Crop Protection Chemicals Market Size 2024-2028

The crop protection chemicals market size is forecast to increase by USD 23.3 billion at a CAGR of 3.21% between 2023 and 2028.

What will be the Size of the Crop Protection Chemicals Market During the Forecast Period?

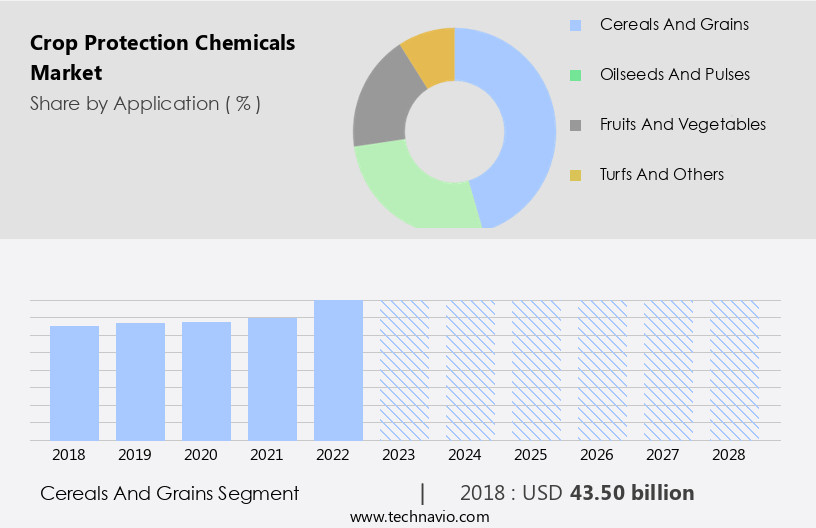

How is this Crop Protection Chemicals Industry segmented and which is the largest segment?

The crop protection chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Cereals and grains

- Oilseeds and pulses

- Fruits and vegetables

- Turfs and others

- Type

- Herbicides

- Insecticides

- Fungicides

- Rodenticides and others

- Geography

- APAC

- China

- India

- South America

- Brazil

- Europe

- France

- North America

- US

- Middle East and Africa

- APAC

By Application Insights

- The cereals and grains segment is estimated to witness significant growth during the forecast period.

Crop protection chemicals play a crucial role in ensuring the growth and yield of essential food crops, particularly cereals and grains, which form the foundation of many traditional diets. The high demand for these crops, driven by agricultural subsidies and consumer preferences for staple foods, necessitates the use of effective crop protection solutions. The availability of various forms of these chemicals, including dry, powdered, liquid, and sprayable, enhances their applicability and accessibility. Strict regulations governing pesticide registration and environmental impact are key considerations In the market. Emerging diseases and invasive pests pose significant challenges, necessitating continuous innovation in chemical solutions.

Biologicals, biopesticides, and synthetic as well as natural alternatives are gaining popularity due to their environmental benefits. The Herbicides segment, particularly in cereals and oilseeds, dominates the market. Key factors driving growth include the need to increase crop yields, mitigate malnutrition and food insecurity, and adhere to healthy dietary recommendations. The use of precision agriculture technologies, such as GPS-guided equipment, drones, and sensors, is transforming the industry. Regulatory pressures and formulation technologies, including nanotechnology and encapsulation techniques, are shaping the competitive landscape.

Get a glance at the Crop Protection Chemicals Industry report of share of various segments Request Free Sample

The Cereals and grains segment was valued at USD 43.50 billion in 2018 and showed a gradual increase during the forecast period.

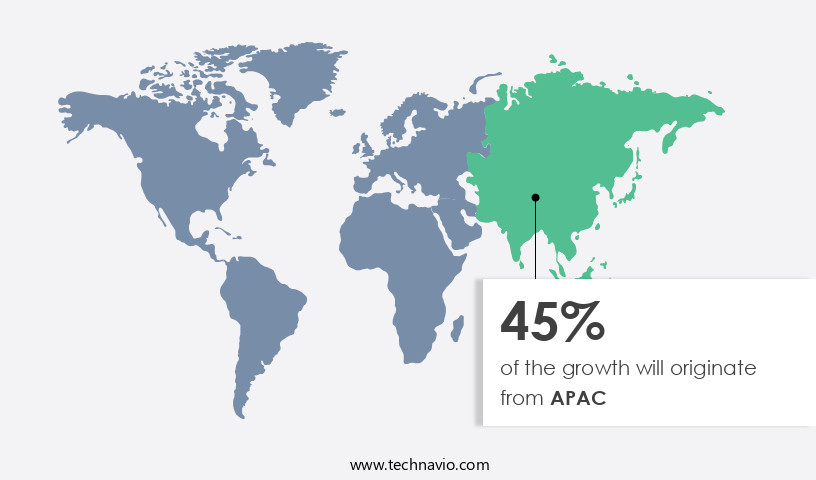

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region, with its vast expanses of arable land and significant population, plays a pivotal role in global agriculture. Accounting for approximately 60% of the world's population and 30% of the global land, it is the largest market for agrochemicals and the fastest-growing consumer of pesticides. Modern farming practices and the integration of agrochemicals are key drivers of this growth. However, challenges such as invasive pests, emerging diseases, and stringent regulations necessitate the use of advanced chemical solutions. Pesticide registration requirements and environmental impact are critical considerations, as are consumer food preferences and the importance of staple foods like cereals and grains, fruits and vegetables, oilseed and pulses.

Biologicals, biopesticides, and synthetic as well as natural solutions are employed in various forms, including foliar spray, seed treatment, and soil treatment. The Herbicides segment, particularly in cereals and oilseeds, is significant in rice cultivation. Small-scale manufacturers and agribusiness companies leverage formulation technologies like nanotechnology and encapsulation techniques to improve efficiency and effectiveness. Regulatory pressures and precision agriculture technologies, including GPS-guided equipment and drones, are shaping the future of crop protection chemicals. The environmental benefits of pesticide use, greenhouse gas emissions reduction through tillage practices, and the role of biotechnology and microbiology are essential aspects of this industry's development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Crop Protection Chemicals Industry?

Increasing use of herbicides is the key driver of the market.

What are the market trends shaping the Crop Protection Chemicals Industry?

Implementation of integrated pest management (IPM) as new method of crop protection is the upcoming market trend.

What challenges does the Crop Protection Chemicals Industry face during its growth?

Organic farming as substitutes is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The crop protection chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the crop protection chemicals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, crop protection chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Vanguard Corp. - The company is a significant player In the market, offering innovative solutions under the brands Agrinos, Green plants, and Agri Center. These brands encompass a diverse range of agrochemicals designed to enhance crop productivity and improve agricultural sustainability. The company's offerings cater to various crop types and pest management needs, ensuring farmers can effectively mitigate risks and optimize yields. By leveraging advanced research and development capabilities, the company remains at the forefront of delivering effective and environmentally responsible crop protection solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Vanguard Corp.

- BASF SE

- Bayer AG

- Bharat Rasayan Ltd.

- BioWorks Inc.

- Chr Hansen Holding AS

- Coromandel International Ltd.

- Corteva Inc.

- Dhanuka Agritech Ltd.

- Dow Chemical Co.

- DuPont de Nemours Inc.

- FMC Corp.

- Nufarm Ltd.

- Rotam CropSciences Ltd.

- Sumitomo Chemical Co. Ltd.

- Syngenta Crop Protection AG

- Tata Chemicals Ltd.

- The Indogulf CropSciences Ltd.

- UPL Ltd.

- Verdesian Life Sciences LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Crop protection chemicals play a crucial role in ensuring healthy and productive agricultural yields, safeguarding crops from invasive pests and emerging diseases. The global agriculture sector faces numerous challenges, including stringent regulations, environmental impact, and consumer food preferences. Crop protection solutions, which encompass a range of chemical and biological options, are essential tools for farmers to mitigate these challenges and maintain food security. The market for crop protection chemicals is influenced by several factors. One significant factor is the increasing prevalence of invasive pests and diseases, which can decimate entire crops and lead to malnutrition and food insecurity. These issues are particularly pressing in regions where staple foods are grown, such as cereals and grains, fruits and vegetables, oilseed and pulses.

Another critical factor is the regulatory landscape. Pesticide registration requirements and environmental impact assessments are becoming increasingly stringent, leading to a shift towards more sustainable and environmentally friendly crop protection solutions. This trend is driving innovation In the sector, with a focus on biologicals, biopesticides, and natural alternatives to synthetic chemicals. The herbicides segment is a significant market for crop protection chemicals, particularly in cereals and oilseeds. Rice cultivation, for example, relies heavily on herbicides to manage weeds and maintain high yields. Small-scale manufacturers and agribusiness companies are investing in formulation technologies, such as nanotechnology and encapsulation techniques, to improve the efficacy and sustainability of herbicides.

Insecticides and fungicides are also essential crop protection chemicals, with applications across a range of crops. Foliar sprays, seed treatments, and soil treatments are common methods of application. Biotechnology and microbiology are playing an increasingly important role In the development of new insecticides and fungicides, with a focus on reducing the environmental impact of these chemicals. The environmental benefits of crop protection chemicals are a key consideration for farmers and regulators alike. The use of these chemicals can contribute to greenhouse gas emissions, but precision agriculture technologies, such as GPS-guided equipment, drones, and sensors, can help minimize their application and improve their efficacy.

In conclusion, the market is a dynamic and evolving sector, driven by the need to maintain healthy and productive agricultural yields while addressing regulatory pressures and consumer preferences. Innovation and sustainability are key themes, with a focus on biologicals, biopesticides, and natural alternatives to synthetic chemicals. The market is expected to continue growing, driven by the demand for food security and the need to mitigate the impact of invasive pests and diseases on global agriculture.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 3.21% |

|

Market growth 2024-2028 |

USD 23.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.09 |

|

Key countries |

China, Brazil, India, France, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Crop Protection Chemicals Market Research and Growth Report?

- CAGR of the Crop Protection Chemicals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, South America, Europe, North America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the crop protection chemicals market growth of industry companies

We can help! Our analysts can customize this crop protection chemicals market research report to meet your requirements.