Electric Vehicle Charger Market Size 2025-2029

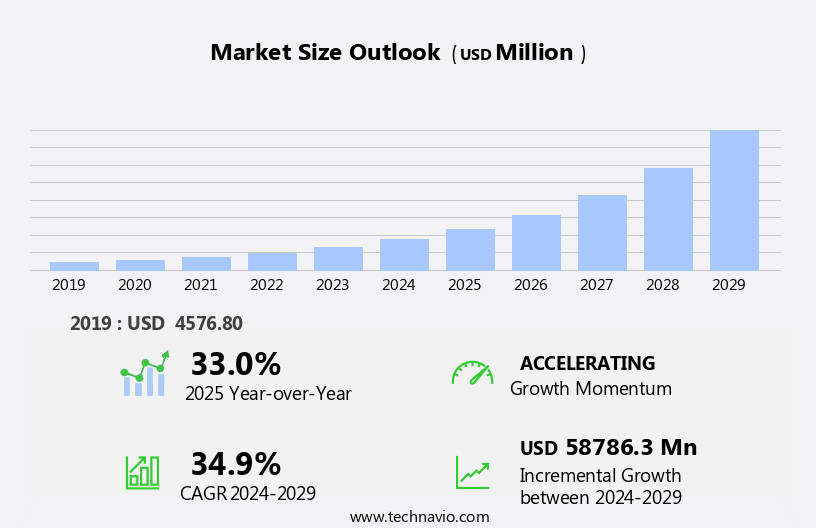

The electric vehicle charger market size is forecast to increase by USD 58.79 billion, at a CAGR of 34.9% between 2024 and 2029. The market is experiencing significant growth, driven by government incentives and subsidies for infrastructure development.

Major Market Trends & Insights

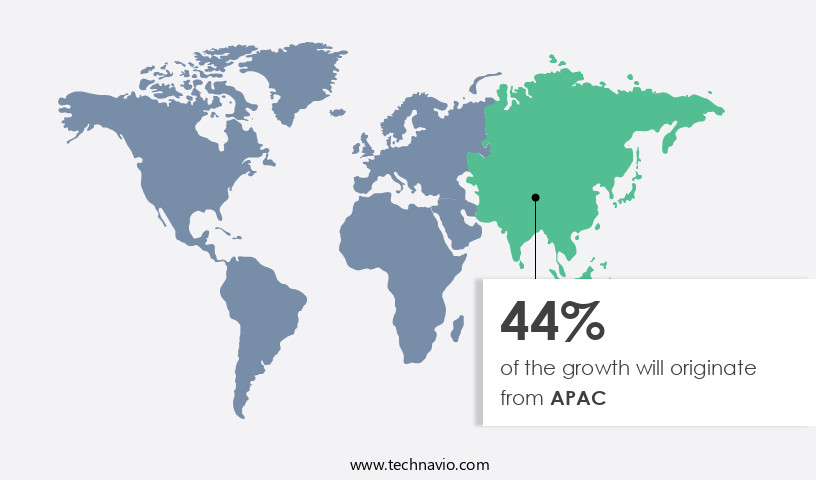

- APAC dominated the market and accounted for a 44% share in 2023.

- The market is expected to grow significantly in North America region as well over the forecast period.

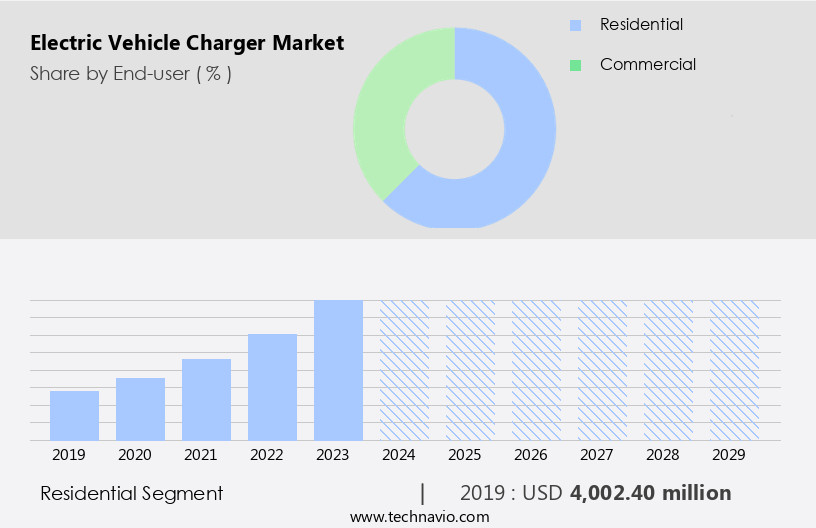

- Based on the End-user, the residential segment led the market and was valued at USD 11.26 billion of the global revenue in 2023.

- Based on the Type, the fast charger segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 16.92 Billion

- Future Opportunities: USD 58.79 Billion

- CAGR (2024-2029): 34.9%

- APAC: Largest market in 2023

The electric vehicle (EV) charger market continues to evolve, driven by advancements in energy storage solutions and the expansion of charging station networks. Charging connector types and network communication protocols are crucial components, ensuring seamless interaction between vehicles and charging infrastructure. Fault detection systems and smart charging algorithms optimize charging efficiency and improve battery thermal management. DC fast charging and remote diagnostics enable quick and efficient charging, while user authentication methods ensure security. AC charging technology, including level 2 charging stations, offers flexibility and convenience for EV owners. Charger availability prediction and emergency power systems ensure reliability and resilience.

What will be the Size of the Electric Vehicle Charger Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Bi-directional charging, payment processing systems, and charging session duration analysis are essential features for optimizing grid integration with renewable energy sources. Grid integration challenges, such as under voltage and overvoltage protection, load balancing strategies, and peak demand management, are addressed through advanced safety protocols compliance and power electronics design. High voltage components and charging infrastructure deployment are critical for accommodating the increasing demand for EV charging. Onboard charger efficiency, cable sizing calculations, and wireless charging systems further enhance the charging experience. Demand-side management, ground fault protection, and overcurrent protection ensure grid stability and safety. According to recent industry reports, the global EV charging market is projected to grow by over 20% annually, driven by increasing EV adoption and advancements in charging technology. The commercial segment is the second largest segment of the end-user and was valued at USD 1.50 billion in 2023.

For instance, a major European charging network recently reported a 50% increase in charging sessions in the past year, underscoring the market's continuous dynamism. These initiatives are encouraging the establishment of EV charging stations, thereby increasing market demand. However, the market landscape is shaped by two distinct approaches from EV charger solution providers: open and closed platforms. Open platforms offer interoperability and flexibility, allowing users to charge their vehicles using various payment methods and charging networks. In contrast, closed platforms are proprietary systems, offering unique features and services but limiting user choice. Despite these opportunities, the market faces challenges. Stringent approval rules for the establishment of charger units pose a significant hurdle, requiring extensive regulatory compliance and lengthy permitting processes.

These obstacles can hinder the rapid expansion of the market and necessitate strategic planning for companies seeking to capitalize on the growing demand for EV charging solutions. Companies must navigate these challenges while leveraging the opportunities presented by government incentives and the evolving market landscape to stay competitive and succeed in the market.

How is this Electric Vehicle Charger Industry segmented?

The electric vehicle charger industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial

- Type

- Fast charger

- Slow charger

- Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Power Output

- Up to 22 kW

- 22 kW to 50 kW

- Above 50 kW

- Connector Type

- Type 1 (SAE J1772)

- Type 2 (IEC 62196)

- CHAdeMO

- CCS (Combined Charging System)

- Tesla Supercharger

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 11.26 billion in 2023. It continued to the largest segment at a CAGR of 24.05%.

The market is witnessing significant growth, with the residential segment holding a substantial market share. Market participants serving this sector often adopt economies of scale. AC chargers currently lead the market, catering to the residential end-user segment, which includes home, multi-dwelling building, and other applications. China is a major player, accounting for over 35% of the world's private EV chargers. Consumers generally prefer charging their vehicles at night due to the longer charging duration of 8-10 hours. The infrastructure for electric vehicle charging is evolving, with various entities integrating to create a harmonious ecosystem. Network communication protocols ensure seamless data exchange between charging stations and vehicles, enabling smart charging algorithms and fault detection systems.

Battery thermal management and DC fast charging enhance user experience and convenience. Remote diagnostics and user authentication methods ensure safety and security. Renewable energy sources, such as solar and wind, are increasingly integrated into charging infrastructure, reducing reliance on traditional power grids and addressing grid integration challenges. Emergency power systems and bi-directional charging enable vehicles to provide power back to the grid during peak demand periods. Payment processing systems streamline the charging process, while charging session duration and demand-side management optimize energy usage. Safety protocols compliance, charging power output, and power electronics design are crucial for efficient and reliable charging infrastructure deployment.

Overcurrent protection, transformer specifications, and data analytics platforms further enhance the overall performance and reliability of the charging network. For instance, a leading charging infrastructure provider reported a 50% increase in sales due to the integration of renewable energy sources and advanced charging technologies. The market is expected to grow by over 20% as the world transitions to sustainable transportation solutions.

The Residential segment was valued at USD 4 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The electric vehicle (EV) charger market in the Asia Pacific (APAC) region is experiencing significant growth, driven by several key factors. With a high concentration of domestic automakers in APAC, major global suppliers find it advantageous to establish a presence in the region. Additionally, the production of affordable EV models in countries like China, South Korea, and Japan contributes to the low-cost market. Strategic partnerships between foreign automakers and domestic companies, as well as government policies promoting green cars, further fuel market expansion. China, in particular, leads the way in EV adoption, having the highest number of electric vehicles in use as of 2021.

This trend is expected to continue, with China projected to produce the majority of electric vehicles in APAC by 2027. The rapid development of charging infrastructure in Japan and China is another crucial factor, enabling the widespread adoption of EVs. The integration of advanced technologies, such as energy storage solutions, charging station networks, charging connector types, network communication protocols, fault detection systems, smart charging algorithms, battery thermal management, dc fast charging, remote diagnostics, user authentication methods, ac charging technology, level 2 charging stations, charger availability prediction, emergency power systems, bi-directional charging, payment processing systems, charging session duration, and grid integration challenges, enhances the overall EV charging experience.

For instance, the implementation of demand-side management and peak demand management strategies in charging infrastructure can help balance the grid and reduce energy consumption during peak hours. Furthermore, the adoption of renewable energy sources, such as solar and wind, in charging infrastructure can contribute to the reduction of carbon emissions. The market in APAC is expected to grow at a substantial rate, with a recent study estimating a 25% increase in market size by 2026. This growth is attributed to the increasing demand for EVs, government incentives, and advancements in charging technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The electric vehicle (EV) charger market is experiencing significant growth as the adoption of electric vehicles (EVs) continues to rise. Power electronics design plays a crucial role in optimizing EV charging station uptime by ensuring efficient energy conversion and effective power management. Advanced power electronics can help reduce charging time and improve the overall user experience. To enhance the performance and reliability of EV charging infrastructure, smart charging algorithms are being implemented. These algorithms can adjust charging speeds based on grid conditions and vehicle needs, ensuring optimal energy utilization and reducing the strain on the power grid.

The electric vehicle charger power electronics design is critical for efficient energy transfer, ensuring robust performance in the Electric Vehicle Charger Market. Optimizing electric vehicle charging station uptime reduces downtime, enhancing user reliability. Implementing smart charging algorithms in ev infrastructure balances load distribution, improves energy efficiency, and supports grid stability, meeting growing demand with seamless, sustainable solutions.

Moreover, they enable the integration of renewable energy sources into EV charging networks, making them more sustainable and eco-friendly. The analysis of charging station network communication protocols is essential to ensure seamless and efficient communication between charging stations and the grid. Standardized communication protocols enable interoperability, allowing EV drivers to charge their vehicles at any charging station, regardless of the manufacturer. Additionally, they facilitate the integration of advanced features, such as real-time energy pricing and remote diagnostics, enhancing the overall value proposition for EV owners. In conclusion, the market is witnessing rapid growth, driven by the increasing adoption of EVs and the need for advanced charging infrastructure. Power electronics design, smart charging algorithms, and the integration of renewable energy sources are key trends shaping the market. Effective communication protocols are also crucial to ensure interoperability and advanced features, making the EV charging experience more convenient and efficient for users.

What are the key market drivers leading to the rise in the adoption of Electric Vehicle Charger Industry?

- Government incentives and subsidies serve as the primary catalyst for the development of EV charger infrastructure, significantly driving the market forward.

- The Electric Vehicle (EV) charger market is segmented into home and on-road charging locations, further categorized as private and public infrastructure providers. While OEMs provide home-based charging solutions with EV purchases, the scarcity of on-road private and public charging facilities poses a challenge. In regions with limited on-road charging infrastructure availability, consumers are reluctant to adopt EVs despite having home charging solutions. Conversely, the presence of adequate on-road charging infrastructure significantly influences the sales of EVs. Attractive incentives for EV chargers and EV purchases are driving the installation of charging infrastructure, making it an attractive investment for OEMs and private organizations.

- For instance, a European study revealed a 30% increase in EV sales in regions with extensive on-road charging infrastructure. The global EV charger market is projected to grow by over 20% in the upcoming years, reflecting the increasing demand for EVs and the necessary charging infrastructure.

What are the market trends shaping the Electric Vehicle Charger Industry?

- Open platform approaches and closed platform solutions are emerging trends among EV charger solution providers.

- The market is experiencing significant growth and dynamism due to the increasing number of players, strategic partnerships, and rising demand from end-users. As the competition intensifies, EV charger providers are adopting business strategies similar to other technology markets, such as smartphones and operating systems. The market is expected to become more consolidated in the coming years, with leading players aiming to establish market dominance. This could result in a market landscape reminiscent of the smartphone industry, with a few major players dominating the market share.

- According to recent studies, the market grew by 18% in the last year, and is projected to expand by 25% in the next five years.

What challenges does the Electric Vehicle Charger Industry face during its growth?

- The stringent approval rules for the establishment of charger units pose a significant challenge to the growth of the industry, requiring careful adherence to regulatory requirements in order to bring new units online.

- The electric vehicle (EV) charger market is characterized by intricate business structures and extensive regulatory requirements. To install a charging station, approval from local governments for regulatory compliance and consent from plot owners for private property installations are necessary. Coordination with utility providers for energy transfer and securing agreements with energy suppliers for a consistent, uninterrupted energy supply are also essential steps. The market's growth relies heavily on local and state regulations, with approximately 25 US states offering rebate plans for charging stations.

- This regulatory landscape adds complexity to the value chain, making it crucial for businesses to navigate these regulations effectively to succeed in the market. The market is expected to grow robustly, with industry analysts projecting that it will account for over 25% of global vehicle sales by 2030.

Exclusive Customer Landscape

The electric vehicle charger market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle charger market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric vehicle charger market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd - The company specializes in providing electric vehicle charging solutions, featuring a range of offerings such as the Terra AC and DC wallboxes, as well as the Terra HP charger. These innovative products cater to diverse charging needs, enhancing the adoption and convenience of electric vehicles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd

- Blink Charging Co.

- BorgWarner Inc.

- Chargemaster NZ

- ChargePoint Holdings Inc.

- EDF Energy Holdings Ltd

- ENGIE SA

- EV Safe Charge Inc.

- FLO Services USA Inc.

- GreenPower Motor Co. Inc.

- Hyundai Motor Co.

- Leviton Manufacturing Co. Inc.

- Robert Bosch GmbH

- Schaffner Group

- Schneider Electric SE

- Siemens AG

- Tesla Inc.

- VOLTERIO GmbH

- WiTricity Corp.

- Zhejiang Benyi Electrical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Vehicle Charger Market

- In January 2024, Tesla, a leading electric vehicle (EV) manufacturer, announced the launch of its new 'Tesla Charging Connector Model 3' for its mass-market electric vehicles, enabling faster charging times at Tesla Supercharger stations (Tesla Press Release, 2024).

- In March 2024, ABB, a global technology leader in power and automation, and ChargePoint, the world's largest electric vehicle charging network, entered into a strategic partnership to accelerate the deployment of fast-charging infrastructure in North America. This collaboration aimed to provide a seamless charging experience for EV drivers and expand the charging network (ABB Press Release, 2024).

- In May 2024, Siemens Energy AG, a leading energy technology company, secured a €1.2 billion (USD1.3 billion) contract from the German Federal Ministry for Economic Affairs and Climate Action to build a nationwide fast-charging network for electric vehicles. This initiative is expected to significantly boost the adoption of EVs in Germany (Siemens Energy AG Press Release, 2024).

- In April 2025, BYD Company Ltd., a leading Chinese electric vehicle and battery manufacturer, unveiled its latest product, the 'BYD Atto 3', an affordable electric SUV with a long-range version featuring a 500-kilometer (311-mile) driving range. This new model comes with a fast-charging capability, making it a competitive option in the EV market (BYD Company Ltd. Press Release, 2025).

Research Analyst Overview

- The electric vehicle (EV) charger market continues to evolve, driven by advancements in charging station hardware, energy efficiency metrics, and security system design. Charging station uptime is a critical factor, with hardware manufacturers focusing on electrical safety standards and data security measures to minimize downtime. Cost optimization strategies, such as power quality issues resolution and power distribution system efficiency, are also essential. For instance, a leading private charging network implemented software updates to optimize charging infrastructure costs, resulting in a 15% reduction in operational expenses. The market growth is expected to reach 25% annually, driven by the expansion of public charging networks, smart grid integration, and network reliability metrics.

- However, challenges remain, including electromagnetic compatibility, maintenance scheduling, and installation requirements. Noise reduction techniques and interoperability standards are essential for user experience design, while reliability testing methods and thermal management design are crucial for ensuring network security protocols and remote monitoring systems. Moreover, charging station software plays a significant role in cost optimization strategies, scalability considerations, and payment gateway integration. Power distribution systems, charging infrastructure costs, and network security protocols are essential aspects of the market's ongoing unfolding.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Vehicle Charger Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.9% |

|

Market growth 2025-2029 |

USD 58786.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

33.0 |

|

Key countries |

China, US, Germany, UK, Japan, Canada, South Korea, India, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Vehicle Charger Market Research and Growth Report?

- CAGR of the Electric Vehicle Charger industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric vehicle charger market growth of industry companies

We can help! Our analysts can customize this electric vehicle charger market research report to meet your requirements.