Diagnostic Imaging Market Size 2023-2027

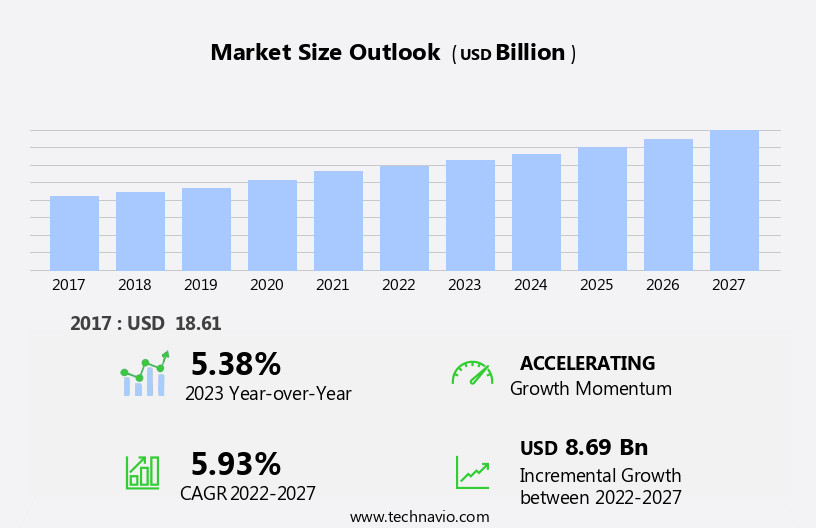

The diagnostic imaging market size is forecast to increase by USD 8.69 billion at a CAGR of 5.93% between 2022 and 2027. The market In the US is witnessing robust growth due to several key factors. The increasing prevalence of chronic conditions necessitates frequent imaging examinations, fueling market expansion. Technological advancements and continuous upgrades in diagnostic imaging modalities offer improved accuracy, efficiency, and patient comfort, making them increasingly popular. Furthermore, mergers and acquisitions (M&A) activities among industry players are on the rise, consolidating market presence and enhancing product portfolios. This growth trajectory is driven by the evolving needs of consumers and healthcare providers. There is a growing demand for innovative solutions that cater to the increasing complexity of medical conditions and the need for faster, more accurate diagnoses. The industry is responding by investing in research and development, focusing on creating more efficient systems, and prioritizing better accessibility. Moreover, there is a shift towards sustainability and operational efficiency as a means of maintaining a competitive edge.

What will be the size of the market during the forecast period?

Diagnostic Imaging Market Segmentation

The diagnostic imaging market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2023-2027, as well as historical data from 2017 - 2021 for the following segments.

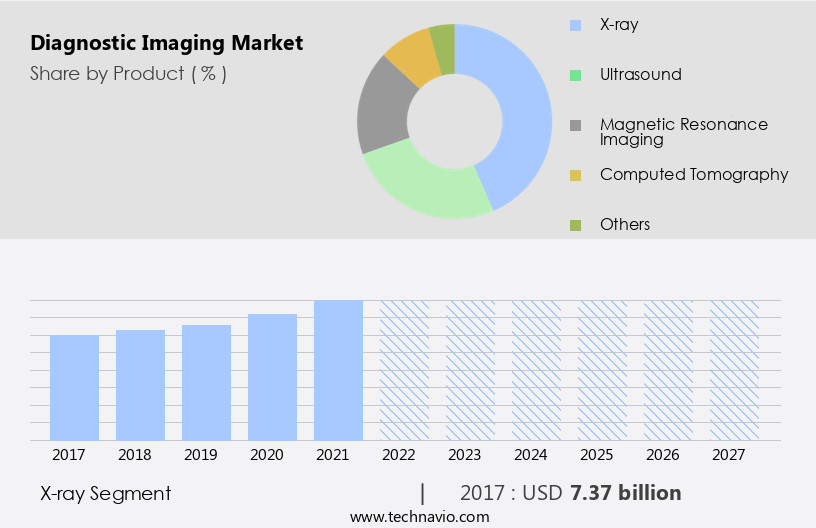

- Product

- X-ray

- Ultrasound

- Magnetic resonance imaging

- Computed tomography

- Others

- End-user

- Hospitals and clinics

- Diagnostic centers

- Research laboratories and institutes

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

Which is the largest segment driving market growth?

The x-ray segment is estimated to witness significant growth during the forecast period.

The market, encompassing X-ray, Magnetic Resonance (MRI), Computed Tomography (CT), Ultrasound, and Molecular Imaging, is witnessing significant growth, particularly In the digital X-ray systems segment. This expansion is driven by the adoption of advanced imaging modalities in developed regions, including North America and Europe. Early detection tools, such as AI-enabled diagnostic equipment and state-of-the-art imaging technologies from companies like Siemens Healthineers, are crucial in addressing chronic diseases, including cardiovascular disorders and neurology disorders. The Indian government's initiatives, like X-Ray Setu, aim to improve radiology operations and increase accessibility to diagnostic services. Turnaround time is another critical factor, with teleradiology services and AI platforms, such as Google's DeepMind, streamlining the diagnostic process.

The CT market, including ultrasound and advanced ultrasound transducers, portable ultrasound devices, and surgical suits, is also experiencing growth. Age-related macular degeneration and orthopedic disorders are among the conditions being diagnosed using computer vision and optical CT scanners. Despite the economic setback, the market is expected to continue its growth trajectory.

Get a glance at the market share of various regions. Download the PDF Sample

The X-ray segment was valued at USD 7.37 billion in 2017 and showed a gradual increase during the forecast period.

Which region is leading the market?

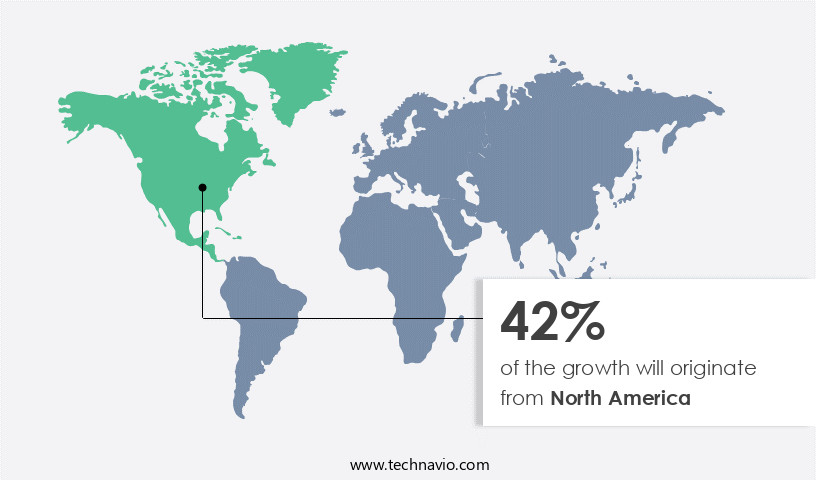

North America is estimated to contribute 42% to the growth of the global market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.The market in North America is projected to expand at a steady pace due to several factors. Chronic diseases, such as cardiovascular disorders and neurology disorders, are on the rise, necessitating frequent diagnostic imaging. Technological advancements, including AI-enabled diagnostic equipment and state-of-the-art imaging modalities like magnetic resonance imaging (MRI), computed tomography (CT), and X-ray, are enhancing clinical capabilities and driving market growth. Early detection tools, such as Google's DeepMind and Moorfields Eye Hospital's Optical CT scanner, are reducing turnaround times and improving diagnostic accuracy. Government initiatives, like X-Ray Setu in India, are increasing access to diagnostic imaging services. The Ultrasound segment, including advanced ultrasound transducers and portable ultrasound devices, is gaining popularity due to their affordability and mobility.

Hospitals, teaching institutions, and surgical suits are significant end-users of diagnostic imaging technologies. The Computed Tomography market is expected to grow, with product launches from industry leaders like Siemens Healthineers and their Cardiovascular ultrasound portfolio, including the Affiniti CVx. Despite the economic setback, the demand for diagnostic imaging services remains strong due to the importance of timely and accurate diagnosis. Teleradiology services are also gaining traction, allowing for remote diagnosis and reducing the need for physical presence at hospitals. Molecular imaging and orthopedic disorders are other emerging applications for diagnostic imaging technologies.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Agfa Gevaert NV - The company specializes in diagnostic imaging technology, providing innovative solutions including mobile Digital Radiography (DR), Uarm DR, and floormounted DR systems. These advanced imaging tools enable healthcare professionals to obtain high-quality diagnostic images, enhancing patient care and improving clinical outcomes.

Technavio's diagnostic imaging market research and growth report provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Agfa Gevaert NV

- Allengers Medical Systems Ltd.

- BCL XRay Canada Inc.

- Carestream Health Inc.

- CurveBeam AI Ltd.

- Esaote Spa

- Fujifilm Corp.

- General Electric Co.

- Hitachi Ltd.

- Hologic Inc.

- Konica Minolta Inc.

- Mediso Ltd.

- Neusoft Corp.

- Northrop Grumman Corp.

- Planmeca Oy

- Shenzhen Mindray BioMedical Electronics

- Shimadzu Corp.

- Siemens AG

- SternMed GmbH

- Thales Group

Explore our company rankings and market positioning. Request Free Sample

What is the market structure and year-over-year growth of the Diagnostic Imaging Market?

