Crowdfunding Market Size 2025-2029

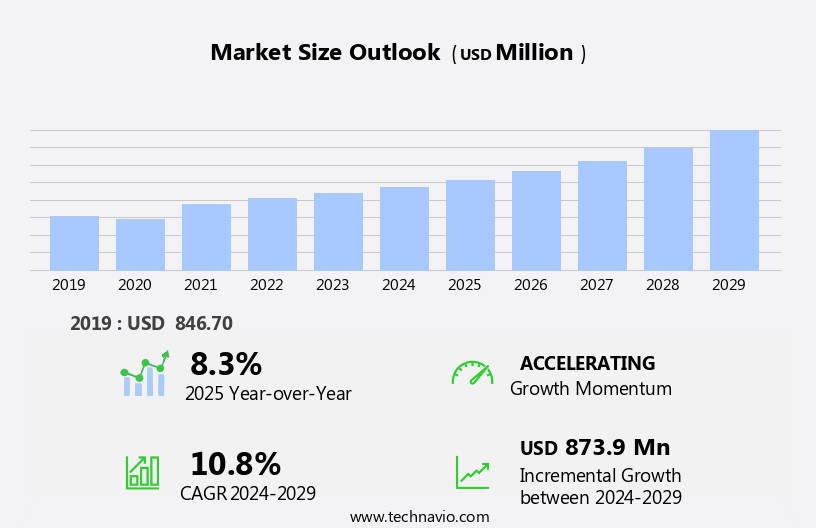

The crowdfunding market size is forecast to increase by USD 873.9 million, at a CAGR of 10.8% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing use of social media as a cost-effective promotional tool for campaigns and the emergence of P2P lending. This trend is enabling entrepreneurs and creators to reach larger audiences and secure funding for their projects.

Major Market Trends & Insights

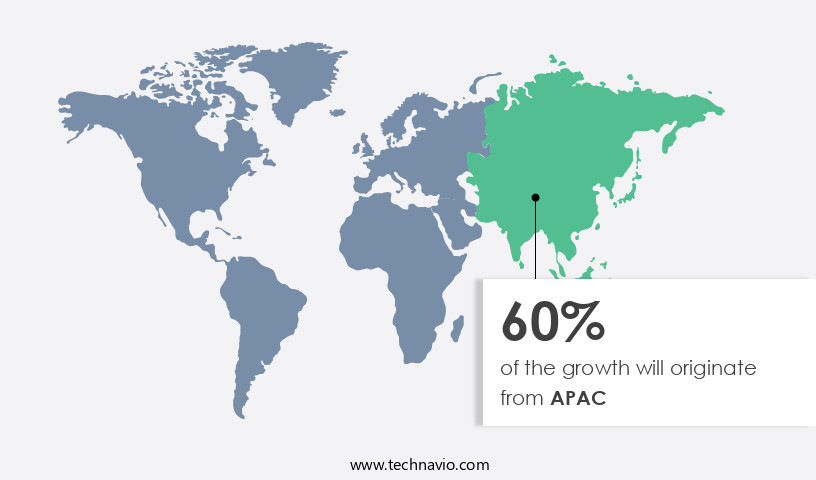

- APAC dominated the market and accounted for a 60% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

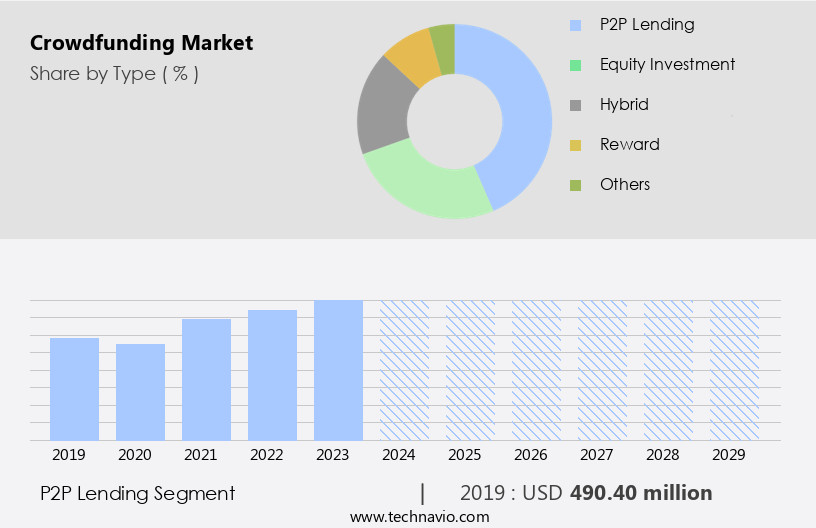

- Based on the Type, the P2P lending segment led the market and was valued at USD 671.80 million of the global revenue in 2023.

- Based on the Deployment, the on-premises segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 157.01 Million

- Future Opportunities: USD 873.9 Million

- CAGR (2024-2029): 10.8%

The high time-consuming process of managing campaigns remains a notable challenge. Creating compelling content, setting realistic goals, and engaging with potential investors can consume considerable resources. Successful campaigns require a strategic approach, effective communication, and a strong online presence. Companies seeking to capitalize on this market's opportunities should focus on streamlining their campaign management processes and leveraging social media effectively.

Navigating the challenges and maximizing the potential of the crowdfunding landscape requires a deep understanding of audience engagement and a commitment to delivering value to investors.

What will be the Size of the Crowdfunding Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, offering innovative financing solutions across various sectors. Equity stake valuation and regulatory compliance frameworks are integral components of the business plan development process for startups seeking capital through crowdfunding platforms. Financial reporting requirements and investor communication are essential for maintaining transparency and trust. Startup fundraising metrics, such as conversion rates and average donation amounts, provide insight into campaign performance tracking. Portfolio diversification through peer-to-peer lending and reward-based crowdfunding allows investors to spread risk and potentially increase returns. Financial modeling techniques and capital raising strategies are crucial for optimizing the funding cycle and maximizing investment potential.

Online payment gateways facilitate seamless transactions, while marketing campaign strategies and community building initiatives foster engagement and support. Scalability assessment and legal compliance issues are ongoing concerns for businesses navigating the project funding lifecycle. Risk assessment models and revenue projection models help investors make informed decisions, while social media fundraising and impact investing platforms broaden the reach of campaigns. Crowdfunding investment strategies, exit strategy planning, and pitch deck preparation are essential elements for entrepreneurs seeking to make the most of this dynamic market. The industry is expected to grow by over 20% annually, reflecting the ongoing unfolding of market activities and evolving patterns.

A successful campaign on an equity crowdfunding platform, for instance, raised USD2.5 million with a 40% conversion rate, demonstrating the significant potential of this innovative financing approach.

How is this Crowdfunding Industry segmented?

The crowdfunding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- P2P lending

- Equity investment

- Hybrid

- Reward

- Others

- Deployment

- On-premises

- Cloud

- Application

- Product Development

- Social Causes

- Creative Projects

- Business Expansion

- End-User

- Startups

- Individuals

- Non-Profits

- Small Businesses

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The P2P lending segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 671.80 million in 2023. It continued to the largest segment at a CAGR of 6.53%.

In the dynamic world of crowdfunding, various models cater to diverse business needs and investor preferences. One such model, Peer-to-Peer (P2P) lending, has gained significant traction due to its unique features. In this arrangement, a lender directly funds a borrower without the intervention of financial institutions. P2P lending's popularity stems from several factors. Firstly, it offers quick access to funds for individuals planning activities, as P2P lenders often liquidate loans before their terms end. Secondly, P2P lending platforms facilitate the accumulation of minor investments, providing essential financing for small businesses. Additionally, the interest earned through P2P lending is considered part of a personal savings allowance, making it an attractive investment option for many. These elements ensure a harmonious and efficient fundraising experience for both investors and entrepreneurs.

The P2P lending segment was valued at USD 490.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 157 million. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing substantial growth in the Asia Pacific region, primarily due to the expanding Internet and smartphone usage, enabling seamless online transactions. The proliferation of social media fosters credible relationships through short messages, boosting the popularity of peer-to-peer (P2P) business models. In APAC, the choice of crowdfunding platform depends on the nature of the project. For instance, small businesses, charities, and individual projects suit donation-based platforms like GoFundMe. In contrast, start-ups and large projects seeking investors prefer equity crowdfunding platforms or peer-to-business lending services. Regulatory compliance frameworks and financial reporting requirements are essential elements in the market.

Businesses must develop robust and compelling business plans to attract potential investors. Startup fundraising metrics, such as conversion rates and average investment sizes, provide valuable insights into campaign performance. Portfolio diversification and financial modeling techniques help investors manage risks and maximize returns. Capital raising strategies, such as marketing campaign strategies and investor communication, are crucial for successful campaigns. Equity crowdfunding platforms offer tools for investor due diligence and campaign management. Risk assessment models and revenue projection models aid in making informed investment decisions. Social media fundraising and funding cycle optimization are effective marketing channels. Legal compliance issues, including securities regulations, are significant challenges in the equity market.

Exit strategy planning and pitch deck preparation are essential for startups seeking long-term success. Peer-to-peer lending platforms facilitate reward-fulfillment processes and cost-benefit analysis. According to recent industry reports, the market in APAC is projected to grow by over 30% annually. In conclusion, the market in APAC is thriving due to increasing digital penetration and social media usage. The choice of platform, regulatory compliance, financial reporting, business planning, fundraising metrics, portfolio diversification, financial modeling, capital raising strategies, investor communication, campaign management, risk assessment, revenue projection, social media fundraising, legal compliance, exit strategy planning, and peer-to-peer lending are essential elements shaping the market's dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has experienced significant growth in recent years, offering entrepreneurs and innovators an effective means of securing funding for their projects. However, launching a successful crowdfunding campaign requires careful planning and execution. Effective campaign strategies are crucial for optimizing reach and measuring performance. Analyzing campaign data and improving investor communication are key components of this process. Developing a compelling story and building a strong community are also essential for generating interest and support. Managing risk is another important consideration in crowdfunding campaigns. Legal compliance for crowdfunding platforms and securing funding through equity or reward-based models each present unique challenges that must be addressed. Best practices for reward fulfillment and managing campaign budgets are also vital for ensuring a positive outcome.

To launch an effective crowdfunding campaign strategies, focus on developing a compelling crowdfunding story that resonates with potential backers. Optimizing crowdfunding campaign reach requires leveraging crowdfunding campaign marketing techniques, such as targeted social media ads and influencer partnerships. Building a strong crowdfunding community fosters trust and engagement, while improving investor communication strategies ensures transparency. For reward-based crowdfunding campaign design, prioritize best practices for reward fulfillment to maintain backer satisfaction. Securing funding through crowdfunding involves managing crowdfunding campaign budget wisely and analyzing crowdfunding campaign data to refine approaches. Understanding crowdfunding campaign metrics and measuring crowdfunding campaign performance are key to achieving successful crowdfunding outcomes. When exploring equity crowdfunding platform comparison, consider evaluating crowdfunding platform fees and legal compliance for crowdfunding platforms to mitigate risks. Assessing crowdfunding investment opportunities and managing risk in crowdfunding campaigns further enhance success.

What are the key market drivers leading to the rise in the adoption of Crowdfunding Industry?

- The growing reliance on social media as a cost-effective promotional tool is a primary market driver, significantly influencing business strategies.

- The market is experiencing significant growth due to its role as an effective marketing tool. By launching a crowdfunding campaign, businesses can generate free promotion and pre-sell their products, expanding their reach beyond their immediate network. The cost-effective nature of crowdfunding allows enterprises to access multiple channels quickly, enabling them to communicate their mission and vision to a wider audience. Social media is a popular platform for crowdfunding campaigns, providing a means to track referral traffic to websites and promote ideas at no cost.

- This free marketing is expected to fuel the expansion of the market, with industry growth projected at over 20% annually. For instance, a tech startup successfully raised USD 2.5 million through a crowdfunding campaign, exceeding its funding goal while also generating substantial media coverage and customer interest.

What are the market trends shaping the Crowdfunding Industry?

- Crowdfunding campaigns have emerged as a popular trend in the market for sourcing funds from a large number of people. This approach offers numerous benefits, including the potential for greater reach and funding possibilities compared to traditional financing methods.

- Crowdfunding campaigns offer a unique opportunity for entrepreneurs to engage directly with their customers, fostering a demand-pull dynamic that can inform investment decisions and marketing strategies. Traditionally, product development and customer acquisition relied on post-purchase behavior to assess market demand. However, with the rise of crowdfunding, campaign owners can interact with their target audience, gauge interest, and understand customer expectations prior to launch. This real-time feedback can significantly impact investment and marketing strategy planning, making crowdfunding a robust and agile alternative to conventional funding and marketing methods.

- According to recent studies, the market has experienced a surge in growth, with an estimated 25% of businesses turning to crowdfunding for financing in 2021. Furthermore, market projections indicate a continued burgeoning trend, with a potential 30% increase in crowdfunding campaigns expected in the next five years.

What challenges does the Crowdfunding Industry face during its growth?

- The time-consuming nature of high processing demands is a significant challenge impeding industry growth.

- Crowdfunding is an intricate process involving various stages from product development to securing initial investments, product registration, and ensuring compliance with standards. Entrepreneurs face time-consuming pre-launch processes, which can lead to delays in crowdfunding projects. Consequently, fixed deadlines put pressure on entrepreneurs to build a customer base, and delays can result in customers withdrawing their investments or requesting refunds. This trend negatively impacts investor confidence in the market.

- For instance, a recent study revealed that over 15% of crowdfunding campaigns fail to meet their funding goals, leading to complete refunds. Despite these challenges, the industry is expected to grow by over 20% annually, indicating robust demand and potential for entrepreneurs to successfully navigate the process.

Exclusive Customer Landscape

The crowdfunding market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the crowdfunding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, crowdfunding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Chuffed.org Pty Ltd. - The company provides a crowdfunding platform, ChuffedAmplify, enabling projects to secure funding from a global community, utilizing advanced algorithms for campaign optimization and ensuring transparency and security for backers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chuffed.org Pty Ltd.

- Companisto GmbH

- ConnectionPoint Systems Inc.

- Crowdcube Ltd.

- Crowdera Inc

- Crowdfunder Ltd.

- DonorsChoose

- FUELADREAM Online Ventures Pvt. Ltd.

- Fundable LLC

- Fundly

- GGF Global Ltd.

- GoFundMe Inc.

- Indiegogo Inc.

- Ioby Inc.

- Ketto Online Ventures Pvt. Ltd.

- Kickstarter PBC

- Kiva Microfunds

- Patreon Inc.

- Republic

- Wishberry Online Services Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Crowdfunding Market

- In January 2024, Kickstarter, a leading crowdfunding platform, announced the launch of its new service, Kickstarter Pro, catering to businesses and creators seeking larger funding and more robust project management tools (Kickstarter Press Release).

- In March 2024, Indiegogo, another prominent player in the market, formed a strategic partnership with PayPal to simplify the payment process for campaign creators and backers, enhancing user experience and convenience (Indiegogo Press Release).

- In May 2024, the European Union passed the Crowdfunding Service Providers Regulation, creating a harmonized regulatory framework for crowdfunding platforms across Europe, aiming to boost the market's growth and attract more investors (European Parliament Press Release).

- In April 2025, Fig, a crowdfunding platform specializing in video games, raised USD 20 million in a Series C funding round led by Andreessen Horowitz, enabling the company to expand its offerings and enhance its technology (Crunchbase).

Research Analyst Overview

- The market for crowdfunding continues to evolve, with applications spanning various sectors from technology to arts and social projects. According to recent industry reports, the market is projected to grow by over 20% annually, driven by the increasing popularity of alternative funding methods and the continuous refinement of platform features. Campaign success hinges on various factors, such as effective goal setting, cost-efficient customer and investor acquisition, and risk mitigation strategies. Platform selection criteria, campaign timeline management, and due diligence processes are crucial elements in project viability assessment. Transparency and accountability, compliance best practices, and campaign reach optimization are essential for maintaining investor trust and building a strong network.

- Financial performance metrics, including platform fees comparison, project milestones tracking, and campaign budget allocation, play a significant role in campaign management. Effective investor relations management, financial projections accuracy, and equity crowdfunding regulations are essential components of a successful campaign. Market research methods, reward design principles, financial statement analysis, community engagement, and campaign marketing channels further contribute to a successful crowdfunding campaign. For instance, a tech startup raised over USD 2 million through a crowdfunding campaign, exceeding its funding goal by 150%. This success can be attributed to a well-planned campaign strategy, effective marketing channels, and a compelling reward design.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Crowdfunding Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.8% |

|

Market growth 2025-2029 |

USD 873.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Crowdfunding Market Research and Growth Report?

- CAGR of the Crowdfunding industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the crowdfunding market growth of industry companies

We can help! Our analysts can customize this crowdfunding market research report to meet your requirements.