E-Bike Battery Market Size 2025-2029

The e-bike battery market size is forecast to increase by USD 1.63 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is witnessing significant growth due to several key factors. One of the primary drivers is the longer shelf life of lithium-ion batteries compared to other battery technologies. This extended battery life makes e-bikes an attractive alternative to traditional bicycles and cars, as they offer a more sustainable and cost-effective transportation solution. Another trend influencing the market is the continuous advancements in e-bike designs.

- Manufacturers are focusing on improving battery efficiency, reducing weight, and increasing power output to meet the growing demand for more powerful and longer-lasting e-bikes. However, the market also faces challenges such as lead pollution and stringent laws. However, lead-acid and nickel batteries continue to find applications in specific niches due to their affordability and reliability.

- Governments and environmental organizations are increasing their efforts to reduce lead pollution from batteries, which may lead to higher production costs and potential regulatory hurdles for e-bike manufacturers.

What will be the Size of the E-Bike Battery Market During the Forecast Period?

- The market is experiencing strong growth, driven by the increasing popularity of electric bicycles worldwide. E-bikes, which offer pedal-assist and throttle options, cater to various riding styles and terrains, including mountain, trekking, cargo, and luggage transport. Lithium-ion batteries dominate the market due to their high energy density, long cycle life, and compact size.

- E-bike battery sales are on an upward trajectory, fueled by advancements in battery technology, increasing consumer awareness, and government incentives. High-capacity batteries enable longer riding ranges and enhance the overall e-biking experience.

- Furthermore, the market for battery accessories, including chargers and protective cases, is expanding to cater to the growing e-bike user base. Overall, the market is poised for significant growth, offering opportunities for investors and stakeholders alike.

How is this E-Bike Battery Industry segmented and which is the largest segment?

The e-bike battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

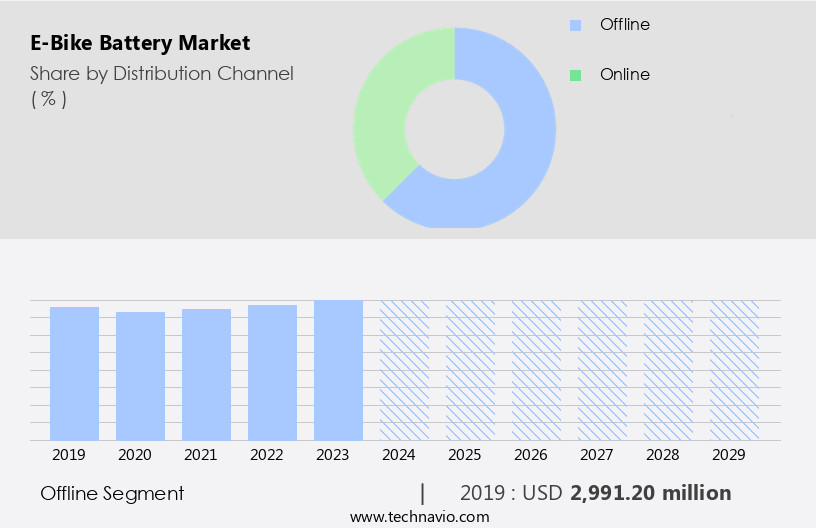

- Distribution Channel

- Offline

- Online

- Battery Type

- Lithium-ion battery

- Lead acid battery

- Others

- Variant

- Mid motor

- Hub motor

- Fitment

- Down tube

- In frame

- Rear carrier

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The offline segment holds the largest market share In the market. Consumers prefer purchasing e-bike batteries from offline stores due to their convenience and economic pricing. Hypermarkets and supermarkets are popular offline retail channels, offering a wide range of e-bike batteries from various brands under one roof. Specialty stores and department stores are also significant retail outlets, catering to specific consumer segments and providing personalized customer service. Companies prioritize organized retail strategies, considering factors such as inventory management, merchandise transportation, and ease of production. Offline stores offer a diverse selection of e-bike batteries, enabling consumers to make informed decisions based on their requirements and budget.

Get a glance at the share of various segments. Request Free Sample

The offline segment was valued at USD 2.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 85% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC, led by China, Japan, Vietnam, and India, has experienced significant growth due to increasing e-bike sales and government initiatives to promote clean transportation. In China, the largest market In the region, e-bikes have gained popularity as a solution to traffic congestion and accidents in urban areas. However, the market growth showed signs of slowing down after a decade of expansion. In May 2018, the Chinese government implemented national standards to differentiate e-bikes and e-motorcycles, enabling the growth of e-bike-based shared mobility services. Lithium-ion batteries are increasingly preferred due to their high energy density, extended lifespan, and reduced weight, enhancing e-bike performance and functionality. Additionally, connected e-bikes with features like remote diagnostics, integrated navigation, anti-theft systems, social media connectivity, and automatic emergency calls cater to the needs of ebike riders, commuters, and adventure seekers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of E-Bike Battery Industry?

Longer shelf life of Li-ion battery when compared with other battery technologies is the key driver of the market.

- Lithium-ion batteries, a popular technology in Electric Vehicles (EVs), are experiencing significant growth In the EV market. Extending beyond cars, these batteries are increasingly being adopted in e-bikes, including pedal-assisted and throttle-assisted models for trekking, mountain biking, cargo transportation, and even scooters. Lithium-ion batteries offer advantages over nickel-metal hydride batteries and lead-acid batteries. Their extended shelf life and high energy density make them a preferred choice. Amongst various Li-ion battery technologies, lithium iron phosphate batteries are the most widely used due to their superior electrochemical performance, thermal stability, safety, and long lifespan. These features enhance e-bike performance, battery capacity, and reduce range anxiety.

- Modern e-bike batteries come with advanced technology, including remote diagnostics, integrated navigation, anti-theft systems, social media connectivity, and automatic emergency calls. E-bike riders, commuters, and adventure seekers benefit from these features, making lithium-ion batteries a game-changer In the e-mobility sector.

What are the market trends shaping the E-Bike Battery Industry?

Advances in e-bike designs is the upcoming market trend.

- E-bike manufacturers are innovating to meet the growing demand for advanced, multipurpose e-bikes. To accommodate new designs and higher battery capacity requirements, there is a shift towards high-energy-density batteries. However, traditional lead-acid batteries lack the necessary energy density. As a result, lithium-ion batteries are gaining popularity due to their advanced technology and superior energy density.

- E-bike riders, including commuters and adventure seekers, desire extended battery life and additional functionalities such as pedal-assisted and throttle-assisted modes, remote diagnostics, integrated navigation, anti-theft systems, social media connectivity, and automatic emergency calls. These features enhance the overall performance and user experience of electric bikes and e-scooters, addressing range anxiety and portability concerns. E-bike batteries must be compact, lightweight, portable, and offer a seamless integration of advanced technology to meet consumer expectations.

What challenges does the E-Bike Battery Industry face during its growth?

Lead pollution and stringent laws is a key challenge affecting the industry growth.

- The market encompasses two primary types: Lead-acid and Lithium-ion batteries. Lead-acid batteries, with their standard arrangement of lead plates in sulfuric acid, have seen increased demand due to their application In the automotive sector and battery energy storage for hybrid electric vehicles and renewable power generation. However, the recycling of these batteries in densely populated areas without proper pollution checks can negatively impact the environment. On the other hand, Lithium-ion batteries, popular in pedal-assisted and throttle-assisted e-bikes, offer advanced technology with higher energy density, extended lifespan, and reduced weight. Brands like Swytch, Priority Bicycles, Bosch, Yamaha Bicycles, Optibike, ZappBatt, Lectric, and others contribute to the market growth with their electric vehicle offerings.

- E-Bike riders, including commuters and adventure seekers, benefit from the seamless integration of features like remote diagnostics, integrated navigation, anti-theft systems, social media connectivity, and automatic emergency calls. These functionalities address range anxiety and enhance the overall user experience. The market for E-Bike Batteries continues to expand as the demand for compact, portable, and lightweight power sources for electric bikes, electric kick-scooters, and other electric vehicles grows.

Exclusive Customer Landscape

The e-bike battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-bike battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-bike battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BMZ Holding GmbH - The company offers tailored e-mobility solutions, focusing on advanced E-bike battery technologies for diverse applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BMZ Holding GmbH

- Coslight India Telecom Pvt. Ltd.

- Giant Manufacturing Co. Ltd.

- GRUPO FOTONA

- Guangzhou Yuntong Lithium Battery Co. Ltd.

- Hunan CTS Technology Co. Ltd.

- Johnson Matthey Plc

- Kingbo Power Technology Co. Ltd.

- LG Corp.

- Melsen Power Technology Co. Ltd.

- OptimumNano Energy Co. Ltd.

- Panasonic Holdings Corp.

- Phylion Battery Co. Ltd.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Shenzhen Handpack Technology Co. Ltd.

- SHIMANO INC.

- VARTA AG

- Yamaha Motor Co. Ltd.

- ZHANGZHOU YOKU ENERGY TECHNOLOGY Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing popularity of electric bikes as a sustainable and efficient transportation alternative. E-bikes offer the benefits of traditional bicycles, with the added convenience of electric power, making them an attractive option for various user groups, including commuters, adventure seekers, and cargo transporters. Two primary types of batteries are used in e-bikes: lead-acid and lithium-ion. Lead-acid batteries have been the traditional choice for e-bikes due to their affordability and reliability. However, they are heavier and have a shorter lifespan compared to lithium-ion batteries. Lithium-ion batteries, on the other hand, offer several advantages, including high energy density, extended lifespan, and reduced weight.

These batteries have gained popularity in recent years due to their ability to provide longer ranges and improved performance. E-bikes come in various types, including pedal-assisted and throttle-assisted models. Pedal-assisted e-bikes require the rider to pedal to activate the motor, while throttle-assisted e-bikes allow the rider to engage the motor without pedaling. The choice between the two depends on the user's preference and intended use. E-bikes are used for various purposes, including trekking, cargo transport, and mountain biking. Trekking e-bikes are designed for long-distance commuting and touring, while cargo e-bikes are used for transporting goods. Mountain e-bikes offer the benefits of traditional mountain bikes, with the added convenience of electric power, making them an attractive option for adventure seekers.

E-bikes are equipped with various features to enhance user experience and functionality. These features include remote diagnostics, integrated navigation, anti-theft systems, social media connectivity, and automatic emergency calls. These features make e-bikes more convenient and user-friendly, increasing their appeal to potential buyers. Battery capacity is a critical factor in e-bike performance, as it determines the bike's range and power output. Lithium-ion batteries offer higher energy density and longer lifespan compared to lead-acid batteries, making them the preferred choice for e-bikes with high battery capacities. Range anxiety is a concern for some e-bike riders, particularly those who plan to use their bikes for long-distance commuting or touring. To address this concern, manufacturers are developing high-capacity, seamless, and compact lithium-ion batteries that offer longer ranges and improved performance. The market is experiencing significant growth due to the increasing popularity of e-bikes as a sustainable and efficient transportation alternative.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

China, India, US, Japan, South Korea, UK, France, Canada, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Bike Battery Market Research and Growth Report?

- CAGR of the E-Bike Battery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-bike battery market growth of industry companies

We can help! Our analysts can customize this e-bike battery market research report to meet your requirements.