Fabric Conditioner Market Size 2025-2029

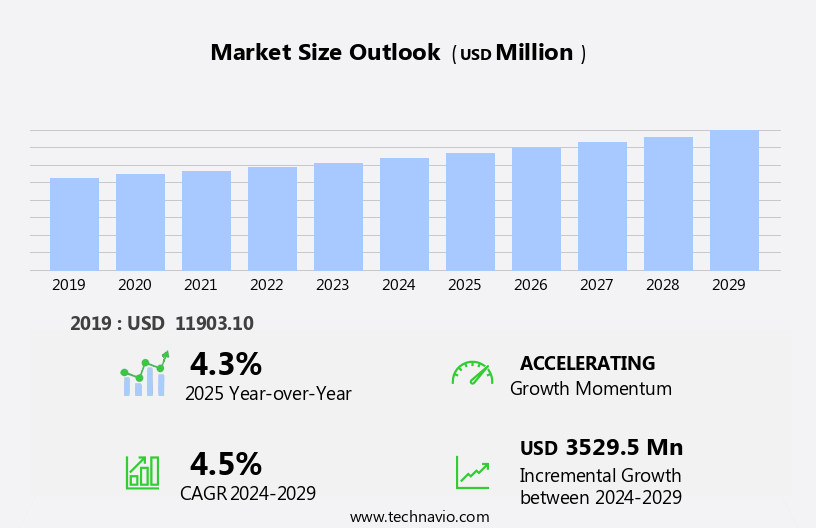

The fabric conditioner market size is forecast to increase by USD 3.53 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing preference for concentrated fabric conditioners. These products offer several advantages, including cost savings, reduced packaging, and improved environmental sustainability. Furthermore, the demand for new formats, such as pods, detergents and tablets, is fueling market expansion. However, the market faces challenges in the form of low penetration of advanced fabric conditioner products in developing regions. Consumers in these areas often rely on traditional methods for fabric care, presenting an opportunity for market players to introduce affordable and effective solutions. To capitalize on this potential, companies must focus on innovation, localization, and strategic partnerships.

- By addressing the unique needs of consumers in developing regions, they can expand their customer base and drive market growth. Additionally, investments in research and development to create advanced, eco-friendly fabric conditioners will help companies differentiate themselves in a competitive landscape. Overall, the market holds immense potential, with opportunities for growth in emerging markets and the development of innovative, sustainable products.

What will be the Size of the Fabric Conditioner Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by consumer preferences for enhanced fabric care and evolving industry trends. Performance-focused fabric care products, such as liquid fabric softeners and sheet fabric softeners, are gaining popularity due to their ability to provide superior fabric conditioning benefits. Scent intensity and fragrance preferences remain key differentiators, with advertising campaigns leveraging scent marketing to capture consumer attention. Packaging design plays a crucial role in market dynamics, with e-commerce platforms driving demand for sustainable and recyclable materials. Industry regulations and product safety testing are essential considerations, shaping pricing strategies and consumer trust. Concentrated formulas and ingredient disclosure are becoming increasingly important, as are sustainable packaging and environmental regulations.

cationic surfactants and static reduction technologies are essential fabric conditioning agents, while fragrance encapsulation and color protection technology offer additional benefits. Fabric conditioner dispensers, manual and automatic, cater to various consumer preferences and retail channels. Brand awareness and consumer loyalty are fostered through digital marketing, social media, and public relations efforts. New product development, including plant-based formulas and anti-bacterial properties, continues to shape the market landscape. Consumer safety, allergen information, and fabric feel remain key concerns, with fabric conditioners offering a range of fragrance profiles and static control agents to meet diverse consumer needs. The home care products sector, including laundry detergents and fabric conditioners, remains a dynamic and evolving market.

How is this Fabric Conditioner Industry segmented?

The fabric conditioner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- RCFS

