E-Scooter Market Size 2023-2027

The e-scooter market size is forecast to increase by 4.26 th units at a CAGR of 9.38% between 2022 and 2027.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market growth is the declining prices of Li-ion batteries, making e-scooters more affordable for consumers. Another trend is the development of high-performance e-scooters, which offer longer battery life, faster charging times, and improved durability. However, the market also faces challenges such as the high costs and maintenance complexities associated with e-scooters. Despite these challenges, the market is expected to continue growing as e-scooters become increasingly popular as a convenient and eco-friendly transportation option. The market analysis report provides an in-depth examination of these trends and challenges, offering valuable insights for businesses looking to enter or expand in the market.

What will be the Size of the E-Scooter Market During the Forecast Period?

- The market is experiencing significant growth as demand for sustainable urban mobility solutions continues to rise. Motorized two-wheeler vehicles, including electric scooters and e-mopeds, offer zero-emissions transportation alternatives, bridging the carbon emission gap between conventional scooters and fossil fuel engines. The market is driven by tax rebates and incentives for e-vehicles, as well as the increasing importance of air quality and reducing greenhouse gas emissions. Smart transportation infrastructure, such as renewable energy stations and smart charging systems, enables e-scooters to be powered by solar or other renewable energy sources, further reducing their carbon footprint. Lithium-ion batteries and advanced electronic systems, including LED lights and electronic braking systems, enhance the functionality and user experience of these vehicles.

- Battery charging remains a critical component of the market, with innovations in smart charging and battery technology driving efficiency and sustainability. The market is expected to continue growing as the benefits of e-scooters as a cost-effective, eco-friendly, and convenient transportation option become increasingly apparent.

How is this E-Scooter Industry segmented and which is the largest segment?

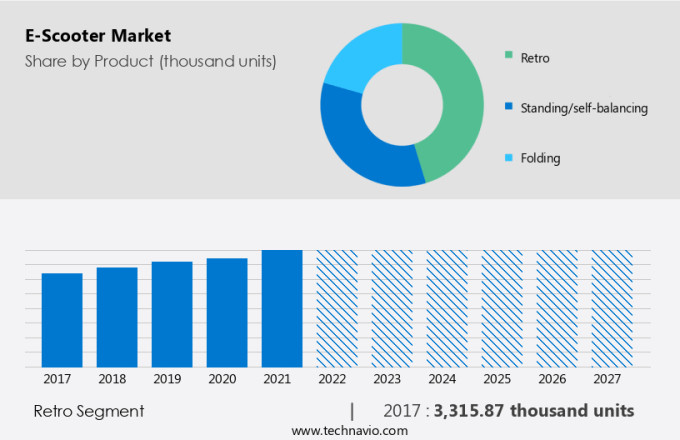

The e-scooter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in " th units" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Product

- Retro

- Standing/self-balancing

- Folding

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- France

- South America

- Middle East and Africa

- APAC

By Product Insights

- The Retro segment is estimated to witness significant growth during the forecast period.

The retro e-scooter segment of The market is experiencing steady growth, driven by its nostalgic appeal and affordability. Retro e-scooters, with their classic design, cater to consumers seeking a unique and enjoyable transportation experience. These e-scooters are popular among all age groups, particularly the elderly, due to their ease of use and maintenance. Government initiatives, such as subsidies for e-scooter purchases, further fuel the market's growth. Solar power and lithium-ion batteries are increasingly being integrated into retro e-scooters, making them eco-friendly and sustainable transport options. Electronic braking systems and LED lights enhance safety and functionality. The retro e-scooter segment continues to dominate the market, accounting for a significant market share, making it an attractive investment opportunity in the micro-mobility sector.

Get a glance at the e-scooter industry share of various segments Request Free Sample

The Retro segment accounted for 3315.87 th units in 2017 and showed a gradual increase during the forecast period.

Regional Insights

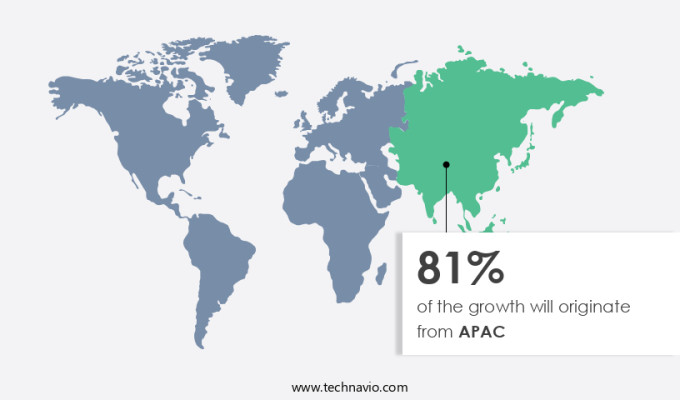

- APAC is estimated to contribute 81% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) has witnessed significant growth, with China being the dominant player due to increasing urbanization and environmental concerns. The Chinese government's focus on sustainable urban mobility and smart transportation infrastructure has led to the adoption of e-scooters as an alternative fuel vehicle. In April 2019, the government established a clear distinction between e-scooters and electric motorcycles, requiring e-scooters to have a pedaling function and a maximum speed limit of 15 mph. This distinction, along with subsidies and tax rebates, has encouraged the use of e-scooters as a zero-emissions transportation option. The growth of e-scooter adoption is also driven by the need to bridge the carbon emission gap and the availability of renewable energy charging stations with smart charging technology.

Market Dynamics

Our e-scooter market researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of E-Scooter Industry?

Declining prices of Li-ion batteries is the key driver of the market.

- The market is experiencing significant growth due to the increasing adoption of zero-emission vehicles for sustainable urban mobility. The use of electric scooters, including e-mopeds and electric motorcycles, as alternative fuel vehicles is reducing fossil fuel consumption and carbon emission gaps. The fleet of e-scooters is being supplemented by smart transportation infrastructure, such as renewable energy stations and smart charging systems, to ensure energy security and improve air quality. The battery segment, particularly Lithium-Ion batteries, is a key driver in the market. The cost of these batteries has declined rapidly, making them an affordable option for electric two-wheelers. By the end of the forecast period, the cost of Lithium-Ion batteries is expected to decline by about 35%.

- This cost reduction will drive the adoption of electric two-wheelers, even in cost-sensitive markets, as they offer easy-to-operate features and are lightweight commuters. Governments and organizations are offering incentives, such as tax rebates and subsidies, to promote the electrification of transportation. The adoption of e-scooters and other e-vehicles, including e-buses and e-three wheelers, is seen as a crucial step towards cleaner transportation and reducing greenhouse gas emissions. The integration of big data and the Internet of Things in e-scooters and other smart vehicles is further enhancing their appeal by providing real-time information and improving safety features. Battery-powered two-wheelers, including e-scooters, are becoming increasingly popular as individual transit options, especially in urban areas.

- The market for e-scooters is expected to grow further as more people look for fuel-efficient and environmentally friendly transportation options. The market dynamics are being influenced by various factors, including the availability of charging infrastructure, the development of new technologies, and the increasing focus on reducing carbon footprint. The market is also being driven by advancements in technology, such as LED lights, electronic braking systems, and belt or chain-driven hub motors. The market is expected to continue growing as more people turn to e-scooters and other e-vehicles as a viable alternative to gasoline-powered vehicles. The environmental impact of e-scooters is minimal, making them an attractive option for those looking to reduce their carbon emissions and contribute to a more sustainable future.

What are the market trends shaping the E-Scooter Industry?

Development of high-performance e-scooters is the upcoming trend in the market.

- The market in the US is experiencing significant growth due to the adoption of sustainable urban mobility solutions. Zero-emission vehicles, such as electric scooters, are becoming increasingly popular as an alternative to traditional fuel-efficient vehicles and gasoline-powered cars. High-performance electric two-wheelers, including e-scooters, e-mopeds, and electric motorcycles, are gaining traction due to their easy-to-operate features, lightweight design, and minimal carbon footprint. Key drivers for this market include declining battery prices, government subsidies and incentives, and the need to reduce greenhouse gas emissions. Motor manufacturers are investing in high-performance electric motorcycles and scooters, utilizing advanced technologies such as hub motors, lithium-ion batteries, and electronic braking systems.

- Smart transportation infrastructure, including renewable energy stations and smart charging, is also contributing to the growth of the market. These charging solutions offer energy security and improved air quality, making them an attractive option for individuals and public transport vehicles alike. The battery segment, which includes sealed lead-acid batteries, lithium-ion batteries, and nickel-metal hydride batteries, is a significant part of the market. Advancements in battery technology, such as solar power and rechargeable scooter sharing, are further fueling market growth. The shift towards electrification of transportation is reducing the carbon emission gap and promoting cleaner transportation options. As the demand for high-performance, zero-emission vehicles continues to rise, the market is poised for continued growth.

What challenges does E-Scooter Industry face during the growth?

High costs and maintenance complexities associated with e-scooters is a key challenge affecting the market growth.

- The global electric scooters market is experiencing significant growth due to the increasing demand for sustainable urban mobility solutions. However, the high upfront cost of electric scooters, with prices ranging from 1,300 to 1,600, remains a significant barrier to entry for many consumers. This is despite the availability of tax rebates, subsidies, and incentives for the adoption of zero-emission vehicles. The high price point is in contrast to the average price of conventional scooters and fuel-efficient vehicles, such as electric motorcycles, electric mopeds, and even gasoline-powered scooters, which are priced significantly lower. To address this issue, smart transportation infrastructure, such as renewable energy stations and smart charging systems, is being developed to reduce the total cost of ownership for e-scooter users.

- These charging solutions, powered by solar or other renewable energy sources, offer a more sustainable and cost-effective alternative to traditional charging stations. Moreover, the integration of advanced features, such as easy-to-operate designs, belt or chain drives, hub motors, and lithium-ion batteries, enhances the appeal of e-scooters as a viable and efficient alternative to traditional motor vehicles. However, the carbon emission gap between electric scooters and their fossil fuel counterparts remains a concern. While electric scooters produce zero tailpipe emissions, the production and disposal of their batteries contribute to greenhouse gas emissions. Therefore, the development of cleaner transportation solutions, such as e-buses, e-three wheelers, and e-passenger vehicles, is essential to minimize the overall carbon footprint of the transportation sector.

- In conclusion, the global electric scooters market is poised for growth, driven by the demand for sustainable urban mobility solutions. However, the high upfront cost of electric scooters and the carbon emission gap between electric and conventional scooters present challenges that must be addressed to ensure the long-term success of this market. The development of smart charging infrastructure, the integration of advanced features, and the adoption of cleaner transportation solutions are crucial steps in overcoming these challenges and making electric scooters a more viable and attractive option for consumers.

Exclusive Customer Landscape

The e-scooter market market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ather Energy Pvt. Ltd. - Our company provides a range of e-scooters, including the Chetak model, for the US market. These innovative and eco-friendly transportation solutions offer a convenient and efficient alternative to traditional modes of transportation. With their sleek designs, user-friendly features, and impressive battery life, our e-scooters are an excellent choice for both short commutes and recreational use. Our commitment to quality and customer satisfaction ensures that you'll enjoy a smooth and enjoyable riding experience.

The market research and growth report includes detailed analyses of the competitive landscape of the e-scooter market industry and information about key companies, including:

- Ather Energy Pvt. Ltd.

- Bajaj Auto Ltd.

- BMW AG

- Bodo Vehicle Group Co. Ltd.

- Electrotherm Ltd

- GOVECS AG

- Greaves Cotton Ltd.

- Hero Electric Vehicles Pvt. Ltd

- Honda Motor Co. Ltd

- KWANG YANG MOTOR Co. Ltd.

- Mahindra and Mahindra Ltd.

- Niu Technologies

- Okinawa Autotech Pvt. Ltd.

- Piaggio and C. Spa

- Songguo New Energy Automobile Co Ltd

- TVS Motor Co. Ltd.

- Vmoto Ltd.

- Yadea Group Holdings Ltd

- Z Electric Vehicle Corp

- Zhejiang Luyuan Electric Vehicle Co Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The electric scooter market is witnessing significant growth as the world shifts towards sustainable urban mobility solutions. This shift is driven by various factors, including the need for smart transportation infrastructure, the desire for zero-emissions transportation, and government incentives. Electric scooters offer an attractive alternative to traditional fuel-efficient vehicles such as cars and motorcycles. They provide a lightweight, easy-to-operate commuting option that is ideal for short distances. The use of electric motors and rechargeable batteries makes these vehicles a viable zero-emission alternative to gasoline-powered vehicles.

The market for electric scooters is diverse, encompassing various types of vehicles such as e-mopeds, motorized scooters, and electric motorcycles. These vehicles come equipped with features like hub motors, lithium-ion batteries, and electronic braking systems, making them efficient and convenient for urban commuters. The adoption of electric scooters is being driven by several market dynamics. One of the primary factors is the increasing concern for energy security and air quality. As urban populations continue to grow, there is a pressing need for cleaner transportation options to reduce greenhouse gas emissions and carbon footprints. Another factor contributing to the growth of the electric scooter market is the availability of charging infrastructure.

Renewable energy stations and smart charging systems are being developed to support the widespread use of battery-powered two-wheelers. Governments and private organizations are investing in charging infrastructure to encourage the adoption of electric vehicles. Subsidies and incentives are also playing a significant role in the growth of the electric scooter market. Governments are offering tax rebates and other incentives to encourage the purchase of zero-emission vehicles. This is particularly true in the context of alternative fuel vehicles, including electric scooters. The electric scooter market is also being driven by technological advancements. The integration of big data and the Internet of Things (IoT) is enabling the development of smart vehicles that can optimize battery usage and improve overall performance.

Despite the numerous benefits of electric scooters, there are challenges that need to be addressed. One of the main challenges is the availability and affordability of batteries. While lithium-ion batteries offer superior performance, they are more expensive than lead-acid batteries. However, as technology advances and economies of scale are achieved, the cost of lithium-ion batteries is expected to come down. Another challenge is the availability of charging infrastructure. While progress is being made in this area, there is still a need for more charging stations to support the growing number of electric scooters on the road. In conclusion, the electric scooter market is poised for significant growth as urban populations continue to seek sustainable and efficient transportation solutions. The market is being driven by various factors, including the need for smart transportation infrastructure, the desire for zero-emissions transportation, and government incentives. Despite the challenges, the future looks bright for electric scooters as they become an increasingly popular option for urban commuters.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.38% |

|

Market growth 2023-2027 |

4261.82 th units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

8.34 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 81% |

|

Key countries |

US, China, Japan, Taiwan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Ather Energy Pvt. Ltd., Bajaj Auto Ltd., BMW AG, Bodo Vehicle Group Co. Ltd., Electrotherm Ltd, GOVECS AG, Greaves Cotton Ltd., Hero Electric Vehicles Pvt. Ltd, Honda Motor Co. Ltd, KWANG YANG MOTOR Co. Ltd., Mahindra and Mahindra Ltd., Niu Technologies, Okinawa Autotech Pvt. Ltd., Piaggio and C. Spa, Songguo New Energy Automobile Co Ltd, TVS Motor Co. Ltd., Vmoto Ltd., Yadea Group Holdings Ltd, Z Electric Vehicle Corp, and Zhejiang Luyuan Electric Vehicle Co Ltd |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the e-scooter market industry growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch