Defense Land Vehicles Market Size 2024-2028

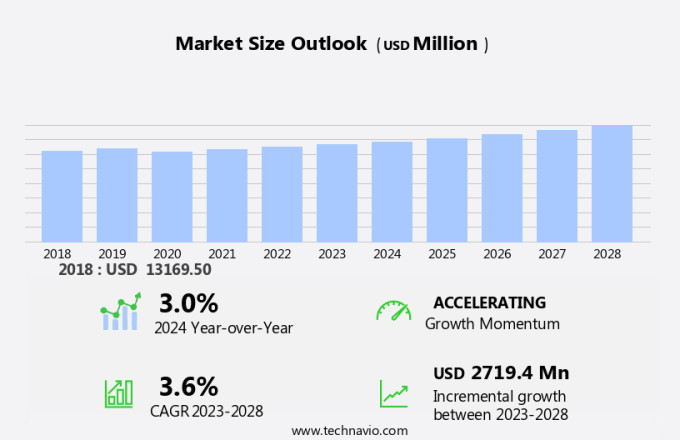

The defense land vehicles market size is forecast to increase by USD 2.72 billion at a CAGR of 3.6% between 2023 and 2028. The market is driven by several key factors, including rising defense budgets allocated by governments worldwide. companies in this market are focusing on introducing new product offerings to cater to the evolving needs of military operations. However, the market is also subject to intricate regulatory compliance requirements during the export of military vehicles. Military logistical challenges, such as complex regulatory compliance requirements in military armored vehicles export, remain a concern. Moreover, the demand for advanced vehicle features, such as military antennas for communication and surveillance, military vehicle electrification for enhanced mobility, and advanced weapon systems like anti-aircraft warfare and artillery systems, is on the rise. Additionally, the integration of military laser systems is gaining traction due to their potential to provide accurate and effective targeting capabilities.

What will be the Size of the Market During the Forecast Period?

The market encompasses a range of platforms designed for mobility and adaptability in challenging terrain. These vehicles play a crucial role in the transportation of personnel, combat equipment, and resupply in defense applications. Mobility and adaptability are essential factors driving the growth of the market. High-performance vehicles are engineered to traverse diverse terrains, ensuring efficient transportation of troops and supplies in various defense scenarios. Power-to-weight ratio and ground clearance are critical specifications for defense land vehicles. These features enable them to carry substantial weight while maintaining agility and maneuverability. Weight capacity is another significant consideration for defense land vehicles.

Furthermore, these platforms must transport personnel and equipment, necessitating strong weight capacities to meet the demands of military operations. Defense land vehicles serve various roles, including infantry fighting vehicles, armored personnel carriers, main battle tanks, light multi-role vehicles, and tactical trucks. Each vehicle type caters to specific defense applications, enhancing overall military capabilities. Logistical challenges are a persistent issue in defense spending. Military modernization and geopolitical tensions necessitate continuous investment in defense applications. Budget allocations for defense spending remain a critical factor influencing the market. Military vehicle electrification is an emerging trend in the market. This technology offers several advantages, including reduced fuel consumption, lower emissions, and increased reliability.

Moreover, CBRN defense market is another area of growth for defense land vehicles. These vehicles are designed to protect against chemical, biological, radiological, and nuclear threats, ensuring the safety of personnel in hazardous environments. In conclusion, the market is driven by the need for mobility, adaptability, in defense applications. Factors such as power-to-weight ratio, ground clearance, weight capacity, and logistical challenges continue to shape the market's growth. Emerging trends like military vehicle electrification and the CBRN defense market are poised to offer new opportunities for market participants.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Combat operations

- Logistics and support

- Reconnaisance and surveillance

- Others

- Vehicle Type

- Infantry fighting vehicles

- Armored personnel carriers

- Main battle tanks

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

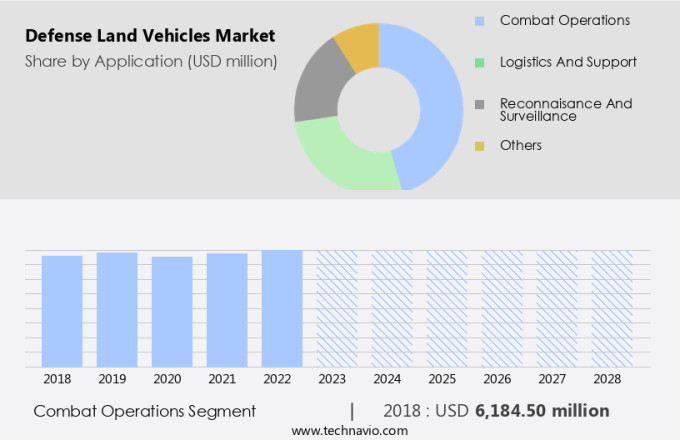

The combat operations segment is estimated to witness significant growth during the forecast period. The market encompasses a segment focused on combat operations, which features vehicles engineered for engaging enemy forces directly. This segment incorporates MBTs, IFVs, and APCs, outfitted with sophisticated weaponry, armor, and technology to optimize their battlefield performance. The segment's growth is fueled by geopolitical conflicts, military modernization initiatives, and the dynamic nature of warfare. This innovation underscores the ongoing commitment to enhancing military capabilities and readiness.

Furthermore, military Electro-Optics and Infrared Systems are essential components of advanced defense land vehicles, providing enhanced situational awareness and target acquisition. Directed Energy weapons, such as lasers and microwave systems, are increasingly being integrated into these vehicles to neutralize threats from a distance. Soldier Systems, including body armor and wearable technology, are also evolving to protect personnel in combat situations. The Small Arms and Turret System Markets are integral to the market, as these systems enable vehicles to engage targets effectively and efficiently. Military Embedded Systems and Digital Battlefield technologies are essential for vehicle connectivity, communication, and data processing.

Moreover, gunshot Detection Systems are also gaining traction, as they provide real-time threat detection and response capabilities. In conclusion, the market is witnessing significant growth due to ongoing military modernization programs and the evolving nature of warfare. Innovations in technologies such as Military Electro-Optics, Infrared Systems, Directed Energy, Soldier Systems, Remote Weapon Stations, Gunshot Detection Systems, Small Arms, Turret Systems, Military Embedded Systems, and Digital Battlefield technologies are driving the market forward.

Get a glance at the market share of various segments Request Free Sample

The combat operations segment accounted for USD 6.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The United States, a major player in The market, is leading the way with its substantial military budget and focus on advanced technology to ensure military superiority. In 2023, the US military budget amounted to USD 916 billion, representing a 2.3% increase from the previous year. This significant investment in defense is being allocated towards modernizing and expanding the US land vehicle fleet, which includes the acquisition of high-performance armored vehicles, tanks, and light tactical vehicles. These vehicles are designed to traverse challenging terrain, carry heavy weight, and offer superior ground clearance to transport personnel and combat equipment. A

Furthermore, this contract underscores the US military's commitment to enhancing battlefield mobility, protection, and operational efficiency. With a focus on power-to-weight ratio and adaptability, these vehicles are essential for transporting personnel and supplies in various terrains and conditions. The market is expected to continue growing, driven by the need for advanced technology and the strategic importance of maintaining military readiness.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased defense budgets by governments globally is the key driver of the market. The market experiences growth due to escalating defense budgets as countries prioritize enhancing their military capabilities in the face of expanding security concerns. Geopolitical tensions, border disputes, and terrorism fears have led numerous nations to invest substantially in upgrading their ground forces, including infantry fighting vehicles, armored personnel carriers, main battle tanks, light multi-role vehicles, tactical trucks, and other defense applications.

Furthermore, key regions, such as North America, Europe, the Middle East, and Asia-Pacific, have witnessed substantial military expenditures, driving the demand for advanced defense land vehicles. These platforms play crucial roles in transportation applications and services, ensuring the efficient and effective deployment of military personnel and resources.

Market Trends

Increasing focus of companies on new product launches is the upcoming trend in the market. The market is witnessing significant growth due to the increasing demand for advanced solutions to support defense-related activities. companies in this market are focusing on introducing new vehicle features to enhance military capabilities and address emerging security challenges

Furthermore, the innovations showcases the industry's commitment to providing cutting-edge technology for military operations. Other trends in the market include military vehicle electrification, the integration of military antennas, and the development of combat vehicles, military laser systems, airborne radars, and artillery systems. These advancements aim to improve military effectiveness and adapt to the evolving nature of defense requirements.

Market Challenge

Complex regulatory compliance requirements in military vehicles export is a key challenge affecting the market growth. The market encounters intricate logistical challenges due to the intricacies of military modernization and geopolitical tensions. Military budgets and global military spending continue to escalate, driving the need for product innovations to maintain a competitive edge. Autonomous systems and advanced capabilities for urban warfare are increasingly in demand to counter hybrid warfare threats. Compliance with regulations is a significant hurdle for market participants. In the US, adherence to export control laws, such as the International Traffic in Arms Regulations (ITAR), is mandatory. ITAR regulations ensure the protection of sensitive military technologies from unauthorized access. Failure to comply with these stringent regulations can result in severe consequences, including financial penalties and restrictions on future exports.

Moreover, military modernization and geopolitical tensions continue to shape the market landscape. With increasing global military spending, there is a growing demand for advanced capabilities, such as autonomous systems and urban warfare capabilities. To maintain a competitive edge, market participants must innovate and comply with complex regulatory requirements. In the US, the International Traffic in Arms Regulations (ITAR) govern the design, production, and export of military vehicles. These regulations are essential for safeguarding national security, but they create a complex regulatory landscape for defense contractors operating in multiple jurisdictions. Failure to comply with ITAR regulations can result in severe penalties, including fines and restrictions on future exports.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BAE Systems Plc - The company offers defense land vehicles such as the Bradley Fighting Vehicle, CV90 Infantry Fighting Vehicle, M109 Howitzer, M113 Armored Personnel Carrier, and BvS10 All-Terrain Vehicle.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Elbit Systems Ltd.

- FNSS Savunma Sistemleri A.S.

- General Dynamics Corp.

- Hanwha Systems Co. Ltd.

- HYUNDAI ROTEM CO

- Leonardo Spa

- Lockheed Martin Corp.

- Mitsubishi Heavy Industries Ltd

- Northrop Grumman Corp.

- Oshkosh Defense LLC

- Paramount Group

- Patria Group

- Rheinmetall AG

- Rolls Royce Power Systems AG

- RTX Corp.

- Saab AB

- Singapore Technologies Engineering Ltd.

- Tata Advanced Systems Ltd.

- Thales Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of high-performance vehicles designed for defense applications. These vehicles prioritize mobility and adaptability, enabling them to traverse challenging terrain with ease. Additionally, the evolving nature of electronic warfare, including hybrid warfare tactics, is driving the need for new vehicle designs and technologies. Key features include power-to-weight ratio, ground clearance, and weight capacity, ensuring efficient transport of personnel, combat equipment, and resupply. Infantry fighting vehicles, armored personnel carriers, main battle tanks, light multi-role vehicles, tactical trucks, and various other types of military vehicles cater to diverse defense and transportation needs.

Furthermore, budget allocations and defense spending significantly influence the market, with logistical challenges and military modernization driving demand. Geopolitical tensions and military budgets contribute to the global military spending rise, leading to product innovations in autonomous systems, hybrid warfare capabilities, urban warfare capabilities, and military vehicle electrification. These vehicles, such as Main Battle Tanks (MBTs), Infantry Fighting Vehicles (IFVs), and Armored Personnel Carriers (APCs), boast advanced features like electrical weapons, weaponry, body armor, and technology to optimize their performance in combat situations. Ballistic protection, coupled with an advanced Active Protection System, enhances the effectiveness of military wearables, high-performance batteries, and cutting-edge military simulation to ensure the safety and operational readiness of personnel in combat environments. The military industry relies on advanced technologies such as Active Protection Systems, specialized military lighting, wearables, high-performance batteries, waveguide components, and simulation tools, all of which are supported by durable military cables.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.6% |

|

Market growth 2024-2028 |

USD 2.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.0 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, China, Germany, Japan, India, South Korea, France, UK, Russia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BAE Systems Plc, Elbit Systems Ltd., FNSS Savunma Sistemleri A.S., General Dynamics Corp., Hanwha Systems Co. Ltd., HYUNDAI ROTEM CO, Leonardo Spa, Lockheed Martin Corp., Mitsubishi Heavy Industries Ltd, Northrop Grumman Corp., Oshkosh Defense LLC, Paramount Group, Patria Group, Rheinmetall AG, Rolls Royce Power Systems AG, RTX Corp., Saab AB, Singapore Technologies Engineering Ltd., Tata Advanced Systems Ltd., and Thales Group |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch