Email Security Market Size 2025-2029

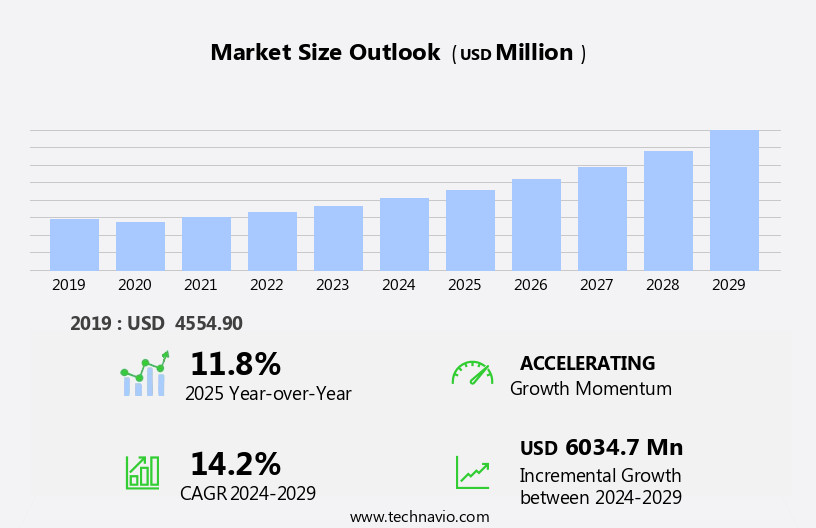

The email security market size is forecast to increase by USD 6.03 billion, at a CAGR of 14.2% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by the increasing trend towards remote work and employee mobility. This shift has led to an escalating need for robust email security solutions to protect sensitive business information from cyber threats. Another key trend is the widespread adoption of cloud-based email security services, enabling organizations to benefit from scalability, flexibility, and cost savings. However, the availability of open-source email security solutions poses a challenge for market players, as they must differentiate their offerings and provide added value to compete effectively.

- Companies seeking to capitalize on market opportunities should focus on offering advanced threat detection and response capabilities, seamless integration with other security solutions, and user-friendly interfaces. Navigating the challenges requires a deep understanding of the evolving threat landscape and the ability to adapt quickly to new technologies and customer needs.

What will be the Size of the Email Security Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the ever-evolving email security landscape, entities continue to integrate various solutions to fortify their defenses against persistent threats. On-premise security, incident response, PCI DSS compliance, artificial intelligence, antivirus protection, threat modeling, penetration testing, access control, and security policy are among the essential components of a robust email security strategy. The market witnesses continuous dynamism, with advancements in areas such as spam detection, malware scanning, email authentication protocols, multi-factor authentication, email filtering, behavioral analytics, security audits, and security software. Threat intelligence, intrusion detection, security services, machine learning, data encryption, phishing prevention, email security appliances, email security gateways, business continuity, single sign-on, vulnerability management, email archiving, risk management, email encryption, hybrid cloud security, and cloud security are other critical aspects of this evolving market.

As cybercriminals adopt increasingly sophisticated tactics, organizations must remain vigilant and adapt their email security strategies accordingly. Continuous threat modeling, penetration testing, and vulnerability assessments are essential to identify and address potential weaknesses. Security awareness training is also crucial to ensure that employees are equipped to recognize and respond to phishing attempts and other social engineering attacks. The integration of AI and machine learning technologies is revolutionizing email security, enabling more effective threat detection and response. However, this also presents new challenges, such as the need for robust data encryption and privacy protections. As the market continues to evolve, organizations must stay informed and adapt their strategies to stay ahead of emerging threats.

How is this Email Security Industry segmented?

The email security industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- BFSI

- Government

- Healthcare

- IT and telecom

- Others

- Component

- Products

- Services

- Deployment

- Cloud

- On-premises

- Hybrid

- Threat Type

- Phishing

- Malware

- Spam

- Data Loss Prevention

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

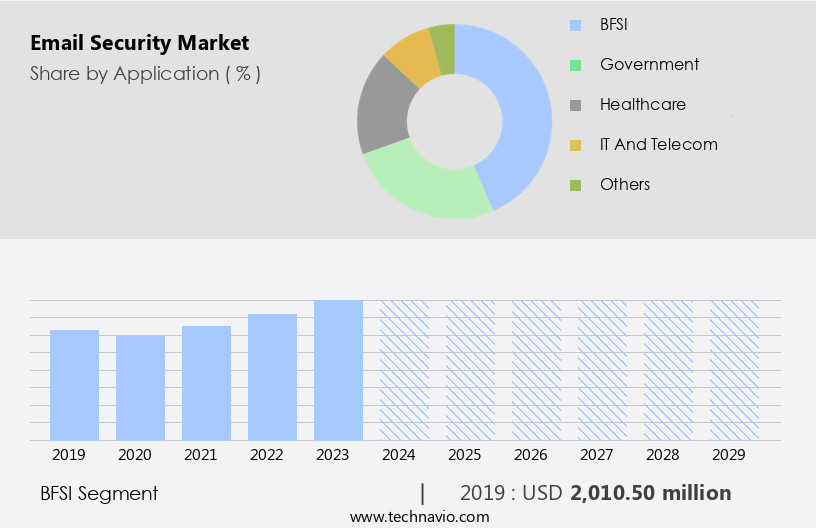

The bfsi segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the Banking, Financial Services, and Insurance (BFSI) sector. With the increasing use of digital technologies like cloud computing, mobile banking, and internet banking, financial institutions are becoming prime targets for sophisticated cyber threats such as phishing, ransomware, and business email compromise (BEC). Email security solutions are essential to protect sensitive financial data and maintain customer trust. Advanced measures like encryption, multi-factor authentication (MFA), and AI-driven threat detection systems are being adopted to safeguard communication channels. Email security appliances and gateways, security software, and security services are crucial components of these solutions.

Threat intelligence, machine learning, and behavioral analytics are integral to proactively identifying and mitigating potential threats. Security policies, access control, and vulnerability management are also essential for maintaining a robust security posture. Business continuity, incident response, and disaster recovery plans are vital for ensuring business resilience in the face of cyber attacks. Email archiving and risk management are essential for regulatory compliance, such as PCI DSS. Hybrid cloud security and cloud security are becoming increasingly important as more financial institutions adopt these technologies. Security awareness training and vulnerability assessments are crucial for employees to identify and prevent potential threats.

Overall, the BFSI sector's digital transformation has expanded the attack surface, necessitating continuous investment in advanced email security solutions.

The BFSI segment was valued at USD 2.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

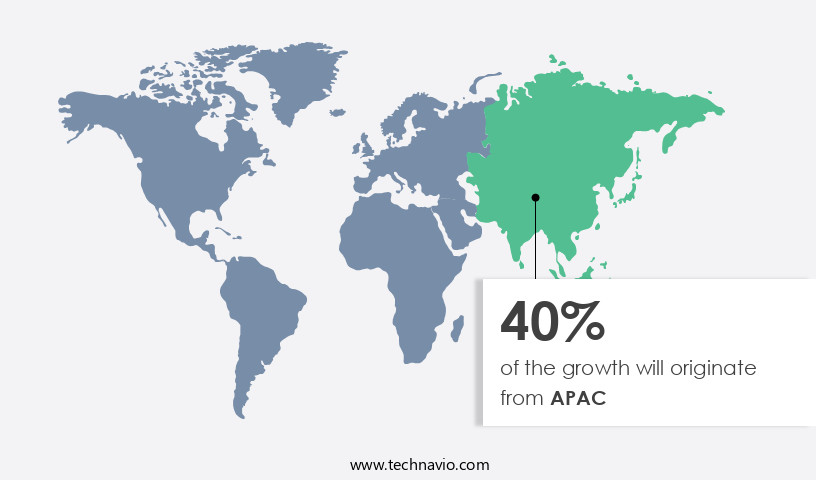

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing prevalence of insider fraud activities and the widespread adoption of mobile devices for both personal and professional use, driven by the bring-your-own-device (BYOD) trend. The market is highly competitive, with numerous solutions available, including spam detection, malware scanning, email authentication protocols, multi-factor authentication (MFA), email filtering, behavioral analytics, security audits, security software, threat intelligence, intrusion detection, security services, machine learning, data encryption, phishing prevention, email security appliances, email security gateways, business continuity, single sign-on (SSO), on-premise security, incident response, PCI DSS, artificial intelligence, antivirus protection, threat modeling, penetration testing, access control, security policy, vulnerability management, email archiving, risk management, email encryption, hybrid cloud security, and cloud security.

The presence of a large number of global financial institutions and corporations in North America is a major factor fueling market growth in the region. Email security solutions are essential for organizations to protect against various threats, including phishing attacks, malware, and data breaches, ensuring business continuity and maintaining regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic digital landscape, the market plays a pivotal role in safeguarding businesses and individuals from malicious cyber threats. This market encompasses solutions that shield against phishing attacks, spam, malware, and data breaches. Email encryption, two-factor authentication, and filtering technologies are integral components, ensuring confidentiality, integrity, and authenticity of messages. Advanced threat protection, including machine learning and artificial intelligence, proactively detects and neutralizes emerging threats. Email security policies and training empower users to recognize and respond to potential risks, fortifying the human firewall. The market continues to evolve, offering robust, adaptive solutions that safeguard valuable data and maintain trust in the digital realm.

What are the key market drivers leading to the rise in the adoption of Email Security Industry?

- Employee mobility, characterized by the frequent shifting of workforce between organizations, serves as a significant driving force in market dynamics.

- The market experiences significant growth due to the expanding mobile workforce and the increasing use of mobile devices for business communications. Mobile workers, such as traveling executives, sales representatives, and field workers, require constant access to company data. Emails are a primary means for these professionals to access confidential information from remote locations. Small and medium-sized enterprises (SMEs) have a substantial mobile workforce, enabling them to expand their sales across various geographical regions. However, the use of mobile devices also increases the risk of email-borne data theft. As the worldwide penetration of mobile devices like tablets, smartphones, and laptops continues to rise, the mobile workforce is anticipated to grow substantially.

- To mitigate the risks associated with email security, businesses invest in advanced security solutions, including intrusion detection, machine learning, data encryption, phishing prevention, email security appliances, email security gateways, business continuity, and single sign-on (SSO) services. These technologies help protect sensitive data, ensure business continuity, and maintain a secure and productive workforce.

What are the market trends shaping the Email Security Industry?

- Cloud-based solutions are increasingly becoming the norm in the market. Adoption of these technologies is not only a trend but also a necessity for businesses seeking to remain competitive and efficient.

- Email security is a critical concern for businesses, particularly those in finance, healthcare, and government sectors, due to the large volumes of sensitive data being handled. Cloud-based email security solutions offer several advantages, including centralized data management, accessibility from anywhere, and cost savings. These solutions enable organizations to maintain a searchable repository of historical data, ensuring that employees can access information regardless of their location or time zone. Moreover, cloud-based email security solutions provide scalability on demand, allowing businesses to manage increasing data volumes without additional costs. Despite the benefits, email security remains a significant challenge for enterprises.

- The threat landscape is constantly evolving, with new threats emerging regularly. To mitigate these risks, email security solutions must incorporate advanced technologies such as artificial intelligence, antivirus protection, access control, security policy, threat modeling, penetration testing, and incident response. These features help organizations identify and respond to threats in real-time, reducing the risk of data loss or breaches. Cloud-based email security solutions offer a harmonious balance between security and convenience. They provide robust protection against various threats while ensuring the availability of data at all times. By implementing these solutions, businesses can prioritize their focus on core operations, confident that their email communications are secure.

What challenges does the Email Security Industry face during its growth?

- The expansion of the industry is significantly influenced by the prevalence of open-source solutions, posing a significant challenge to its growth.

- The market is experiencing a significant shift towards open-source solutions due to their affordability and advanced capabilities. SMEs and individual users, who often have limited financial resources, are turning to open-source email security solutions as an alternative to expensive commercial offerings. Solutions like MailScanner and Proxmox Mail Gateway are gaining popularity due to their effectiveness in vulnerability management, email encryption, and risk management. Open-source email security solutions offer an immersive and harmonious approach to email security, emphasizing the importance of security awareness training, vulnerability assessments, hybrid cloud security, and disaster recovery.

- These solutions provide essential features, including email archiving and cloud security, without the need for substantial investment. By adopting open-source email security solutions, businesses can effectively mitigate email-borne threats and safeguard their digital assets.

Exclusive Customer Landscape

The email security market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the email security market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, email security market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agari Data Inc. - The company provides an advanced email security solution, the Barracuda Email Security Gateway. This service shields against malware, spam, phishing attempts, and Denial of Service attacks. By implementing this robust solution, organizations can safeguard their email communications from potential threats, ensuring the integrity and confidentiality of their digital exchanges.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agari Data Inc.

- Avanan Inc.

- Barracuda Networks Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- FireEye Inc.

- Forcepoint LLC

- Fortinet Inc.

- Hornetsecurity GmbH

- McAfee Corp.

- Mimecast Limited

- Palo Alto Networks Inc.

- Proofpoint Inc.

- Sophos Group Plc

- SpamTitan (TitanHQ)

- Symantec (Broadcom Inc.)

- Tessian Limited

- Trend Micro Incorporated

- Vade Secure

- Zix Corporation

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Email Security Market

- In January 2024, Proofpoint, a leading email security provider, announced the launch of its new Artificial Intelligence (AI)-based solution, "Targeted Attack Protection 2.0," which uses machine learning to detect and block advanced email threats in real-time (Proofpoint Press Release, 2024).

- In March 2024, Symantec Corporation and Microsoft entered into a strategic partnership to integrate Symantec's email security services into Microsoft 365, enhancing Microsoft's security offerings and expanding Symantec's reach to Microsoft's vast customer base (Symantec Press Release, 2024).

- In May 2024, Barracuda Networks raised USD150 million in a funding round led by Blackstone Growth, enabling the company to expand its email security offerings and accelerate its innovation in the cloud-based security market (Barracuda Press Release, 2024).

- In April 2025, the European Union's General Data Protection Regulation (GDPR) was strengthened with the introduction of the "right to explain," requiring organizations to provide clear explanations of their automated decision-making processes, including email filtering and spam blocking, to their users (European Commission Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, organizations prioritize safeguarding their digital communications against various threats. Email deliverability remains a significant concern, with the need for effective deliverability testing and anti-spam techniques to ensure messages reach intended recipients. Purple teaming, a collaborative approach to security, merges red and blue teaming to enhance threat detection and response. Security awareness training is crucial, with employee education on anti-phishing techniques and incident management essential to mitigate risks. Security event correlation and log management facilitate threat hunting and incident response, while network security, endpoint security, and zero trust security strategies fortify the perimeter.

- Anti-malware and anti-phishing techniques are vital components of a comprehensive security posture. Vulnerability scanning and patch management are ongoing tasks to address known vulnerabilities. DNS security adds an additional layer of protection against domain-based threats. Security analytics and threat intelligence inform security monitoring and incident response. Continuous security testing, including email spam filtering and phishing simulations, ensures readiness against evolving threats. The email security landscape is ever-changing, necessitating a proactive approach to staying informed and adaptive.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Email Security Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.2% |

|

Market growth 2025-2029 |

USD 6034.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.8 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Email Security Market Research and Growth Report?

- CAGR of the Email Security industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the email security market growth of industry companies

We can help! Our analysts can customize this email security market research report to meet your requirements.