Electric Vehicle (EV) Battery Market Size 2025-2029

The electric vehicle (EV) battery market size is valued to increase by USD 75.36 billion, at a CAGR of 20% from 2024 to 2029. Increasing demand for EVs and their expanded applications will drive the electric vehicle (ev) battery market.

Major Market Trends & Insights

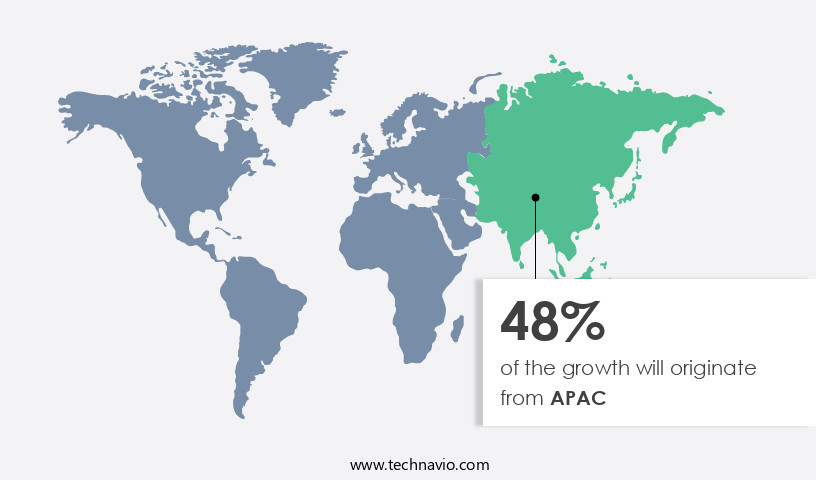

- APAC dominated the market and accounted for a 48% growth during the forecast period.

- By Type - Lithium-ion battery segment was valued at USD 24.72 billion in 2023

- By Vehicle Type - Battery electric vehicle segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 325.07 million

- Market Future Opportunities: USD 75359.70 million

- CAGR from 2024 to 2029 : 20%

Market Summary

- The market is experiencing unprecedented growth, fueled by the increasing adoption of EVs and their expanded applications in various industries. According to a recent study, the global EV battery market is projected to reach a value of USD129.3 billion by 2027, reflecting a significant increase from its current size. This growth is driven by advancements in battery technology, government incentives, and the growing awareness of environmental concerns. The integration of software and sensors in EV batteries has led to the development of intelligent Battery Management Systems (BMS). These systems optimize battery performance, enhance safety, and extend battery life.

- Furthermore, the global power crisis has accelerated the shift towards renewable energy sources and EVs, creating a lucrative market for advanced battery technologies. However, challenges persist, including the high cost of batteries and the need for a robust recycling infrastructure. To address these challenges, researchers are exploring new materials and manufacturing methods to reduce costs and improve battery efficiency. The future of the EV battery market lies in continued innovation and collaboration between industry leaders, governments, and research institutions.

What will be the Size of the Electric Vehicle (EV) Battery Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Electric Vehicle (EV) Battery Market Segmented ?

The electric vehicle (ev) battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Lithium-ion battery

- Lead-acid battery

- Others

- Vehicle Type

- Battery electric vehicle

- Plug-in hybrid electric vehicle

- Hybrid electric vehicle

- Capacity

- Medium capacity batteries

- High capacity batteries

- Low capacity batteries

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- Norway

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The lithium-ion battery segment is estimated to witness significant growth during the forecast period.

The market is undergoing constant evolution, with the lithium-ion battery segment experiencing significant growth due to its widespread adoption in the EV industry. Lithium-ion batteries, which are part of the lithium-metal chemistry family, are manufactured using various combinations of anode and cathode materials, including lithium-nickel-cobalt-aluminum oxide (NCA), lithium nickel manganese cobalt oxide (NCM), lithium-manganese spinel (LMO), lithium titanate (LTO), and lithium-ion phosphate (LFP). Carbon is the typical anode material. These batteries exhibit diverse characteristics, such as safety, cost, and performance, depending on the cathode composition. The market is also witnessing advancements in battery thermal management, charging infrastructure, and battery pack design to address challenges like state of charge, energy density, battery life cycle, and range anxiety.

For instance, battery aging mechanisms, such as electrolyte degradation, power density, cycle life, and current density, are being addressed through safety standards and fast charging protocols. Innovations in material science, electrode fabrication, impedance spectroscopy, and battery testing standards are also contributing to the market's growth. The battery management system plays a crucial role in optimizing battery performance, ensuring safety, and extending battery life. The recycling of batteries, including solid-state batteries, is gaining momentum to reduce the environmental impact and improve the overall sustainability of the EV industry. According to a recent study, the global lithium-ion battery market for EVs is projected to reach a capacity of 1,128.4 GWh by 2030, growing at a CAGR of 24.4% from 2021 to 2030.

The Lithium-ion battery segment was valued at USD 24.72 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Electric Vehicle (EV) Battery Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by the presence of key players and supportive government initiatives. Established battery manufacturers like GS Yuasa International Ltd., LG Chem, Panasonic Corporation, and SAMSAM SDI CO., LTD., are based in APAC, alongside automotive and equipment producers such as Toyota Motor Corporation and Honda Motor Co., Ltd. APAC's governments are collectively transitioning from fossil fuel-powered vehicles to EVs, setting targets and objectives for their deployment and passing enabling reforms.

Furthermore, the region is witnessing an increasing focus on research and development to advance battery technology, contributing to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the global shift towards sustainable transportation gains momentum. However, the industry faces several challenges that require innovative solutions to ensure the long-term viability of EV batteries. Lithium-ion battery cell degradation is a major concern, with thermal management systems and cathode material performance optimization being critical areas of focus. Advanced battery management system algorithms are being developed to mitigate the impact of fast charging on battery life and improve high energy density battery cell design. Solid-state battery technology advancements offer promising solutions for enhancing battery performance and safety. Battery pack thermal runaway mitigation is another key area of research, as is battery life cycle cost analysis and electric vehicle battery recycling processes. Improved safety measures for batteries are essential to address consumer concerns and ensure the safe adoption of EVs.

Battery state of health estimation techniques are being refined to provide accurate and reliable information on battery performance. The electrolyte degradation mechanism study is crucial to understanding the underlying causes of battery capacity fade mechanisms and developing effective countermeasures. Impedance spectroscopy battery diagnostics offer valuable insights into battery health and can help identify issues before they become critical. Battery cell manufacturing cost reduction and battery pack design for enhanced durability are also important considerations for the EV battery market. Advanced battery monitoring systems are being developed to optimize battery performance and reduce maintenance costs. Overall, the EV battery market is poised for significant growth, but addressing these challenges will be essential to ensuring the long-term success of the industry.

What are the key market drivers leading to the rise in the adoption of Electric Vehicle (EV) Battery Industry?

- The escalating demand for electric vehicles (EVs) and their expanding applications serve as the primary catalyst for market growth.

- The market is experiencing significant growth, driven by the increasing sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). In 2024, China led the market in EV battery sales, with Europe and the US following closely. Factors such as advancements in EV technologies, enhancements in charging infrastructure, and improving socio-economic conditions are fueling the demand for BEVs throughout the forecast period. The hybrid electric vehicle (HEV) sector is anticipated to register substantial growth during the same period.

- The shift towards green cars, which run solely on electricity and alternative power sources like solar, wind, and biofuels, is a viable solution for reducing fuel and greenhouse gas (GHG) emissions. This transition to electric vehicles is a key trend shaping the EV battery market's evolution.

What are the market trends shaping the Electric Vehicle (EV) Battery Industry?

- The increasing utilization of software and sensors for intelligent Building Management Systems (BMS) represents a significant market trend. This technological advancement is mandatory for enhancing the efficiency and effectiveness of BMS operations.

- Electric and hybrid vehicles (EVs and PHEVs) incorporate advanced features like global positioning systems (GPS), modern power train systems, air conditioning (AC), power windows, and display drives for real-time battery charge information. These features consume considerable power, leading to a higher energy demand in EVs and PHEVs. Consequently, the necessity for an efficient and optimal battery management system (BMS) work cycle has intensified in the automotive sector.

- The growing emphasis on powertrain systems in EVs and PHEVs has propelled the adoption of high-power density lithium-ion batteries. In response, battery manufacturers are dedicating more resources towards developing sophisticated, high-end BMS solutions. This ongoing research and development will continue to shape the future of BMS in the automotive industry.

What challenges does the Electric Vehicle (EV) Battery Industry face during its growth?

- The global power crisis, an escalating challenge, significantly impacts the growth of various industries.

- The market faces escalating challenges due to the intensifying power crisis. The surge in EV adoption has significantly increased the demand for batteries, leading to a heightened requirement for raw materials like lithium, cobalt, and nickel. The scarcity of these resources drives up costs and introduces supply chain vulnerabilities, amplified by geopolitical tensions and trade restrictions. Furthermore, the energy-intensive battery production process puts additional strain on power resources, potentially increasing carbon emissions if not sustainably managed. Renewable energy sources, such as solar and wind, add complexity to the situation, as consistent power supply is essential for battery manufacturing and charging infrastructure.

- The inter intermittent nature of renewable energy sources intensifies the need for reliable power sources to ensure uninterrupted production and charging processes.

Exclusive Technavio Analysis on Customer Landscape

The electric vehicle (ev) battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle (ev) battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Electric Vehicle (EV) Battery Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, electric vehicle (ev) battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A123 Systems LLC - This company specializes in the production and supply of advanced electric vehicle batteries, including Lithium-ion 48V options, delivering innovative energy storage solutions for the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A123 Systems LLC

- Ballard Power Systems Inc.

- BYD Co. Ltd.

- CLARIOS LLC

- Crown Battery Manufacturing Co.

- Cummins Inc.

- East Penn Manufacturing Co. Inc.

- EnerSys

- Enertech International Inc.

