Exfoliators And Scrubs Market Size 2025-2029

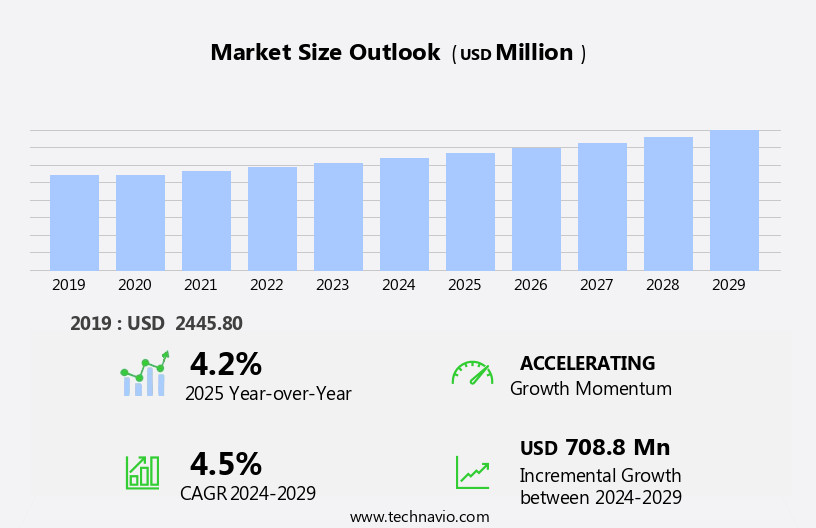

The exfoliators and scrubs market size is forecast to increase by USD 708.8 million at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for skin-care products that offer effective exfoliation. This trend is particularly prominent in regions with a high awareness of beauty and personal care, such as North America and Europe. Innovation in exfoliators and scrubs continues to shape the market, with new product launches that cater to diverse consumer preferences, including natural and organic options. However, the market faces challenges due to regulatory restrictions, particularly the ban on microbeads used in exfoliators and scrubs in various countries. Moreover, the integration of these treatments into mainstream healthcare, health and wellness practices is expected to boost market growth.

- This shift towards eco-friendly alternatives presents both challenges and opportunities for market players. Companies that can successfully innovate and adapt to these changing consumer preferences and regulatory requirements will be well-positioned to capitalize on the market's growth potential. Effective strategic planning and operational agility will be crucial for companies seeking to navigate this dynamic market landscape.

What will be the Size of the Exfoliators And Scrubs Market during the forecast period?

- The market is witnessing significant growth due to the increasing emphasis on scientific research and product differentiation in skincare routines. Safety standards and brand loyalty play a crucial role in consumers' skin care regimens, driving the demand for high-quality exfoliators and scrubs. Skin concerns, such as acne, aging, and hyperpigmentation, continue to fuel the market's growth. Digital platforms and skin analysis tools are transforming the industry by enabling personalized skincare solutions and product recommendations based on individual skin health and microbiome. Quality control, supply chain management, and skin care trends are key factors influencing the competitive advantage of market players.

- The market is expected to grow steadily, with the healthcare industry, medical tourism industry, and C3 Organization among the key players driving demand. Product claims backed by clinical trials and the involvement of skin care professionals in multi-step skincare routines further boost market growth. Ingredient synergy and product layering are becoming essential aspects of effective skincare, catering to evolving consumer preferences. The industry is subject to stringent regulations, ensuring product efficacy and safety. Skin health and the skin barrier are the focal points of ongoing research, offering opportunities for innovation and growth.

How is this Exfoliators And Scrubs Industry segmented?

The exfoliators and scrubs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Women

- Men

- Distribution Channel

- Offline

- Online

- Type

- Mechanical

- Chemical

- Enzyme

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- North America

By End-user Insights

The women segment is estimated to witness significant growth during the forecast period. Women make up the primary consumer base for body care products, specifically exfoliators and scrubs. These offerings catering to female consumers provide numerous advantages, such as minimizing ingrown hairs, enhancing circulation, and diminishing the look of cellulite. Moreover, these products contribute to improved skin texture, making it feel softer and more hydrated. Regular application of body scrubs aids in preventing acne and mitigating the signs of aging. Women can attain smoother, radiant skin that efficiently absorbs treatments and other products by incorporating a gentle body scrub into their routine. Exfoliating agents come in various forms, including mechanical (exfoliating brushes) and chemical (polyhydroxy acids or phas).

Frequency of use depends on individual skin types and sensitivities. For instance, sensitive skin may require less frequent use, while those with acne-prone skin might benefit from more frequent application. Skin irritation is a concern for some consumers, and natural ingredients, such as organic scrubbing particles, are increasingly popular due to their gentler approach. Product formulations catering to various skin types, including dry, oily, and combination skin, are essential. Specialty stores, beauty retailers, and online platforms offer a wide range of options for consumers to choose from. Consumer feedback plays a crucial role in shaping the market, with product reviews influencing purchasing decisions.

Subscription boxes and direct-to-consumer brands offer convenience and personalized recommendations. Skin regeneration and pore refining are additional benefits that attract consumers to these products. Despite the benefits, potential allergic reactions to certain ingredients necessitate careful consideration when selecting a body scrub.

The Women segment was valued at USD 1.84 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the realm of body care, the market for metal additive manufacturing in the production of exfoliating tools, such as mechanical brushes and body scrubs, experiences significant growth in the Asia Pacific (APAC) region. Fueled by the region's high population density and increasing consumer awareness of personal grooming, this market is poised for expansion. Exfoliating tools, including brushes and scrubs, are gaining popularity due to their ability to enhance skin texture, refine pores, and improve overall skin health. In countries like India and China, the growing middle class population is driving demand for these products. Moreover, the rising preference for skin-lightening exfoliators and scrubs in countries like Japan, India, China, and South Korea represents an emerging trend.

Sensitive skin types and those with acne-prone skin are increasingly seeking gentle exfoliating solutions. As a result, there is a growing demand for exfoliators with natural ingredients and organic formulations. Consumers are also paying close attention to product reviews and ingredient concentrations to ensure they find the right solution for their skin concerns. Specialty stores, beauty retailers, and online platforms cater to this demand, offering a wide range of exfoliating tools and formulations. Subscription boxes have also emerged as a popular choice for consumers looking to try new products and discover innovative solutions. Despite the benefits, allergic reactions and skin irritation are potential concerns for some consumers.

Manufacturers are addressing these issues by developing exfoliators with gentle, non-irritating ingredients and focusing on product safety and quality. Polyhydroxy acids (PHAs) are a popular choice for chemical exfoliants due to their gentler nature compared to traditional alpha hydroxy acids. These ingredients offer effective exfoliation while minimizing the risk of skin irritation and dryness. The market for metal additive manufacturing in the production of exfoliating tools and scrubs in the APAC region is experiencing strong growth, driven by increasing consumer awareness, rising demand for gentle, effective solutions, and the popularity of natural and organic formulations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Exfoliators And Scrubs market drivers leading to the rise in the adoption of Industry?

- The wave in consumer preference for skin-lightening exfoliators and scrubs serves as the primary growth catalyst for the market. Skin-lightening exfoliators and scrubs have gained significant popularity in the global market due to the increasing consumer demand for products that address various skin issues, such as pigmentation, discoloration, acne marks, age spots, and medical conditions like melasma, hyperpigmentation, vitiligo, and rosacea. The market for these products is not limited to women, as men are also increasingly investing in personal grooming and personal care. APAC, particularly countries like China, India, and Japan, has witnessed a high demand for skin-lightening and brightening exfoliators and scrubs for men, as fairness of the skin is often associated with youth and beauty in these cultures.

- The demand for these products in the US and the UK is also driven by the growing immigrant population and the expanding base of ethnic minorities. The market for skin-lightening exfoliators and scrubs is expected to grow due to the increasing awareness of personal grooming and the availability of a wide range of products catering to various skin types and concerns. The market is dynamic and competitive, with various companies offering innovative products and marketing strategies to attract and retain customers. Consumers are encouraged to make informed decisions by considering factors such as product ingredients, effectiveness, and affordability.

What are the Exfoliators And Scrubs market trends shaping the Industry?

- The emerging market trend revolves around innovation in the development of exfoliators and scrubs, offering consumers effective and advanced skincare solutions. The facial care market has witnessed significant advancements, leading to an expansion of innovative and effective exfoliators and scrub offerings. Consumers' demand for multifunctional products that remove impurities and dead cells while addressing ancillary needs such as hydration and antioxidant properties has driven market growth. Manufacturers continue to introduce new products catering to these demands. For example, APIVITA's Face Scrub Line uses organic green tea infusion instead of water for added antioxidant benefits.

- The increasing preference for high-quality, performance-driven products, regardless of cost, underscores the market's potential. Consumers' expectations go beyond basic requirements, making it essential for manufacturers to deliver value-added solutions.

How does Exfoliators And Scrubs market faces challenges face during its growth?

- The implementation of bans on microbeads in exfoliators and scrubs poses a significant challenge to the industry's growth trajectory. This regulatory development necessitates adjustments in product formulations and manufacturing processes for companies in the personal care sector. Exfoliators and scrubs are popular personal care products used for cleansing and removing dead skin cells. Microbeads, a common ingredient in these products, are small plastic particles that offer an effective exfoliating experience. However, the environmental concerns surrounding microbeads have gained significant attention. These particles, which measure less than 5 millimeters, are not biodegradable and contribute to the accumulation of microplastics in water bodies. This pollution poses a threat to aquatic life, as animals may mistake microbeads for food. Moreover, microbeads can cause bruising on the skin of users. In response to these concerns, several European countries have enacted laws banning the use of microbeads in cosmetics.

- Consumers are increasingly seeking alternatives to microbeads, such as natural exfoliants like sugar, salt, and coffee grounds. This shift in consumer preferences is expected to impact the market, driving demand for eco-friendly alternatives. The environmental concerns and consumer preferences for natural ingredients are key market dynamics shaping the exfoliators and scrubs industry. Companies are responding to these trends by introducing new products that cater to the growing demand for natural and sustainable personal care solutions.

Exclusive Customer Landscape

The exfoliators and scrubs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the exfoliators and scrubs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, exfoliators and scrubs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amway Corp.- The company offers exfoliators and scrubs such as Artistry Signature Select Polishing Body Scrub and Attitude Be Bright Herbals 2 in 1 Scrub and Mask.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3LAB.COM

- Amorepacific Corp.

- Beiersdorf AG

- Chanel Ltd.

- Groupe Clarins

- Grupo Boticario

- Home and Body Co.

- Johnson and Johnson Services Inc.

- Kao Corp.

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Natura and Co Holding SA

- Oriflame Cosmetics S.A.

- PEP Technologies Pvt. Ltd.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

- Yunos Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Exfoliators And Scrubs Market

- The market has witnessed significant developments in recent years, with key players focusing on product innovation, technological collaborations, and strategic mergers and acquisitions to expand their market presence. Here are the most notable developments from 2024 to 2025:

- In Q1 2024, Unilever, a leading consumer goods company, launched a new range of Face Care Exfoliators under its popular brand, Dove. The new product line includes gentle exfoliating pads infused with aloe vera and vitamin E, catering to the increasing demand for mild and effective exfoliating solutions (Unilever Press Release, 2024).

- In H2 2024, L'Oréal, the world's largest cosmetics company, announced a strategic partnership with Clarins S.A., a French skincare company, to develop advanced exfoliating technologies. The collaboration aims to create innovative exfoliators using natural ingredients, addressing the growing consumer trend towards eco-friendly and sustainable personal care products (L'Oréal Press Release, 2024).

- In Q3 2025, Beiersdorf AG, the German skincare giant, acquired a majority stake in The Body Shop International plc, a leading ethical beauty retailer. The acquisition will enable Beiersdorf to expand its presence in the market, leveraging The Body Shop's strong brand reputation and extensive retail network (Beiersdorf AG Press Release, 2025).

- In Q4 2025, Estée Lauder Companies, a leading cosmetics manufacturer, launched a new line of advanced exfoliating treatments under its prestige brand, La Mer. The new product line includes a micro-exfoliating powder and a peel pad system, utilizing innovative ingredients such as sea kelp and diamond powder to deliver gentle yet effective exfoliation (Estée Lauder Companies Press Release, 2025).

- These strategic developments demonstrate the dynamic nature of the market, with companies continuously innovating and expanding their offerings to cater to evolving consumer preferences and trends.

- According to the latest market research report by Technavio, the market is expected to grow at a CAGR of over 5% from 2021 to 2026, driven by the increasing demand for natural and organic personal care products and the growing popularity of facial exfoliators. (Technavio, Global market 2021-2026)

Research Analyst Overview

The market for exfoliators and scrubs continues to evolve, catering to the diverse needs of consumers seeking to maintain healthy and radiant skin. This segment encompasses a range of products designed to remove dead skin cells and debris, revealing smoother, brighter skin. Two primary methods dominate the landscape: mechanical exfoliation and chemical exfoliation. Mechanical exfoliators, such as exfoliating brushes and body scrubs, employ physical means to eliminate impurities. The use of natural ingredients adds appeal to this category, as consumers increasingly demand products that align with their preference for more organic and sustainable offerings. Frequency of use varies, with some opting for daily application and others adhering to a weekly regimen.

Body care is a significant area where exfoliators and scrubs find a strong foothold. These products are not only effective in addressing various skin concerns but also serve as a crucial step in overall body care routines. However, it is essential to consider individual skin sensitivities, as allergic reactions can occur with certain ingredients or application methods. Skin brightening and skin tone are essential concerns for many consumers, leading to a swell in demand for exfoliators and scrubs formulated with ingredients that promote these benefits. Skin regeneration is another key area where these products excel, contributing to the continuous growth of the market.

In addition, these products often contain ingredients such as caffeine, retinol, and herbal extracts, which are believed to help reduce the appearance of cellulite. Specialty stores and direct-to-consumer brands have emerged as key players in the market, offering a wide selection of products tailored to various skin types and concerns. Application methods vary, with some preferring traditional scrubbing particles and others embracing innovative formulations, such as polyhydroxy acids (PHAs), which provide gentle yet effective exfoliation for acne-prone skin. Product reviews play a significant role in consumer decision-making, with online retailers and beauty stores serving as popular platforms for sharing feedback and recommendations. Consumers seek products that cater to their unique skin needs, with a focus on skin texture, pore refining, and skin irritation relief.

Organic ingredients and product formulations have gained significant traction in the market, as consumers increasingly prioritize natural and eco-friendly offerings. Subscription boxes have also emerged as a popular choice for those seeking regular deliveries of high-quality exfoliating products. The market continues to evolve, driven by consumer demand for effective and natural solutions to maintain healthy, radiant skin. The landscape is diverse, with a range of products and application methods catering to various skin types and concerns. As the market continues to grow, it will be essential for brands to stay attuned to consumer preferences and deliver innovative, high-quality offerings.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Exfoliators And Scrubs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 708.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

China, US, Japan, India, Germany, South Korea, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Exfoliators And Scrubs Market Research and Growth Report?

- CAGR of the Exfoliators And Scrubs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the exfoliators and scrubs market growth and forecasting

We can help! Our analysts can customize this exfoliators and scrubs market research report to meet your requirements.