Cosmetic Pigments Market Size 2024-2028

The cosmetic pigments market size is estimated to grow by USD 272.1 million at a CAGR of 7.08% between 2023 and 2028. In today's fast-paced world, people are constantly seeking ways to enhance their income and improve their lifestyles. One industry that has seen significant growth in response to these trends is the multifunctional beauty and personal care (BPC) cosmetics sector. With the increasing popularity of multitasking products, consumers can save time and money by purchasing items that serve multiple purposes. Furthermore, the rise of social media influencers has led to a surge in demand for innovative and effective BPC cosmetics. Influencers, with their vast reach and influence, can promote these products to their followers, driving sales and increasing brand awareness. As a result, the BPC cosmetics market is experiencing robust growth, offering numerous opportunities for businesses and entrepreneurs.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

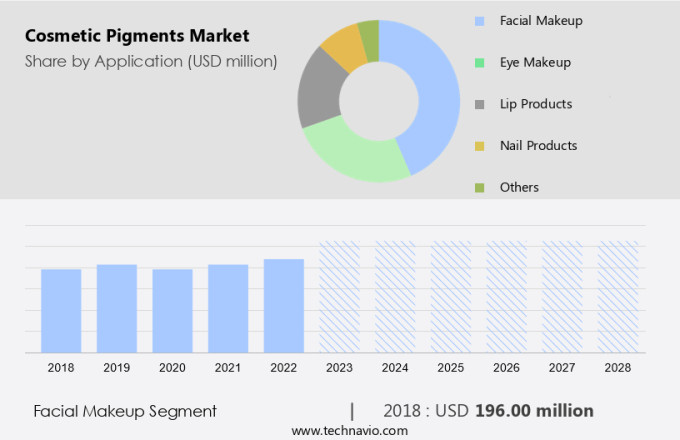

Cosmetic pigments are essential coloring agents used in various cosmetic products such as facial makeup, lip products, eye makeup, and nail products. These pigments add color and enhance the visual appeal of cosmetics. The market for cosmetic pigments is driven by the increasing demand for color cosmetics and personal care products. Facial makeup, including foundations, blushes, and concealers, is the largest application segment for cosmetic pigments. Lip products, particularly lipsticks and lip glosses, are another significant application area. The market for cosmetic pigments in eye makeup is also growing due to the rising popularity of eye shadows, eyeliners, and mascaras. Pearlescent pigments are gaining popularity due to their ability to add a shimmering effect to cosmetics. However, safety standards and environmental concerns are crucial factors influencing the cosmetic pigments market. Key players in the cosmetic pigments market include Sun Chemical, among others. Central & South America is a growing market for cosmetic pigments due to the increasing demand for cosmetics in the region. The market is expected to continue its growth trajectory, driven by the expanding consumer base and the rising trend of using natural and organic cosmetics. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing income and changing lifestyles is notably driving market growth. The market is witnessing substantial growth due to the rising living standards in emerging economies, such as China, India, and Brazil. The increasing disposable income and changing lifestyles, driven by modernization, are significantly boosting the demand for cosmetic and personal care products. Among the younger generation (aged between 18-30 years), there is a noticeable shift in purchasing patterns towards color cosmetics as they become more affordable. Women's financial independence has also played a crucial role in driving market growth, as they now have more disposable income to spend on cosmetics. Environmental concerns are increasingly influencing consumer choices, leading to a preference for eco-friendly and natural cosmetic pigments. Sun Chemical, a leading player in the industry, is focusing on sustainable production methods to cater to this trend. The rise of e-commerce platforms is also providing a significant boost to the market, making cosmetic products more accessible to consumers in remote areas. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The recent developments in cosmetic pigment in cosmetic sector is the key trend in the market. The cosmetic pigments market has experienced notable growth in recent years, driven by increasing environmental concerns and the rising demand for e-commerce in the beauty industry. Established players, such as Sun Chemical, are expanding their portfolios through strategic mergers and acquisitions (M&A) to meet this demand. For instance, in June 2021, Sun Chemical acquired Infinitec Activos, a company specializing in the development and manufacturing of innovative active delivery systems for cosmetic applications. This acquisition will enable Sun Chemical to broaden its cosmetic ingredient offerings and cater to the evolving needs of consumers. The growing trend towards sustainable and eco-friendly cosmetics is also fueling the demand for cosmetic pigments, as these ingredients play a crucial role in enhancing the visual appeal of cosmetic products while minimizing their environmental impact. The e-commerce sector's continued growth is another significant factor driving the market's expansion, as consumers increasingly turn to online platforms to purchase cosmetics. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The increase in stringent regulations in cosmetic pigment is the major challenge that affects the growth of the market. Cosmetic pigment manufacturers are required to comply with stringent regulations regarding the production and labeling of their products. These standards, which include labeling and packaging specifications, are particularly rigorous in Europe and North America due to increasing health and environmental consciousness. In the United States, the Food and Drug Administration (FDA) sets the rules for color additives and pigments used in cosmetics. Similarly, the European Union (EU) enforces restrictions on potentially hazardous pigments or dyes, such as cadmium pigments and lead (Pb) and its derivatives, due to environmental concerns. These regulations significantly impact the manufacturing of cosmetic pigments, leading to higher pricing. E-commerce platforms are increasingly important sales channels for cosmetic pigment suppliers, allowing them to reach a wider customer base and expand their market reach. Sun Chemical, a leading global producer of cosmetic pigments, is one company that has successfully navigated this regulatory landscape and leveraged e-commerce to grow its business. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Clariant International Ltd. - The company offers cosmetic pigments that includes pigment powders, aqueous dispersions based on pigments, powder dyes, shampoos, and cosmetics.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Clariant International Ltd.

