Electric Aircraft Market Size 2024-2028

The electric aircraft market size is forecast to increase by USD 7.2 billion at a CAGR of 14.76% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for eco-friendly and quiet aircraft is driving market growth. Advanced techniques in aircraft construction, such as lightweight materials and aerodynamic designs, are also contributing to market expansion.

- However, the limitations of existing battery technology pose a significant challenge to the market. Despite these hurdles, the market is expected to continue growing as advancements in technology address these challenges. The adoption of electric aircraft is expected to increase as governments and airlines prioritize reducing carbon emissions and improving air quality. Additionally, the development of more efficient batteries and the integration of renewable energy sources into aviation are expected to further boost market growth.

What will be the Size of the Electric Aircraft Market During the Forecast Period?

- The market is experiencing significant growth, driven by advancements in electric motor and battery technologies. Electric motors offer improved efficiency and reduced emissions compared to traditional jet fuel engines, making them an attractive alternative for both UAVs and drones, as well as larger aircraft. Major aircraft manufacturers are investing in electric propulsion systems for regional jets and single-aisles. Companies are developing electric and hybrid-electric aircraft platforms. Energy density and cycle lifetimes of batteries are critical factors In the success of electric aircraft, with ongoing research focusing on improving these metrics.

- Additionally, the market is witnessing the emergence of electric VTOLs, which offer the potential for increased efficiency and reduced noise pollution in urban environments. According to the International Energy Agency, the aviation sector is responsible for around 2% of global CO2 emissions, making the shift towards electric aircraft a crucial step in reducing the industry's carbon footprint.

How is this Electric Aircraft Industry segmented and which is the largest segment?

The electric aircraft industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Hybrid

- All electric

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Technology Insights

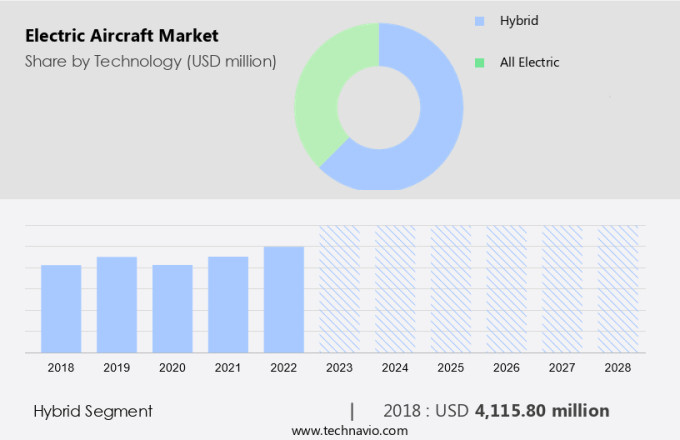

- The hybrid segment is estimated to witness significant growth during the forecast period.

Electric aircraft represent the future of aviation, integrating electric motors and batteries to enhance performance and reduce carbon emissions. While lithium-ion batteries currently power electric aircraft for limited flight times, they can be effectively utilized during specific phases, such as taxiing and takeoff. Hybrid-electric aircraft, which combine conventional and electric power systems, optimize energy usage. During takeoff, electric motors can supplement jet fuel, reducing noise and emissions. Once cruising altitude is reached, the aircraft can operate as an electric aircraft, using the generator to power electric fans and recharge batteries for descent and landing.

The Federal government supports the development of electric aircraft through initiatives promoting sustainable aviation fuel (SAF) and regional aviation. Electric motors and battery technologies, including lithium-ion and lithium-sulfur, are advancing, increasing energy density and cycle lifetimes. Electric aircraft manufacturers are innovating in regional jets, single-aisles, and electric VTOLs.

Get a glance at the Electric Aircraft Industry report of share of various segments Request Free Sample

The Hybrid segment was valued at USD 4.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The United States, specifically North America, is at the forefront of the market due to increasing environmental regulations. In 2023, the Environmental Protection Agency (EPA) reported that the US air transportation sector accounted for a significant portion of global greenhouse gas emissions and aircraft emissions. This has led to growing pressure from environmental groups for stricter regulations under the Clean Air Act. To mitigate these regulations, the adoption of electric aircraft is anticipated, as they are projected to consume approximately 25% less fuel than traditional aircraft. This shift towards electric aircraft will not only decrease carbon dioxide (CO?) emissions but also save the ozone layer and reduce noise pollution during takeoff and landing.

The implementation of such regulations is expected to encourage major aircraft manufacturers to invest in advanced battery technologies such as lithium-ion and lithium-sulfur batteries. These advancements will contribute to the growth of the market, particularly in regional aviation and commercial aviation sectors, including regional jets, single-aisles, and electric vertical takeoff and landing (eVTOL) aircraft.

Market Dynamics

Our electric aircraft market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Electric Aircraft Industry?

Increasing requirement for clean and quiet aircraft is the key driver of the market.

- The aviation industry's carbon footprint is a significant concern, with global flights producing approximately 915 million tons of CO2 in 2020, accounting for around 2% of human-induced emissions. With the expansion of the aircraft fleet and increasing air travel, these figures are expected to escalate. In response, there is a growing demand for electric aircraft as a sustainable alternative. Authorities such as the International Civil Aviation Organization, Federal Aviation Administration, and European Union Aviation Safety Agency advocate for sustainable fuel alternatives, predicting that aircraft emissions will triple by 2050. Electric motors and batteries are at the heart of this shift.

- Other organizations are also investing in electric and hybrid-electric aircraft. Battery technologies, such as lithium-ion and lithium-sulfur, are crucial components In the development of electric UAVs, drones, and even commercial aircraft, including regional jets and single-aisles. The energy density and cycle lifetimes of these batteries are essential factors In the success of electric aviation. Companies are working on electric vertical takeoff and landing (eVTOL) aircraft, which could revolutionize regional aviation by reducing CO2 emissions at aviation airports. The Federal government is also investing in electric aviation, recognizing its potential to minimize the environmental impact of the aviation sector.

What are the market trends shaping the Electric Aircraft Industry?

Use of advanced techniques for aircraft construction is the upcoming market trend.

- The market is experiencing significant growth as aircraft manufacturers explore the use of electric motors and batteries to power their aircraft. Electric motors offer numerous advantages, including higher energy efficiency and lower CO2 emissions compared to jet fuel. However, the weight of batteries remains a challenge, accounting for approximately two-thirds of the total weight of the aircraft. To address this issue, manufacturers are turning to lightweight materials like carbon fiber reinforced polymer for the production of aircraft components. This material offers the mechanical strength of metal while being extremely lightweight and malleable.

- By reducing the overall weight of the aircraft, designers can make electric aircraft commercially viable in various platforms, including UAVs, drones, regional jets, and even commercial aviation. The use of advanced battery technologies, such as lithium-ion and lithium-sulfur, is also essential to increasing energy density and cycle lifetimes. The Federal government's support for Sustainable Aviation Fuel (SAF) initiatives further emphasizes the importance of reducing CO2 emissions In the aviation industry. Companies are leading the way In the development of electric aircraft, including hybrid-electric regional jets, single-aisles, and electric VTOLs. The future of aviation is electric, and these advancements are paving the way for a more sustainable and efficient industry.

What challenges does the Electric Aircraft Industry face during its growth?

Limitations of existing battery technology is a key challenge affecting the industry growth.

- The market is experiencing significant buzz due to the potential of electric motors and batteries to revolutionize aviation. However, the conversion of electric aircraft designs into commercial models faces challenges, primarily due to the energy requirements for flight. While the automotive industry successfully electrified vehicles by focusing on affordability and compactness, the aviation industry prioritizes weight over cost and volume. To design an electric aircraft with commercial payload-range capabilities, batteries must have a minimum energy density of 500Wh/kg. Currently, most commercial batteries can only deliver 30%-50% of this requirement. Companies are investing in advanced battery technologies, such as lithium-ion and lithium-sulfur batteries, to address this challenge.

- The Federal government is also supporting research and development in sustainable aviation fuel (SAF) and electric aircraft through grants and initiatives. The market encompasses various platforms, including UAVs, drones, hybrid-electric aircraft, and electric vertical takeoff and landing (eVTOL) aircraft. Companies are also exploring electric propulsion systems for regional jets, single-aisles, and commercial aviation. The market dynamics are influenced by factors such as CO2 emissions, battery technologies, and the need for longer cycle lifetimes. The market is poised for growth as advancements in battery technology and government support continue to drive innovation.

Exclusive Customer Landscape

The electric aircraft market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric aircraft market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric aircraft market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Airbus SE - The Airbus portfolio includes the E-Fan 1.0, a two-seat electric aircraft with twin-propeller configuration. This innovative monoplane represents Airbus' commitment to advancing sustainable aviation technology. The E-Fan 1.0 is a significant step towards reducing carbon emissions In the aviation industry, showcasing Airbus' expertise in electric aircraft development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Bye Aerospace

- DBT Aero Inc.

- Delorean Aerospace LLC

- DIGISKY srl

- E-PROPS

- Equator Aircraft AS

- Evektor spol sro

- Eviation Aircraft

- Gust Inc.

- Joby Aviation Inc.

- Lilium GmbH

- PIPISTREL doo

- Schempp-Hirth Flugzeug-Vertriebs GmbH

- Siemens AG

- The Boeing Co.

- Volta Volare

- Watt Flight

- Wright Electric

- Zunum Aero

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Joby Aviation received FAA certification for its electric vertical take-off and landing (eVTOL) aircraft, marking a significant milestone in the development of electric aircraft for urban air mobility. This certification allows Joby to begin commercial operations, catering to the rising demand for environmentally friendly and efficient air travel solutions in urban environments.

-

In November 2024, a strategic partnership was formed between a major aerospace manufacturer and a renewable energy company to develop electric aircraft powered by sustainable energy sources. The collaboration focuses on reducing carbon emissions in the aviation sector, responding to the increasing pressure on the industry to adopt greener technologies.

-

In October 2024, Vertical Aerospace secured a major order from a leading airline for its electric aircraft, designed for regional air travel. The aircraft aims to reduce operating costs and carbon footprints compared to traditional jet aircraft, responding to the growing demand for sustainable and cost-efficient air travel options.

-

In September 2024, a significant acquisition took place when a major aviation company acquired a startup specializing in battery technology for electric aircraft. This acquisition strengthens the company's position in the electric aviation space, enabling it to enhance the performance and range of its electric aircraft, catering to the increasing demand for longer-range, eco-friendly flight options.

Research Analyst Overview

The market is experiencing significant growth as advancements in electric motor technology and battery development continue to make strides. Electric motors, a key component of electric aircraft, have seen improvements in power density and efficiency, making them increasingly viable for use in aviation. These motors are designed to provide high power output while maintaining a compact size and low weight, which is essential for aircraft applications. Batteries, another crucial element of electric aircraft, have also undergone significant advancements. Lithium-ion batteries, in particular, have gained popularity due to their high energy density and long cycle lifetimes. These batteries offer a significant improvement in energy storage capacity compared to traditional lead-acid batteries, making them an attractive option for electric aircraft.

The use of electric propulsion systems is not limited to traditional fixed-wing aircraft. Unmanned aerial vehicles (UAVs) and drones have already adopted electric motors for their power needs. These applications have paved the way for the development of electric propulsion systems for larger aircraft, including those used in regional and commercial aviation. The market encompasses various platforms, from small UAVs to larger hybrid-electric regional jets and single-aisles. Duxion, Evasion, Lilium, Pipistrel, and SAF are among the companies working on electric aircraft projects. These companies are developing electric vertical takeoff and landing (eVTOL) aircraft, which offer the potential for reduced CO2 emissions and increased efficiency compared to traditional jet fuel-powered aircraft.

The Federal Government's interest in reducing carbon emissions and promoting sustainable aviation has provided a significant boost to the market. Companies are working on developing electric propulsion systems for regional jets and single-aisles. These developments could lead to a significant shift In the aviation industry, with electric aircraft becoming a more common sight at regional aviation airports and commercial aviation terminals. Battery technologies continue to evolve, with companies such as LithiumSulfur batteries offering the potential for even higher energy density and longer cycle lifetimes. These advancements could further increase the viability of electric aircraft and make them a more practical alternative to traditional jet fuel-powered aircraft.

In conclusion, the market is experiencing significant growth as advancements in electric motor technology and battery development continue to make strides. The use of electric propulsion systems is not limited to small UAVs and drones but is also being explored for larger aircraft, including regional jets and single-aisles. The potential for reduced CO2 emissions and increased efficiency has attracted the interest of both private companies and the Federal Government, leading to significant investments in electric aircraft research and development.

|

Electric Aircraft Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.76% |

|

Market growth 2024-2028 |

USD 7199.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.55 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Aircraft Market Research and Growth Report?

- CAGR of the Electric Aircraft industry during the forecast period

- Detailed information on factors that will drive the Electric Aircraft growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric aircraft market growth of industry companies

We can help! Our analysts can customize this electric aircraft market research report to meet your requirements.