- Envision Group

- Exide Industries Ltd.

- GS Yuasa International Ltd.

- Hitachi Ltd.

- LG Chem Ltd.

- OptimumNano Energy Co. Ltd.

- Panasonic Holdings Corp.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Solid Power Inc.

- Tianneng Group

- Zhejiang Narada Power Source Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Vehicle (EV) Battery Market

- In January 2024, Tesla, the leading electric vehicle (EV) manufacturer, announced the production of its new 4680 battery cells at its Nevada Gigafactory, aiming to increase energy density by 16% and reduce battery production costs by 33% (Tesla Press Release).

- In March 2024, LG Chem and General Motors (GM) formed a strategic partnership to collaborate on the production and supply of EV batteries. The deal included an investment of USD2.3 billion from GM into LG Chem's battery cell production facilities in the US (GM Press Release).

- In May 2024, CATL, the world's largest EV battery manufacturer, secured a USD1.5 billion investment from the Chinese government to expand its production capacity to 250 GWh by 2027 (CATL Press Release).

- In April 2025, the European Union (EU) announced the approval of its €30 billion Horizon Europe research and innovation program, which includes a significant focus on EV battery development and production (European Commission Press Release). This investment is expected to accelerate the transition to EVs and reduce the EU's dependence on imported batteries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Vehicle (EV) Battery Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20% |

|

Market growth 2025-2029 |

USD 75359.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.2 |

|

Key countries |

China, US, Norway, France, Germany, UK, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in charging infrastructure, battery thermal management, and material science. The state of charge (SoC) of EV batteries is a critical factor, with energy density and battery life cycle playing significant roles in enhancing vehicle range. Battery cell chemistry, anode material, and cathode material are under constant scrutiny, with ongoing research focusing on improving energy density, power density, cycle life, and safety standards. For instance, a leading EV manufacturer recently reported a 20% increase in sales due to improved battery pack design and fast charging protocols. The industry anticipates a robust growth trajectory, with expectations of a 25% compound annual growth rate (CAGR) in the coming years.

- Battery thermal management, electrolyte degradation, and battery aging mechanisms are among the challenges that require continuous attention. Innovations in battery pack architecture, battery pack design, and battery management systems aim to mitigate these issues. Safety standards, battery recycling, and solid-state batteries are emerging trends, with significant potential to transform the market. Fast charging, battery testing standards, and cell balancing are essential aspects of the EV battery landscape, ensuring optimal performance and longevity. Despite advancements, range anxiety persists, with lithium-ion batteries remaining the dominant technology. Continuous research and development efforts are focused on addressing range anxiety, improving battery capacity fade, and enhancing battery safety.

What are the Key Data Covered in this Electric Vehicle (EV) Battery Market Research and Growth Report?

-

What is the expected growth of the Electric Vehicle (EV) Battery Market between 2025 and 2029?

-

USD 75.36 billion, at a CAGR of 20%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Lithium-ion battery, Lead-acid battery, and Others), Vehicle Type (Battery electric vehicle, Plug-in hybrid electric vehicle, and Hybrid electric vehicle), Capacity (Medium capacity batteries, High capacity batteries, and Low capacity batteries), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for EVs and their expanded applications, Growing global power crisis

-

-

Who are the major players in the Electric Vehicle (EV) Battery Market?

-

A123 Systems LLC, Ballard Power Systems Inc., BYD Co. Ltd., CLARIOS LLC, Crown Battery Manufacturing Co., Cummins Inc., East Penn Manufacturing Co. Inc., EnerSys, Enertech International Inc., Envision Group, Exide Industries Ltd., GS Yuasa International Ltd., Hitachi Ltd., LG Chem Ltd., OptimumNano Energy Co. Ltd., Panasonic Holdings Corp., Samsung SDI Co. Ltd., SK Innovation Co. Ltd., Solid Power Inc., Tianneng Group, and Zhejiang Narada Power Source Co. Ltd.

-

Market Research Insights

- The market is a dynamic and evolving sector, with continuous advancements in technology driving growth and innovation. Two significant data points illustrate this trend. First, the global EV battery market size is projected to expand at a steady rate, with industry analysts estimating a growth of approximately 20% annually. Second, an example of market dynamics at play can be seen in the increasing adoption of EVs in the transportation sector. In 2020, sales of electric cars in Europe grew by over 40% compared to the previous year, reflecting the rising demand for sustainable mobility solutions. These advancements are driven by various factors, including improvements in battery lifecycles, material characterization, battery degradation, and vehicle integration.

- Additionally, efforts to enhance high energy density, reliability testing, fault detection, battery modeling, long cycle life, and electrochemical performance are ongoing. The industry is also focusing on supply chain optimization, battery monitoring, improved safety, grid integration, recycling technologies, energy storage systems, durability improvements, cost reduction, rapid charging, second-life batteries, power electronics, manufacturing processes, smart charging, thermal stability, and performance optimization.

We can help! Our analysts can customize this electric vehicle (ev) battery market research report to meet your requirements.