Dark Beer Market Size 2024-2028

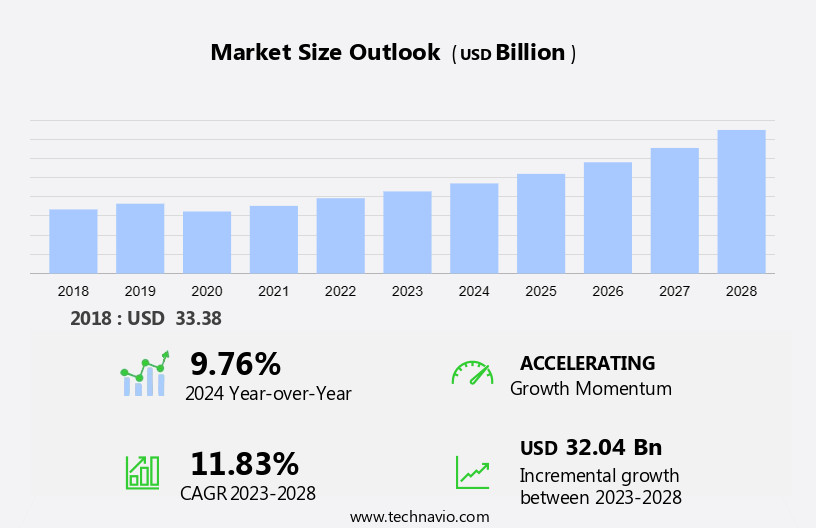

The dark beer market size is forecast to increase by USD 32.04 billion, at a CAGR of 11.83% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One trend driving market expansion is the increasing preference for dark beers among millennials. These beverages, which include stouts, porters, and black beers, offer unique flavors derived from ingredients such as chocolate, coffee, and roasted malted barley. Additionally, dark beers contain essential vitamins, minerals, and antioxidants, making them a healthier choice compared to other alcoholic beverages. Another growth factor is the innovation in packaging, with an increasing number of breweries opting for metal cans to preserve the beer's freshness and maintain its flavor profile. The use of hops and enzymes in the brewing process also adds to the beer's nutritional value, providing consumers with protein, flavonoids, and other essential nutrients.

- However, the market growth is not without challenges. Stringent regulations and heavy taxations pose significant hurdles for breweries, particularly for small and craft beer producers. These regulations and taxes can increase production costs, making it difficult for smaller players to compete with larger, more established brands. Despite these challenges, the market for dark beers is expected to continue growing due to its unique flavors, health benefits, and increasing popularity among consumers.

What will be the Size of the Dark Beer Market During the Forecast Period?

- The market encompasses a diverse range of fermented drinks, with stout ale being a prominent category. This sector has experienced significant growth in recent years, driven by the increasing popularity of craft ale among consumers, particularly millennials. The market's size is substantial, with numerous microbreweries and local breweries contributing to its expansion. Dark beers, known for their strong flavor profile and ingredients like malted barley and enzymes, offer health benefits such as flavonoids and antioxidant properties, making them an attractive choice for health-conscious consumers.

- The American Heart Association and other health organizations have acknowledged the potential cardiovascular benefits of moderate alcoholic beverage consumption, further fueling demand. The market's direction is towards premiumization, with consumers seeking out unique, high-quality brews in various packaging formats, including kegs, bottles, and cans. The brewery sector continues to innovate, incorporating new ingredients and brewing techniques to meet evolving consumer preferences. Overall, the market shows no signs of slowing down, offering ample opportunities for growth In the global alcoholic beverages industry.

How is this Dark Beer Industry segmented and which is the largest segment?

The dark beer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Off-trade

- On-trade

- Packaging

- Cans

- Bottles

- Geography

- Europe

- Germany

- UK

- France

- APAC

- China

- North America

- US

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

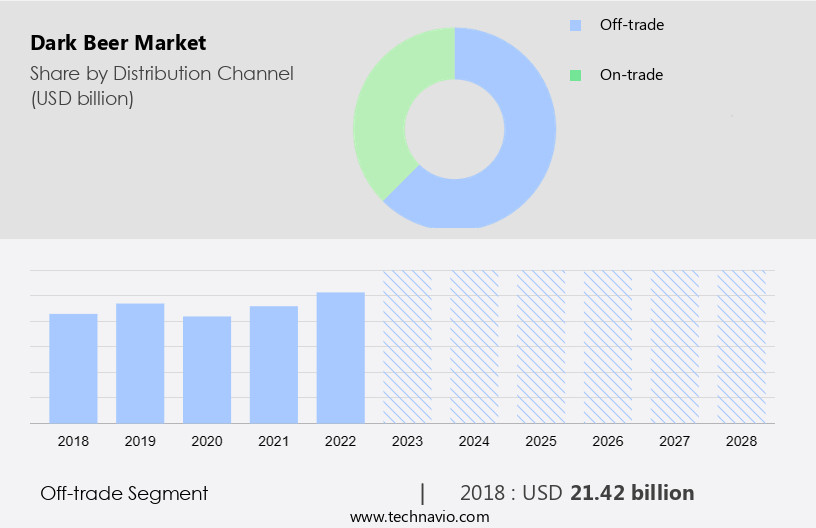

- The off-trade segment is estimated to witness significant growth during the forecast period.

Dark beer, a popular alcoholic beverage variant, is widely distributed through off-trade channels such as supermarkets and hypermarkets. These distribution channels provide consumers with a range of dark beer options, including stout ale and porter. Compared to on-trade channels, off-trade offers cost advantages as it eliminates the need to cover additional seating costs. Major retailers like Tesco Plc (Tesco) and Carrefour SA (Carrefour) are significant distributors of dark beer worldwide. Off-trade channels offer the convenience of extended hours and easy access to various beer brands. Dark beer, rich in flavonoids and antioxidant properties, is increasingly popular among millennials and health-conscious consumers.

Its ingredients, including medium-roast malts, coffee, almonds, chocolate, and caramel, provide vitamins, carbs, proteins, and antioxidants. However, excessive consumption may lead to side effects like cardiovascular ailments and liver cirrhosis. Dark beer's alcohol content ranges from 3.5% to 12%, making it a premium drink for many. Brewed using malted barley, enzymes, and fermented with brewing techniques, dark beer is a favorite among craft ale market enthusiasts. Off-trade channels, including LCBO stores, offer dark beer in various formats like kegs, bottles, and cans.

Get a glance at the Dark Beer Industry report of share of various segments Request Free Sample

The off-trade segment was valued at USD 21.42 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Europe, home to significant beer production, accounts for approximately one quarter of the EU's total beer output with around 7.5 billion liters produced in 2022. The popularity of dark beer in Europe contributes to the market's expansion. Consumers' growing preference for this beverage is influenced by its potential health benefits. Dark beer aids in kidney function alleviates insomnia and reduces cholesterol levels. This ale variant, rich in flavonoids and antioxidant properties, also contains vitamins, carbs, proteins, and minerals like iron. The American Heart Association recognizes these health benefits, making dark beer an appealing choice for health-conscious consumers. Microbreweries and craft ale markets have gained traction among millennials, contributing to the demand for dark beer.

Medium-roast malts, reminiscent of coffee, almonds, chocolate, and caramel, enhance its flavor profile. Brands like Black Viking Brewing, Peoples Beer, Porter Airlines, Beau's Brewing, and Porter Porter offer dark beer options in various formats, including kegs, bottles, and cans. Dark lagers, brown porters, and stout ales are popular choices among premium drinkers. Urbanization and the rise of local breweries have fueled the growth of the craft beer sector, further boosting the market. Despite these benefits, excessive alcoholic beverage consumption can lead to cardiovascular ailments and liver cirrhosis. Enzymes and brewing processes play a crucial role in producing dark beer, making it a fascinating and complex fermented drink.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Dark Beer Industry?

Rising demand for dark beer among millennials is the key driver of the market.

- Millennials, individuals aged 18-33 years, comprise a significant market segment for dark beer. This preference is driven by the authenticity and diversity of dark beer styles, which aligns with millennials' inclination towards unique experiences. The expanding multicultural consumer base further fuels this trend. Pubs and nightlife, popular social activities among millennials, have led to increased spending on premium alcoholic beverages, including dark beer. Dark beer, such as stout ale and porter, offers various health benefits, including flavonoids and antioxidant properties, which contribute to the heart health as per the American Heart Association. These beers are rich in vitamins, carbs, proteins, and antioxidants, providing essential nutrients.

- Dark beers also contain iron, which is crucial for maintaining good health. However, excessive consumption may lead to side effects, including obesity, cardiovascular ailments, and liver cirrhosis. Dark beer's flavor profile is derived from medium-roast malts, which provide a rich, complex taste. Coffee, almonds, chocolate, and caramel are common flavor notes found in dark beer. Microbreweries, such as Zingabier, Black Viking Brewing, Peoples Beer, and Porter Airlines, and local breweries contribute to the craft ale market by offering unique and authentic dark beer variants. Dark beer is available in various formats, including kegs, bottles, and cans, catering to diverse consumer preferences.

What are the market trends shaping the Dark Beer Industry?

An increasing number of mergers and acquisitions is the upcoming market trend.

- The market is experiencing significant growth due to the increasing preference for flavored and premium alcoholic beverages among millennials. Dark beers, such as stout ale and porter, offer unique flavor profiles derived from ingredients like medium-roast malts, coffee, almonds, chocolate, and caramel. These beers are rich in vitamins, minerals, and antioxidants, including flavonoids and iron, which contribute to their antioxidant properties. The American Heart Association recognizes these benefits, making an attractive alternative to mass merchandiser lager beers for health-conscious consumers. Microbreweries and craft ale markets have gained traction in recent years, offering diverse and innovative options.

- Successful mergers and acquisitions (M and A) between key players and smaller regional breweries and distributors have increased market share and provided access to new technologies. companies have also invested in urbanization and local breweries to cater to the growing demand for craft beer. The brewing process involves fermented drinks, enzymes, and malted barley, resulting in a variety of types, including black beer and brown porter. Despite the potential health benefits, excessive alcoholic beverage consumption can lead to side effects such as cardiovascular ailments and liver cirrhosis. Therefore, moderation is essential when enjoying these delicious and nutritious liquor.

What challenges does the Dark Beer Industry face during its growth?

Stringent regulations and heavy taxations is a key challenge affecting the industry growth.

- The market in the global alcoholic beverage industry is subject to stringent regulations and taxation policies. These regulations and policies are enforced by various governmental and non-governmental entities to ensure the safety and quality of products. companies must adhere to sectoral laws and regulations regarding ingredients and packaging labels. The American Heart Association highlights the potential health benefits, such as flavonoids and antioxidant properties, which can contribute to vitamins, carbs, proteins, and antioxidants. Dark beer variants like stout ale and porter contain iron, derived from the use of medium-roast malts, and are reminiscent of flavors like coffee, almonds, chocolate, and caramel.

- The craft ale market, particularly among millennials, has experienced significant growth due to the unique flavor profiles and premium appeal. Despite these benefits, excessive alcoholic beverage consumption can lead to side effects, including cardiovascular ailments and liver cirrhosis. The brewing process involves the use of enzymes and fermented drinks, which are subject to regulations and quality checks. The market participants must comply with these regulations to maintain consumer trust and adhere to industry standards.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dark beer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allagash Brewing Co.

- B9 Beverages Pvt. Ltd.

- Beavertown Brewery

- BrewDog Plc

- Buxton Brewery Co. Ltd.

- Carlsberg Breweries AS

- D.G. Yuengling and Son Inc.

- Deschutes Brewery

- Diageo Plc

- Evolution Craft Brewing Co.

- Faubourg Brewing Co. LLC

- Flying Dog Brewery LLLP

- Great Divide Brewing Co.

- Harviestoun Brewery Ltd.

- Heineken NV

- Molson Coors Beverage Co.

- New Belgium Brewing Co. Inc.

- Sierra Nevada Brewing Co.

- Surly Brewing Co.

- Weekend Beer Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth, driven by the increasing preference for unique and complex flavors among consumers. This trend is particularly prominent In the microbrewery sector, where artisanal production methods and innovative ingredient combinations have gained favor among a discerning clientele. One of the key factors fueling the demand is their perceived health benefits. Liquors such as such as stout ale and porter, contain various vitamins, minerals, and antioxidants. Flavonoids, a type of antioxidant, are abundant In these beverages, providing potential cardiovascular benefits. Vitamins B and C, as well as iron, are also present in significant quantities.

However, it is essential to note that alcoholic beverage consumption, including dark beers, can have side effects. Excessive intake can lead to cardiovascular ailments, liver cirrhosis, and other health issues. Therefore, moderation is key when enjoying these fermented drinks. The brewing process involves the use of medium-roast malts, which impart distinct flavors reminiscent of coffee, almonds, chocolate, and caramel. These flavors have resonated with consumers, particularly millennials, who value unique and authentic experiences. The market dynamics of the sector are influenced by various factors, including urbanization and the rise of local breweries.

Additionally, consumers are increasingly seeking out specialty stores and mass merchandisers that offer a wide variety of options. The use of enzymes during the brewing process also plays a crucial role in producing the desired flavor profile. The brewery sector has seen a rise in innovation, with breweries experimenting with new ingredients and production methods to differentiate themselves In the market. For instance, some breweries have introduced Zingabier, a beer infused with ginger and citrus, offering a unique twist on the traditional flavor profile. Despite the growth potential In the market, challenges remain. The use of kegs, bottles, and cans for distribution adds to the cost of production and distribution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.83% |

|

Market Growth 2024-2028 |

USD 32.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.76 |

|

Key countries |

China, US, UK, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dark Beer Market Research and Growth Report?

- CAGR of the Dark Beer industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dark beer market growth of industry companies

We can help! Our analysts can customize this dark beer market research report to meet your requirements.