Electric Vehicle (Ev) Transmission System Market Size 2024-2028

The electric vehicle (ev) transmission system market size is forecast to increase by USD 52.6 billion at a CAGR of 36.38% between 2023 and 2028.

- The market is experiencing significant growth driven by the increasing demand for Battery Electric Vehicles (BEVs) and the rise in popularity of e-axle systems. The e-axle, an integrated electric motor and transmission system, offers improved efficiency, reduced complexity, and enhanced performance, making it a preferred choice for automakers. However, the market growth is not without challenges. The lack of adequate supporting infrastructure for EVs, including charging stations and battery swapping facilities, poses a significant obstacle to widespread adoption. Additionally, the high cost of EVs and their transmission systems remains a barrier to entry for many consumers. To capitalize on market opportunities and navigate challenges effectively, companies should focus on developing innovative solutions to address infrastructure gaps and reduce production costs.

- Strategic partnerships and collaborations with charging infrastructure providers and governments can help accelerate market penetration. Furthermore, advancements in battery technology and the integration of renewable energy sources into the charging infrastructure can help mitigate range anxiety and reduce the overall carbon footprint of EVs. In summary, the EV Transmission System market is poised for growth, driven by the increasing popularity of BEVs and e-axle systems. However, the lack of supporting infrastructure and high production costs present significant challenges that require innovative solutions and strategic partnerships to overcome. Companies that successfully address these challenges will be well-positioned to capitalize on the market's potential and drive sustainable growth.

What will be the Size of the Electric Vehicle (Ev) Transmission System Market during the forecast period?

- The market is experiencing significant growth, driven by advancements in EV development and the increasing focus on sustainability. EV propulsion systems, including electric drivetrains and powertrains, are at the forefront of this trend, with smart charging and range enhancement technologies also playing crucial roles.The industry analysis encompasses electric vehicle production, cost, servicing, charging infrastructure, supply chain, ownership costs, reliability, standards, durability, architecture, and safety regulations.

- Additionally, telematics and OTA updates are essential components of the EV market, contributing to its continuous evolution. EV policy and maintenance are also significant factors influencing market dynamics.

How is this Electric Vehicle (Ev) Transmission System Industry segmented?

The electric vehicle (ev) transmission system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Single-speed transmission

- Multi-speed transmission

- Application

- Battery electric vehicle (BEV)

- Plug-in hybrid electric vehicle (PHEV)

- Fuel cell electric vehicle (FCEV)

- End-User

- OEMs

- Aftermarket

- Fleet Operators

- Motor Type

- Direct Drive

- Integrated Motors

- Hybrid Systems

- Vehicle Type

- Passenger EVs

- Commercial EVs

- Two-Wheelers

- E-Buses

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Norway

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

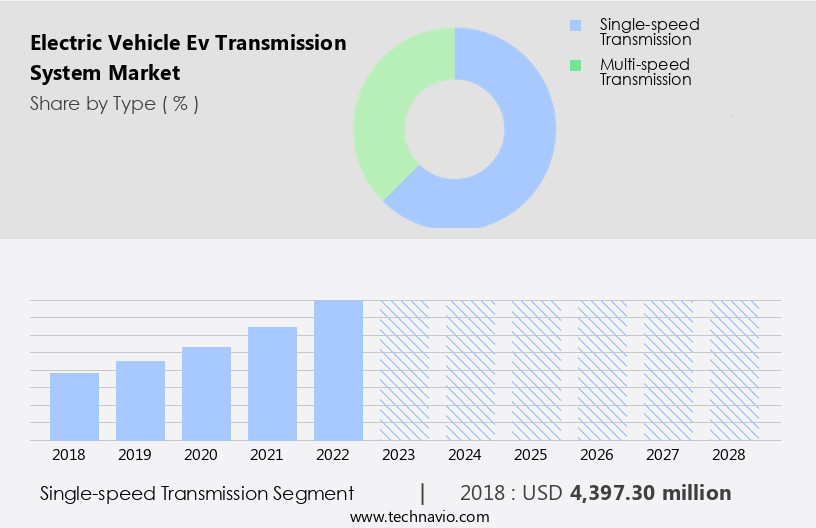

The single-speed transmission segment is estimated to witness significant growth during the forecast period.

The single-speed transmission segment dominates the market due to its widespread adoption in all-EVs. In 2022, this transmission type was the preferred choice for numerous EV manufacturers, including General Motors Co., Ford Motor Co., and Volkswagen AG. The less complex design of single-speed transmission systems is a significant factor driving their adoption. Electric motors generate maximum torque at low speeds, making single-speed transmission systems ideal for EV applications. EV regulations and safety features are crucial factors influencing the market's growth. Power output, charging infrastructure, and EV technology innovation are also essential elements shaping the market's dynamics.

Government incentives and subsidies play a vital role in boosting EV adoption, while the development of advanced software and connectivity features enhances the driving experience. EV powertrains, including electric motors, power electronics, and battery life, are undergoing continuous advancements to improve vehicle performance, efficiency, and range. The integration of electric axles, torque vectoring, and regenerative braking systems further optimizes power transmission and energy consumption. Heavy-duty vehicles are also transitioning to electric automotive powertrains to reduce energy consumption and comply with evolving regulations. The market for EV charging networks, including Level 1, 2, and 3 charging, is expanding to cater to the growing demand for convenient and efficient charging solutions.

The future of the EV transmission system market lies in the integration of autonomous driving systems, advanced driver assistance systems, and multi-speed transmissions, such as dual-clutch transmissions (DCTs), to enhance vehicle performance and efficiency. The market is expected to grow significantly as the adoption of EVs continues to increase.

The Single-speed transmission segment was valued at USD 4.4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

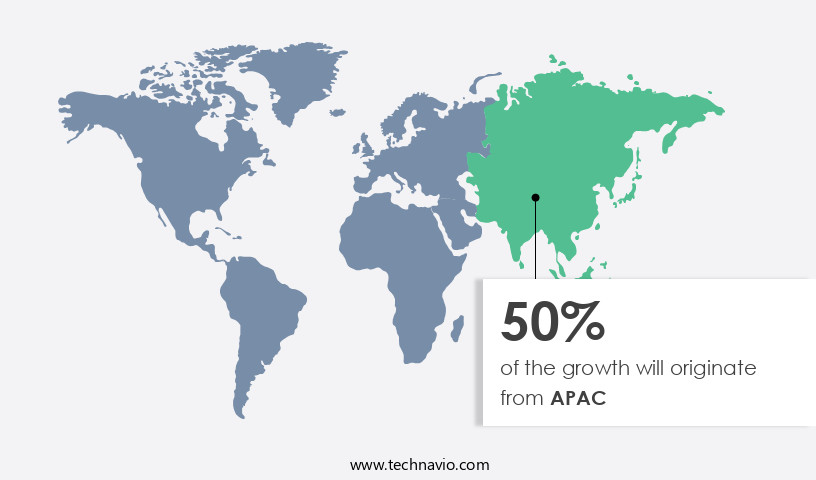

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. This region is currently the largest market segment due to the strong adoption of EVs in countries like China and Japan. Factors driving this trend include government initiatives to reduce pollution, increasing stringent carbon emission norms, the expansion of EV charging infrastructure, and the participation of foreign and local Original Equipment Manufacturers (OEMs) to make EV technology more efficient and cost-effective. In China, the government considers EVs as an essential solution to combat air pollution in urban areas such as Beijing and Shanghai. Consequently, various measures have been implemented to promote EV sales, including subsidies, tax incentives, and the development of charging infrastructure.

Moreover, the increasing demand for EVs with advanced features, such as torque vectoring, electric axles, and regenerative braking, is further fueling market growth. The integration of electric motors, power electronics, and battery life management systems into EV powertrains is also contributing to the market's expansion. Additionally, the adoption of autonomous driving technology, electric vehicle software, and connectivity features is expected to create new opportunities for market growth. The EV market's growth is also influenced by factors such as fuel economy, charging infrastructure, and safety concerns. Governments and organizations are investing in research and development to improve battery performance, electric vehicle efficiency, and safety features.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Electric Vehicle (Ev) Transmission System Industry?

- The significant surge in demand for battery electric vehicles (BEVs) serves as the primary catalyst for market growth.

- The market has experienced notable growth in recent years, as evidenced by the increasing year-over-year sales of Battery Electric Vehicles (BEVs). BEVs, which utilize all-electric powertrains and related systems and components, accounted for over 6% of global EV sales in 2021. This figure represents a significant increase from the approximately 2.5 million units sold in 2020. Norway led the sales of BEVs, with Iceland and Sweden following closely. Factors contributing to this growth include advancements in EV technologies, enhancements to charging infrastructure, and improving socioeconomic conditions. These elements are anticipated to continue fueling the demand for BEVs throughout the forecast period.

- The global sales of BEVs reached 4.2 million units in 2021, reflecting the market's robust growth. The increasing adoption of electric vehicles and advancements in related technologies are expected to further drive market expansion. As the world transitions towards more sustainable transportation solutions, the EV Transmission System Market is poised for continued growth.

What are the market trends shaping the Electric Vehicle (Ev) Transmission System Industry?

- The e-axle system's rising popularity represents a significant market trend in the automotive industry, signifying a shift towards more efficient and environmentally friendly powertrain solutions.

- The market is experiencing significant growth due to the increasing demand for EVs with higher efficiency and extended driving ranges. Lightweighting and larger battery sizes are key factors driving this trend. To optimally utilize vehicle space for larger batteries, innovative solutions such as integrating electric motors into the rigid rear axle are being explored. This integration can reduce vehicle weight by up to 100 kg.

- Furthermore, advancements in e-axle systems, which combine an electric motor and a rigid rear axle into a single streamlined module, are enhancing efficiency even further. These developments are crucial in addressing consumer concerns for increased range and improved performance in EVs.

What challenges does the Electric Vehicle (Ev) Transmission System Industry face during its growth?

- The insufficient development of essential infrastructure for electric vehicles (EVs) represents a significant obstacle to the industry's expansion. This challenge encompasses the need for improved charging station availability, reliable power grids, and supportive government policies. Addressing these infrastructure gaps is crucial for fostering market growth and widespread EV adoption.

- The market is witnessing significant growth due to the increasing demand for electric motorcycles and other types of EVs, including cars and scooters. However, the lack of proper charging infrastructure poses a major challenge. Long charge times and the inability to support different charging ports are among the other obstacles hindering the widespread adoption of electric motorcycles. This issue is particularly impacting the sales of high-performance electric motorcycles to mainstream customers.

- The absence of charging infrastructure continues to be a persistent barrier, negatively affecting the market growth. Despite these challenges, the increasing popularity of EVs and advancements in charging technology offer promising opportunities for market participants.

Exclusive Customer Landscape

The electric vehicle (ev) transmission system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the electric vehicle (ev) transmission system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, electric vehicle (ev) transmission system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AVL List GmbH (Germany, operations)

- Bosch GmbH (Germany)

- BorgWarner Inc. (United States)

- BYD Company Limited (China)

- Dana Incorporated (United States)

- Eaton Corporation plc (United States, operations)

- Elaphe Propulsion Technologies (Germany, operations)

- GKN Automotive (United Kingdom)

- Li Auto Inc. (China)

- Magna International Inc. (United States, operations)

- NIO Inc. (China)

- SAIC Motor Corporation (China)

- Schaeffler Technologies AG (Germany)

- Tesla Inc. (United States)

- TREMEC Corporation (United States)

- Valeo Siemens eAutomotive (Germany)

- Xpeng Motors (China)

- Xtrac Ltd. (United Kingdom)

- ZF Friedrichshafen AG (Germany)

- Zhejiang Geely Holding Group (China)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Electric Vehicle (Ev) Transmission System Market

- In February 2025, Schaeffler AG, a leading automotive and industrial supplier, announced the expansion of its e-mobility portfolio with the launch of its new compact electric drive system. This transmission system is designed to cater to the growing demand for compact electric vehicles (EVs), offering improved efficiency and reduced weight. The system's modular design enables easy integration into various vehicle architectures, making it a versatile solution for OEMs (Original Equipment Manufacturers) (BusinessWire, 2025).

- In December 2024, Magna International, a global automotive supplier, entered into a technological collaboration with Siemens Energy to develop a high-performance, compact, and lightweight transmission system for electric vehicles.

- This collaboration aims to combine Magna's automotive expertise with Siemens Energy's power electronics know-how, resulting in an advanced transmission system that delivers increased power density and efficiency (Magna International Press Release, 2024).

- In August 2024, Continental AG, a leading automotive technology company, acquired Vitesco Technologies, a global automotive technology supplier specializing in electric drives, transmissions, and thermal management systems. This acquisition is expected to strengthen Continental's position in the e-mobility market and provide a broader product portfolio, enabling the company to offer comprehensive solutions for electric vehicle drivetrains (Continental AG Press Release, 2024).

- In May 2024, CATL (Contemporary Amperex Technology Co.Limited), the world's largest producer of lithium-ion batteries for electric vehicles, announced the development of its in-house transmission system. The new system is designed to be compact, lightweight, and highly efficient, offering significant improvements in power density and reducing the overall weight of electric vehicles. This strategic move is expected to provide CATL with a competitive edge in the EV market by offering integrated battery and transmission solutions (CATL Press Release, 2024).

Research Analyst Overview

The Electric Drive Systems market is experiencing rapid growth, integral to the broader Electric Vehicle Components sector. Efficient EV System Integration is crucial within the overall Electric Vehicle Architecture, influencing EV Design and performance. Rigorous EV Testing and EV Validation ensure the reliability and safety of these systems before Electric Vehicle Manufacturing and EV Production. The EV Supply Chain plays a vital role in sourcing materials and components. The EV Aftermarket is emerging, focusing on EV Maintenance, EV Repair, and Electric Vehicle Servicing. EV Sustainability and reduced EV Emissions are key drivers, impacting Electric Vehicle Cost and EV Ownership Costs. Enhancing Electric Vehicle Reliability and Electric Vehicle Durability, alongside EV Range Enhancement technologies and Over-the-Air (OTA) Updates, are critical for consumer adoption. EV Telematics and Vehicle-to-Grid (V2G) Technology represent future advancements, guided by EV Standards and EV Safety Regulations.

Tier 1 suppliers are investing heavily in research and development to create more efficient electric axles, electric gearboxes, and battery life-extending technologies. Regenerative braking is also becoming more advanced, allowing EVs to recover more energy during braking and extend their range. Efficiency and energy consumption are essential considerations for the EV market. EVs are generally more efficient than traditional internal combustion engine vehicles, but there is still room for improvement. Innovations in power electronics and electric vehicle transmissions are helping to reduce energy consumption and improve overall performance. The EV market is also seeing advancements in EV technology related to autonomous driving.

Electric powertrains offer unique advantages for autonomous vehicles, including smooth acceleration and quiet operation. However, there are challenges to overcome, such as battery life and charging infrastructure. In conclusion, the EV market is experiencing significant growth due to a combination of regulatory pressures, infrastructure development, and technological innovation. The focus on improving power output, reducing energy consumption, and enhancing safety features is driving competition among manufacturers and suppliers. The future of the EV market looks promising, with continued advancements in technology and infrastructure expected to accelerate its growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Electric Vehicle (Ev) Transmission System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.38% |

|

Market growth 2024-2028 |

USD 52599.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

26.82 |

|

Key countries |

China, US, Norway, Germany, UKUS, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Electric Vehicle (Ev) Transmission System Market Research and Growth Report?

- CAGR of the Electric Vehicle (Ev) Transmission System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the electric vehicle (ev) transmission system market growth of industry companies

We can help! Our analysts can customize this electric vehicle (ev) transmission system market research report to meet your requirements.