to meet consumer preferences.

What are the market trends shaping the Cosmetic Ingredients Industry?

- Growing prominence of clean labeling in cosmetic formulations is the upcoming market trend.

- The cosmetics industry is witnessing a shift towards clean labeling, with a growing preference for minimal synthetic ingredients in cosmetic formulations. This trend prioritizes transparency, safety, and authenticity in the cosmetics sector. companies in The market, including Koninklijke DSM NV and BASF SE, are responding by expanding their offerings of clean-label ingredients. Cosmetic companies are also emphasizing the use of natural ingredients to promote formulation transparency and align with consumer demands.

- The adoption of organic and sustainable production methods for cosmetic ingredients is on the rise, reflecting this market dynamic.

What challenges does the Cosmetic Ingredients Industry face during its growth?

- Stringent regulations is a key challenge affecting the industry growth.

- The market is subject to stringent regulations in major economies, including the US, Australia, and EU member states like France and Germany. In the US, the Food and Drug Administration (FDA) governs the cosmetic industry under the Food, Drug and Cosmetic Act (FDCA). This legislation mandates companies and individuals involved in marketing and sales of cosmetics to ensure product and ingredient safety.

- The FDA oversees cosmetic production, handling, and labeling, with organic cosmetics' labeling standards primarily based on the percentage of organic ingredients.

Exclusive Customer Landscape

The cosmetic ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cosmetic ingredients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cosmetic ingredients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfa Chemicals Ltd. - The company specializes in providing a diverse range of sports products, ensuring optimal performance and enjoyment for consumers. Our offerings cater to various athletic pursuits, reflecting a commitment to innovation and quality. By adhering to industry best practices and utilizing cutting-edge research, we aim to deliver products that meet the evolving needs of our customers. Our dedication to excellence and customer satisfaction sets us apart in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Chemicals Ltd.

- Ashland Inc.

- Aston Chemicals Ltd.

- BASF SE

- Clariant International Ltd.

- Croda International Plc

- DSM-Firmenich AG

- Eastman Chemical Co.

- Evonik Industries AG

- Givaudan SA

- J M Huber Corp.

- Lonza Group Ltd.

- Nouryon Chemicals Holding B.V.

- Pharmacos India

- Solvay SA

- Symrise Group

- The Dow Chemical Co.

- The Estee Lauder Co. Inc.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vast array of substances used in the production of various personal care products. These ingredients play a crucial role in determining the texture, appearance, and performance of body lotions, moisturizers, and other skincare and body care offerings. Among the key components are water, preservatives, emulsifiers, thickeners, lubricants, pigments, perfumes, and natural sources. Water serves as a fundamental ingredient in cosmetics, contributing to the consistency and spreadability of products. Preservatives are essential for maintaining product integrity and preventing microbial growth. Emulsifiers facilitate the blending of oil and water components, while thickeners enhance the texture and provide a desirable consistency.

Lubricants contribute to the smooth application and spreadability of cosmetics. Pigments impart color to cosmetics, such as eyeliners and lipsticks. Perfumes add fragrance, while natural sources, including plants, are increasingly popular in the production of green cosmetics. These ingredients offer various benefits, such as antioxidant and anti-inflammatory properties, which contribute to the health and well-being of consumers. The market dynamics of cosmetic ingredients are influenced by several factors. Urbanization and increasing consumer awareness of health concerns have led to a growing demand for natural and organic ingredients. This trend is evident in the popularity of plant extracts, vitamins, fatty acids, and antioxidants.

The use of certain ingredients, however, has raised concerns regarding their potential hazardous effects. For instance, sodium lauryl sulfate and propylene glycol have been linked to skin irritation and allergic reactions in some individuals. Methyl, a preservative, has been identified as a potential carcinogen. These concerns have led to the development of alternative ingredients, such as natural thickeners, like starch, and emollients derived from renewable sources. The market is diverse and dynamic, with a wide range of products catering to various skin and health concerns. These include face washes, sunscreens, face masks, serums or oils, and oral care products, such as toothpaste and gels.

Skin problems, such as acne, and hair issues, like hair loss, split ends, and dandruff, are common concerns addressed by cosmetic ingredients. The market for cosmetic ingredients is continually evolving, with ongoing research and development aimed at addressing new health concerns and consumer preferences. Innovations in the field include the use of alpha hydroxy acids, beta hydroxy acids, retinol, hydroquinone, copper peptide, and kojic acid. These ingredients offer various benefits, such as exfoliating, anti-aging, and skin brightening properties. In , the market is a dynamic and diverse sector, driven by consumer preferences and health concerns.

The use of natural and organic ingredients, as well as ongoing research and development, are key trends shaping the market. The production and application of cosmetic ingredients play a crucial role in the development of various personal care products, including body lotions, moisturizers, and other skincare and body care offerings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 6571.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, China, Japan, Germany, South Korea, France, India, Canada, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cosmetic Ingredients Market Research and Growth Report?

- CAGR of the Cosmetic Ingredients industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cosmetic ingredients market growth of industry companies

We can help! Our analysts can customize this cosmetic ingredients market research report to meet your requirements.