- Dryer sheets

- Application

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

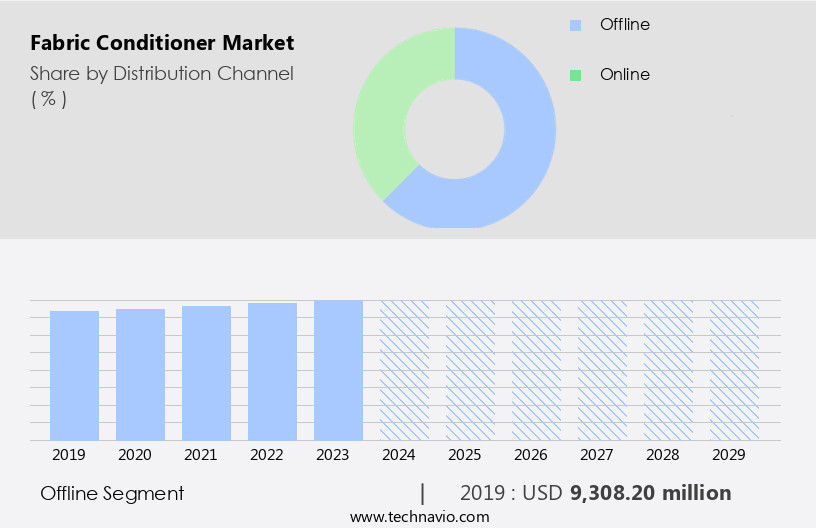

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses the sales of fabric softeners and related fabric care products through various distribution channels. Liquid fabric softeners, sheet fabric softeners, and fabric conditioner dispensers are popular offerings in this market. Product differentiation is achieved through scent intensity, color protection technology, static reduction, and fabric feel. Marketing strategies include advertising campaigns, fragrance marketing, and digital marketing. E-commerce platforms have gained traction, influencing sales trends. Industry regulations mandate product safety testing, sustainable packaging, and environmental regulations. Concentrated formulas, ingredient disclosure, and recyclable materials are key pricing strategies. New product development, such as plant-based formulas and anti-bacterial properties, cater to consumer preferences.

Automatic dispensers and fabric conditioner agents are also part of the market landscape. Manufacturers employ brand awareness initiatives, social media marketing, and public relations to engage consumers. The offline distribution channel, including specialty stores, hypermarkets, and department stores, continues to generate revenue despite declining sales due to increasing online shopping trends. Competition intensifies as manufacturers expand their retail presence. Consumer safety, fragrance profiles, and allergen information are essential product labeling considerations. The market evolves with evolving consumer preferences and industry regulations.

The Offline segment was valued at USD 9.31 billion in 2019 and showed a gradual increase during the forecast period.

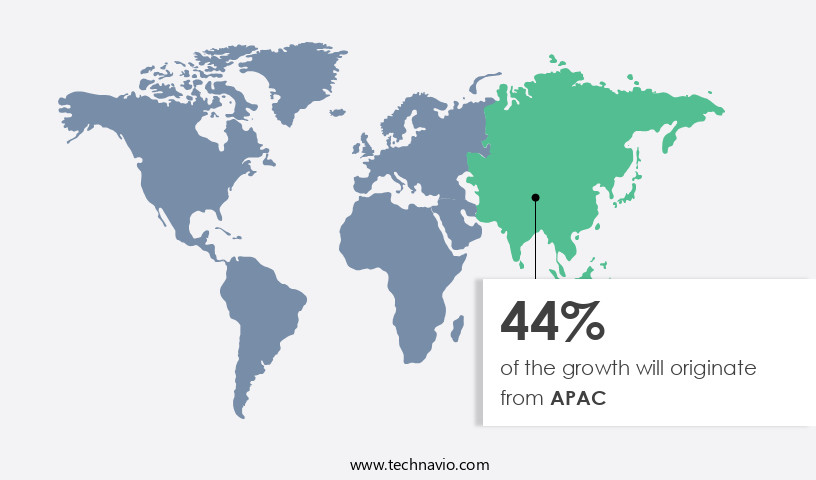

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) represents a substantial segment of the global fabric conditioner industry. China, Japan, and India are prominent markets for fabric conditioners in APAC. Factors fueling the market's growth include globalization, an increasing number of households, expanding penetration of washing machines, consumer preference for advanced fabric conditioner products, and shifts in consumer preferences towards fabric conditioners. The increasing popularity of e-commerce platforms presents opportunities for manufacturers selling fabric conditioner products. They distribute their offerings through both third-party retailers and their own websites. Product differentiation, scent intensity, color protection technology, static reduction, and fabric feel are essential features driving consumer preferences.

Manufacturers focus on product safety testing, sustainable packaging, and environmental regulations to cater to evolving consumer demands. Concentrated formulas, ingredient disclosure, and pricing strategies are other critical factors influencing the market. New product development, brand awareness, and consumer loyalty are key areas of focus for market participants. Fabric conditioner dispensers, fragrance encapsulation, sheet fabric softeners, and automatic dispensers are some of the product innovations in the market. Manufacturers prioritize brand loyalty, social media marketing, and public relations to expand their consumer base. Plant-based formulas, anti-bacterial properties, and allergen information are emerging trends in the fabric conditioner industry. Safety standards, static control agents, and fabric conditioning agents are essential components of fabric conditioners. The market's evolution is shaped by consumer preferences, industry regulations, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fabric Conditioner Industry?

