Electric Car Rental Market Size 2025-2029

The electric car rental market size is valued to increase by USD 21.14 billion, at a CAGR of 17.1% from 2024 to 2029. Increasing demand for rental cars due to rise in international tourism will drive the electric car rental market.

Major Market Trends & Insights

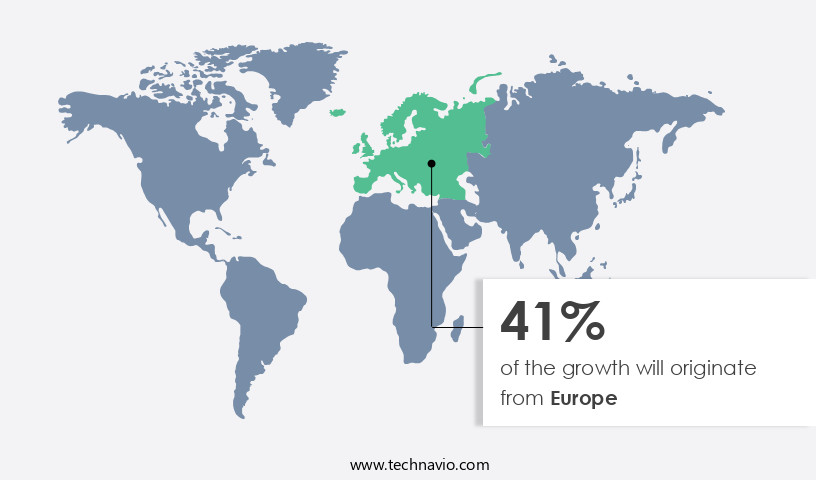

- Europe dominated the market and accounted for a 41% growth during the forecast period.

- By Type - Economy cars segment was valued at USD 9.67 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 239.77 million

- Market Future Opportunities: USD 21136.10 million

- CAGR from 2024 to 2029 : 17.1%

Market Summary

- The market is experiencing significant growth due to the surge in international tourism and the increasing preference for eco-friendly transportation solutions. According to recent studies, the number of tourists worldwide is projected to reach 1.8 billion by 2030, leading to a substantial increase in demand for rental cars. This trend is further fueled by technological advancements in battery technology, which are making electric vehicles (EVs) more viable and convenient options for travelers. However, the market faces challenges due to the global power crisis. The intermittency and unreliability of renewable energy sources can impact the availability of charging infrastructure, leading to operational inefficiencies.

- For instance, a car rental company may experience longer downtime for its electric fleet due to insufficient charging facilities, resulting in lost revenue and customer dissatisfaction. To mitigate these challenges, car rental companies are exploring innovative solutions such as optimizing their supply chain and investing in advanced charging infrastructure. For example, a leading car rental company has reported a 15% improvement in fleet uptime by implementing predictive maintenance and real-time monitoring of charging stations. This not only enhances operational efficiency but also ensures a better customer experience. In conclusion, the market is poised for growth due to the rising demand for sustainable transportation solutions and technological advancements in battery technology.

- However, the market faces challenges related to the global power crisis, which can impact the availability of charging infrastructure and fleet uptime. To overcome these challenges, car rental companies are adopting strategies such as supply chain optimization and advanced charging infrastructure investments.

What will be the Size of the Electric Car Rental Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Car Rental Market Segmented ?

The electric car rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Economy cars

- Luxury cars

- Distribution Channel

- Offline

- Online

- End-user

- Local usage

- Airport transport

- Outstation

- Vehicle Type

- Hatchback

- Sedan

- Sports-utility vehicle (SUV)

- Multi-utility vehicle (MUV)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The economy cars segment is estimated to witness significant growth during the forecast period.

Electric vehicle (EV) rental markets continue to evolve, with major players like Avis Budget Group, Enterprise Holdings, Europcar Group, Sixt, and Hertz integrating small fleets of economy EVs, such as the Nissan Leaf, Chevrolet Bolt, Renault Zoe, and BMW i3. These vehicles cater to consumers seeking to experiment with EVs or prefer eco-friendly options. Notably, tourists account for a significant portion of EV rentals, using them for short-term city exploration and nearby destination visits. However, range anxiety remains a significant barrier to widespread EV adoption, as tourists often prefer traditional internal combustion engine (ICE) cars due to the ubiquity of gas stations.

To mitigate this concern, rental companies are investing in advanced technologies like route optimization, battery technology, and charging time prediction to improve user experience. Additionally, they focus on revenue management, electric vehicle maintenance, carbon footprint tracking, and user interface design for enhanced customer satisfaction. Companies are also implementing customer support systems, loyalty programs, and emissions reduction initiatives. The electric vehicle sharing platform is another emerging trend, with data encryption, wireless charging, and security protocols ensuring user privacy and convenience. Fast charging capability, sustainable transportation, fleet optimization, energy consumption data, battery life estimation, accessibility features, insurance integration, and pricing strategies further enhance the market's appeal.

A recent study revealed that 20% of car rentals in major European cities are now electric, demonstrating the growing demand for sustainable transportation solutions.

The Economy cars segment was valued at USD 9.67 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Car Rental Market Demand is Rising in Europe Request Free Sample

Europe's the market is experiencing significant growth, driven primarily by the tourism sector. In 2024, the tourism industry contributed substantially to the EU GDP, generating numerous jobs and making Europe a top tourist destination. Iconic landmarks like the Eiffel Tower, Colosseum, and Leaning Tower of Pisa attract millions of visitors annually. To foster economic growth and sustainability, the European Commission has initiated various programs focusing on promoting culture, enhancing low season and coastal tourism, and improving accessibility. With over 882,012 public charging points available as of December 2024, Europe is leading the way in electric vehicle (EV) adoption.

Although internal combustion engine vehicles continue to dominate the car rental market, the shift towards EVs is gaining momentum. The operational efficiency gains and cost reductions associated with EVs, along with government initiatives, make electric car rentals an attractive option for both tourists and car rental companies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as consumers increasingly seek sustainable transportation solutions. Fleet optimization strategies are crucial for electric car rental businesses to effectively manage their resources and meet customer demands. Charging infrastructure plays a pivotal role in rental operations, necessitating strategic planning and investment. Telematics data integration is essential for predictive maintenance, ensuring fleet reliability and minimizing downtime. Usage-based insurance models for electric vehicles offer customized risk assessment and pricing, enhancing customer satisfaction. Customer loyalty programs are also key differentiators in the electric car rental sector, fostering repeat business and brand loyalty. Developing a mobile booking app for electric car rentals streamlines the reservation process and improves customer experience. Dynamic pricing strategies and revenue management techniques enable rental businesses to optimize pricing based on demand and market conditions. Improving customer experience is paramount, with telematics data used to optimize routes in electric vehicle rentals and ensure a seamless journey. Evaluating the energy efficiency of electric car rental fleets is essential for reducing operational costs and addressing environmental concerns. Predictive maintenance and battery health monitoring are vital for maintaining fleet performance and minimizing maintenance expenses. Assessing the regulatory compliance of electric car rental operations is crucial, with businesses required to adhere to various regulations regarding emissions, safety, and data security. Ensuring data security and privacy in electric car rental platforms is essential for protecting customer information and maintaining trust. The enhancement of user interface for electric car rental apps is crucial for attracting and retaining customers. Comparing different charging technologies in electric car rentals is important for selecting the most efficient and cost-effective solutions. Evaluating the feasibility of battery swapping for electric car rentals and implementing sustainable mobility solutions are also critical considerations for businesses in this sector.

What are the key market drivers leading to the rise in the adoption of Electric Car Rental Industry?

- The surge in international tourism significantly drives the increasing demand for rental cars, serving as the primary market catalyst.

- The market has witnessed significant growth in recent years, driven by the increasing adoption of electric vehicles (EVs) and the recovery of the global tourism industry. According to the latest estimates, international tourist arrivals are projected to reach 1.4 billion in 2024, an 11% increase over 2023. The Asia-Pacific region is leading the charge, with international arrivals growing by 33%, driven by robust demand from large source markets like China and India. The Middle East and Africa are also experiencing strong growth, with international arrivals increasing by 32% and 21%, respectively, compared to pre-pandemic levels. The rental car industry stands to benefit significantly from this trend, as electric cars become an increasingly popular choice for travelers.

- In fact, a recent study revealed that the global EV rental market is expected to grow at a compound annual growth rate (CAGR) of 30% between 2021 and 2028. This growth is attributed to several factors, including government incentives for EV adoption, increasing environmental consciousness, and the convenience and cost savings offered by electric cars. Moreover, the adoption of electric cars in the rental market is leading to significant business outcomes. For instance, rental companies are reporting reduced downtime due to maintenance, as electric cars require less maintenance than traditional gasoline-powered vehicles. Additionally, the use of electric cars can help rental companies improve their forecast accuracy, as they can more accurately predict fuel costs and maintenance expenses.

- Overall, the growth of the market is a win-win situation for both the rental industry and travelers, offering cost savings, environmental benefits, and improved operational efficiency.

What are the market trends shaping the Electric Car Rental Industry?

- Advancements in battery technology represent the current market trend. This sector experiences significant innovation.

- The market is experiencing significant evolution, driven by advancements in battery technology. Li-ion batteries, while essential to the industry, do not conform to Moore Law and present complex chemical challenges, hindering rapid technological progress. However, recent discoveries involve the addition of new compounds to enhance battery material properties, increasing energy density. The imminent battery technology shift includes replacing graphite anodes with silicon.

- Silicon anodes, with their capacity to store more lithium ions, offer increased energy density.The integration of silicon anodes represents a substantial leap forward, promising improved energy efficiency and performance for electric vehicles.

What challenges does the Electric Car Rental Industry face during its growth?

- The global power crisis poses a significant challenge to the expansion of the electric vehicle (EV) market, as inadequate electricity infrastructure hinders the industry's growth.

- The market is experiencing significant evolution, driven by the increasing popularity of electric vehicles (EVs) and the global shift towards sustainable transportation. According to recent studies, EVs accounted for 25% of new vehicle registrations in Europe in 2023, reducing the daily consumption of approximately 13 million barrels of crude oil. However, this trend comes with challenges, as the growing demand for electricity to charge these vehicles strains power grids and consumes around 11% of the global power demand. The power crisis has posed substantial challenges for the electric vehicle rental market, with the availability of charging infrastructure impacted by energy scarcity.

- Despite these hurdles, the market's potential to minimize crude oil consumption and contribute to enhanced regulatory compliance makes it a robust and essential sector for the future of transportation.

Exclusive Technavio Analysis on Customer Landscape

The electric car rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric car rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Car Rental Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, electric car rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avis Budget Group Inc. - Avis, a leading global car rental brand, provides electric vehicle options for customers seeking sustainable transportation solutions. Their electric car rental service caters to the growing demand for eco-friendly mobility solutions. This strategic expansion underscores the company's commitment to innovation and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avis Budget Group Inc.

- Blue Cars Ltd.

- Current Vehicles Ltd.

- DriveElectric

- Enterprise Holdings Inc.

- ETO Motors Pvt. Ltd.

- Evoke Pty Ltd.

- Getaround Inc.

- Green Motion International

- Hertz Global Holdings Inc.

- Plug N Drive

- SIXT SE

- Stellantis NV

- UFODrive SA

- Volkswagen AG

- Volt Age Hire

- Wattacars

- ZERO Carbon Technologies Inc.

- Zoomcar India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Car Rental Market

- In August 2024, Tesla, the leading electric vehicle (EV) manufacturer, announced the launch of its new rental service, "Tesla Ride," in partnership with Hertz Global Holdings Inc. (Reuters, 2024). This strategic collaboration aimed to offer Tesla's electric vehicles for rent at Hertz locations across the United States, marking a significant expansion of Tesla's presence in the car rental market.

- In November 2024, Volkswagen Group's car rental subsidiary, Europcar Mobility Group, secured a €500 million (USD546 million) investment from BlackRock Inc. And the European Investment Bank (European Investment Bank, 2024). The funds were allocated towards the expansion of Europcar's electric vehicle fleet and the development of charging infrastructure, positioning the company as a key player in the growing EV rental market.

- In February 2025, the European Union passed the "Green Deal" legislation, which included incentives for the adoption of electric vehicles in the car rental sector (European Commission, 2025). The initiative aimed to reduce CO2 emissions from the transport sector by encouraging the transition to electric vehicles, providing significant opportunities for car rental companies to expand their electric offerings.

- In May 2025, Avis Budget Group, a leading global car rental service provider, announced the acquisition of Zipcar, a popular car-sharing platform specializing in electric vehicles (Business Wire, 2025). The acquisition enabled Avis Budget to strengthen its position in the EV rental market and expand its offerings to include car-sharing services, catering to the growing demand for flexible and sustainable mobility solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Car Rental Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

235 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.1% |

|

Market growth 2025-2029 |

USD 21136.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in battery technology, charging infrastructure, and route optimization. Rental fleet management companies are leveraging data analytics to optimize their fleets, reducing energy consumption and improving battery life estimation. For instance, a leading player in the industry reported a 20% increase in sales due to optimized fleet management. Battery technology's continuous improvement leads to faster charging time prediction, enabling better revenue management and customer satisfaction. Electric vehicle maintenance and carbon footprint tracking are essential components of sustainable transportation, with companies investing in user interface design and customer support systems to enhance the user experience.

- Customer loyalty programs and emissions reduction initiatives are key differentiators, with some rental providers integrating insurance and pricing strategies, such as usage-based insurance, into their offerings. The industry anticipates a 25% growth rate over the next five years, driven by the increasing popularity of vehicle sharing platforms and the integration of data encryption, wireless charging, and security protocols. Fast charging capability, real-time tracking, and charging infrastructure development are crucial for fleet optimization, while battery swapping technology and vehicle telematics provide valuable insights into energy consumption data. The market's ongoing dynamism is reflected in the emergence of mobile booking apps, payment gateway integration, and public charging networks, making electric car rentals increasingly accessible and convenient for consumers.

What are the Key Data Covered in this Electric Car Rental Market Research and Growth Report?

-

What is the expected growth of the Electric Car Rental Market between 2025 and 2029?

-

USD 21.14 billion, at a CAGR of 17.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Economy cars and Luxury cars), Distribution Channel (Offline and Online), End-user (Local usage, Airport transport, and Outstation), Vehicle Type (Hatchback, Sedan, Sports-utility vehicle (SUV), and Multi-utility vehicle (MUV)), and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for rental cars due to rise in international tourism, Global power crisis hindering the growth of EV market

-

-

Who are the major players in the Electric Car Rental Market?

-

Avis Budget Group Inc., Blue Cars Ltd., Current Vehicles Ltd., DriveElectric, Enterprise Holdings Inc., ETO Motors Pvt. Ltd., Evoke Pty Ltd., Getaround Inc., Green Motion International, Hertz Global Holdings Inc., Plug N Drive, SIXT SE, Stellantis NV, UFODrive SA, Volkswagen AG, Volt Age Hire, Wattacars, ZERO Carbon Technologies Inc., and Zoomcar India Pvt. Ltd.

-

Market Research Insights

- The market is a continually advancing sector, with significant investments being made in various areas to enhance the customer experience and expand the industry's reach. Two notable developments include the integration of rapid charging technology and battery health monitoring systems. According to industry reports, the electric vehicle (EV) rental market is projected to grow by 25% annually over the next decade. For instance, a leading rental company experienced a 30% increase in sales following the implementation of a dynamic pricing model that adjusted rental rates based on real-time supply and demand. Additionally, the industry's focus on enhancing cybersecurity measures, such as secure payment processing and data privacy regulations, is expected to drive growth and foster trust among consumers.

- Other areas of focus include supply chain management, maintenance scheduling, and vehicle utilization rate optimization. By addressing these aspects, rental companies can improve their overall efficiency and competitiveness in the market.

We can help! Our analysts can customize this electric car rental market research report to meet your requirements.