E-Bike Market Size and Forecast 2025-2029

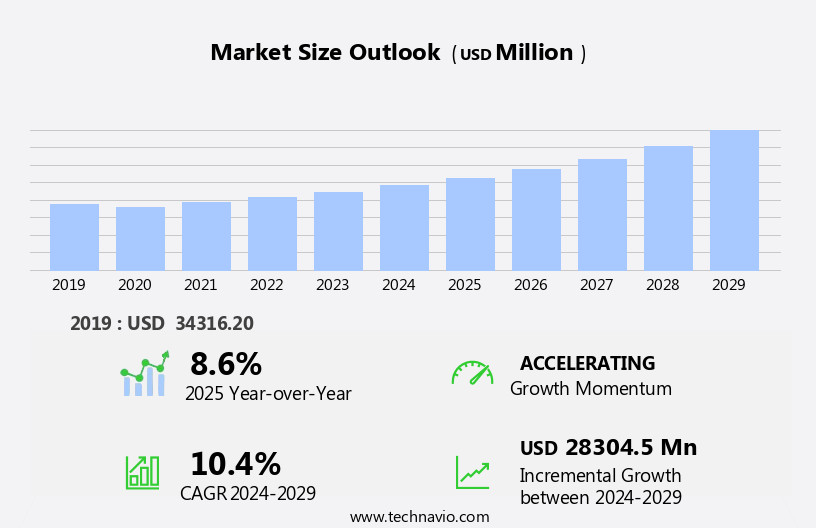

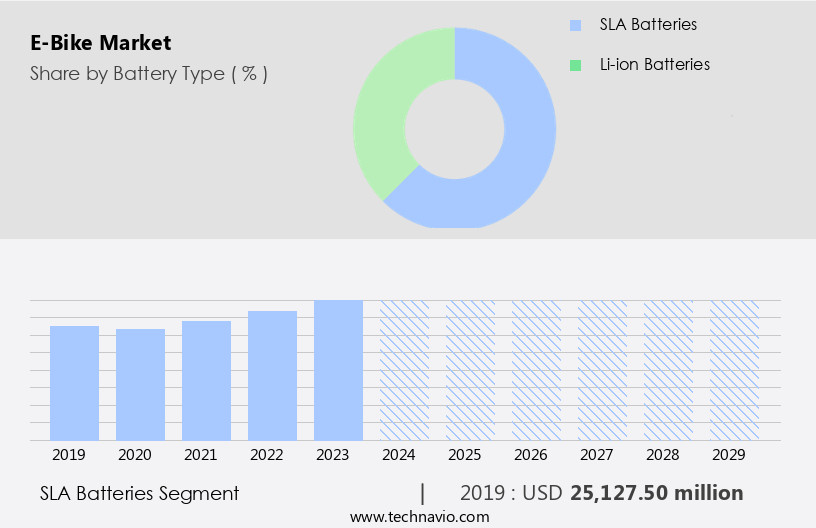

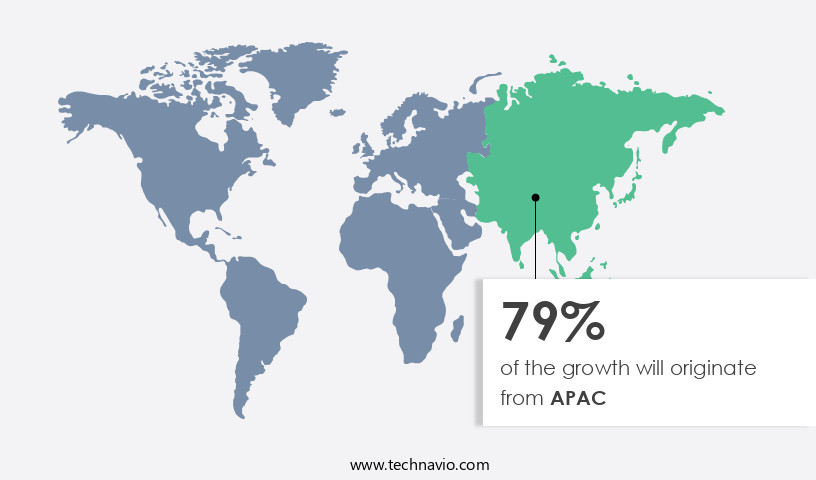

The e-bike market size estimates the market to reach by USD 28.3 billion, at a CAGR of 10.4% between 2024 and 2029.APAC is expected to account for 79% of the growth contribution to the global market during this period. In 2019 the SLA batteries segment was valued at USD 25.13 billion and has demonstrated steady growth since then.

- The market is experiencing significant growth, driven by increasing sustainability and environmental concerns, making e-bikes an attractive alternative to traditional motor vehicles. The popularity of connected e-bikes, which offer features such as GPS tracking, smartphone integration, and real-time performance data, is further fueling market expansion. However, the market faces challenges, including the risk of product recalls due to possible failures of e-bike components. These recalls can lead to reputational damage and financial losses for manufacturers.

- Companies must prioritize product quality and safety to mitigate these risks and maintain consumer trust. To capitalize on market opportunities and navigate challenges effectively, businesses should focus on innovation, sustainability, and robust quality control measures.

What will be the Size of the E-Bike Market during the forecast period?

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Hub motor performance and energy consumption rate are key areas of focus, with manufacturers striving to optimize these factors for improved efficiency and longer ranges. For instance, a leading e-bike manufacturer reduced charging time by 30% through innovative battery technology. Tire rolling resistance, torque sensor technology, and GPS navigation integration are other critical aspects shaping the market. Frame material strength, integrated sensors, and electric motor efficiency are essential for enhancing performance and safety. Braking system performance and charging time reduction are also significant concerns, with regenerative braking systems gaining popularity for their energy recovery capabilities.

Lighting system efficiency, theft prevention systems, and battery pack capacity are essential for ensuring user convenience and peace of mind. Pedal assist levels, wheel size impact, motor controller design, and chain drive system are other factors influencing e-bike performance and user experience. Connectivity options, maintenance requirements, weight distribution effect, and repair cost estimation are essential considerations for e-bike buyers. The market is expected to grow at a robust pace, with industry analysts projecting a 15% annual growth rate. Safety features, such as power assist cutoff, motor thermal management, e-bike component lifespan, and range anxiety mitigation, are becoming increasingly important.

Display unit features and maximum speed limiter are also significant factors, as they offer riders valuable information and control over their e-bikes. Lithium-ion battery life and battery management systems are crucial for ensuring reliable and long-lasting e-bike performance. Mid-drive motor systems and belt drive systems are gaining traction for their efficiency and durability. Overall, the market is an ever-evolving landscape, with continuous innovation and progress shaping its future.

How is this E-Bike Industry segmented?

The e-bike industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Battery Type

- SLA batteries

- Li-ion batteries

- Propulsion

- Pedal assist

- Throttle assist

- Drive

- Belt drive

- Chain drive

- Belt drive

- Chain drive

- End Use

- Personal

- Commercial

- Personal

- Commercial

- Speed

- Up to 25 km/h

- 25-45 km/h

- Up to 25 km/h

- 25-45 km/h

- E-Bike Type

- City

- Mountain

- Folding

- Cargo

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Battery Type Insights

The sla batteries segment is estimated to witness significant growth during the forecast period.

Electric bikes (e-bikes) incorporate various technological advancements in Electric vehicles to enhance performance and user experience. Sealed Lead Acid (SLA) batteries, a common power source, offer affordability and minimal maintenance requirements. SLA batteries, also known as gel cells, are partially sealed lead-acid batteries with coagulated sulfuric acid electrolyte. They are heavier and larger than lithium-ion batteries, but provide reliability. Hub motor performance is crucial, with high torque output ensuring efficient power transfer. Torque sensor technology offers pedal assist, adapting motor assistance based on rider input. GPS navigation integration and connectivity options enable real-time location tracking and remote bike monitoring. Braking system performance is essential for safety, with regenerative braking systems reducing charging time.

Motor controller design optimizes battery usage and pedal assist levels. Lighting system efficiency and frame material strength contribute to extended range and durability. Integrated sensors monitor battery status, motor temperature, and other vital functions. Theft prevention systems, charging time reduction, and motor thermal management are key features addressing rider concerns. Lithium-ion battery life, battery management systems, and maximum speed limiters are essential considerations for e-bike buyers. Weight distribution effect, belt drive systems, and chain drive systems impact performance and maintenance. Safety features, such as power assist cutoff and mid-drive motor systems, ensure rider protection. Repair cost estimation and component lifespan are crucial factors in the long-term ownership of an e-bike.

As of 2019 the SLA batteries segment estimated at USD 25.13 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 79% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia Pacific (APAC) the market is witnessing substantial growth, with China, Vietnam, Japan, and India being the key contributors. China's the market holds the largest market share in APAC due to the Chinese government's initiative to limit motorcycles in city areas. This policy shift has significantly boosted the adoption of E-bikes for short-distance commutes, leading to impressive unit shipment sales. Japan's the market is also gaining traction, with the introduction of two- and three-passenger models. Hub motor performance and electric motor efficiency are essential factors influencing the market's growth. Torque sensor technology, integrated sensors, and GPS navigation integration enhance user experience.

Braking system performance and motor thermal management ensure safety. Charging time reduction, lightweight frames, and theft prevention systems address consumer concerns. E-bike component lifespan, pedal assist levels, and wheel size impact are crucial factors affecting purchasing decisions. Mid-drive motor systems, regenerative braking systems, and connectivity options offer added value. Lithium-ion battery life and battery management systems are vital considerations for long-term usage. Maximum speed limiters and motor controller designs ensure regulatory compliance. The market trends reflect the evolving needs of consumers, with a focus on range anxiety mitigation, display unit features, and safety features overview.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global E-Bike Market is undergoing dynamic innovation, where sustainability and performance align through advanced engineering and material optimization. Key focus areas now include lithium-ion battery degradation modeling and e-bike component lifespan prediction model—essential for estimating product durability and optimizing battery management systems. Integrating human factors engineering in e-bike design ensures enhanced rider ergonomics and intuitive control.

Sustainable growth is backed by robust e-bike supply chain sustainability initiatives, while e-bike safety system design and testing maintain high standards in rider protection. Leading manufacturers are advancing e-bike performance testing and certification protocols, alongside evolving e-bike user interface design best practices to improve user experience. In response to rising urban theft, e-bike theft prevention system effectiveness is becoming a key design consideration.

Environmental focus is highlighted through e-bike lifecycle environmental impact assessment and electric motor thermal management strategies, minimizing energy loss. Efficiency gains are further driven by regenerative braking energy recovery efficiency and pedal assist torque sensor calibration methods for smoother power delivery. Durability is reinforced with e-bike frame material fatigue analysis, while tire rolling resistance optimization techniques enhance ride quality.

Next-gen designs feature optimized e-bike battery pack charging profile design and refined e-bike weight distribution and handling characteristics. Additionally, e-bike energy consumption modeling and prediction supports smarter energy use. Software updates via e-bike motor controller firmware update protocols ensure systems remain up-to-date. Cost-efficiency is boosted through e-bike manufacturing cost reduction strategies, while connectivity is elevated via e-bike connectivity and data integration techniques.

What are the key market drivers leading to the rise in the adoption of E-Bike Industry?

- The growing emphasis on sustainability and environmental concerns serves as the primary catalyst for market expansion. The market is experiencing significant growth due to increasing environmental consciousness and the desire for eco-friendly transportation alternatives. E-bikes, which emit zero emissions during use, offer a sustainable commuting solution for short- to medium-distance travel. As more people recognize the environmental impact of traditional vehicles, the demand for e-bikes is rising, contributing to improved air quality in urban areas. According to industry reports, The market is projected to grow by over 15% in the next few years, reflecting the growing trend toward sustainable transportation.

- For instance, a European city reported a 60% increase in e-bike sales in the past year, underscoring the market's potential. E-bikes consume less energy than cars and motorcycles, making them an attractive option for reducing carbon footprints and promoting cleaner transportation.

What are the market trends shaping the E-Bike Industry?

- The rising popularity of connected e-bikes represents a significant market trend in the transportation industry. These advanced bicycles, equipped with Internet of Things (IoT) technology, offer enhanced functionality and convenience to users.

- The market has experienced a robust surge due to the increasing popularity of bike-sharing services and the integration of connectivity features. According to recent research, the number of bike-sharing users in the US is expected to reach 100 million by 2025, representing a significant increase from the current user base. Connected e-bikes, which can be tracked, booked, and paid for via smartphone applications, have become an integral part of the urban mobility landscape. The real-time location of a connected e-bike can be monitored by both e-bike and ride sharing companies and users, enhancing the bike-sharing business model and making it a harmonious component of Mobility-as-a-Service (MaaS).

- This integration of technology into traditional bike-sharing services has the potential to revolutionize urban transportation, offering a more efficient and convenient solution for commuters.

What challenges does the E-Bike Industry face during its growth?

- The e-bike industry faces significant challenges due to product recalls resulting from potential failures in the electronic components, posing a threat to industry growth.

- Product recalls in the market can result from defects or potential system failures, leading to significant costs for manufacturers and suppliers. For instance, in January 2024, Ride Aventon recalled 2,300 Sinch.2 folding e-bikes due to crash and injury hazards, while Pacific Cycle recalled 1,700 Ascend Cabrillo and Minaret e-bikes due to fire hazards. These incidents highlight the importance of a robust upstream value chain. Improvements in company relationships and collaborations have led to cost-sharing arrangements for product recalls. This trend has alleviated some of the financial burden on vehicle manufacturers, tier-1 suppliers, and other stakeholders.

- According to industry reports, The market is expected to grow by over 15% annually, reaching a value of USD100 billion by 2028. The cost-sharing approach not only benefits individual companies but also contributes to the overall growth and sustainability of the e-bike industry.

Exclusive Customer Landscape

The e-bike market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-bike market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-bike market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accell Group NV - This European bicycle manufacturer presents a diverse product range under the brands Haibike, Winora, Ghost, Batavus, Koga, and Lapierre. Specializing in e-bikes, their innovative designs cater to various customer preferences, ensuring a comprehensive market presence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accell Group NV

- Avon Cycles Ltd.

- BH BIKES Europe SL

- Cortina Bikes

- Giant Manufacturing Co. Ltd.

- Greenwit Technologies Ltd.

- Hero Cycles Ltd.

- Hero Ecotech Ltd.

- Kalkhoff Werke GmbH

- Klever Mobility Europe GmbH

- myStromer AG

- Pedego Electric Bikes

- PIERER Mobility AG

- Riese and Muller GmbH

- SCOTT Sports SA

- SHIMANO INC.

- Trek Bicycle Corp.

- TVS Motor Co.

- Yamaha Motor Co. Ltd.

- Zhejiang Luyuan Electric Vehicle Co Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Bike Market

- In January 2024, Bosch eBike Systems, a leading supplier of technology for e-bikes, announced the launch of its new Performance Line CX motor, which offers up to 85Nm of torque and a range of up to 150 kilometers on a single charge (Bosch press release). This innovation marked a significant advancement in e-bike motor technology, enabling longer ranges and improved performance.

- In March 2024, Mercedes-Benz and Peugeot entered into a strategic partnership to co-develop and produce e-bikes under the Mercedes-Benz brand (Mercedes-Benz press release). This collaboration represented a major move by automakers into the market, leveraging their manufacturing expertise and brand recognition to tap into the growing demand for sustainable transportation solutions.

- In May 2024, Super73, a US-based e-bike manufacturer, raised USD15 million in a Series C funding round led by new investor, Tiger Global Management (Super73 press release). This investment supported the company's expansion plans, including the launch of new models and entry into international markets.

- In January 2025, the European Union approved new regulations to classify e-bikes as motor vehicles, requiring them to meet stricter safety and emissions standards (EU press release). This move aimed to improve safety and environmental sustainability in the market while also creating opportunities for e-bike manufacturers to differentiate themselves through compliance with these regulations.

Research Analyst Overview

- The market for e-bikes continues to evolve, with ongoing advancements in battery cell chemistry, suspension system tuning, and frame geometry design driving innovation. Durability testing protocols and recycling considerations are increasingly prioritized, as manufacturers optimize their manufacturing processes and navigate regulatory compliance issues. Energy recovery strategies and component failure analysis are key focus areas, with user experience design and e-bike ergonomics gaining significance. Supply chain management and environmental impact assessment are essential for ensuring sustainability, while battery disposal methods and warranty program design are critical for long-term success. Performance testing standards and powertrain optimization are essential for maintaining reliability, with predictive maintenance and motor controller algorithms improving safety and efficiency.

- Suspension system tuning, tire pressure monitoring, wheel bearing durability, and safety standards compliance are also critical factors shaping market dynamics. According to recent industry reports, The market is expected to grow by over 15% annually, driven by increasing consumer demand and technological advancements. For instance, a leading e-bike manufacturer reported a 20% increase in sales due to the introduction of a new, high-performance model.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Bike Market insights. See full methodology.

E-Bike Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 28304.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Bike Market Research and Growth Report?

- CAGR of the E-Bike industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-bike market growth of industry companies

We can help! Our analysts can customize this e-bike market research report to meet your requirements.