Dry Eye Syndrome Drugs Market Size 2024-2028

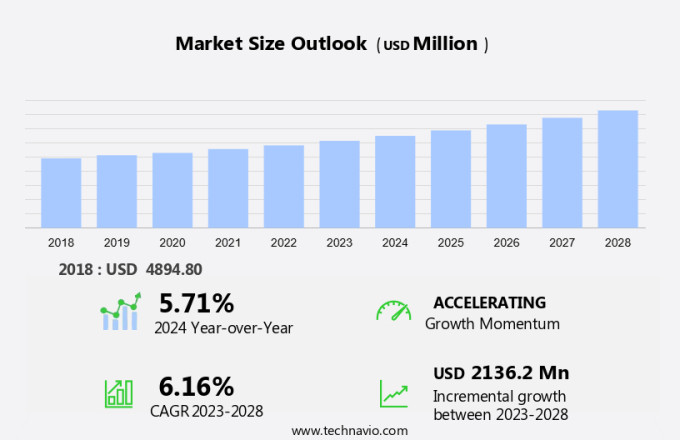

The dry eye syndrome drugs market size is forecast to increase by USD 2.14 billion, at a CAGR of 6.16% between 2023 and 2028.

- The market's expansion hinges on numerous factors, prominently the burgeoning geriatric population with a rising incidence of health concerns. The escalating healthcare expenditure and shifting lifestyles also play pivotal roles. Furthermore, the increasing prevalence of diseases like dry eye syndrome due to modern lifestyle choices underscores the market's growth trajectory. As individuals experience prolonged screen time and environmental factors impact ocular health, the demand for dry eye syndrome treatments intensifies. These interconnected dynamics drive innovation and investment in the ophthalmic industry, propelling advancements in eye care technologies and therapies to meet the evolving needs of consumers and healthcare providers alike.

What will be the Size of the Market During the Forecast Period?

- Dry Eye Syndrome (DES) is a common condition affecting the geriatric population and individuals with autoimmune disorders, hormonal changes, and prolonged high screen time. Eye Care Centers and clinics offer clinical care for DES patients, including treatments from ophthalmologists and optometrists in private practices. The market is significant, with various drug manufacturers developing innovative solutions. One such development is CEQUA therapy, which utilizes nanodroplet technology for effective treatment.

- Alternative therapies, such as nutritional supplements and acupuncture, also play a role in managing DES. Regulatory procedures for drug approval involve clinical trials to ensure safety and efficacy. Conditions like diabetes and rheumatic disorders can contribute to DES. Drug manufacturers like Alcon are actively researching and developing new treatments for DES, including those targeting specific causes, such as hormonal imbalances or blood composition alterations. The market growth is driven by the increasing prevalence of the condition and the demand for effective treatments.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

- Product

- OTC drugs

- Prescription drugs

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

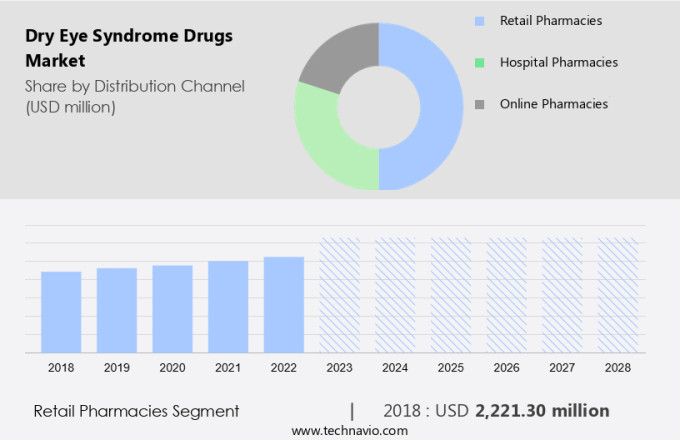

- The retail pharmacies segment is estimated to witness significant growth during the forecast period.

Dry Eye Disease (DED) is a multifactorial disorder characterized by ocular discomfort, visual disturbance, and tear film instability. Eye Care Centers, Eye Clinics, and private practices play a pivotal role in the distribution and availability of dry eye syndrome drugs. These centers cater to the needs of patients seeking clinical care, including Over-The-Counter (OTC) and prescription medications. Autoimmune Disorders, hormonal changes, aging, and certain medical conditions, such as Diabetes and Rheumatic conditions, contribute to the development of DED. Patients with DED may benefit from various therapies, including alternative treatments like nutritional supplements, acupuncture, and nanobiotechnology-based solutions, such as nanodroplet technology and microencapsulation.

The market is driven by the growing geriatric population, increasing healthcare infrastructure, and regulatory procedures for drug approval and clinical trials. Nanobiotechnology and microencapsulation are emerging trends in the market, with innovative products like CEQUA therapy drug and contact lenses. The market faces regulatory burden and pressure due to the complexities of drug development and approval processes. Key challenges include the high investment cost and the need for rigorous clinical trials to ensure safety and efficacy. Other factors influencing the market include disease prevalence, diagnosis and treatment methods, and the impact of high screen time on dry eye symptoms.

Get a glance at the market report of share of various segments Request Free Sample

The retail pharmacies segment was valued at USD 2.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Dry Eye Syndrome, an ocular condition characterized by inflammation and chronic health conditions, affects a significant patient pool. Healing treatments for this debilitating ailment are of great importance, as patients often experience discomfort and impaired vision. Advanced emerging drugs, such as Cyclosporine and Selagine, are gaining attention due to their anti-inflammatory properties and ability to reverse the symptoms of Dry Eye Syndrome. Cyclosporine, an immunosuppressant, acts locally in the eye to reduce inflammation and increase tear production. Its systemic absorption is minimal, making it a safe option for patients. Selagine, an immunoglobulin drop, also targets inflammation and has shown promising Phase 3 data in clinical trials.

Meibomian gland dysfunction, a common cause of Dry Eye Syndrome, contributes to the patient burden. Anti-inflammatory drugs, like Cyclosporine and Selagine, are essential in managing the symptoms of this condition. Inflammation plays a crucial role in the occurrence and progression of Dry Eye Syndrome, making the development of effective treatments a priority. The pharmacokinetic characteristics of these drugs are crucial in determining their efficacy and safety. Rheumatic diseases, which often co-occur with Dry Eye Syndrome, can complicate treatment and increase the need for prescription disease drugs. Immunoglobulin drops, like Selagine, offer a potential solution for patients with complex health conditions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Dry Eye Syndrome Drugs Market?

The growing geriatric population is the key driver of the market.

- The market is experiencing substantial growth due to the increasing prevalence of this condition among the geriatric population. Dry eye disease is a common eye disorder characterized by insufficient tear production or excessive tear evaporation. This condition is more frequent among older adults, as age-related hormonal changes and various health issues increase the risk of developing dry eyes. Asia, with its rapidly expanding geriatric population and growing healthcare infrastructure, is emerging as a lucrative region for dry eye syndrome drugs. Eye care centers, clinics, and private practices in this part of the world are witnessing a rise in demand for clinical care and alternative therapies, such as nutritional supplements, acupuncture, and nanobiotechnology-based treatments.

- Drug manufacturers are investing heavily in research and development to create innovative solutions for dry eye syndrome. Nanobiotechnology and microencapsulation are two cutting-edge technologies being explored to improve the efficacy and bioavailability of dry eye drugs. For instance, Alcon's CEQUA therapy, which utilizes nanodroplet technology, has gained significant attention in the market. However, the regulatory burden and pressure to secure drug approvals through clinical trials can be challenging for drug manufacturers. Diabetes, rheumatic conditions, hormonal imbalances, vitamin A deficiency, lupus, and thyroid disease are some of the underlying health conditions that can contribute to dry eye syndrome. As a result, the market for dry eye syndrome drugs is expected to grow, driven by the increasing demand for effective diagnosis and treatment options.

What are the market trends shaping the Dry Eye Syndrome Drugs Market?

Advancements in drug delivery technologies is the upcoming trend in the market.

- Dry Eye Syndrome, or keratoconjunctivitis sicca, is a prevalent ocular condition characterized by insufficient tear production or excessive tear evaporation. This condition can cause discomfort, irritation, and potential damage to the ocular surface. Eye Care Centers opting for advanced clinical care have witnessed significant growth in the Dry Eye Disease market. Autoimmune disorders, hormonal changes, aging, and certain health conditions, including diabetes and rheumatic conditions, can trigger this syndrome. Ophthalmologists and optometrists in Eye Clinics and private practices diagnose and treat Dry Eye Syndrome using various therapies. Alternative treatments, such as nutritional supplements, acupuncture, and contact lenses, are also gaining popularity.