- The increasing preference for concentrated fabric conditioners is the primary factor fueling market growth in this sector.

- Concentrated fabric conditioners, characterized by their thicker consistency and reduced dilution compared to traditional fabric softeners, have gained significant traction in the global market. These formulas offer several advantages, including the ability to serve the same purpose with fewer quantities, resulting in less packaging and water usage during manufacturing. Furthermore, the compact size of concentrated fabric conditioners allows for increased transportation capacity, thereby reducing fuel consumption and associated costs. The rising popularity of concentrated fabric conditioners can be attributed to the expanding global middle class, particularly in emerging markets. Consumers in these regions are increasingly seeking cost-effective and efficient solutions for their fabric care needs.

- Marketing strategies, such as product differentiation through scent intensity and fragrance encapsulation, have played a crucial role in the growth of the market. Advertising campaigns highlighting the benefits of concentrated fabric conditioners, like color protection technology, static reduction, and the use of biodegradable ingredients, have also contributed to their market penetration. Innovations in fabric conditioner dispensers, such as those utilizing silicone polymers, have further enhanced the appeal of concentrated fabric conditioners. These advancements offer consumers a more immersive and harmonious fabric care experience, emphasizing the importance of fabric conditioners in overall fabric care solutions.

What are the market trends shaping the Fabric Conditioner Industry?

- The demand for innovative formats of fabric conditioners is gaining momentum in the market. This emerging trend signifies a shift towards more convenient and effective solutions for fabric care.

- Fabric conditioners continue to evolve, offering various forms including capsules, sprays, bars, and crystals. One eco-friendly alternative is the ball-shaped organic fabric conditioner, made of wool and lasting for multiple washes. Procter & Gamble's Downy Unstoppable provides a wide selection of fragrances in spray and crystal formats. Unilever's Comfort brand has introduced liquid capsules in Europe and China, ensuring consistent conditioner usage with each capsule. Another innovation from Downy Infusions utilizes scent beads with various fragrances for long-lasting, multi-layered fabric fragrance. Industry regulations prioritize product safety testing and sustainable packaging, with recyclable materials and environmental certifications becoming increasingly important. Cationic surfactants, a key ingredient in fabric conditioners, undergo rigorous testing for safety and effectiveness.

- Pricing strategies vary, with some brands focusing on affordability while others emphasize premium fragrances and eco-friendly packaging. Ingredient disclosure is also a growing trend, allowing consumers to make informed decisions based on their preferences and values.

What challenges does the Fabric Conditioner Industry face during its growth?

- The limited adoption of advanced fabric conditioners in developing regions represents a significant obstacle to the industry's expansion.

- The market faces growth challenges in developing regions due to the low adoption of advanced fabric conditioners and the prevalence of traditional laundry detergents. Price sensitivity and limited awareness about the benefits of fabric conditioning agents among the population are significant factors hindering market expansion. In countries like India, China, Indonesia, and the Philippines in the Asia Pacific region, the penetration of branded Laundry Care products is low, and fabric softeners and liquid detergents are not widely used. Instead, powder and bar detergents remain popular in rural areas. To expand their reach, market players are focusing on new product development, brand awareness campaigns, and safety standards compliance.

- Scent marketing through online sales channels is also a popular strategy to attract consumers. Static control agents are increasingly being incorporated into fabric conditioners to cater to consumer demands. Social media marketing is being utilized to engage with the target audience and promote product labeling transparency. Despite these efforts, the market growth is restrained due to the aforementioned challenges.

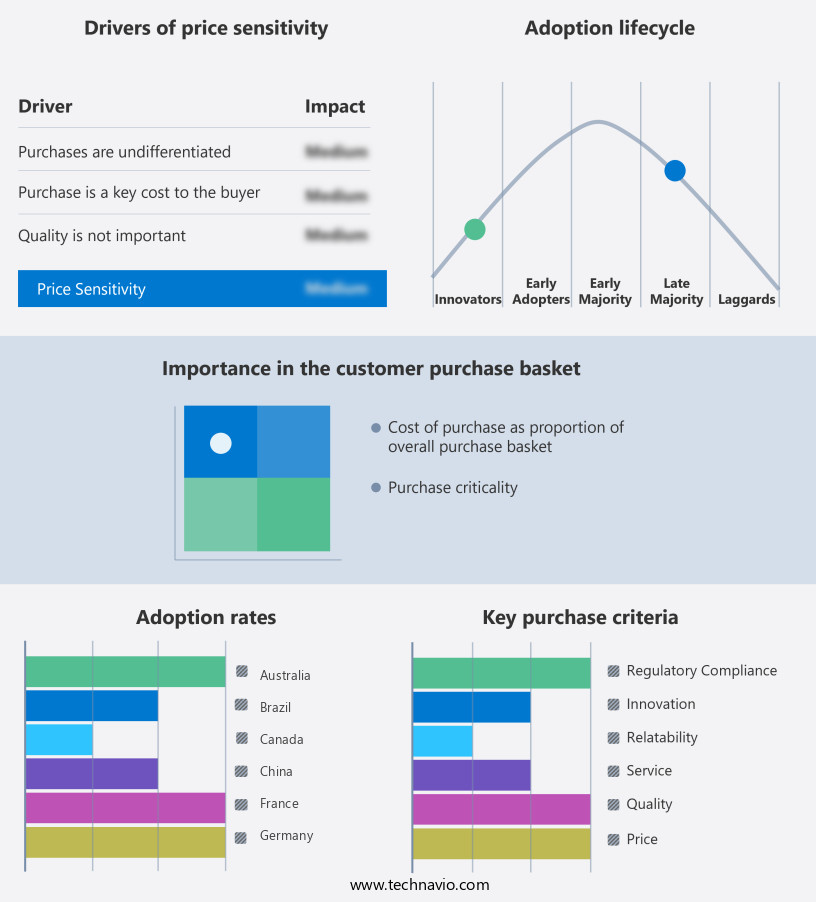

Exclusive Customer Landscape

The fabric conditioner market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fabric conditioner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fabric conditioner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Church and Dwight Co. Inc. - Arm and Hammer, a leading provider of innovative home solutions, introduces its fabric conditioner product line. This conditioner optimizes laundry performance by enhancing fabric softness, reducing wrinkles, and extending the life of clothes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Dropps

- Henkel AG and Co. KGaA

- Industrias AlEn SA de CV

- Kao Corp.

- LG Corp.

- Lion Corp.

- Marico Ltd.

- Melaleuca Inc.

- NeoVchem

- Norfolk Natural Living

- Pigeon Corp.

- PZ Cussons Plc

- Reckitt Benckiser Group Plc

- S.C. Johnson and Son Inc.

- The Procter and Gamble Co.

- Unilever PLC

- Werner and Mertz GmbH

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fabric Conditioner Market

- In February 2024, Procter & Gamble (P&G), a leading player in the market, introduced a new eco-friendly fabric conditioner, named "Free & Clear," in the United States. This product is free from dyes, fragrances, and chlorine bleach, catering to the growing consumer preference for sustainable and hypoallergenic products (P&G Press Release, 2024).

- In March 2025, Unilever, another major fabric conditioner manufacturer, announced a strategic partnership with Google to develop a voice-activated fabric conditioner refill service. This collaboration aims to enhance convenience for consumers and reduce plastic waste by enabling refills through Google's voice assistant, Google Assistant (Unilever Press Release, 2025).

- In May 2024, Henan Xinte Chemical Co. Ltd., a Chinese fabric conditioner manufacturer, completed a USD300 million expansion project to increase its annual production capacity by 50%. This expansion is expected to strengthen the company's market position and meet the growing demand for fabric conditioners in China and other Asian markets (Henan Xinte Chemical Co. Ltd. Press Release, 2024).

- In January 2025, the European Union (EU) approved new regulations on single-use plastics, including fabric conditioner bottles. Manufacturers will be required to ensure that at least 25% of their plastic packaging is recycled content by 2025 and 30% by 2030. This policy change is expected to drive innovation and investment in sustainable fabric conditioner packaging solutions (European Commission Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, customer experience and consumer trust play pivotal roles. Consumers increasingly seek eco-friendly production methods and skin-friendly formulas, reflected in the growing popularity of mineral oil-free and recycled material-based products. Product reviews and consumer feedback shape brand reputation, with transparency in ingredient sourcing and cost optimization essential for maintaining consumer satisfaction. Supply chain management and production optimization are crucial for meeting demand, while fabric damage prevention through microcapsule technology and anti-static agents enhance laundry efficiency. Scent customization and personalized fragrance options cater to individual preferences, aligning with the trend towards home care tips tailored to specific fabric types.

- Brands prioritize social responsibility and sustainability, integrating sustainable sourcing and bio-based materials into their offerings. Marketing analytics enable targeted campaigns, while fabric conditioning benefits extend beyond softness to include fabric longevity and cost savings. Consumer education on fabric care tips and laundry care techniques further strengthens market growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fabric Conditioner Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 3529.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, UK, Canada, Japan, India, Germany, Australia, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fabric Conditioner Market Research and Growth Report?

- CAGR of the Fabric Conditioner industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fabric conditioner market growth of industry companies

We can help! Our analysts can customize this fabric conditioner market research report to meet your requirements.