Dolomite Market Size 2024-2028

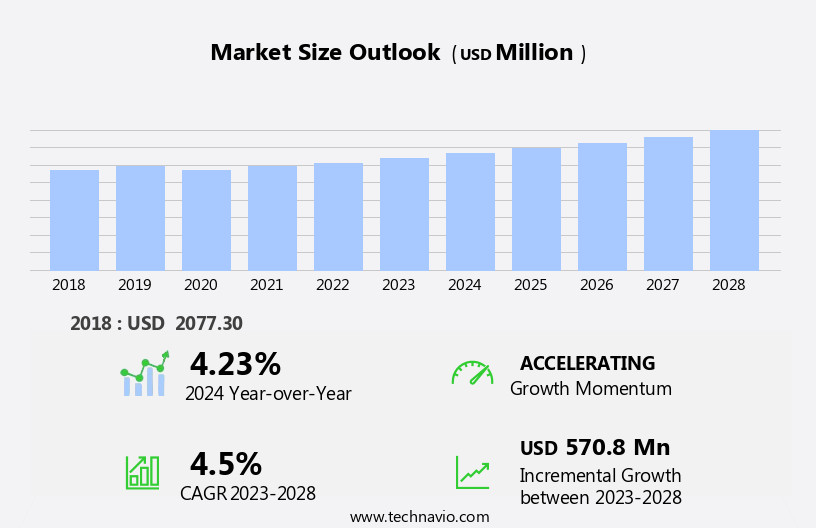

The dolomite market size is forecast to increase by USD 570.8 million at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Dolomite Market During the Forecast Period?

How is this Dolomite Industry segmented and which is the largest segment?

The dolomite industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Calcined

- Sintered

- Agglomerated

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Product Insights

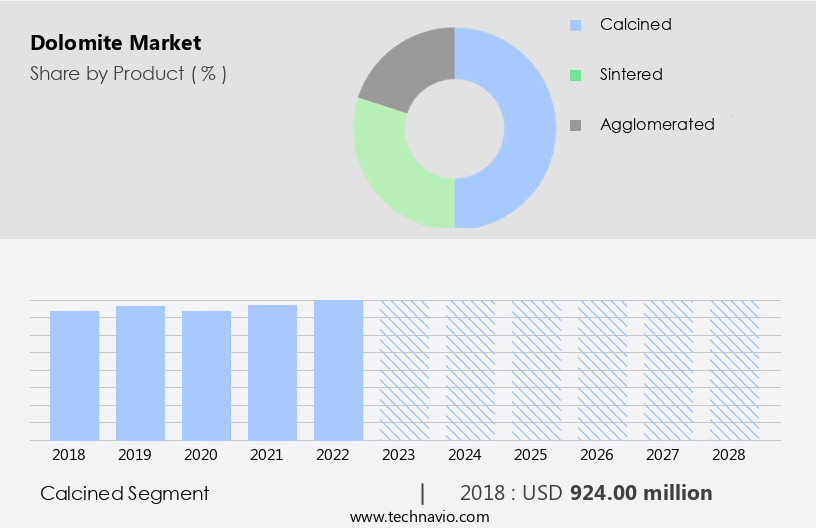

- The calcined segment is estimated to witness significant growth during the forecast period.

Calcined dolomite, derived from calcium carbonate and magnesium minerals through calcination, holds the largest market share, surpassing 44% in 2023. This product significantly contributes to the steel industry as a crucial component in protective agents and refractory linings. In the agriculture sector, calcined dolomite functions as a soil conditioner and water treatment agent. The expansion of the construction and infrastructure sectors globally has driven cement consumption, subsequently increasing the demand for calcined dolomite. Its utilization in cement production not only decreases carbon emissions but also generates less waste, making it a preferred choice for industry players. The growth trajectory of the construction sector, fueled by economic growth, monetary policy normalization, and government-led fiscal stimulus, further bolsters the market expansion for calcined dolomite.

Additionally, its application extends to various industries such as glass manufacturing, animal feed, and steel facilities.

Get a glance at the Dolomite Industry report of share of various segments Request Free Sample

The Calcined segment was valued at USD 924.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

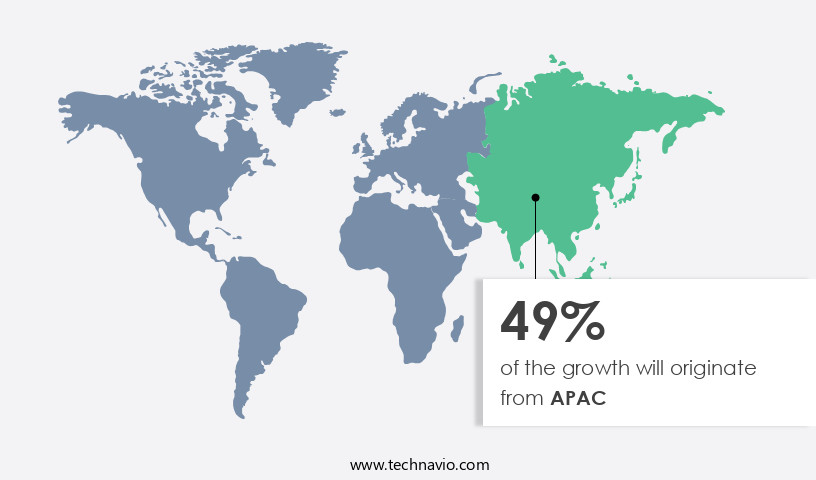

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region is expected to dominate The market due to its significant role in cement production. China, as the world's leading cement manufacturer, is the largest consumer of dolomite. The country's construction sector, particularly in residential and infrastructure development, has experienced growth in recent years. India, the second-largest cement producer In the region, is also witnessing a construction industry expansion. The Indian government's emphasis on infrastructure development contributes to the increasing demand for cement and, consequently, dolomite. Dolomite is a crucial raw material in steel production, used as a flux and furnace lining. The steel industry's output growth in North America, driven by economic recovery, monetary policy normalization, and fiscal stimulus, is expected to boost the demand for dolomite.

The construction sector's spending increase, urbanization, and growth in industries like food & beverages, tourism, and mining & metallurgy further contribute to the market's expansion. Additionally, the demand for low-carbon steel products and synthetic fluxes made from dolomite is increasing due to environmental concerns and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Dolomite Industry?

Increase in prices of construction aggregates is the key driver of the market.

What are the market trends shaping the Dolomite Industry?

Rising demand for refractory materials is the upcoming market trend.

What challenges does the Dolomite Industry face during its growth?

Rising demand from cement industry is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The dolomite market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dolomite market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dolomite market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Arihant Min chem - The company specializes In the production and supply of dolomite products, specifically magnesium carbonate minerals, catering to various industries. These minerals derive from the naturally occurring mineral dolomite and undergo refining processes to yield high-purity magnesium carbonate. This product line is integral to numerous applications, including pharmaceuticals, agriculture, and water treatment, among others. The company's commitment to quality and consistency ensures the delivery of superior magnesium carbonate minerals to its clientele.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arihant Min chem

- Calcinor SA

- Carmeuse Coordination Center SA

- Dolomine de villers le Gambon SA

- E. Dillon and Co.

- Essel Mining and Industries Ltd.

- Imerys S.A.

- Inca Mining Pty Ltd.

- JFE Mineral and Alloy Co. Ltd.

- Lhoist SA

- Liaoning Beihai Industry Group Co. Ltd.

- Longcliffe Quarries Ltd.

- Minerals Technologies Inc.

- Nordkalk Corp.

- Omya International AG

- Raw Edge Industrial Solutions Ltd.

- RHI Magnesita GmbH

- SCR Sibelco NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Dolomite, a calcium magnesium carbonate mineral, plays a significant role in various industries due to its unique properties. This mineral is widely used as a raw material In the production of steel and other metals, serving as a flux and furnace lining material. In the context of steel production, dolomite's ability to lower the melting point of iron and reduce the amount of impurities makes it an essential component. The demand for dolomite is driven by the economic growth and development in various sectors. The steel industry, in particular, has been a major consumer of dolomite due to the increasing steel production.

The steel output has been on an upward trend in recent years, fueled by infrastructure development, urbanization, and industrialization. Moreover, the shift towards low-carbon steel production has further boosted the demand for dolomite. Synthetic fluxes, such as dolomitic limestone, have gained popularity In the steel industry as they help reduce the carbon footprint of the production process. Beyond the steel industry, dolomite finds applications in various sectors, including refractories, construction aggregate, water treatment, and agriculture. In the refractories industry, dolomite is used to produce magnesia oxide (MGO), refractory bricks, and converter linings for electric furnaces and steel facilities.

In the construction sector, dolomite is used as a raw material for cement production and as a construction aggregate. In the water treatment industry, dolomite is used for water softening and as a source of magnesium in drinking water. In agriculture, dolomite is used as a soil conditioner and as a source of magnesium for livestock feed. In the glass manufacturing industry, dolomite is used as a flux and as a raw material for the production of glass and ceramics. The market dynamics for dolomite are influenced by various factors, including economic conditions, government policies, and technological advancements.

Monetary policy normalization and fiscal stimulus measures can impact the demand for dolomite In the steel industry. The construction sector's spending patterns and urbanization trends can influence the demand for dolomite In the construction sector. The carbonate minerals market, which includes dolomite, limestone, magnesite, and gypsum, is expected to grow at a steady pace due to the increasing demand from various industries. The infrastructure sector's growth, particularly in emerging economies, is expected to drive the demand for dolomite In the construction sector. The pharma & healthcare and food & beverages industries are also expected to contribute to the growth of the carbonate minerals market.

The mining and metallurgy sector's technological advancements, such as single-cell research and microfluidic technology, can lead to new applications for dolomite and other carbonate minerals. The start-up ecosystem's focus on innovation and sustainability can also lead to new applications for dolomite and other minerals. In conclusion, dolomite is a versatile mineral with a wide range of applications in various industries. Its demand is driven by the economic growth and development in various sectors, particularly the steel industry and the construction sector. The market dynamics for dolomite are influenced by various factors, including economic conditions, government policies, and technological advancements.

The carbonate minerals market, which includes dolomite, is expected to grow at a steady pace due to the increasing demand from various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 570.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, India, Japan, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dolomite Market Research and Growth Report?

- CAGR of the Dolomite industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dolomite market growth of industry companies

We can help! Our analysts can customize this dolomite market research report to meet your requirements.