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 |

5.38 |

Diagnostic Imaging Market Dynamics

The market encompasses a range of technologies and modalities, including X-ray, ultrasound, computed tomography (CT), and magnetic resonance imaging (MRI), among others. This market is driven by the growing demand for early detection and accurate diagnosis of various medical conditions. Advanced imaging modalities, such as state-of-the-art CT scanners and MRI machines, are increasingly being adopted to improve diagnostic accuracy and turnaround time. Artificial intelligence (AI) and machine learning algorithms are also gaining traction in diagnostic imaging, enabling faster and more accurate analysis of medical images. The market is witnessing significant innovation, with companies investing in R&D to expand their product portfolios and enhance their market position.

The ultrasound segment is expected to dominate the market due to its affordability and versatility. However, economic setbacks and regulatory challenges may impact market growth. Teleradiology services and AI platforms are emerging trends, enabling remote diagnosis and analysis of medical images, respectively. Despite these challenges, the market is projected to grow steadily, driven by the increasing prevalence of chronic diseases and the need for early and accurate diagnosis.

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Increasing prevalence of chronic conditions is the key driver of the market.

The market is driven by the rising prevalence of chronic conditions, including cancer and cardiovascular diseases. According to the International Agency for Research on Cancer, the age-adjusted rate of new cancer cases was 19.3 million in 2020. Additionally, the incidence of respiratory diseases, such as COPD, asthma, and lung cancer, is increasing globally. Early detection of these conditions is crucial, leading to a growing demand for advanced diagnostic tools. Turning to technology, state-of-the-art imaging modalities, such as X-ray, magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound, are increasingly being adopted for their ability to provide accurate and timely diagnoses.

Market leaders, like Siemens Healthineers, are investing in AI-enabled diagnostic equipment, such as the Affiniti CVx cardiovascular ultrasound system, to enhance radiology operations and improve turnaround time. Google's Deepmind and Moorfields Eye Hospital have collaborated to develop an AI platform for the diagnosis of age-related macular degeneration using optical CT scanners. AI-enabled imaging technologies are also being used for the detection and diagnosis of neurological disorders, such as Alzheimer's disease and Parkinson's disease. The economic setback caused by the pandemic has led to an increased focus on cost-effective solutions, including refurbished equipment and teleradiology services. However, product recalls and concerns regarding the safety and efficacy of some imaging modalities, such as molecular imaging and orthopedic disorders, may pose challenges to the market.

In conclusion, the market is expected to grow significantly due to the increasing prevalence of chronic diseases and the adoption of advanced imaging technologies, such as AI-enabled diagnostic equipment and MRI. However, challenges, such as product recalls and safety concerns, may impact market growth.

What are the significant market trends being witnessed?

Integration of AI with diagnostic imaging is the upcoming market trend.

Diagnostic imaging is a critical component of healthcare, providing valuable insights into various health conditions through X-rays, CT scans, magnetic resonance imaging (MRI), and other modalities. The integration of artificial intelligence (AI) into diagnostic imaging is revolutionizing the industry by automating complex procedures, enhancing equipment features, and improving patient outcomes. AI-enabled diagnostic equipment, such as Siemens Healthineers' Cardiovascular ultrasound portfolio with the Affiniti CVx system, enables early detection and diagnosis of chronic diseases like cardiovascular disorders and neurology disorders. The analysis of diagnostic imaging data can be challenging, even for experienced professionals. AI platforms, like Google's Deepmind, and computer vision technologies, help increase productivity, improve accuracy, and reduce errors in diagnosis.

Moreover, AI-enabled imaging technologies on Google Cloud facilitate remote diagnosis through teleradiology services, enabling faster turnaround times and better access to care. The market for diagnostic imaging is driven by the increasing prevalence of chronic diseases and the need for state-of-the-art imaging modalities, such as optical CT scanners and advanced ultrasound transducers. The refurbished equipment market also plays a role in making diagnostic imaging more accessible and cost-effective. However, product recalls and concerns regarding data privacy and security may pose challenges to the market's growth. In summary, the integration of AI into diagnostic imaging is transforming the healthcare industry by improving diagnostic accuracy, reducing turnaround times, and enhancing patient outcomes.

The market for diagnostic imaging is expected to grow due to the increasing prevalence of chronic diseases and the need for advanced imaging technologies. However, challenges such as product recalls and data privacy concerns may impact market growth.

What are the major market challenges?

High costs associated with diagnostic imaging is a key challenge affecting the industry growth.

Diagnostic imaging is a critical sector in healthcare, offering early detection tools for various chronic diseases, including cardiovascular disorders and neurology disorders. However, the high cost of diagnostic imaging equipment and procedures is a significant challenge for market growth. For instance, an MRI machine can cost between USD150,000 and USD300,000, with additional expenses for remodeling, installation, and annual maintenance. These costs can burden hospitals, diagnostic centers, and clinics, potentially limiting access to state-of-the-art imaging modalities such as magnetic resonance imaging, computed tomography, and X-ray. The Indian market, represented by initiatives like X-Ray Setu, is exploring innovative solutions to address affordability concerns.

For example, the Government of India's collaboration with Siemens Healthineers and Moorfields Eye Hospital has led to the development of AI-enabled diagnostic equipment like the Affiniti CVx. This collaboration also includes the use of Google's Deepmind for computer vision applications in age-related macular degeneration diagnosis. Moreover, teleradiology services and advanced ultrasound transducers in portable ultrasound devices offer cost-effective alternatives for hospitals and clinics. The Computed Tomography market and Ultrasound segment are expected to grow due to the increasing demand for non-invasive diagnostic procedures. However, product recalls and the refurbished equipment market pose challenges to market growth. The integration of AI platforms in diagnostic imaging technologies from Google Cloud and other market players is expected to revolutionize the industry, offering faster turnaround times and improved accuracy.

In conclusion, the market faces challenges due to high equipment costs, but innovative solutions like AI-enabled imaging technologies and cost-effective alternatives are driving growth. The market dynamics are influenced by factors such as the increasing prevalence of chronic diseases, the need for early detection, and advancements in imaging technologies.

Exclusive Customer Landscape

The diagnostic imaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the diagnostic imaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Diagnostic imaging plays a crucial role In the healthcare industry, enabling medical professionals to identify and treat various health conditions. The market for diagnostic imaging technologies continues to evolve, driven by advancements in technology and increasing demand for early detection and accurate diagnosis. One significant trend In the market is the emphasis on reducing turnaround times. Early detection tools are becoming increasingly important, as they allow for timely intervention and improved patient outcomes. State-of-the-art imaging modalities, such as magnetic resonance imaging (MRI), computed tomography (CT), and x-ray, are being utilized to provide clear and detailed images for accurate diagnosis.

Artificial intelligence (AI) is another key trend in diagnostic imaging, with various companies investing in AI platforms to enhance their product offerings. These AI-enabled diagnostic equipment are designed to improve efficiency, accuracy, and productivity in radiology operations. For instance, AI algorithms can be used to analyze medical images and identify patterns that may be indicative of certain conditions, such as cardiovascular disorders or neurology disorders. Google's DeepMind is one of the companies leading the way in AI-enabled imaging technologies. Their collaboration with Moorfields Eye Hospital in London has resulted in an optical CT scanner that uses AI to detect age-related macular degeneration.

This breakthrough has the potential to revolutionize the diagnosis and treatment of this condition, which affects millions of people worldwide. Another trend in diagnostic imaging is the adoption of teleradiology services, which allow radiologists to remotely review and interpret images from various locations. This is particularly useful in rural areas or developing regions, where access to specialized medical expertise may be limited. The market for diagnostic imaging technologies is diverse and includes various segments, such as MRI, CT, x-ray, ultrasound, molecular imaging, and orthopedic disorders. Each segment has its unique challenges and opportunities, with advanced ultrasound transducers and portable ultrasound devices being notable trends In the ultrasound segment.

The economic setback caused by the pandemic has led to increased focus on cost-effective solutions, such as refurbished equipment and product recalls. The refurbished equipment market is expected to grow significantly In the coming years, as hospitals and diagnostic centers look for affordable alternatives to new equipment. In conclusion, the market is dynamic and evolving, driven by various trends, including early detection, AI, and cost-effective solutions. The market is diverse, with various segments catering to different medical needs. As the demand for accurate and timely diagnosis continues to grow, diagnostic imaging technologies will remain a critical component of the healthcare industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2022 |

|

Historic period |

2017 - 2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.93% |

|

Market growth 2023-2027 |

USD 8.69 billion |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agfa Gevaert NV, Allengers Medical Systems Ltd., BCL XRay Canada Inc., Carestream Health Inc., CurveBeam AI Ltd., Esaote Spa, Fujifilm Corp., General Electric Co., Hitachi Ltd., Hologic Inc., Konica Minolta Inc., Mediso Ltd., Neusoft Corp., Northrop Grumman Corp., Planmeca Oy, Shenzhen Mindray BioMedical Electronics, Shimadzu Corp., Siemens AG, SternMed GmbH, and Thales Group |

|

Market Segmentation |

Product (X-ray, Ultrasound, Magnetic resonance imaging, Computed tomography, and Others), End-user (Hospitals and clinics, Diagnostic centers, Research laboratories and institutes, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW)) |

|

Customization purview |

If our diagnostic imaging market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Diagnostic Imaging Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies