Decorative Lighting Market Size 2024-2028

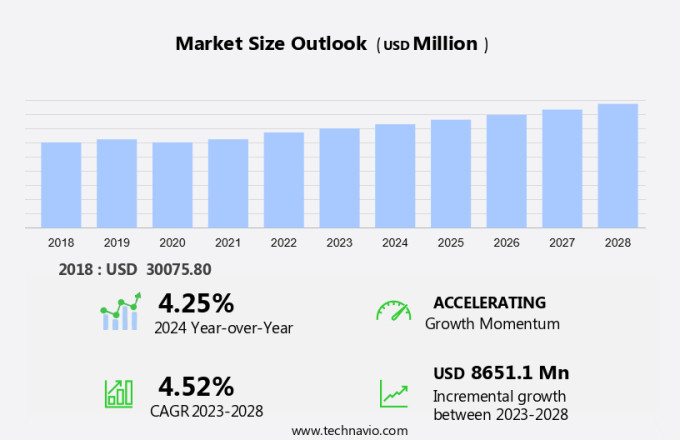

The decorative lighting market size is forecast to increase by USD 8.65 billion, at a CAGR of 4.52% between 2023 and 2028.

- The market growth depends on key drivers such as the evolving lighting product design concept, which is leading to premiumization in the market. A significant trend shaping the market is the increasing use of smart lighting systems, offering enhanced convenience and energy efficiency. However, a key challenge affecting the market growth is the perceived value gap of customers, where some consumers may find the price of premium decorative lighting products to be high relative to their perceived benefits. This challenge, combined with the growing preference for smart and energy-efficient lighting solutions, continues to influence the dynamics of the market.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a wide range of lighting fixtures designed to enhance room ambiance and complement modern décor. Producers prioritize functionality and design, offering various options such as fiber fixtures made of ceramic, glass, bamboo, or carved wood. LED filament and LED lights are popular choices due to their energy efficiency and smart lighting system capabilities. Pendants, string lights, tape lights, and lamps are essential decorative fixtures for home décor. Wireless technology enables rising disposable and convenient options like LED decorative lighting and incandescent decorative alternatives. Service quality is crucial, with flush mount and sconce lightings providing ceiling lighting solutions for different spaces. The market offers a diverse range of fixtures, including fiber, ceramic, glass, bamboo, carved wood, LED filament, and LED light options, catering to various tastes and preferences to ensure a perfect match for any home décor style.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

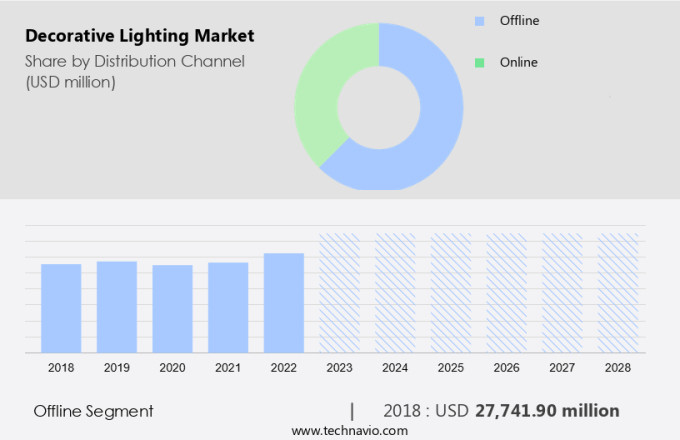

- Distribution Channel

- Offline

- Online

- Product

- Ceiling

- Wall mounted

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

Decorative lighting fixtures play a significant role in enhancing room ambiance and adding modern décor to various spaces. Producers of these fixtures cater to diverse functionalities and design preferences, offering a wide range of options in fiber fixtures, ceramic, glass, bamboo, carved wood, fabric, and more. Modern décor incorporates smart lighting systems, which can be found in shops, restaurants, homes, spas, malls, libraries, and various other establishments. Lighting fixtures come in various forms, including pendants, string lights, tape lights, lamps, and chandeliers. Traditional light sources, such as incandescent decorative and LED decorative lighting, continue to be popular choices. However, the rise of wireless technology and LED filament and LED light have brought about innovative advancements in decorative lighting.