- Couleurs de Plantes

- DayGlo Color Corp.

- DIC Corp.

- ECKART GmbH

- Elemental SRL

- Geotech International B.V.

- Kobo Products Inc.

- Koel Colours Pvt Ltd.

- Lanxess AG

- LI PIGMENTS

- Merck KGaA

- Neelikon Food Dyes and Chemicals Ltd.

- NIHON KOKEN KOGYO CO. LTD.

- RPM International Inc.

- SCHLENK SE

- Sensient Technologies Corp.

- Shanghai Orcheer Pigment Technology Co., Ltd.

- Sudarshan Chemical Industries Ltd.

- Venator Materials Plc

- Yipin USA INC.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

The facial makeup segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of colorants used in various cosmetic products, including facial makeup, lip products, and eye makeup. Pearlescent pigments add a radiant shine to lipsticks, lip glosses, and nail products, while blemishes and skin tone irregularities are concealed with root makeup products.

Get a glance at the market share of various regions Download the PDF Sample

The facial makeup segment accounted for USD 196 million in 2018. Cosmetic brands continually innovate, introducing bright colors such as neon pink and blaze orange, catering to diverse consumer lifestyles and trends. Regulations, particularly in the European Union (EU), have led to the phasing out of lead and cadmium-based pigments, driving the cosmetic pigments market towards environment-friendly, sustainable ingredients like organic pigments. Quality remains a priority, with mass-market products utilizing inorganic pigments, whose elemental compositions include titanium oxide, iron oxide, and chromium oxide, as well as mica. Luxury cosmetic products and hair color products often incorporate surface-treated pigments for enhanced performance and safety standards. Consumer demand for eco-friendly and high-quality cosmetics continues to grow, influencing the cosmetic pigments market. While regulations and labor costs pose challenges, the market is expected to expand, driven by the increasing popularity of cosmetic products and the desire for vibrant, long-lasting colors.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 42% to the growth of the global market during the market forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market encompasses a wide range of colorants used in various cosmetic products, including facial makeup, lip products, and eye makeup. Pearlescent pigments add a radiant sheen to lipsticks, lip glosses, and nail products, while blemishes and skin tone concerns are addressed through the use of cover-up foundations and root makeup products. Cosmetic brands continually innovate with bright colors such as neon pink and blaze orange, while adhering to regulations set by entities like the European Union (EU), which restrict the use of lead and cadmium-based pigments. The cosmetic pigments market is evolving to meet consumer demand for environment-friendly and sustainable ingredients, with a shift towards organic pigments and green market trends. Quality and safety standards are paramount, with mass-market products utilizing inorganic pigments and elemental compositions such as titanium oxide, iron oxide, and chromium oxide, while luxury cosmetic products may incorporate surface-treated pigments for enhanced performance. The consumer lifestyle and labor costs influence the pricing and demand for cosmetic pigments, making them a crucial component in the cosmetics industry.

Segment Overview

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- Facial makeup

- Eye makeup

- Lip products

- Nail products

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Argentina

- Brazil

- Chile

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also be interested in:

- Cosmetic Ingredients Market Analysis APAC, North America, Europe, South America, Middle East and Africa - France, Singapore, South Korea, Japan, US - Size and Forecast

- Plastic Pigments Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, Japan, India, Germany - Size and Forecast

- Color Cosmetics Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, Japan, Germany, Brazil - Size and Forecast

Market Analyst Overview

The market encompasses a wide range of coloring agents used in various cosmetic products such as Facial makeup, Lip products, Nail products, Eye makeup, and more. Pearlescent pigments are popular in the market, adding a radiant and shimmering effect to blemish-concealing foundations and highlighters. Cosmetic pigments find extensive applications in Lipsticks and Lip glosses, where bright colors like Neon pink and Blaze orange continue to be in demand. The market is diverse, catering to both mass-market products and luxury cosmetic brands. Regulations play a significant role in the market, with the European Union (EU) imposing stringent safety standards. As a result, there is a growing trend towards using environment-friendly, sustainable ingredients, such as Organic pigments, in place of Lead and Cadmium-based pigments. The market is segmented based on product type, including Inorganic pigments (Titanium oxide, Iron oxide, Chromium oxide, and Mica) and Organic pigments. Surface-treated pigments are also gaining popularity due to their improved color intensity and stability. Consumer lifestyle and labor costs influence the market, with an increasing focus on quality and safety. The market for Hair color products is also expanding, driven by the growing popularity of Root makeup products. Overall, the Cosmetic Pigments Market is expected to grow, driven by the increasing demand for cosmetic products and the continuous innovation in pigment technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 272.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Clariant International Ltd., Couleurs de Plantes, DayGlo Color Corp., DIC Corp., ECKART GmbH, Elemental SRL, Geotech International B.V., Kobo Products Inc., Koel Colours Pvt Ltd., Lanxess AG, LI PIGMENTS, Merck KGaA, Neelikon Food Dyes and Chemicals Ltd., NIHON KOKEN KOGYO CO. LTD., RPM International Inc., SCHLENK SE, Sensient Technologies Corp., Shanghai Orcheer Pigment Technology Co., Ltd., Sudarshan Chemical Industries Ltd., Venator Materials Plc, and Yipin USA INC. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies