E-Cigarette And Vape Market Size 2025-2029

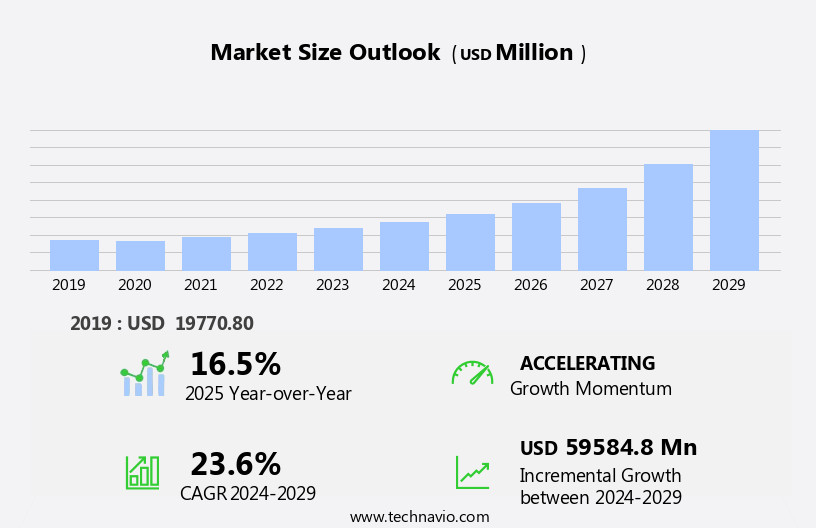

The e-cigarette and vape market size is forecast to increase by USD 59.58 billion at a CAGR of 23.6% between 2024 and 2029.

- The market in the US is experiencing significant growth due to several key factors. The increasing awareness of the health risks associated with traditional tobacco smoking has led to a shift towards alternative smoking options. This trend is further fueled by product innovations in the market, including advanced battery technology, herbal e-cigarettes, and a wide range of e-juice flavors. However, the market also faces challenges such as increasing taxes and excise duties on e-cigarettes and vapes, which may impact consumer affordability. Additionally, concerns over the potential health risks of e-cigarettes, including the presence of harmful chemicals like benzene and hydrogen cyanide, remain a concern for some. Despite these challenges, the convenience offered by e-cigarettes and vapes, particularly in terms of portability and ease of use, continues to drive demand in the market.

What will be the Size of the E-Cigarette And Vape Market During the Forecast Period?

- The market encompasses a diverse range of products and technologies designed to deliver nicotine and flavors without the combustion of traditional tobacco. This market exhibits growth, driven by consumer preferences for customization options, such as temperature control, nicotine dosages, and various flavors, including menthol and tobacco. Pod systems and modular devices cater to different user needs, while e-liquids, atomizers, and vaping products continue to evolve, offering a wide array of choices. The vaping industry is characterized by a complex distribution landscape, encompassing online marketplaces, retail stores, and vape shops. Established brands and new entrants compete in this dynamic market, with acquisitions and regulatory frameworks shaping the competitive landscape.

- Harm reduction and customer choice are key drivers, as e-cigarettes are perceived as less harmful than traditional tobacco. However, challenges persist, including concerns over e-liquid poisoning, compatibility issues, and regulatory oversight. The market's size and direction remain subject to ongoing research and analysis by industry experts, such as Bis Research, as social acceptance and harm reduction continue to shape consumer behavior and market trends.

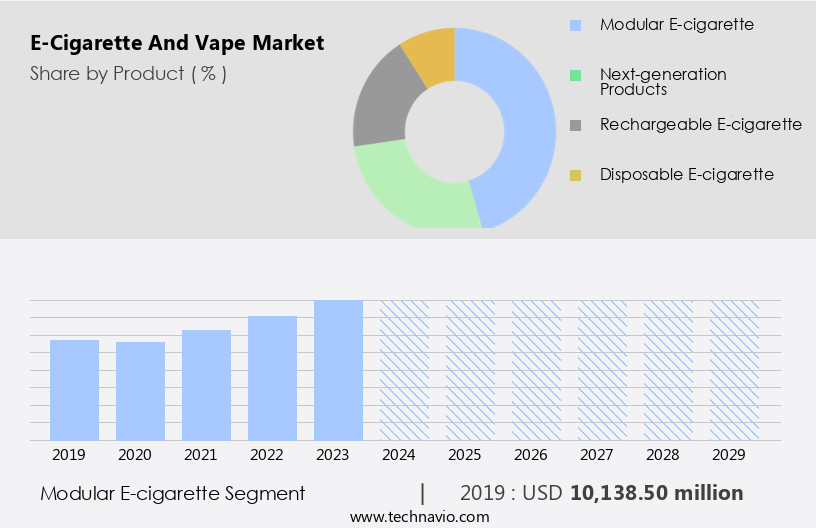

How is this E-Cigarette And Vape Industry segmented and which is the largest segment?

The e-cigarette and vape industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Modular e-cigarette

- Next-generation products

- Rechargeable e-cigarette

- Disposable e-cigarette

- Distribution Channel

- Offline

- Online

- Type

- Open

- Closed

- Product Type

- Automatic e-cigarette

- Manual e-cigarette

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Japan

- South America

- Middle East and Africa

- South Africa

- North America

By Product Insights

- The modular e-cigarette segment is estimated to witness significant growth during the forecast period.

Modular e-cigarettes represent a segment of electronic cigarettes that enable users to customize and modify various components of their vaping device. Distinct from traditional e-cigarettes, which are typically sold as single units, modular e-cigarettes offer flexibility and versatility to cater to individual preferences. The modular design comprises separate components that can be easily assembled or disassembled. The battery module is a crucial component of an e-cigarette, providing power to heat the e-liquid. Modular e-cigarettes offer various battery capacities or types, including removable rechargeable batteries and built-in rechargeable batteries. Moreover, these devices incorporate advanced control features, such as variable wattage and temperature control, enhancing the user experience.

E-liquids, available in a wide range of flavors including menthol, tobacco, and nicotine dosages, are essential consumables for these devices. The market for modular e-cigarettes is witnessing significant technological advancements, with innovations in atomizer technology, Bluetooth connectivity, and induction-heating technology. Despite the health benefits associated with harm reduction and consumer choice, concerns regarding e-liquid poisoning and compatibility issues persist. Regulations, retail stores, and vape shops play a crucial role in shaping the market landscape. Key players in the industry include Imperial Brands, Logic Technology, and others.

Get a glance at the E-Cigarette And Vape Industry report of share of various segments Request Free Sample

The Modular e-cigarette segment was valued at USD 10.14 billion in 2019 and showed a gradual increase during the forecast period.

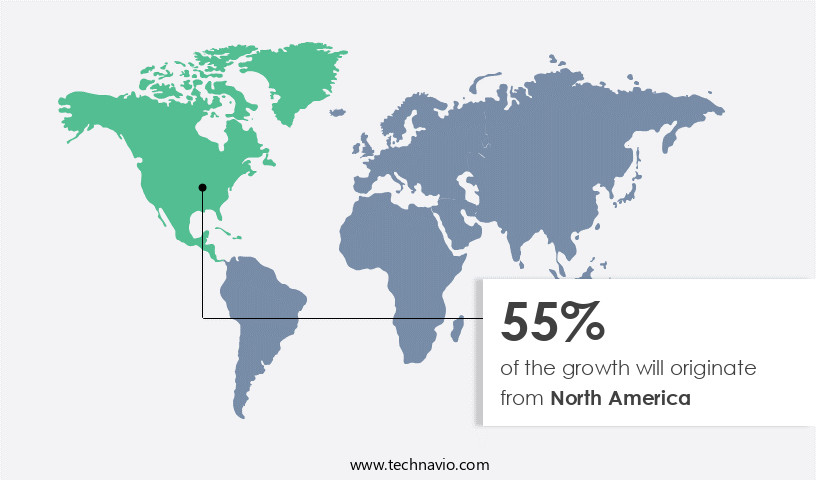

Regional Analysis

- North America is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for e-cigarettes and vape products is the largest globally, driven by increasing consumer preference for harm reduction and customization. Temperature control, nicotine dosages, and pod systems are popular features in open-system vape devices, while advanced personal vaporizers, such as squonk mods, cater to more experienced users. E-liquids, available in various flavors including menthol and tobacco, are a significant market driver. Regulations and retail outlets, including vape shops and retail stores, continue to evolve, influencing market dynamics. Technology advancements, such as atomizer technology, Bluetooth connectivity, and induction-heating technology, are shaping the competitive landscape. Companies like Imperial Brands, Logic Technology, and others are innovating to meet consumer demands for health benefits, product customization, and convenience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of E-Cigarette And Vape Industry?

Growing awareness of health dangers related to traditional tobacco smoking is the key driver of the market.

- E-cigarettes and vape products have emerged as potential alternatives to traditional tobacco smoking, addressing health concerns by delivering nicotine without harmful chemicals, such as tar. With temperature control and customizable nicotine dosages, these devices cater to diverse consumer preferences. Two popular types are pod systems and squonk mods. Flavors, including menthol and tobacco, are available in various e-liquids and vape juices, adding to the product customization. Regulations continue to shape the market, impacting retail stores and vape shops. Modular devices, such as advanced personal vaporizers, are gaining popularity due to their compatibility with various atomizers and e-liquids. Harm reduction is a significant market driver, as e-cigarettes are perceived to carry fewer health risks compared to tobacco products.

- However, concerns over e-liquid poisoning and compatibility issues persist. Technology advancements, including atomizer technology, Bluetooth connectivity, and induction-heating technology, are shaping the industry. Harm-reduction initiatives, public health campaigns, and heated tobacco devices further influence consumer choices. Despite these benefits, youth vaping remains a concern, necessitating ongoing research and regulations. BIS Research reports that the market for vaping products is expected to grow, driven by continuous technology advancements and increasing social acceptance.

What are the market trends shaping the E-Cigarette And Vape Industry?

Product innovations in market in focus is the upcoming market trend.

- The market is witnessing significant growth due to increasing consumer preferences for temperature control, nicotine dosages, and tobacco alternatives. Temperature control allows users to adjust the heating element's temperature, ensuring optimal vapor production and flavor. Nicotine dosages cater to various consumer needs, from low to high. Pod systems and squonk mods offer customization and ease of use. Flavors, including menthol and tobacco, continue to dominate the market, with e-liquids and atomizers essential components. Regulations and retail outlets, including vape shops and retail stores, impact market dynamics. Modular devices, such as Bluetooth connectivity and induction-heating technology, enhance the user experience.

- Consumer choice is a crucial factor, with harm reduction and health benefits driving the market. Product customization, including e-liquid flavors and nicotine levels, cater to diverse consumer preferences. However, concerns over e-liquid poisoning and compatibility issues persist. Technology advancements, including atomizer technology and heated tobacco devices, are shaping the market. Harm-reduction initiatives and social acceptance are also influencing market growth. CBD-infused and herbal vaping products, derived from natural ingredients, are gaining popularity for their potential health benefits and non-addictive nature.

What challenges does the E-Cigarette And Vape Industry face during its growth?

Increasing taxes and excise duties on e-cigarettes and vapes is a key challenge affecting the industry growth.

- The market faces significant challenges due to increasing taxes and excise duties on these products. Governments worldwide impose higher taxes, resulting in increased retail prices, making e-cigarettes and vapes less affordable for consumers. This affordability issue can negatively impact sales and market growth. For businesses, these taxes increase the cost burden, potentially leading to price hikes that could deter consumers further. Complex tax regulations across various regions add operational challenges for companies operating on a global scale. Consumers' preference for nicotine dosages, temperature control, and flavors, including menthol and tobacco, drives the market. E-liquids, atomizers, and various vaping products, such as pod systems, squonk mods, and modular devices, cater to this demand.

- Technology advancements, including atomizer technology, Bluetooth connectivity, and induction-heating technology, offer product customization and health benefits. However, concerns over e-liquid poisoning and compatibility issues persist. Regulations, retail stores, vape shops, and health initiatives shape the market landscape. Imperial Brands and Logic Technology are significant players in the market. Consumer choice and harm reduction are crucial factors in the e-cigarette technology market.

Exclusive Customer Landscape

The e-cigarette and vape market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-cigarette and vape market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-cigarette and vape market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

DashVapes - The company offers E-cigarettes such as Aspire Zelos, Freemax, and Geekvape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allo Technology Shenzhen Co. Ltd.

- British American Tobacco Plc

- Eleaf Group

- ENVI

- Flavour Beast

- Geekvape

- Imperial Brands Plc

- Innokin Technology Ltd.

- Japan Tobacco Inc.

- JUUL Labs Inc.

- NicQuid LLC

- NJOY, LLC

- Philip Morris International Inc.

- Shenzhen Eigate Technology Co. Ltd.

- Shenzhen FreeMax Technology Co. Ltd.

- Shenzhen IVPS Technology Co Ltd.

- Shenzhen Kanger Technology Co. Ltd.

- SVC Labs Ltd.

- Turning Point Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, driven by consumer preferences for alternative nicotine delivery systems. Two key trends shaping the industry are temperature control and nicotine dosage customization. Temperature control technology enables users to adjust the heating element's temperature, ensuring optimal vapor production and enhancing the overall experience. This feature caters to those seeking a more personalized vaping experience. Another trend is nicotine dosage customization, allowing users to tailor their intake according to their preferences. Pod systems, which use pre-filled cartridges, offer convenience and ease of use, while squonk mods provide the flexibility to manually adjust nicotine levels. The vape market is diverse, with various product offerings catering to different consumer segments.

Flavors remain a significant factor in consumer choice, with menthol and tobacco being popular options. E-liquids, available in various nicotine strengths, provide consumers with a wide range of choices. Product customization is another key trend, with consumers seeking advanced personal vaporizers and modular devices. Harm reduction and customer choice are essential drivers of this market, as many view vaping as a less harmful alternative to traditional tobacco products. Despite the market's growth, challenges persist. E-liquid poisoning and compatibility issues are concerns, requiring ongoing regulatory oversight and industry best practices. Social acceptance and public health initiatives continue to shape the market's landscape.

Technology advancements, such as induction-heating technology and Bluetooth connectivity, are transforming the vape industry. Heated tobacco devices, which heat tobacco instead of vaporizing e-liquids, represent another emerging trend. Regulations remain a critical factor in the market. Retail outlets, including vape shops, face ongoing regulatory challenges, requiring compliance with various standards and guidelines. The market continue to evolve, driven by consumer preferences for alternative nicotine delivery systems and technology advancements. Temperature control, nicotine dosage customization, and product customization are key trends shaping the industry. Regulations and health concerns remain challenges, requiring ongoing attention and industry best practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.6% |

|

Market growth 2025-2029 |

USD 59.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.5 |

|

Key countries |

US, China, Canada, UK, Germany, Japan, Australia, France, South Africa, and Malaysia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Cigarette And Vape Market Research and Growth Report?

- CAGR of the E-Cigarette And Vape industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-cigarette and vape market growth of industry companies

We can help! Our analysts can customize this e-cigarette and vape market research report to meet your requirements.