E-Mail Encryption Market Size 2025-2029

The e-mail encryption market size is forecast to increase by USD 25.83 billion, at a CAGR of 37.8% between 2024 and 2029.

- The market is witnessing significant growth, driven by the high adoption of cloud-based email services and the emergence of integrated security solutions. Cloud email providers, such as Microsoft Office 365 and Google Workspace, offer built-in encryption features, making encryption a standard practice for businesses migrating to these platforms. This trend is expected to continue, as more organizations seek to streamline their security infrastructure and improve data protection. The email encryption market reflects the evolving email security landscape, with increasing IT spending on data protection and cloud integration. However, the market faces challenges, including the high total cost of ownership (TCO) of e-mail encryption solutions. Traditional on-premises encryption systems require substantial upfront investments in hardware, software, and maintenance. Moreover, the increasing sophistication of cyber threats necessitates continuous updates and improvements to encryption technologies, adding to the TCO.

- Despite these challenges, opportunities abound for companies offering advanced encryption solutions that address these concerns. For instance, providers of cloud-based, subscription-based encryption services can offer affordable, scalable, and easy-to-deploy solutions, appealing to businesses of all sizes. Additionally, encryption companies focusing on user-friendly interfaces, seamless integration with popular email platforms, and robust threat protection can differentiate themselves in a crowded market. Another area of growth lies in the integration of encryption with other security solutions, such as data loss prevention (DLP) and secure messaging. E-mail encryption solutions have gained significant importance in the business world as data security becomes a top priority. By offering comprehensive, multi-layered security solutions, companies can cater to the evolving needs of businesses, ensuring their sensitive information remains protected from both external and internal threats.

What will be the Size of the E-Mail Encryption Market during the forecast period?

- In the dynamic email security landscape, encryption plays a crucial role in safeguarding data privacy. Email encryption deployment has gained momentum in response to escalating threats such as ransomware, malware, and phishing attacks. Email security awareness is essential for effective implementation, with training programs focusing on best practices and identifying risks. Email logging and auditing are integral to email security management, enabling organizations to monitor and analyze email traffic for compliance and security purposes. Compliance requirements, including legal holds and data privacy regulations, necessitate robust encryption solutions. Encryption speed and key length are critical factors in choosing an email encryption solution.

- Email signature verification and attachment security help prevent data leakage and data theft. Encryption strength is paramount against advanced threats like email spoofing and phishing attempts. Email security configuration and authentication are essential for maintaining email security. Email content filtering and forensics tools help mitigate risks and ensure data integrity. Consulting services offer expert guidance on email security management and configuration. Despite these efforts, email security remains a challenge due to the ever-evolving threat landscape. Organizations must stay informed and adapt their email security strategies accordingly. Encryption remains a vital component in protecting sensitive information and maintaining email security.

How is this E-Mail Encryption Industry segmented?

The e-mail encryption industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

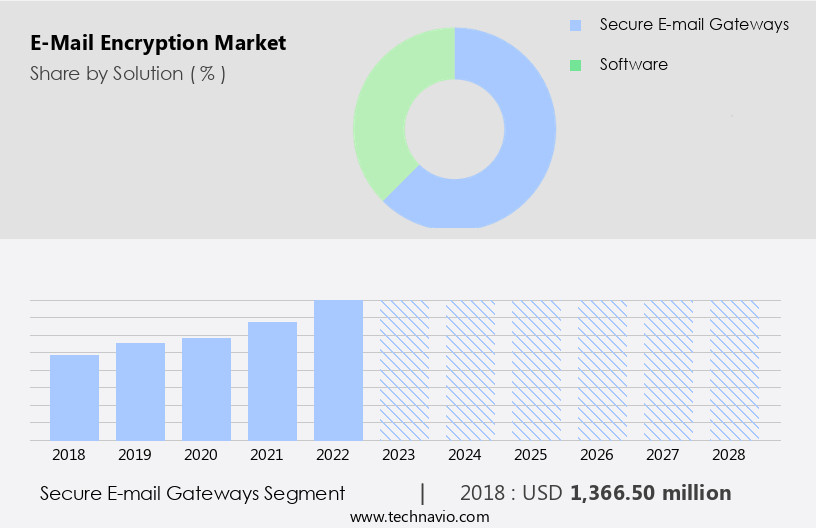

- Solution

- Secure e-mail gateways

- Software

- End-user

- BFSI

- Healthcare

- Government

- Others

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Solution Insights

The secure e-mail gateways segment is estimated to witness significant growth during the forecast period. Secure email gateways play a crucial role in safeguarding organizations from various email-borne threats, including spam, phishing, and malware. These solutions offer functions such as encryption, key distribution, message authentication, and incident response. The market for email security is witnessing significant growth due to the increasing adoption of cloud-based encryption and hybrid encryption methods. Zero-trust security and penetration testing are also gaining popularity to fortify email security. Email retention and data breach prevention are essential concerns for businesses, leading to the implementation of email security services and software. Compliance regulations such as HIPAA and GDPR mandate the use of encryption and digital signatures for secure communication.

On-premise and mobile email security solutions cater to the needs of businesses with diverse requirements. Encryption algorithms like symmetric and asymmetric encryption ensure data confidentiality, while key distribution and key management systems maintain the security of encryption keys. Email encryption solutions also offer features like email filtering, key recovery, and security awareness training to enhance email security. Vulnerability assessments and malware protection are integral parts of email security, helping to prevent data breaches and email threats. Secure email gateways also provide email archiving, message authentication, and key revocation to ensure the integrity of email communication. Email encryption solutions enable end-to-end encryption, ensuring that sensitive information remains secure throughout the email communication process.

These solutions are increasingly being integrated with email clients like Apple Mail and Microsoft Outlook, as well as email APIs and Microsoft Exchange. In summary, the email security market is witnessing significant growth due to the increasing awareness of email security threats and the need for robust email security solutions. The market is evolving to cater to diverse business requirements, with a focus on encryption, key management, and compliance regulations.

The Secure e-mail gateways segment was valued at USD 1.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The email encryption market is experiencing significant growth as businesses prioritize secure communication solutions to mitigate cyber threats. In North America, the region leading the market, companies are increasingly adopting advanced security technologies, such as biometric authentication and multi-factor authentication, for email communications. Cloud-based encryption and email security services are popular choices, with providers like Trend Micro offering efficient key management and cost reduction through their Hosted Key Service. Hybrid encryption and zero-trust security are also gaining traction, while penetration testing and vulnerability assessments ensure robust email security. Encryption algorithms, including asymmetric and symmetric, are integral to email security, along with digital signatures and message authentication.

Email security software, such as Microsoft Outlook and Google Workspace, integrate encryption and offer additional features like spam filtering and phishing prevention. Compliance regulations necessitate data encryption and key management, with solutions providing email discovery, legal hold, and key recovery. Encryption key rotation, malware protection, and incident response are essential components of email security, while secure email gateways and email encryption solutions ensure end-to-end encryption and key revocation. Security awareness training and email filtering further strengthen email security, as the market continues to evolve and adapt to emerging threats.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the E-Mail Encryption market drivers leading to the rise in the adoption of Industry?

- The significant adoption of cloud-based services serves as the primary growth catalyst for the market. In today's digital world, the security of confidential data, particularly in the cloud, is a top priority for businesses, including banks and healthcare organizations. The shift to cloud-based services is accelerating, especially among Small and Medium-sized Businesses (SMBs), due to their cost-effective pay-per-use model and flexibility to accommodate varying enterprise needs. Cloud-based security services offer numerous advantages, such as reduced dependence on internal IT personnel, no licensing costs, low maintenance expenses, minimal hardware infrastructure, and swift implementation of IT solutions.

- With the increasing e-mail volumes, many enterprises are outsourcing e-mail storage to cloud providers. However, ensuring data security remains paramount. Key recovery solutions play a crucial role in maintaining data security by allowing access to encrypted data in case of lost or forgotten keys. This trend is expected to continue as businesses increasingly adopt cloud services for their email communication needs.

What are the E-Mail Encryption market trends shaping the Industry?

- The integration of comprehensive security solutions is becoming increasingly prevalent in the current market. This trend signifies the emergence of advanced systems that address multiple security needs in a coordinated and effective manner. E-mail encryption is a critical component of email security for businesses, ensuring the confidentiality and integrity of sensitive information transmitted via email. The market for email encryption solutions is driven by the increasing need for robust security monitoring and compliance with data protection regulations. Cloud-based encryption and hybrid encryption solutions are gaining popularity due to their flexibility and cost-effectiveness. Zero-trust security and penetration testing are essential features that businesses look for in email security services. Key distribution and encryption algorithms are other key considerations. Encryption key escrow is a concern for some organizations, leading to the demand for on-premise encryption solutions.

- The integration of email encryption with other security solutions, such as data loss prevention (DLP), is a significant trend in the market. This convergence of security solutions provides better support and functionality to customers, reducing the overall cost of ownership and increasing adoption. The complexity of network infrastructures necessitates the integration of various security solutions, making it a crucial buying criterion. The market for email encryption solutions is expected to grow as businesses prioritize security and regulatory compliance. The integration of email encryption with other security solutions and the adoption of cloud-based and hybrid encryption are key trends that will shape the market's future. Machine learning and artificial intelligence are being integrated into encryption solutions to improve interoperability and enhance security features.

How does E-Mail Encryption market face challenges during its growth?

- The high total cost of ownership for e-mail encryption solutions represents a significant challenge that can hinder industry growth. This challenge arises from the expenses associated with implementing, maintaining, and updating encryption technologies for e-mail communications. Companies must carefully weigh the benefits of enhanced security against the costs to determine the most effective solution for their specific needs.

