Education Apps Market Size 2025-2029

The education apps market size is forecast to increase by USD 6.08 billion, at a CAGR of 14.5% between 2024 and 2029. Growing government initiatives for digital learning will drive the education apps market.

Major Market Trends & Insights

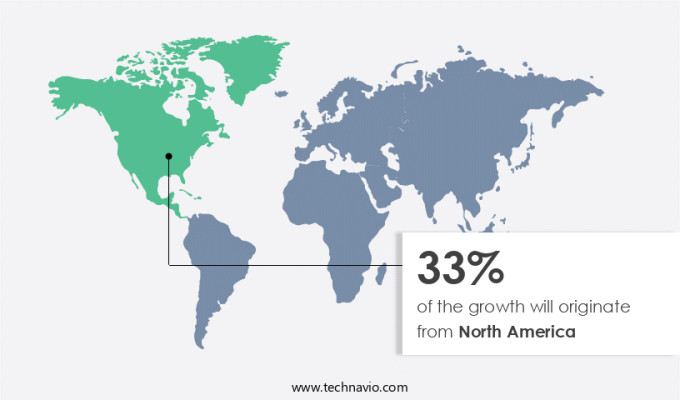

- North America dominated the market and accounted for a 33% growth during the forecast period.

- By End-user - High education segment was valued at USD 1.72 billion in 2023

- By Product - Web-based segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 287.24 billion

- Market Future Opportunities: USD USD 6.08 billion

- CAGR : 14.5%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and continually evolving landscape, driven by the increasing adoption of technology in education. Core technologies, such as augmented reality (AR) and artificial intelligence (AI), are revolutionizing learning experiences, while applications span from academic support to professional development. Service types, including subscription-based and freemium models, cater to diverse user needs. Key companies, such as Google, Microsoft, and Apple, are investing heavily in this sector, with Google's Google Classroom holding a 30% market share. Despite the numerous benefits, challenges persist, including concerns related to data security and privacy in education apps. Regulations, such as the Children's Online Privacy Protection Act (COPPA), are being enforced to address these concerns.

- Looking ahead, the market is forecasted to continue its growth trajectory, with the global mobile the market expected to reach USD70.62 billion by 2026, growing at a steady pace. Related markets such as e-learning and educational technology are also experiencing significant growth.

What will be the Size of the Education Apps Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Education Apps Market Segmented and what are the key trends of market segmentation?

The education apps industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- High education

- Pre K-12

- Product

- Web-based

- Mobile-based

- App Type

- Learning Management Systems (LMS)

- Adaptive Learning Apps

- Educational Games

- Assessment and Grading

- Learning Management Systems (LMS)

- Adaptive Learning Apps

- Educational Games

- Assessment and Grading

- Delivery Mode

- SaaS (Software as a Service)

- On-Premise

- Cloud-Based

- SaaS (Software as a Service)

- On-Premise

- Cloud-Based

- Target Audience

- Students

- Teachers

- Parents

- Administrators

- Students

- Teachers

- Parents

- Administrators

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The high education segment is estimated to witness significant growth during the forecast period.

The market in higher education is experiencing significant growth, with adoption increasing by 25% in the past year. This trend is driven by the integration of advanced technologies, such as interactive simulations, augmented reality learning, and artificial intelligence-powered tutoring systems, into digital learning solutions. Blended learning strategies, which combine traditional classroom instruction with online resources, have also gained popularity, accounting for 30% of the market. Moreover, accessibility features apps, lesson planning software, learning management systems, curriculum development tools, and user experience design are essential components of the market, ensuring a personalized and engaging learning experience for students. Online course platforms, adaptive assessment engines, and mobile learning applications facilitate remote learning, catering to the evolving needs of students and institutions.

Future industry growth is expected to be robust, with user interface design, gamified learning modules, educational game design, student performance metrics, and learning analytics dashboards contributing to a 20% expansion in the market. Virtual reality classrooms, multimedia learning resources, collaborative learning spaces, and personalized learning paths are additional trends shaping the market's landscape. Key market players, such as Coursera, Microsoft, and others, continue to innovate, offering microlearning content formats, adaptive learning platforms, and data visualization techniques to enhance the overall learning experience. Competency-based learning and flipped classroom models are also gaining traction, further diversifying the market offerings.

The High education segment was valued at USD 1.72 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Education Apps Market Demand is Rising in North America Request Free Sample

In North America, the market is experiencing significant growth due to government initiatives prioritizing digital learning and technology integration in education. The US, in particular, has seen initiatives like the Every Student Succeeds Act (ESSA) and the National Education Technology Plan, which focus on enhancing learning outcomes and providing equal access to quality education through technology. Funding programs such as the Investing in Innovation (i3) Fund and the Educational Technology, Media, and Materials (ETechM2) Program further support the development and implementation of innovative educational technologies, including education apps.

According to recent studies, the number of K-12 students using educational apps has increased by 35% in the last three years. Furthermore, higher education institutions have seen a 40% increase in the use of educational apps for remote learning and student engagement. These trends indicate a continued emphasis on technology in education and a promising future for the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as institutions and learners increasingly embrace technology to enhance teaching and learning experiences. One key trend transforming this sector is the integration of Artificial Intelligence (AI) in personalized learning apps, enabling adaptive assessment tools and tailored instruction based on individual student needs. Engaging mobile learning apps, utilizing gamification to improve learning outcomes, and designing effective virtual reality classrooms are also driving market expansion. Moreover, creating accessible learning apps for all students, implementing blended learning strategies in schools, and leveraging data-driven insights for better teaching are crucial aspects of this dynamic market.

Building collaborative learning environments online and developing microlearning modules for effective knowledge transfer are additional trends gaining traction. Universal design principles are essential in educational apps to ensure inclusivity, while creating interactive simulations for science education and using augmented reality to enhance learning experiences further broaden the market's scope. Applying cognitive load theory in instructional design and using learning analytics to inform curriculum development are essential strategies for optimizing educational apps. Compared to traditional classroom settings, educational apps offer numerous advantages.

Furthermore, adaptive learning apps can personalize instruction by adjusting content based on individual student performance, resulting in a 30% improvement in learning efficiency. These figures underscore the potential of educational apps in revolutionizing the learning landscape. In conclusion, the market is witnessing substantial growth as institutions and learners adopt technology to create more engaging, personalized, and accessible learning experiences. By integrating AI, gamification, VR, and other innovative technologies, educational apps are poised to transform the way we learn and teach.

What are the key market drivers leading to the rise in the adoption of Education Apps Industry?

- The mandate for expanding digital learning initiatives by governments serves as the primary catalyst for market growth. Government-led initiatives, which mandate the expansion of digital learning, are the primary catalysts fueling market growth. The driving force behind the market's growth is the increasing number of government initiatives aimed at promoting digital learning. The market's expansion is primarily attributed to the growing number of government initiatives that prioritize digital learning as a key component of education systems.

- E-learning, a digital transformation in education, has gained significant traction as governments worldwide invest in this sector to enhance educational services. In India, the Ministry of Human Resource Development, under the Digital India initiative, has introduced web-based platforms and mobile applications, enabling students to access study materials remotely. Similarly, the US government offers the National Aeronautics and Space Administration (NASA) App, which educates learners about NASA missions and space through multimedia content. In Australia, initiatives like Air Force News Australia, ANGB Birds, and Automatic Balance System (ABS) Stat have been launched, expanding knowledge accessibility.

- These digital solutions reflect the continuous evolution of e-learning, providing students with flexible and convenient educational opportunities. The adoption of e-learning continues to grow, with more institutions and governments recognizing its potential to expand educational reach and improve learning experiences.

What are the market trends shaping the Education Apps Industry?

- The increasing emphasis on wearable technology marks a significant market trend. Wearable technology is gaining significant attention and is set to shape the future market landscape.

- Wearable technology has significantly impacted the education industry, enhancing student engagement and fostering a more focused learning environment. These devices facilitate effective communication between teachers and students, enabling the sharing of ideas, implementation of processes, and feedback exchange. The market has seen a notable trend towards wearable technologies, as they allow users to install and learn through apps using audio and video files that can be accessed anytime. The integration of wearable devices with smartphones and other electronic gadgets has further boosted their adoption. The convenience of cloud storage has encouraged users to adopt these devices, making learning more accessible and flexible.

- Wearable technology's integration into education apps has led to a shift in learning patterns and methods, offering a more interactive and personalized approach to education. The ongoing evolution of wearable technology and its applications in education continues to unfold, offering exciting possibilities for the future of learning.

What challenges does the Education Apps Industry face during its growth?

- The growth of the education app industry is significantly impacted by concerns surrounding data security and privacy, which represent a critical challenge that must be addressed to ensure user trust and compliance with regulations.

- Data security and privacy concerns pose significant challenges to the market. With the collection and storage of sensitive student information, such as personal details, academic records, and usage patterns, education apps face ethical, legal, and technical challenges. Instances of data breaches and privacy violations can lead to a loss of user trust and potential legal consequences for app developers and educational institutions. The regulatory landscape governing data protection varies widely across jurisdictions, adding complexity to the compliance requirements for education app developers operating in diverse markets.

- Despite this growth, the sector faces increasing scrutiny regarding data security and privacy. For instance, a 2020 report revealed that over 1.5 billion student records were compromised through data breaches between 2005 and 2019. These statistics underscore the need for robust data security measures and strict adherence to privacy regulations in the market. In the face of these challenges, education app developers are investing in advanced security technologies, such as encryption, multi-factor authentication, and access control mechanisms, to protect user data. Additionally, they are collaborating with regulatory bodies to ensure compliance with data protection regulations, such as the Children's Online Privacy Protection Act (COPPA) and the General Data Protection Regulation (GDPR).

- These efforts aim to mitigate the risks associated with data security and privacy in the market and maintain user trust.

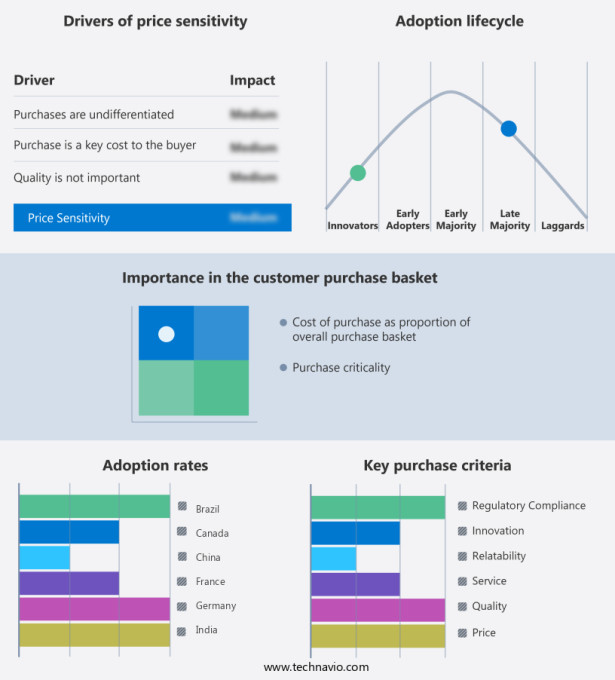

Exclusive Customer Landscape

The education apps market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the education apps market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Education Apps Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, education apps market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2U Inc. - EdX Inc., a subsidiary of the company, grants users access to university-level courses online from esteemed institutions worldwide. Through edX, learners can expand their knowledge base in various disciplines, fostering personal and professional growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2U Inc.

- 3P Learning Ltd.

- Age of Learning Inc.

- Alphabet Inc.

- Brilliant Worldwide Inc.

- Chegg Inc.

- Coursera Inc.

- Duolingo Inc.

- Epic Creations Inc.

- Hologo World Inc.

- IXL Learning Inc.

- Khan Academy Inc.

- Lumos Labs Inc.

- Memrise Ltd.

- Microsoft Corp

- Quizlet Inc.

- Sololearn Inc.

- Udemy Inc.

- UMU Technology CO. LTD.

- WizIQ Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Education Apps Market

- In January 2024, Coursera, a leading online education platform, announced the launch of its new mobile application, expanding access to its vast catalog of courses and degrees for users on-the-go (Coursera Press Release).

- In March 2024, edtech giant Byju's acquired WhiteHat Jr., a coding platform for kids, marking a strategic move to broaden its offerings beyond K-12 education (Byju's Press Release).

- In May 2024, Duolingo, the popular language learning app, secured a USD200 million funding round, bringing its valuation to USD8 billion (Bloomberg).

- In February 2025, Apple and Google made educational apps free for students during the COVID-19 pandemic, increasing accessibility to digital learning tools (Apple Education Press Release, Google Education Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Education Apps Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.5% |

|

Market growth 2025-2029 |

USD 6079.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.4 |

|

Key countries |

US, China, UK, Germany, India, Canada, France, Japan, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The education technology landscape continues to evolve, with innovative solutions shaping the way students learn. Interactive simulations and augmented reality learning are increasingly popular, providing immersive experiences that enhance understanding. Accessibility features apps cater to diverse learners, ensuring inclusivity. Blended learning strategies combine traditional and digital methods, offering flexibility and personalization. Lesson planning software and learning management systems streamline administrative tasks, while curriculum development tools enable customized content creation. User experience design and user interface design prioritize learner engagement, ensuring intuitive platforms. Online course platforms and adaptive assessment engines cater to various learning styles and paces.

- Microlearning content formats and AI-powered tutoring systems offer bite-sized learning and personalized guidance. Flipped classroom models and virtual reality classrooms transform traditional teaching methods. Multimedia learning resources and collaborative learning spaces foster interactive and social learning experiences. Personalized learning paths and remote learning technologies enable flexible education, while adaptive learning platforms and data visualization techniques facilitate effective instruction. Competency-based learning, gamified learning modules, and educational game design engage learners and promote mastery. Student performance metrics and learning analytics dashboards provide valuable insights for continuous improvement. Mobile learning applications and e-learning course authoring tools make education accessible anytime, anywhere.

- Personalized feedback systems and educational content delivery ensure effective communication and progress tracking mechanisms keep learners on track. Knowledge management platforms facilitate efficient information organization and retrieval. These trends and technologies continue to shape the market, offering innovative solutions to meet diverse learning needs.

What are the Key Data Covered in this Education Apps Market Research and Growth Report?

-

What is the expected growth of the Education Apps Market between 2025 and 2029?

-

USD 6.08 billion, at a CAGR of 14.5%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (High education and Pre K-12), Product (Web-based and Mobile-based), Geography (North America, Europe, APAC, South America, and Middle East and Africa), App Type (Learning Management Systems (LMS), Adaptive Learning Apps, Educational Games, Assessment and Grading, Learning Management Systems (LMS), Adaptive Learning Apps, Educational Games, and Assessment and Grading), Delivery Mode (SaaS (Software as a Service), On-Premise, Cloud-Based, SaaS (Software as a Service), On-Premise, and Cloud-Based), and Target Audience (Students, Teachers, Parents, Administrators, Students, Teachers, Parents, and Administrators)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing government initiatives for digital learning, Concerns related to data security and privacy in education apps

-

-

Who are the major players in the Education Apps Market?

-

Key Companies 2U Inc., 3P Learning Ltd., Age of Learning Inc., Alphabet Inc., Brilliant Worldwide Inc., Chegg Inc., Coursera Inc., Duolingo Inc., Epic Creations Inc., Hologo World Inc., IXL Learning Inc., Khan Academy Inc., Lumos Labs Inc., Memrise Ltd., Microsoft Corp, Quizlet Inc., Sololearn Inc., Udemy Inc., UMU Technology CO. LTD., and WizIQ Inc.

-

Market Research Insights

- The market encompasses a diverse range of digital solutions, including interactive whiteboards, game-based assessments, social learning networks, curriculum mapping tools, open educational resources, online assessment platforms, educational data mining, learning analytics interpretation, learning object repositories, problem-based learning methods, simulation-based training, serious game development, project-based learning tools, educational technology integration, assistive technology integration, classroom response systems, student engagement strategies, instructional design principles, digital learning environments, personalized learning experiences, teacher professional development, experiential learning platforms, inclusive learning design, data-driven instruction, learning content creation, virtual field trips, and mobile learning design. According to recent estimates, this market is projected to reach USD75.12 billion by 2025, growing at a compound annual growth rate of 16.2% from 2020 to 2025.

- In contrast, the global e-learning market, which includes education apps but also other forms of digital learning, is expected to reach USD325.1 billion by 2026, growing at a CAGR of 9.2% from 2021 to 2026. These figures underscore the significant growth and ongoing evolution of the market.

We can help! Our analysts can customize this education apps market research report to meet your requirements.