Designers and retailers offer an extensive portfolio of decorative lighting fixtures, catering to diverse tastes and preferences. These include art lamps, LED decorative lighting, and smart lighting systems. Decorative lighting fixtures can be found on floors, walls, furniture, and as part of home décor. Materials like fiber, ceramic, glass, bamboo, carved wood, and fabric add to their aesthetic appeal. Decorative lighting fixtures are essential for creating a warm and inviting atmosphere in homes, offices, and public spaces. They contribute to the overall design and color scheme of a room, making them an essential investment for those seeking to enhance their living or working environment.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 27.74 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses a range of energy-efficient options, including flush mount, sconce, ceiling, and wall-mounted lighting solutions. These lighting types cater to various applications, such as workstations and accent lighting, while ensuring energy savings. Energy-efficient alternatives include light-emitting diodes (LEDs), compact fluorescent lamps (CFLs), and specialized lighting systems with electronic ballasts. Electricity availability is a crucial factor in the market, with energy-efficient solutions like LEDs and CFLs gaining popularity due to their lower power consumption. Ceiling lighting, such as prismatic skylights and integrated lighting systems, contribute significantly to energy savings in buildings. Specialized lighting, including horticulture lighting and lighting controllers, play essential roles in specific applications.

Power supplies and lighting components are integral parts of the market, ensuring the proper functioning and longevity of various lighting systems. Brands like Lithonia Lighting and Architectural Lighting, along with Winona Lighting, offer high-quality decorative lighting solutions that prioritize energy efficiency and service quality. Fluorescent, halogen, and incandescent lighting are traditional options, but their energy consumption makes them less desirable in today's market. Building management systems and advanced lighting technologies, such as lighting controllers and energy-efficient lighting components, are driving innovation in the market. The integration of these technologies enhances the overall functionality and aesthetic appeal of decorative lighting solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Decorative Lighting Market?

Evolving lighting product design concept leading to premiumization is the key driver of the market.

- The market encompasses a diverse range of lighting fixtures designed to enhance room ambiance and add elegance to various living spaces. Producers of these fixtures prioritize functionality, design, and color to cater to modern décor trends. Decorative lighting fixtures come in various forms, including floor lamps, wall sconces, pendant lights, string lights, tape lights, and lamps. Fiber fixtures, ceramic, glass, bamboo, carved wood, fabric, and smart lighting systems are popular materials used in creating these decorative pieces. Traditional light fixtures, such as art lamps and chandeliers, continue to be in demand, especially those designed by renowned interior designers. Luxury chandeliers, for instance, are highly sought after by high-net-worth residential users, offering an exquisite touch to homes.

- Decorative lighting products are not limited to residential use; they are also extensively used in commercial spaces like shops, restaurants, spas, malls, libraries, and offices. LED filament and LED light are increasingly popular choices for decorative lighting due to their energy efficiency and long lifespan. Smart lighting systems incorporating wireless technology add a touch of sophistication and convenience to any space. Decorative lighting fixtures are available in various price points, catering to diverse customer segments. Premium customers are drawn to luxury decorative lighting products, which often feature unique designs and high-quality materials. Manufacturers in countries like Italy, the UK, Spain, Germany, and the US produce a significant portion of the world's decorative lighting products, reflecting their rich design heritage and advanced manufacturing capabilities.

What are the market trends shaping the Decorative Lighting Market?

Increasing use of smart lighting systems is the upcoming trend in the market.

- Decorative lighting fixtures play a significant role in enhancing the room ambiance and adding modern décor to various spaces, including homes, shops, restaurants, spas, malls, and libraries. Producers of lighting fixtures are continually innovating to meet the evolving needs of consumers, focusing on functionality, design, color, and smart technology. Fiber fixtures, ceramic, glass, bamboo, carved wood, fabric, and other materials are used to create a diverse range of lighting fixtures, catering to different design preferences and styles. Smart lighting systems have gained popularity due to their ability to be controlled through mobile apps, offering convenience and flexibility. LED technology is increasingly being used in decorative lighting, with producers focusing on LED filament and LED light to create energy-efficient and long-lasting alternatives to traditional incandescent decorative lighting.

- Pendants, string lights, tape lights, lamps, and wireless technology are some of the popular types of smart lighting systems used in various settings. Designers and consumers alike are drawn to the versatility and aesthetic appeal of decorative lighting fixtures. Art lamps, chandeliers, and pendants add elegance and sophistication to any space, while string lights and tape lights offer a more casual and playful touch. The use of decorative lighting is not limited to homes but is also prevalent in commercial settings such as shops, restaurants, and offices. The rising disposable income and increasing awareness of energy efficiency are driving the growth of the market. With advancements in technology, the integration of smart lighting systems into various aspects of modern life is expected to continue, offering consumers new ways to enhance their living and working spaces.

What challenges does Decorative Lighting Market face during the growth?

Perceived value gap of customers is a key challenge affecting the market growth.

- Decorative lighting fixtures play a significant role in enhancing the room ambiance and adding modern décor to various living spaces. Producers of these fixtures prioritize functionality, design, color, and innovation to cater to diverse customer preferences. The market encompasses a wide array of options, including fiber fixtures, ceramic, glass, bamboo, carved wood, fabric, and smart lighting systems. Customers seek decorative lighting fixtures that complement their furniture, home décor, and personal style. The choice of lighting fixtures can range from traditional lights, such as art lamps and chandeliers, to contemporary options, like LED filament, LED light, and LED decorative lighting.

- Smart lighting systems, pendants, string lights, tape lights, and lamps are also popular choices. Wireless technology has revolutionized the market, allowing for flexibility and ease of use. Decorative lighting fixtures can be found in various settings, including shops, restaurants, homes, spas, malls, and libraries. Designers continue to create unique and innovative designs to cater to the evolving needs and preferences of consumers. The affordability of decorative lighting fixtures is a crucial factor for customers, as they prioritize purchasing decent-quality products at reasonable prices. The market offers a vast selection of designs, colors, and materials to suit various budgets and aesthetic preferences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands Inc.

- Amerlux LLC

- Bridgelux Inc.

- Capital Lighting Fixture Co.

- Crenshaw Lighting

- Current Lighting Solutions LLC

- Fagerhults Belysning AB

- Feit Electric Co. Inc.

- Generation Lighting

- Honeywell International Inc.

- Hubbell Inc.

- Hudson Valley Lighting Inc.

- IDEAL INDUSTRIES Inc.

- Jaquar India

- Lowes Co. Inc.

- Maxim Lighting International

- OSRAM Licht AG

- Shimera Project Lighting Pvt. Ltd.

- Signify NV

- Voylite

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Decorative lighting is a significant segment in the global lighting market, characterized by the use of various designs and technologies to enhance interior and exterior spaces. Fixtures such as chandeliers, table lamps, wall sconces, and string lights are popular choices for decorative lighting. The market for decorative lighting is driven by factors like increasing disposable income, growing urbanization, and the trend toward energy-efficient lighting solutions. Homes and commercial spaces alike prioritize decorative lighting to create ambiance and improve aesthetics. Modern technology, including LED and smart lighting, is also influencing the market, offering features like color customization and remote control. Spas, hotels, and restaurants are major consumers of decorative lighting, as they aim to provide unique and memorable experiences for their clients. The market is expected to grow steadily in the coming years, with a focus on sustainability, design innovation, and cost-effectiveness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.52% |

|

Market Growth 2024-2028 |

USD 8.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.25 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.