- E-mail encryption solutions offer essential security features such as asymmetric and symmetric encryption, digital signatures, and s/mime for mobile email security. These technologies help prevent data breaches, incident response, and phishing attacks. E-mail encryption solutions can be seamlessly integrated into popular email clients like Apple Mail, enhancing security without disrupting workflow. The cost of deploying an e-mail encryption solution includes software licensing for components like key management software and encrypted email servers, system designing and customization, implementation, training, and maintenance. After implementation, constant monitoring and upgrades are necessary, increasing the overall cost. This expense may hinder the growth of the market. Moreover, email encryption solutions provide a complete public key infrastructure (PKI) that includes multiple internal and web-facing servers, additional storage for encrypted emails, and software licenses. PKI enables continuous monitoring of activities, such as help desk support, rotating user certificates, and maintaining certificate revocation lists. These expenses, including software licensing, system design, implementation, training, and maintenance, as well as ongoing upgrades, contribute to the overall cost and may impede the growth of the market.

Exclusive Customer Landscape

The e-mail encryption market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the e-mail encryption market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, e-mail encryption market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Barracuda Networks Inc. - This company provides advanced email security solutions, including encryption technology such as Barracuda Email Protection.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barracuda Networks Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Egress Software Technologies Ltd.

- Entrust Corp.

- Fortinet Inc.

- Jussystemer AS

- McAfee LLC

- Microsoft Corp.

- Mimecast Ltd.

- Musarubra US LLC

- Open Text Corp.

- Proofpoint

- Proton AG

- SAP SE

- Sophos Ltd.

- Trend Micro Inc.

- Trustifi LLC

- WatchGuard Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in E-Mail Encryption Market

- In February 2023, Proofpoint, a leading cybersecurity and compliance company, announced the launch of its latest email encryption solution, "SecureEmail." This advanced product offers advanced threat protection and data loss prevention capabilities, enabling organizations to secure their sensitive information during email communication (Proofpoint Press Release, 2023).

- In July 2024, Microsoft and Google, two tech giants, entered into a strategic partnership to integrate their email encryption services. This collaboration allows users of both Microsoft 365 and Gmail to send encrypted emails seamlessly between the two platforms, enhancing interoperability and security (Microsoft Blog, 2024).

- In October 2024, Symantec, a leading cybersecurity firm, was acquired by Broadcom for approximately USD 10.7 billion. This acquisition strengthened Broadcom's cybersecurity portfolio, positioning the company as a major player in the email encryption market (Bloomberg, 2024).

- In March 2025, the European Union's General Data Protection Regulation (GDPR) introduced stricter email encryption requirements. The new rules mandate that all personal data transmitted via email be encrypted, significantly increasing the demand for email encryption solutions in Europe (European Commission, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. Asymmetric encryption plays a crucial role in safeguarding sensitive data, while mobile email security ensures secure communication on the go. Incident response teams utilize encryption for effective data breach prevention, and email threat intelligence enhances security by identifying potential phishing attempts. Cloud-based encryption and email security services offer flexibility and scalability, while hybrid encryption bridges the gap between cloud and on-premise environments. Key distribution and management are essential components, with encryption algorithms providing the foundation for robust security. Zero-trust security, penetration testing, and vulnerability assessment further strengthen email security, addressing potential weaknesses and mitigating risks.

The E-Mail Encryption Market is expanding rapidly as organizations prioritize data protection against cyber threats like email phishing, email spam, and email malware. Robust email authentication mechanisms play a crucial role in securing communications and preventing unauthorized access. Compliance with industry regulations is essential, driving demand for advanced email compliance solutions. Factors such as encryption key length and encryption overhead impact security efficiency. Strengthened email attachment security ensures safe file transfers, while email auditing and email forensics support investigation and threat mitigation. Legal requirements like email legal holds are shaping encryption strategies. With increasing reliance on email security training and email security consulting, businesses are enhancing protection measures, securing sensitive data, and mitigating cyber risks effectively.

Digital signatures and certificates add an additional layer of trust, ensuring message authenticity and non-repudiation. Email encryption solutions integrate seamlessly with popular email clients like Apple Mail and Microsoft Outlook, as well as platforms such as Google Workspace and Microsoft Exchange. Compliance regulations mandate encryption for various industries, necessitating continuous innovation in encryption technologies. Symmetric encryption, s/mime, and secure email gateways provide comprehensive protection, with email filtering and spam filtering ensuring only legitimate emails reach the inbox. Data encryption and email archiving enable efficient management and retrieval of email data. Key escrow, key rotation, and key revocation ensure secure key management, while message authentication and email discovery help maintain control over email communications.

Security awareness training and email api further enhance overall email security, fostering a culture of vigilance and best practices.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled E-Mail Encryption Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.8% |

|

Market growth 2025-2029 |

USD 25.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.6 |

|

Key countries |

US, Canada, Germany, China, UK, France, Spain, Italy, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this E-Mail Encryption Market Research and Growth Report?

- CAGR of the E-Mail Encryption industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the e-mail encryption market growth of industry companies

We can help! Our analysts can customize this e-mail encryption market research report to meet your requirements.