- Drug manufacturers are investing in research and development to create more effective and convenient drug delivery systems. Nanobiotechnology and microencapsulation are emerging trends in Dry Eye Syndrome Drugs. Technologies like nanodroplet and CEQUA therapy have shown promise in improving bioavailability and patient compliance. Regulatory procedures and clinical trials are essential steps in drug approval. High screen time and vitamin A deficiency are among the factors contributing to the increasing prevalence of Dry Eye Syndrome. Diseases like lupus, thyroid disease, and diabetes can cause Dry Eye Syndrome due to changes in blood composition affecting tear glands. The geriatric population is particularly susceptible due to age-related hormonal changes.

- The regulatory burden and investment cost associated with drug development and approval add pressure to the market. In summary, the market is witnessing significant advancements, driven by the need for more effective and convenient treatments. Eye Care Centers, Ophthalmologists, and Optometrists are adopting new technologies and therapies to diagnose and treat Dry Eye Disease. Drug manufacturers are investing in research and development, focusing on nanobiotechnology, microencapsulation, and other innovative drug delivery systems. The market is influenced by various factors, including demographics, disease prevalence, regulatory procedures, and technological advancements.

What challenges does Dry Eye Syndrome Drugs Market face during the growth?

Less visibility into reimbursement of ophthalmic disorder treatments is a key challenge affecting the market growth.

- In the realm of Eye Care Centers and clinics, the market for Dry Eye Syndrome drugs is a significant concern due to limited visibility into the reimbursement process for treatments. This condition, often linked to autoimmune disorders, affects a substantial number of individuals, particularly those with Hormonal changes or part of the Geriatric population. In developed countries like the US, while insurance coverage is prevalent, out-of-pocket expenses for drugs remain a challenge. The situation worsens in emerging markets such as India and China, where a considerable portion of the population lacks health insurance coverage. Ophthalmologists, optometrists, and private practices provide clinical care for Dry Eye Disease, but the high investment cost and regulatory burden hinder the widespread use of advanced therapies like CEQUA therapy drug and nanobiotechnology-based treatments, such as those utilizing nanodroplet technology.

- Alternative therapies, including nutritional supplements, acupuncture, and herbal remedies, offer potential solutions. However, the regulatory procedures for drug approval and clinical trials can put pressure on drug manufacturers, delaying the availability of new treatments. Dry Eye Syndrome is associated with various conditions, including Diabetes, Rheumatic conditions, Blood composition imbalances, and diseases like Lupus and Thyroid disease. The condition can also be caused by Vitamin A deficiency or prolonged use of contact lenses. High screen time is another contributing factor. Investment in healthcare infrastructure and research is crucial to address the challenges in the market. Technological advancements, such as microencapsulation, hold promise in improving drug delivery and efficacy.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- AFT Pharmaceuticals Ltd.

- Akorn Operating Co LLC

- Bausch Health Companies Inc.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- I MED Pharma Inc.

- Johnson and Johnson Services Inc.

- Laboratoires Thea

- Mitotech SA

- Novaliq GmbH

- Novartis AG

- Oasis Medical Inc.

- Otsuka Holdings Co. Ltd.

- Santen Pharmaceutical Co. Ltd.

- Sentiss Pharma Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Visufarma

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Dry Eye Syndrome (DES) is a common condition characterized by tears that do not provide adequate lubrication and protection to the eyes. The Centers for Disease Control and Prevention (CDC) reports that up to 10 million Americans suffer from dry eyes. The market is growing due to increasing prevalence and awareness of the condition. Eye drops are the primary treatment for DES, with various types available, including artificial tears, lubricants, and anti-inflammatory drugs. Further, the market for these drugs is driven by factors such as an aging population, increased screen time, and environmental factors. The clinical landscape for DES drugs is diverse, with several companies developing new treatments. The use of advanced technologies, such as ocular surface imaging and meibomian gland evaluation, is also increasing to improve diagnosis and treatment. The market for DES drugs is expected to continue growing due to these factors and the unmet need for effective treatments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.16% |

|

Market Growth 2024-2028 |

USD 2.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.71 |

|

Key countries |

US, UK, Japan, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch