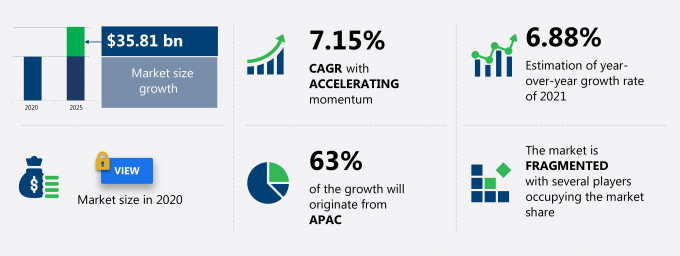

The engineering plastics market share is expected to increase by USD 35.81 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 7.15%.

This engineering plastics market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers engineering plastics market segmentations by type (ABS, PA, fluoropolymer, and others) and geography (APAC, North America, Europe, South America, and MEA). The engineering plastics market report also offers information on several market vendors, including BASF SE, Celanese Corp., Chi Mei Corp., Covestro AG, DuPont de Nemours Inc., Formosa Plastics Corp., LANXESS AG, LG Chem Ltd., Mitsubishi Engineering-Plastics Corp., and Toray Industries Inc. among others.

What will the Engineering Plastics Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Engineering Plastics Market Size for the Forecast Period and Other Important Statistics

Engineering Plastics Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post COVID-19 era. The demand for replacements of metals and fiber glass is notably driving the engineering plastics market growth, although factors such as degenerative properties of abs may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the engineering plastics industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Engineering Plastics Market Driver

One of the key factors driving the engineering plastics market growth is the demand for replacements of metals and fiber glass. The use of metals or thermosets is replaced by engineering plastics in the electrical and electronics, and automobile industries. This can be attributed to the lesser manufacturing cost, time, and higher tensile strength of the products. It is estimated that the cost can be reduced by up to 50% by replacing metals with engineering plastics. The manufacturing process of fiber glass is costly and labor intensive and emits higher volatile organic compounds (VOC) than engineering plastics. Stringent regulations established by several government agencies are challenging the manufacture of fiber glass. For instance, the EPA has adopted regulation 26-1 to control VOC emissions in the U.S. Therefore, limiting the manufacture of fiber glass is boosting the demand for engineering plastics, which is consequently boosting the global engineering plastics market.

Key Engineering Plastics Market Trend

Increasing capacity expansions is the major trend influencing engineering plastics market growth. Owing to the growing demand from the automotive and electrical and electronics industries, several key vendors and prominent vendors are undertaking capacity expansions and joint ventures. This is mostly to maintain the market position in the global engineering plastics market. For instance, BASF, one of the key vendors, has amplified its production capacities in Schwarzheide, Europe, and Korea. In Schwarzheide, the capacity of Ultramid is expected to increase approximately by 70 thousand metric tons per year. In addition, BASF has started a joint venture with Kolon Plastics in Gimcheon, Korea. This joint venture is expected to manufacture additional 70,000 metric tons Polyacetals. LANXESS has also expanded its high-performance plastics capacity in Gastonia and North Carolina in the US. Subsequently, capacity expansions are likely to continue throughout the forecast period by the key vendors. This will positively affect the global engineering plastics market during the forecast period.

Key Engineering Plastics Market Challenge

Degenerative properties of ABS is one of the key challenges hindering the engineering plastics market growth. Acrylonitrile in ABS is considered a carcinomic compound by the EPA. The release of acrylonitrile powder in the air during the manufacturing process can cause health hazards such as limb weakness, labored and irregular breathing, anemia, leukocytosis, and kidney irritation. Considered acceptable oral dose is 0.001 milligrams per kilogram per day. According to the EU Regulation (EU) No 10/2011, residues should not exceed 2.5% of the raw polymer. These stringent regulations by the governments are impeding the manufacture of ABS. Since ABS is predominantly used in the automotive and electrical and electronics industries, the limitations are likely to affect the manufacturing volumes of ABS. Such factors will negatively affect the global engineering plastics market in the coming five years.

This engineering plastics market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global engineering plastics market as a part of the global commodity chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the engineering plastics market during the forecast period.

Who are the Major Engineering Plastics Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- BASF SE

- Celanese Corp.

- Chi Mei Corp.

- Covestro AG

- DuPont de Nemours Inc.

- Formosa Plastics Corp.

- LANXESS AG

- LG Chem Ltd.

- Mitsubishi Engineering-Plastics Corp.

- Toray Industries Inc.

This statistical study of the engineering plastics market encompasses successful business strategies deployed by the key vendors. The engineering plastics market is fragmented and the vendors are deploying growth strategies such as new product launches, M&A, divestitures, JVs, and partnerships to compete in the market.

Product Insights and News

- BASF SE - The company offers a line of products such as Ultradur (polybutylene terephthalate) and Ultramid (polyamide).

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The engineering plastics market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Engineering Plastics Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the engineering plastics market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Engineering Plastics Market?

For more insights on the market share of various regions Request for a FREE sample now!

63% of the market’s growth will originate from APAC during the forecast period. China, India, and Japan are the key markets for engineering plastics in APAC. Market growth in this region will be faster than the growth of the market in other regions.

In APAC, India and China held the major share in the region. The demand is majorly driven by the automobile industry, followed by the electrical and electronics and construction industries. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 in the region hampered the growth of the regional engineering plastics market in the consumer and manufacturing industries. All manufacturing industries were highly affected, as their production units either fully or partially closed. This had a negative impact on the growth of the engineering plastics market in the region in 2020. However, governments are encouraging research on the COVID-19 vaccine which in turn is expected to drive the growth of manufacturing units, and hence, will enhance the growth of the engineering plastics market in the region during the forecast period. The path to recovery for market players is expected to be difficult despite the support from governments during the pandemic. Major automakers can resort to strategies such as smart supply chains, factory automation, and strategic restructuring to strengthen themselves. New capital investments are low in 2021, and companies are expected to redirect their capital flows to ongoing projects. Hence, the regional market in focus is expected to show positive growth over the forecast period.

What are the Revenue-generating Type Segments in the Engineering Plastics Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The engineering plastics market share growth by the ABS will be significant during the forecast period. ABS consist of butadiene, which is evenly distributed across the acrylonitrile-styrene matrix. The increasing concerns for reducing CO2 emissions are likely to drive the ABS engineering plastics market.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the engineering plastics market size and actionable market insights on post COVID-19 impact on each segment.

|

Engineering Plastics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.15% |

|

Market growth 2021-2025 |

$ 35.81 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

6.88 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 63% |

|

Key consumer countries |

China, US, Germany, India, and Japan |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

BASF SE, Celanese Corp., Chi Mei Corp., Covestro AG, DuPont de Nemours Inc., Formosa Plastics Corp., LANXESS AG, LG Chem Ltd., Mitsubishi Engineering-Plastics Corp., and Toray Industries Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Engineering Plastics Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive engineering plastics market growth during the next five years

- Precise estimation of the engineering plastics market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the engineering plastics industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of engineering plastics market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch