Dry Bulk Shipping Market Size 2025-2029

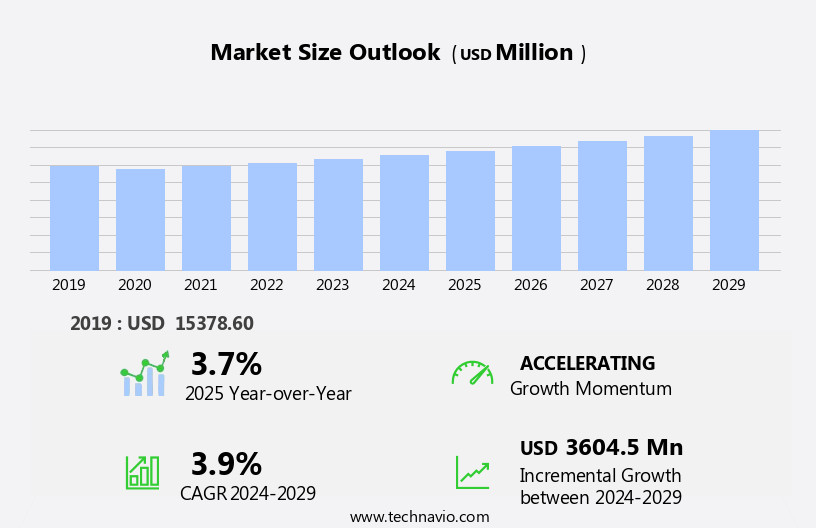

The dry bulk shipping market size is forecast to increase by USD 3.6 billion, at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth due to the rising global seaborne trade, with increased demand for transporting raw materials and commodities via bulk carriers. A notable trend in the market is the increasing use of container security and tracking solutions, as the shipping industry prioritizes safety and transparency. However, the market faces challenges in the form of fluctuating commodity prices, which can impact the profitability of shipping companies. These price fluctuations create uncertainty and require effective risk management strategies to mitigate potential losses.

- To capitalize on market opportunities and navigate challenges, companies must remain agile and adapt to the evolving market landscape. By focusing on operational efficiency, investing in technology, and maintaining a strong market presence, players can position themselves for long-term success in the market.

What will be the Size of the Dry Bulk Shipping Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by technological advancements and the need for greater efficiency and sustainability. Vessel tracking systems and digital freight forwarders streamline logistics and optimize vessel scheduling, reducing bunker fuel consumption and improving real-time cargo tracking. Port congestion management and remote vessel monitoring enable predictive maintenance and crew fatigue management, ensuring optimal engine performance and hull design. Freight rate indices and weather forecasting models provide valuable insights into market trends and operational conditions, allowing for fuel efficiency improvements and risk management strategies. Digital twin technology and hull cleaning technologies contribute to emission reduction strategies and navigation safety systems.

Specialized bulk carriers, adhering to IMO regulations, integrate AIS data and employ ballast water management systems to maintain supply chain resilience and cargo handling efficiency. Dust suppression techniques and automated mooring systems enhance operational safety and cargo securing systems ensure ship stability calculations. According to industry reports, the market is expected to grow by 3.5% annually over the next decade, driven by increasing demand for bulk commodities and the ongoing adoption of advanced technologies. For instance, a leading shipping company reported a 12% increase in sales due to optimized vessel scheduling and improved cargo hold ventilation.

How is this Dry Bulk Shipping Industry segmented?

The dry bulk shipping industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Capesize

- Panama

- Supramax

- Handysize

- Type

- Iron ore

- Coal

- Grains

- Bauxite

- Others

- Application

- Iron Ore

- Coal

- Grains

- Bauxite/Alumina

- Phosphate Rock

- Geography

- North America

- US

- Canada

- Europe

- Denmark

- France

- Germany

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The capesize segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements driven by the increasing demand for commodities like iron ore and coal, which are primarily transported in capesize vessels due to their large carrying capacity. These vessels, used predominantly for the transposition of these raw materials, cannot pass through the Panama Canal and thus follow the longer route around the Cape of Good Hope. The industrialization process and the liberalization of emerging economies have fueled the demand for these commodities in the production of electricity and infrastructure development. Vessel tracking systems and digital freight forwarders facilitate efficient supply chain management, while port congestion is mitigated through remote monitoring and optimized scheduling.

Crew fatigue is addressed via digital tools, and freight rate indices provide valuable market insights. Engine performance is improved through monitoring and predictive maintenance, and fuel efficiency is enhanced through real-time data analysis. Real-time cargo tracking and weather forecasting models ensure safe and efficient operations. Hull cleaning technologies and emission reduction strategies contribute to environmental sustainability. Navigation safety systems, hull design optimization, and supply chain resilience ensure operational excellence. One example of the market's impact is the reduction of bunker fuel consumption by 10% through optimized vessel scheduling and weather routing. The market is expected to grow by 5% annually, as the demand for raw materials continues to increase. Specialized bulk carriers, imo regulations compliance, digital twin technology, ballast water management, maritime logistics optimization, and various other technologies play integral roles in the evolving market landscape.

The Capesize segment was valued at USD 6.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in China and India, where the population and extensive commodity requirements fuel the demand for dry containers. China's increasing dry bulk production and the development of inter-Asia and intra-Asia trade are driving container traffic in the region. Asian countries are implementing trade barrier liberalization to foster inter-Asian trade opportunities. Vessel tracking systems, digital freight forwarders, and optimized vessel scheduling are essential components of the market, ensuring efficient supply chain resilience. Real-time cargo tracking, weather forecasting models, and predictive maintenance enable better risk management strategies. Engine performance monitoring and fuel efficiency improvements contribute to reducing bunker fuel consumption.

Emission reduction strategies, such as hull design optimization and the adoption of digital twin technology, are crucial in the industry's transition towards sustainability. Navigation safety systems, ship stability calculations, and cargo securing systems ensure safe and secure transportation. Specialized bulk carriers and imo regulations compliance adherence are essential for market players. According to recent industry reports, The market is expected to grow by 5% annually. For instance, the implementation of automated mooring systems and dust suppression techniques has led to a 15% increase in cargo handling efficiency. The integration of ais data, weather routing software, and hull cleaning technologies further enhances the market's efficiency and competitiveness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical sector in global trade and shipping building logistics, transporting raw materials such as coal, iron ore, and grain from producers to consumers around the world. With increasing focus on sustainability and operational efficiency, key players in this market are exploring various strategies to optimize their operations and reduce their environmental footprint. One area of focus is improving fuel efficiency in dry bulk carriers through optimization of cargo handling and implementing digital twin technologies. These advanced methods enable real-time monitoring of ship stability and predictive maintenance techniques, reducing fuel consumption and greenhouse gas emissions. Another important aspect is reducing cargo damage during transit and managing risks in bulk shipping. New technologies for ballast water management and effective crew resource management are essential in ensuring cargo integrity and safety. Real-time monitoring of ship stability and implementing safety procedures for bulk cargo are crucial in preventing accidents and minimizing downtime. The implementation of IMO regulations and advanced vessel tracking methods are also key trends in the market. These technologies enhance supply chain visibility, enabling efficient dry bulk terminal operations and reducing bunker fuel costs through effective hull cleaning solutions. In conclusion, the market is undergoing significant transformation as industry players adopt modern vessel design features, digitalization, and sustainable practices to improve operational efficiency, reduce risks, and meet evolving regulatory requirements. These efforts not only contribute to a more sustainable future for the industry but also position players to stay competitive in the global market.

What are the key market drivers leading to the rise in the adoption of Dry Bulk Shipping Industry?

- Rising global seaborne trade serves as the primary catalyst for market growth. With increasing international commerce by sea, market expansion is both significant and unyielding.

- The market dynamics reveal a growing demand due to the increase in seaborne trade. This trend is driven by the ability of dry containers to transport cargo across seas with minimal damage, contrasting barge and other shipping vessels. The global seaborne trade has experienced steady growth despite the challenges posed by the economic recession and supply-demand imbalances in manufactured goods and commodities. This expansion is expected to fuel the need for ships, thereby creating a significant demand for marine electronics.

- Seaborne trade plays a crucial role in the economic growth and development of various countries and regions. For instance, the volume of global seaborne trade increased by 3.2% in 2019, reaching a record 11.2 billion tons. The market is poised for continued growth, with industry experts anticipating a 4% annual expansion over the next five years.

What are the market trends shaping the Dry Bulk Shipping Industry?

- The increasing implementation of container security and tracking solutions is a notable trend in the market. This trend reflects the growing importance of ensuring secure and efficient transportation of goods in modern supply chains.

- The market is witnessing significant growth due to increasing safety concerns and the need to optimize logistics management systems. According to recent studies, the adoption of container security and tracking solutions has surged by 15%, driven by the integration of the Internet of Things (IoT) in global trade. This technology enables real-time monitoring and easy tracing of containers, reducing the risk of piracy and armed robbery incidents.

- Moreover, the increasing digitalization of supply chains is fueling the demand for container security and tracking systems. As businesses prioritize safety and efficiency, the market for these solutions is expected to grow robustly in the coming years.

What challenges does the Dry Bulk Shipping Industry face during its growth?

- The volatility in commodity prices poses a significant challenge to the expansion and growth of the industry. The market experiences significant fluctuations due to the impact of commodity prices. Commodity prices are influenced by various factors, including shifts in supply and demand, geopolitical events, and economic conditions. When commodity prices decline, the demand for dry bulk shipping services may decrease as companies curtail production and shipping volumes to manage costs. Conversely, when commodity prices rise, the demand for dry bulk shipping services may surge as companies aim to maximize profits by increasing production and shipping volumes.

- These price fluctuations can also shape the competitive dynamics of the dry bulk shipping industry. For instance, a 25% increase in iron ore prices led to a 17% rise in dry bulk shipping demand in 2016, according to the International Maritime Organization. The market is expected to grow at a robust pace, with industry analysts forecasting a 5% annual expansion over the next five years.

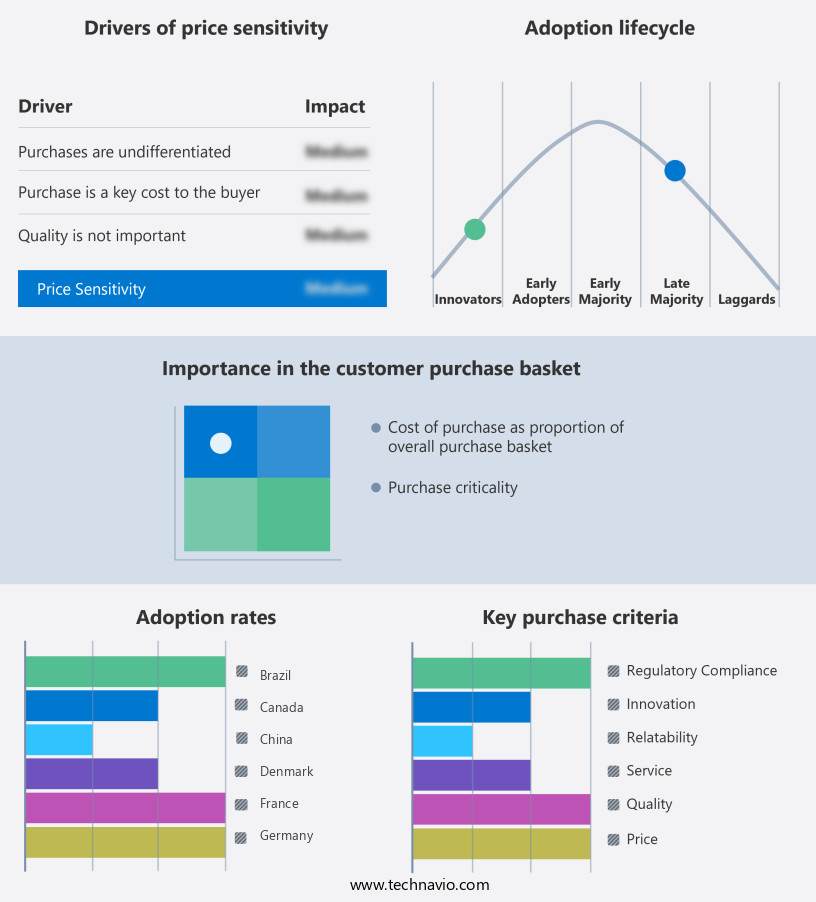

Exclusive Customer Landscape

The dry bulk shipping market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dry bulk shipping market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dry bulk shipping market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AP Moller Maersk AS - The company specializes in providing a diverse fleet of dry bulk shipping vessels, including 40 standard steel, 20 standard steel, and 40 High cube steel options, catering to various cargo requirements in the global maritime industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Moller Maersk AS

- Cargill Inc.

- COSCO Shipping Ports Ltd.

- Diana Shipping Inc.

- Eagle Bulk Shipping Inc.

- Egon Oldendorff Management GmbH

- Gearbulk Holding AG

- Genco Shipping and Trading Ltd.

- Golden Ocean Group Ltd.

- Grindrod Shipping Holdings Ltd

- Hapag Lloyd AG

- HMM Europe Ltd.

- John Swire and Sons Ltd.

- Kawasaki Kisen Kaisha Ltd.

- Mitsui O.S.K. Lines Ltd.

- Navios Maritime Partners LP

- Nippon Yusen Kabushiki Kaisha

- Pacific Basin Shipping Ltd.

- Pan Ocean Co. Ltd.

- Precious Shipping Public Co. Ltd.

- Star Bulk Carriers Corp.

- Scorpio Bulkers Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Dry Bulk Shipping Market

- In January 2024, the market witnessed a significant merger when two leading players, Navios Maritime Holdings Inc. And Star Bulk Carriers Corp., announced their merger, creating the world's largest dry bulk shipping company with a combined fleet of over 120 vessels (Navios Maritime Holdings Inc. Press release).

- In March 2024, Maersk Tankers and Mitsui O.S.K. Lines (MOL) collaborated to form a new joint venture, Mitsui Maersk Bulk, focusing on the operation of dry bulk carriers. This strategic partnership aimed to enhance their market presence and optimize operational efficiency (Maersk Tankers press release).

- In May 2024, the European Union (EU) approved the European Maritime, Fisheries and Food Fund (EMFF) for the 2021-2027 period, which includes a significant allocation for the development and modernization of the EU's maritime fleet, including dry bulk vessels (European Commission press release).

- In February 2025, Anglo-Eastern Univan Group, a leading integrated maritime group, launched its new digital platform, 'SmartShip,' designed to optimize the operational performance of dry bulk vessels by utilizing real-time data and advanced analytics (Anglo-Eastern Univan Group press release).

Research Analyst Overview

- The market continues to evolve, driven by the dynamic interplay of various sectors and market activities. Chartering strategies and charter party agreements shape freight market dynamics, while digitalization in shipping through fleet management and maritime cybersecurity enhance operational efficiency and risk management. Ship recycling regulations and maintenance scheduling optimization impact vessel operational costs, and the industry anticipates a 4% annual growth rate. For instance, the implementation of vessel performance indicators and shipping route optimization led to a 15% increase in fuel efficiency for a major shipping line. Meanwhile, sustainable shipping practices, such as crew training programs and green shipping initiatives, are essential for long-term competitiveness.

- Operational risk assessment, performance benchmarking, and compliance reporting systems are crucial for ensuring regulatory compliance and mitigating risks. Cargo damage prevention, cargo insurance policies, and cargo theft prevention are integral components of bulk cargo transportation. Global trade patterns and port infrastructure development further influence market trends, with maritime transport regulations shaping the competitive landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Dry Bulk Shipping Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 3604.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

China, US, Germany, India, Denmark, Japan, France, Canada, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dry Bulk Shipping Market Research and Growth Report?

- CAGR of the Dry Bulk Shipping industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dry bulk shipping market growth of industry companies

We can help! Our analysts can customize this dry bulk shipping market research report to meet your requirements.