Duct Air Quality Sensors Market Size 2024-2028

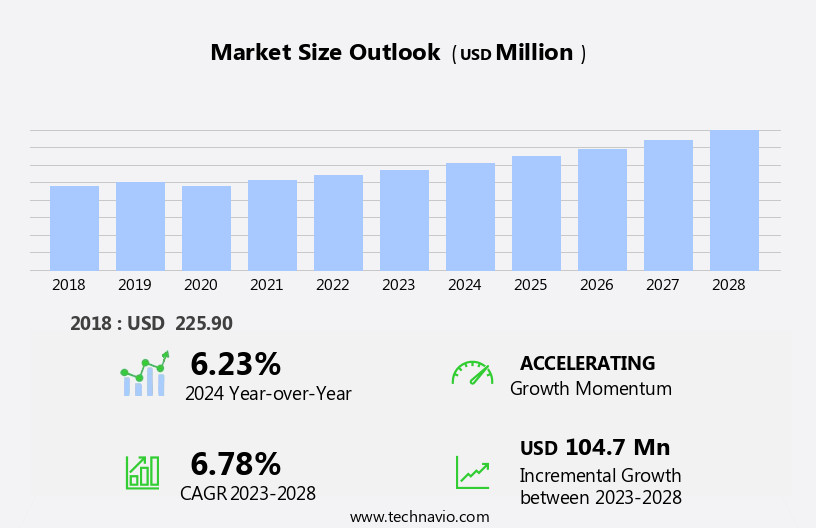

The duct air quality sensors market size is forecast to increase by USD 104.7 million at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing awareness of indoor air quality and the rising adoption of smart building solutions. The demand for duct air quality sensors is increasing as more organizations prioritize maintaining optimal indoor air quality to ensure the health and productivity of their workforces. Furthermore, the integration of duct air quality sensors into smart building systems is becoming increasingly common, enabling real-time monitoring and automated responses to maintain ideal conditions. However, the complexity of air quality assessment poses a challenge for market participants. Accurately assessing and maintaining duct air quality can be a complex process, requiring specialized knowledge and advanced technology.

- Additionally, ensuring compliance with various regulations and standards can add to the complexity and cost of implementing duct air quality sensors. Companies seeking to capitalize on market opportunities in the market must invest in research and development to address these challenges and offer innovative solutions to simplify air quality assessment and ensure regulatory compliance.

What will be the Size of the Duct Air Quality Sensors Market during the forecast period?

- The market continues to evolve, driven by the growing demand for maintaining optimal indoor air quality (IAQ) in various sectors. These sensors play a crucial role in ensuring the health and comfort of occupants, particularly in data centers, healthcare facilities, and commercial buildings. Cloud-based platforms enable real-time data analysis and predictive maintenance, ensuring compliance with regulations and enhancing energy efficiency. Sensor accuracy and response time are critical factors, with advancements in machine learning and AI enabling more precise measurements. Cost-effective solutions, such as wireless connectivity and sensor integration, are gaining popularity. Air filtration and airflow measurement sensors ensure efficient HVAC systems, while CO2 monitoring and humidity sensors maintain optimal conditions for occupant health.

- ASHRAE standards guide the industry, and the market responds with innovations in purification efficiency and sensor calibration. Volatile organic compounds (VOCs) and particle detection sensors address emerging concerns, while mobile apps and remote monitoring enable easy access to data visualization and maintenance. The market's continuous dynamism reflects the ongoing importance of ensuring IAQ and maintaining optimal building performance.

How is this Duct Air Quality Sensors Industry segmented?

The duct air quality sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Type

- Multi-gas monitor

- Single-gas monitor

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

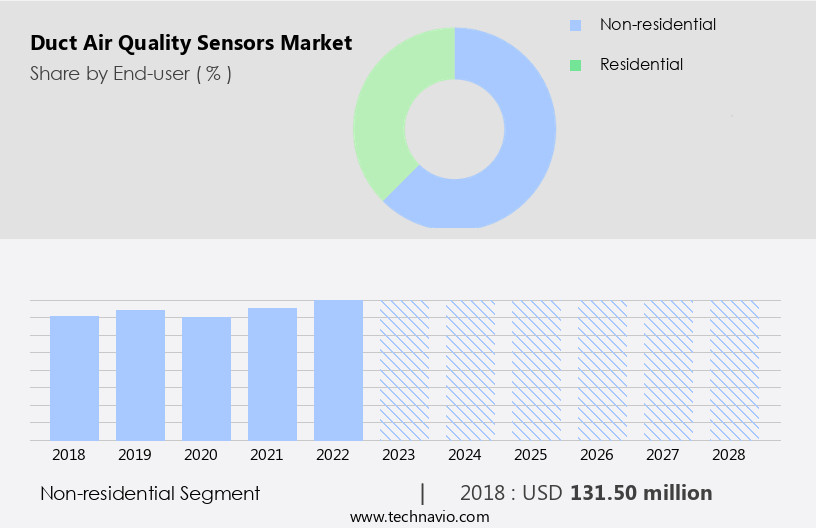

The non-residential segment is estimated to witness significant growth during the forecast period.

In the non-residential sector, duct air quality sensors play a crucial role in ensuring indoor air quality and maintaining regulatory compliance across various commercial, industrial, institutional, and public spaces. These sensors are integrated into ventilation systems of offices, shopping centers, malls, data centers, healthcare facilities, and industrial buildings to monitor pollutants, including volatile organic compounds, Carbon Dioxide, and particulate matter. By providing real-time data on temperature, humidity, and airflow, duct air quality sensors contribute to creating a healthy, comfortable, and energy-efficient environment. Additionally, predictive maintenance and sensor integration enable proactive system optimization and reduced maintenance costs. Compliance with regulations, such as ASHRAE standards and LEED certification, is also facilitated through continuous monitoring and data analytics.

Furthermore, cloud-based platforms and mobile apps enable remote monitoring and data visualization, enhancing building automation and operational efficiency. Duct air quality sensors come in various sizes, with different levels of accuracy, response time, and sensor lifespan, catering to diverse applications and budgets.

The Non-residential segment was valued at USD 131.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the North American market, the US and Canada lead the duct air quality sensors industry due to their advanced economies, high urbanization, and emphasis on indoor air quality. Strict regulations and guidelines from government bodies underline the significance of monitoring air quality to protect public health. Smart Buildings and temperature monitoring systems are increasingly adopted to ensure energy efficiency and occupant health. Data analytics plays a crucial role in predictive maintenance and identifying potential issues in HVAC systems, reducing maintenance costs. Compliance with Ashrae standards and LEED certification is a key driver for the adoption of duct air quality sensors in commercial buildings.

The integration of machine learning and sensor networks enables real-time data analysis and remote monitoring, enhancing building automation. Air filtration and purification efficiency, CO2 monitoring, and humidity monitoring are essential for maintaining optimal indoor air quality in healthcare facilities and industrial settings. Duct air quality sensors offer cost-effective solutions for residential buildings and data centers, with wireless connectivity and long sensor lifespan. The market trends include the development of cloud-based platforms, mobile apps, and advanced sensors for particle detection, pressure sensors, and airflow measurement. The focus on air quality index, filtration efficiency, and ventilation systems ensures a healthy and productive environment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Duct Air Quality Sensors Industry?

- The increasing concern for indoor air quality serves as the primary catalyst for market growth.

- The market is witnessing significant growth due to increasing awareness of indoor air quality and its impact on health. With people spending a considerable amount of time indoors, concerns about the health effects of poor indoor air quality are rising. Factors such as inadequate ventilation, building materials, and indoor activities can contribute to indoor air pollution, which is often more prevalent than outdoor air pollution. Duct air quality sensors play a crucial role in monitoring and maintaining optimal indoor air quality. These sensors use various technologies such as filtration efficiency, wireless connectivity, and sensor calibration to detect and measure pollutants like particles, gases, and pressure changes.

- Data visualization tools enable users to monitor air quality indexes in real-time, allowing for timely interventions to improve indoor air quality. Sensor networks and ventilation systems are essential components of commercial buildings, particularly those aiming for LEED certification. These systems help ensure that indoor air quality meets stringent standards, creating healthier and more productive work environments. Flow sensors and pressure sensors are critical components of these systems, providing essential data for maintaining optimal airflow and pressure levels. Sensor lifespan and sensor calibration are essential considerations for ensuring the accuracy and reliability of duct air quality sensors.

- Regular calibration ensures that sensors continue to provide accurate readings, while long sensor lifespans reduce maintenance costs and downtime. In conclusion, the demand for duct air quality sensors is driven by growing awareness of indoor air quality and its impact on health. These sensors provide essential data for maintaining optimal indoor air quality, enabling organizations to create healthier and more productive work environments while meeting stringent regulatory requirements.

What are the market trends shaping the Duct Air Quality Sensors Industry?

- The trend in the market is toward greater adoption of smart building solutions. This growing preference reflects the increasing recognition of the benefits these technologies bring to efficiency, sustainability, and overall management of commercial and residential structures.

- Duct air quality sensors play a crucial role in smart building solutions, ensuring optimal indoor air quality for occupant health and compliance with regulations. These sensors detect and measure pollutants, temperature, humidity, and ventilation rates in real-time, integrating with building management systems and IoT platforms for data analysis. The advantages of smart building solutions include immediate action based on collected data, enhancing occupant comfort, improving energy efficiency, and ensuring regulatory compliance.

- Data analytics enable predictive maintenance, reducing maintenance costs, and optimizing purification efficiency. Remote monitoring and building automation further streamline operations, making duct air quality sensors an essential component of modern, intelligent building infrastructure.

What challenges does the Duct Air Quality Sensors Industry face during its growth?

- The complex assessment of air quality poses a significant challenge to the industry's growth, requiring extensive expertise and resources.

- Indoor air quality is a critical concern for various sectors, particularly in data centers and healthcare facilities, where maintaining optimal conditions is essential. The complex interplay of factors influencing indoor air quality, such as pollutants, temperature, humidity, and ventilation rates, necessitates advanced sensor technologies for accurate and comprehensive measurements. Different pollutants, including CO2 and airborne particles, have unique sources, chemical compositions, and behaviors, requiring sensors with high selectivity and sensitivity. Real-time data is crucial for effective air quality management. Cloud-based platforms enable remote monitoring and real-time data analysis, reducing installation costs and facilitating seamless integration with air filtration and airflow measurement systems.

- However, ensuring sensor accuracy and quick response times is vital to maintain indoor air quality standards, such as those set by ASHRAE. The duct environment poses unique challenges, as airflow can affect pollutant distribution, leading to variations in sensor readings. Advanced sensor technologies and robust calibration processes are necessary to address these challenges and ensure accurate measurements at different points along the duct. In conclusion, designing and implementing effective indoor air quality monitoring systems requires a deep understanding of the complex factors at play and the use of advanced sensor technologies to ensure accurate, real-time data for optimal indoor air quality management.

Exclusive Customer Landscape

The duct air quality sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the duct air quality sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, duct air quality sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airflow Developments Ltd. - Alphasense Limited, a subsidiary of the company, provides advanced duct air quality sensors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airflow Developments Ltd.

- AMETEK Inc.

- Amphenol Corp.

- Andivi d.o.o.

- BELIMO Holding AG

- Building Automation Products Inc.

- CAREL INDUSTRIES S.p.A.

- EC Products Ltd.

- Fr. Sauter AG

- FuehlerSysteme eNET International GmbH

- Gas Sensing Solutions Ltd.

- Greystone Energy Systems Inc.

- Honeywell International Inc.

- Johnson Controls International Plc.

- S and S Regeltechnik GmbH

- Schneider Electric SE

- Siemens AG

- Sontay Ltd.

- Testo SE and Co. KGaA

- Thermokon Sensortechnik GmbH

- Tongdy Sensing Technology Corp.

- Vaisala Oyj

- WIKA Alexander Wiegand SE and Co. KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Duct Air Quality Sensors Market

- In February 2023, Honeywell International Inc. Announced the launch of their new line of duct air quality sensors, the Honeywell Home Wave Duo. This innovative product can detect and monitor particulate matter, temperature, and humidity levels in real-time, aiming to improve indoor air quality and health (Honeywell International Inc. Press release, 2023).

- In March 2024, Sensirion AG and Siemens AG entered into a strategic partnership to develop and integrate Sensirion's duct air quality sensors into Siemens' building automation systems. This collaboration is expected to enhance energy efficiency and indoor air quality solutions for commercial buildings (Sensirion AG press release, 2024).

- In May 2024, BlueSens GmbH, a leading provider of gas sensors, raised â¬10 million in a funding round to expand its production capacity and invest in research and development for duct air quality sensors. This investment will help the company meet the growing demand for advanced air quality monitoring systems (BlueSens GmbH press release, 2024).

- In October 2025, the European Union passed the new Indoor Air Quality Directive, which mandates the installation of duct air quality sensors in all new and existing buildings. This regulation aims to improve indoor air quality and reduce health risks associated with poor air quality (European Parliament and Council of the European Union, 2025).

Research Analyst Overview

In the market, operational efficiency and health and safety are top priorities for businesses. Alarm systems that detect gas leaks and notify building occupants are essential for ensuring safety. Air quality improvement is a significant trend, with sensors measuring particle size distribution, airborne particle counting, and bioaerosol monitoring playing key roles. Building health and environmental monitoring are crucial for maintaining air quality standards and complying with regulations. Smart Home and green building standards demand advanced air quality management systems, including remote sensor management, data analysis software, and reporting and dashboards.

Energy conservation and risk management are also important considerations, with sensor calibration services and maintenance ensuring accurate readings. Airborne pathogens, mold detection, and allergen detection are increasingly important for maintaining occupant comfort. Gas sensing and bioaerosol monitoring are integral to Smart City initiatives and air quality solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Duct Air Quality Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 104.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Duct Air Quality Sensors Market Research and Growth Report?

- CAGR of the Duct Air Quality Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the duct air quality sensors market growth of industry companies

We can help! Our analysts can customize this duct air quality sensors market research report to meet your requirements.