Drug Repurposing Market Size 2024-2028

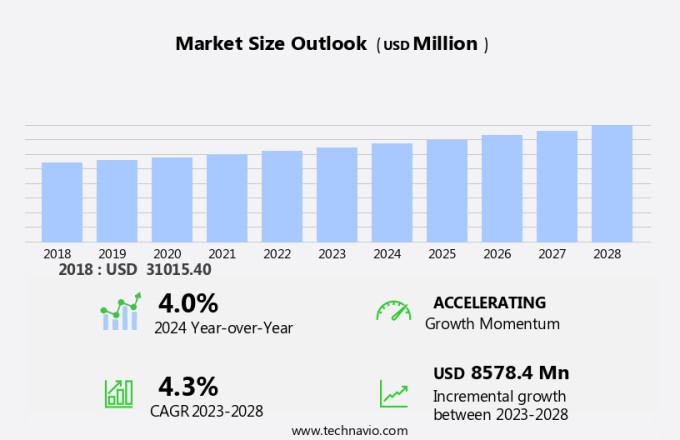

The drug repurposing market size is forecast to increase by USD 8.58 billion at a CAGR of 4.3% between 2023 and 2028. The market is experiencing significant growth due to the increasing application of this approach in therapeutic purposes, particularly in the field of cancer treatment. Investment in this area is surging as researchers seek to unlock the potential of existing drugs for new uses. However, regulatory challenges remain a barrier to success, requiring careful dosage prediction and adherence to stringent safety and efficacy standards. Additionally, the repurposing of antimicrobials for broad-spectrum therapeutics is gaining traction, offering potential solutions to emerging drug discovery outsourcing. Overall, the market holds immense promise for advancing healthcare and improving patient outcomes.

What will be the Size of the Market During the Forecast Period?

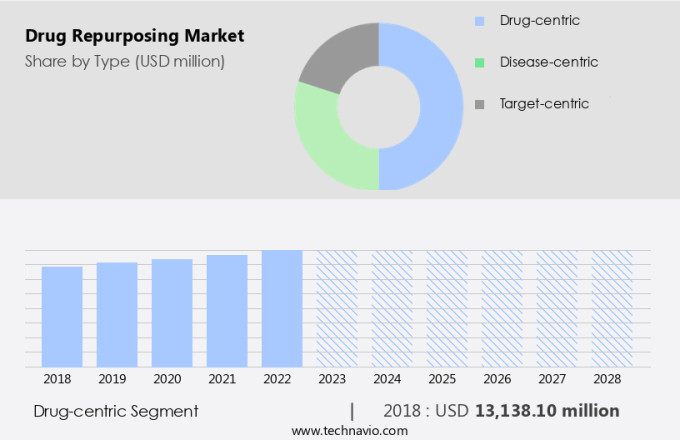

The market holds significant potential in addressing unmet medical requirements and mitigating drug shortages. This approach, also known as medication or drug repositioning, involves the exploration of new therapeutic uses for existing drugs. By repositioning approved drugs for different therapeutic areas, healthcare providers can expand their therapy choices and offer life-saving pharmaceuticals to patients. The drug discovery process is typically disease-centric, target-centric, and drug-centric. However, drug repurposing adopts a more holistic approach by considering the drug's properties and potential applications beyond its initial intended use. A computer model exploring the reuse of biologic molecules in treating neglected tropical diseases (NTDs) could offer new insights into drug class for chronic lymphocytic leukemia (CLL) therapies. The drug development process for repurposed drugs is often disease-centric, target-centric, or drug-centric, depending on the approach used. Therapeutic areas such as cancer, cardiovascular diseases, and neurological disorders are major focus areas for drug repurposing. Artificial intelligence (AI) and Machine Learning (ML) and computer models are increasingly being used to predict the therapeutic efficacy of candidate drugs by analyzing their interactions with cancer cells.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Drug-centric

- Disease-centric

- Target-centric

- Product Type

- Small molecules

- Biologics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The drug-centric segment is estimated to witness significant growth during the forecast period. Drug-centric drug repurposing is an innovative strategy in the pharmaceutical industry that explores the potential of approved medications to treat new therapeutic areas based on their inherent properties and mechanisms. This approach leverages the known pharmacological profiles of existing drugs to uncover novel applications. For instance, aspirin (ASA), initially developed for its analgesic, antipyretic, and anti-inflammatory properties, has been successfully repurposed for cardiovascular disorders. Its antiplatelet effects make it a cornerstone in preventing and treating heart attacks and strokes. This drug repurposing strategy is gaining significant attention due to its potential to reduce the time and cost associated with bringing new drugs to market.

The market is expected to grow significantly due to the advantages it offers over traditional drug discovery methods. Therapeutic recycling, also known as drug repurposing, reduces the time and cost associated with clinical trials, as the safety and efficacy data for the repurposed drug are already available. In conclusion, drug-centric drug repurposing is an innovative strategy that offers significant potential for the pharmaceutical industry. By leveraging the known properties and mechanisms of existing drugs, researchers and pharmaceutical companies can uncover novel applications and address new therapeutic areas, reducing the time and cost associated with bringing new drugs to market. The use of Network Biology, Human Genomics, and Chemoproteomics is driving the growth of the market, particularly in the oncology sector.

Get a glance at the market share of various segments Request Free Sample

The Drug-centric segment accounted for USD 13.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

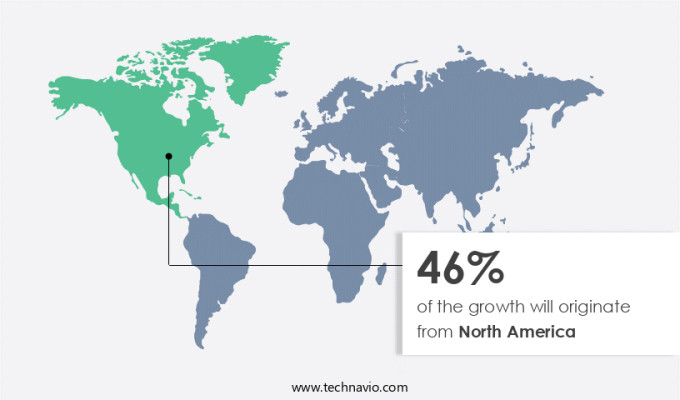

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds significant potential due to escalating healthcare demands and a well-developed pharmaceutical industry. The prevalence of chronic conditions such as heart disease and cancer necessitates innovative treatment options. The US Advanced Research Projects Agency for Health (ARPA-H) recognized this need and awarded a USD48.3 million contract to Every Cure in February 2024. This investment aims to discover new therapeutic uses for existing drugs, addressing unmet medical requirements and potentially saving countless lives. North America's advanced research infrastructure and established pharmaceutical sector create an ideal environment for drug repurposing initiatives. This market trend is expected to continue, as the need for efficient and cost-effective solutions to address unmet medical needs remains a priority.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing use of drug repurposing for cancer treatment is the key driver of the market. The market in the United States is witnessing significant growth, particularly in the therapeutic area of cancer treatment. Traditional methods of discovering new drug applications have relied on serendipitous findings. However, leading research institutions like the Broad Institute and Dana-Farber Cancer Institute are adopting a more deliberate approach. They employ systematic methodologies to identify potential targets for drug repurposing, with a focus on developing new cancer therapies. This strategic shift offers several advantages. It streamlines the drug discovery process by allowing researchers to bypass the initial safety testing hurdles. Furthermore, it reduces the time and resources required to bring new drugs to market.

Biologics and small molecules are both subject to this repurposing trend, as the therapeutic potential of existing medications is explored in greater depth. This systematic approach is a game-changer in the drug development landscape.

Market Trends

Investment in drug repurposing is the upcoming trend in the market. The market in the United States is experiencing significant growth, driven by increased investment and government support. Every Cure, a leading player in this field, recently secured a three-year contract worth USD48.3 million from the US Advanced Research Projects Agency for Health (ARPA-H). This investment underscores the importance of drug repurposing in the pharmaceutical industry and the potential for innovative discoveries. To accelerate the discovery process, a collaborative approach is being adopted. A portal has been established to facilitate contributions from various stakeholders, including researchers, healthcare providers, and patients. This collective expertise and insights are expected to expedite the identification of new therapeutic applications, ultimately benefiting those with unmet medical needs.

Artificial Intelligence (AI) plays a crucial role in drug repurposing by aiding in dosage prediction and identifying potential applications for existing drugs. Antimicrobials and broad-spectrum therapeutics are among the therapeutic areas that have seen success through drug repurposing. The market for drug repurposing is anticipated to expand further, offering opportunities for companies and researchers to make a significant impact on healthcare. Investing in drug repurposing is considered a cost-effective and less risky alternative to traditional drug development. As the market continues to grow, it is essential to stay informed about the latest developments and trends.

Market Challenge

Regulatory challenges associated with drug repurposing is a key challenge affecting the market growth. Biotechnology advancements have led to an increased focus on drug repurposing as a cost-effective and efficient alternative to traditional drug development. Drug repurposing involves reusing existing medications for new indications, including the treatment of tumors. While this approach offers several advantages, such as a known safety profile and established human use, securing marketing authorization from regulatory bodies like the FDA, EMA, and MHRA remains a challenge. Regulatory agencies mandate rigorous clinical trials to evaluate the safety and efficacy of repurposed medications for new indications. These trials can involve extensive preclinical and clinical phases, similar to the development process for novel drugs.

Although the existing drugs' known safety profile can streamline the approval process, hurdles remain. Unlike traditional drug development, repurposing projects typically bypass preclinical testing. Healthcare providers and researchers are increasingly turning to computer models and advanced analytics to predict the potential efficacy and safety of repurposed drugs, streamlining the development process and reducing costs. In conclusion, drug repurposing offers a promising avenue for the discovery of new treatments for various diseases, including tumors. However, securing regulatory approval for repurposed drugs presents significant challenges. Regulatory bodies require comprehensive clinical trials to evaluate safety and efficacy, which can involve extensive preclinical and clinical phases. Despite these challenges, the use of computer models and advanced analytics is helping to streamline the development process and reduce costs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc: The company offers a repurposed drug called Ritonavir -Norvir, which was initially an HIV protease inhibitor, and is now used to boost other HIV medications.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amgen Inc.

- AstraZeneca Plc

- Biogen Inc.

- Bristol Myers Squibb Co.

- Eli Lilly and Co.

- Gilead Sciences Inc.

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the unmet medical requirements and drug shortages in various therapeutic areas. Medication repurposing, also known as drug repositioning, involves the use of existing drugs for therapeutic purposes in new indications. This approach can help expand the therapeutic options for healthcare providers and patients, especially in cases where life-saving pharmaceuticals are scarce. Biotechnology advancements, including network biology, human genomics, chemoproteomics, and artificial intelligence (AI), are playing a crucial role in drug discovery and repurposing. These technologies enable the identification of new therapeutic uses for drug compounds through the analysis of disease-centric, target-centric, and drug-centric data.

Cancer and chronic diseases, such as oncology and multiple sclerosis (MS), are some of the therapeutic areas that have seen significant progress in drug repurposing. For instance, small molecule drugs initially developed for tumor treatment have been repurposed for antimicrobial therapy, demonstrating the potential of broad-spectrum therapeutics. Clinical evaluation and clinical trials are essential steps in the drug development process for both new indications and repurposed drugs. Consultancy services and collaborations between biotech companies and big pharma are also driving the market forward. The success bar for drug repurposing is high, with a significant number of candidate drugs failing in clinical trials due to lack of therapeutic efficacy.

However, the potential benefits of drug repurposing make it an attractive area for investment and innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2024-2028 |

USD 8.58 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.0 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, China, Germany, UK, India, France, Japan, Canada, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Amgen Inc., AstraZeneca Plc, Biogen Inc., Bristol Myers Squibb Co., Eli Lilly and Co., Gilead Sciences Inc., Johnson and Johnson Services Inc., Merck and Co. Inc., Novartis AG, Pfizer Inc., Regeneron Pharmaceuticals Inc., Teva Pharmaceutical Industries Ltd., and Vertex Pharmaceuticals Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch