E-Axle Market Size 2024-2028

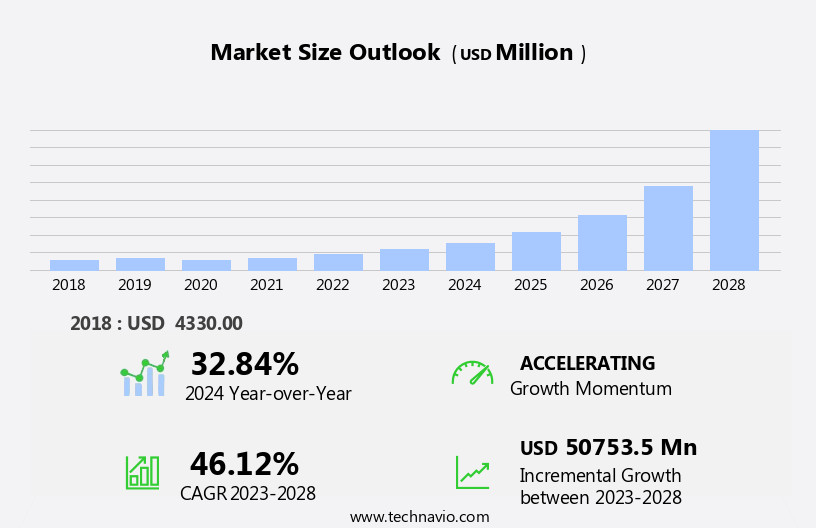

The e-axle market size is forecast to increase by USD 50.75 billion at a CAGR of 46.12% between 2023 and 2028.

What will be the Size of the E-Axle Market During the Forecast Period?

How is this E-Axle Industry segmented and which is the largest segment?

The e-axle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Vehicle Type Insights

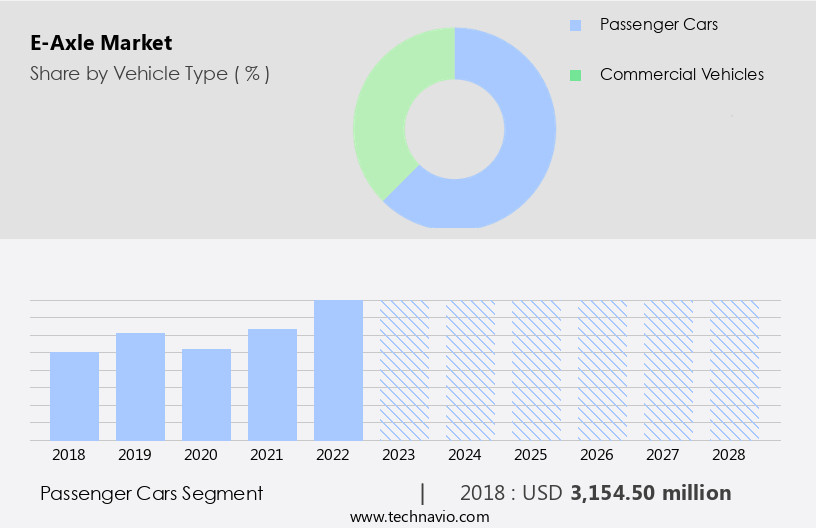

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The global E axle market is experiencing significant growth, particularly In the passenger car segment. This expansion is driven by the increasing sales of battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), where E axles serve as an efficient and cost-effective electric drivetrain solution. The demand for larger utility vehicles, including SUVs, crossovers, and MPVs, is also boosting market growth. Passenger cars are classified into entry-level, mid-level, and premium or luxury-level vehicles. Based on car body type, they are categorized as hatchbacks, compact sedans, mid-size sedans, and luxury sedans. The modular e-axle design offers advantages such as compactness, improved power, and enhanced vehicle dynamics.

Integration of advanced technologies like silicon carbide, MOSFET switches, multilevel inverters, and integrated E axles further enhances the performance and efficiency of electric powertrains. The transition to electric vehicles (EVs) from gasoline-powered engines is essential for reducing carbon neutral society's dependence on fossil fuels, decreasing CO2 emissions, and mitigating ozone layer depletion. Recharging infrastructure development and vehicle pricing are crucial factors influencing the market's growth trajectory.

Get a glance at the E-Axle Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 3.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

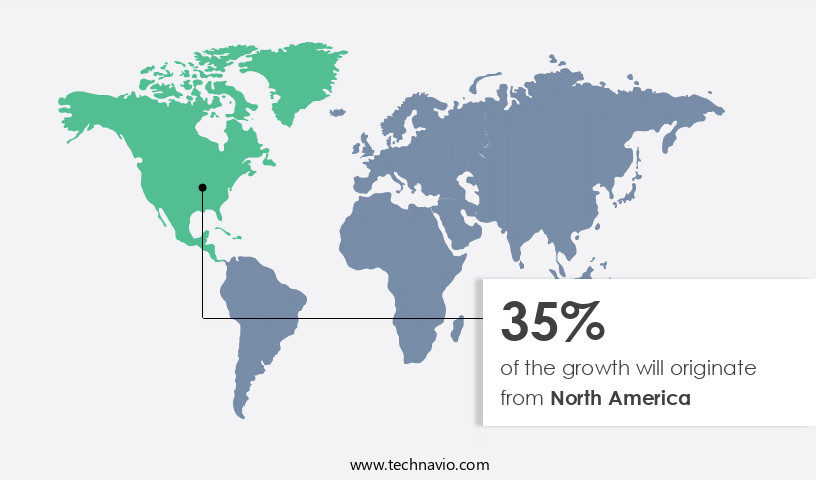

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing adoption of Electric Vehicles (EVs) In the region. The US and Canada are major contributors to this market's revenue growth. The growing concern for reducing vehicle emissions, coupled with the lower operating and maintenance costs of EVs, is driving the demand for these vehicles In the US. Furthermore, government initiatives to promote the use of EVs and the expansion of manufacturing facilities by companies such as Tesla, Nissan, and Ford are also contributing to the market's growth. The integration of electric drivetrain systems, including electric motors, power sources, and battery systems, in EVs is a key trend In the automotive industry.

The compactness, power, and efficiency of electric drive components are major advantages over traditional Internal Combustion Engines (ICEs), including gasoline-powered engines, Diesel Oxidation Catalysts, Diesel Particulate Filters, Lean NO Catalysts, and Selective Catalytic Reductions. The market for E-Axles is expected to continue growing as the world transitions towards a carbon neutral society, requiring the development of recharging infrastructure and the production of more efficient and downsized vehicles. Key components of E-Axles include battery energy density, electric range, hydrogen fuel cells, and vehicle dynamics. The market for E-Axles is expected to witness significant advancements in modularity, scalability, flexibility, cooling system management, and electric powertrain technologies, including Silicon carbide, MOSFET switches, Total Harmonic Distortion, Multilevel inverters, and Integrated E-Axles.

The market's growth is also influenced by factors such as the increasing popularity of hybrid electric vehicles, front-wheel drive, and four-wheel drive systems, as well as the need to reduce unsprung weight and improve suspension system efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of E-Axle Industry?

Growing adoption of EVs is the key driver of the market.

What are the market trends shaping the E-Axle Industry?

Increase in popularity of E-axle system is the upcoming market trend.

What challenges does the E-Axle Industry face during its growth?

Decline in automotive production due to global semiconductor chip shortage is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The e-axle market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-axle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-axle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AVL List GmbH - The company specializes In the production of advanced e-axle systems, incorporating components such as high-voltage electric drive motors and integrated drive modules. These innovative solutions enable improved vehicle efficiency and reduced emissions, making them a valuable addition to the transportation industry. The e-axle systems offer enhanced torque and power density, contributing to superior vehicle performance. By integrating the motor and drive module into a single component, the company's offerings streamline vehicle architecture and simplify manufacturing processes. The adoption of e-axle technology is poised to revolutionize the automotive sector, with numerous automakers and suppliers investing heavily in its development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AVL List GmbH

- BorgWarner Inc.

- BRIST Axle Systems Srl LLC

- Cardone Industries Inc.

- Continental AG

- Cummins Inc.

- Daimler Truck AG

- Dana Inc.

- Dorman Products Inc.

- GKN Automotive Ltd.

- Hyundai WIA Corporation

- J.K. Fenner India Ltd.

- Linamar Corp.

- Magna International Inc.

- Nidec Corp.

- PACCAR Inc.

- Robert Bosch GmbH

- Schaeffler AG

- SONA BLW Precision Forgings Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, production, and integration of electric drivetrain systems for various vehicle types, including battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs). These systems replace conventional gasoline-powered engines and transmissions, integrating electric motor, power source, inverter, and gearbox functions into a single compact unit. The shift towards electric vehicles (EVs) is driven by several factors, including the desire for increased vehicle efficiency, reduced carbon emissions, and the move towards a carbon-neutral society. The electrification of vehicles offers numerous advantages, such as improved power and torque delivery, reduced unsprung weight, and enhanced vehicle dynamics. E-axles enable vehicle users to experience zero-emission driving, contributing to the reduction of harmful pollutants, including CO2 emissions and ozone layer depletion.

The compactness of these systems also facilitates downsizing, leading to smaller vehicle dimensions and improved energy efficiency. The modular design of e-axles allows for scalability and flexibility, enabling their application in various vehicle segments, from small commercial vehicles to heavy commercial vehicles. The integration of advanced technologies, such as silicon carbide power semiconductors, mosfet switches, and multilevel inverters, enhances the performance and efficiency of e-axles. The evolution of e-axle technology has led to significant advancements in cooling system management and active current losses reduction, ensuring reliable and efficient power delivery. Bus bars and stator housing designs have been optimized to minimize energy losses and improve overall system performance.

The integration of independent suspension-based vehicles with e-axles offers numerous benefits, including improved handling and ride quality. In contrast, rigid axle suspension systems may require additional modifications to accommodate e-axles, necessitating careful vehicle engineering considerations. The electrification of vehicles is a complex process, requiring the development of robust recharging infrastructure and the optimization of vehicle prices to make EVs accessible to a broader audience. The integration of e-axles into various vehicle types is a crucial step towards achieving these goals, enabling the mass adoption of EVs and the transition to a sustainable transportation future. In summary, the market represents a significant opportunity for innovation and growth, as the global automotive industry shifts towards electrification.

The development of efficient, compact, and scalable e-axle systems will be essential in enabling the widespread adoption of EVs and contributing to the reduction of carbon emissions and the pursuit of a carbon-neutral society.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 46.12% |

|

Market growth 2024-2028 |

USD 50753.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

32.84 |

|

Key countries |

US, China, UK, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Axle Market Research and Growth Report?

- CAGR of the E-Axle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-axle market growth of industry companies

We can help! Our analysts can customize this e-axle market research report to meet your requirements.