Fast Casual Restaurants Market Size 2025-2029

The fast casual restaurants market size is forecast to increase by USD 181.6 billion, at a CAGR of 16.1% between 2024 and 2029.

- The market is characterized by a significant demand for innovation and customization in food menus, driven by consumers' evolving preferences and expectations. This trend is further fueled by the increasing popularity of chef-driven fast casual restaurant franchises, which offer unique culinary experiences , fresh food and higher quality ingredients. However, this market faces intense competition from quick-service restaurants, which continue to dominate the food industry with their affordability and convenience.

- Navigating this competitive landscape requires strategic planning and a focus on differentiating offerings through unique menu items, efficient operations, and exceptional customer service. Companies that successfully balance affordability, quality, and innovation are well-positioned to capitalize on the growing demand for customized dining experiences in the fast casual restaurant sector.

What will be the Size of the Fast Casual Restaurants Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The fast casual restaurant market continues to evolve, with dynamic market dynamics shaping various sectors. Quick service restaurants (QSRs) are increasingly integrating mobile ordering and recipe management systems for operational efficiency and customer convenience. Online ordering and delivery services are gaining popularity, driving sales growth and brand awareness. Seasonal menus cater to customer preferences, while operational efficiency is enhanced through inventory management and kitchen equipment. Customer retention is a key focus, with employee training, customer service, and community engagement essential for fostering loyalty. Franchise models offer expansion opportunities, while health inspections ensure hygiene standards. Table service and counter service options cater to diverse customer needs.

Food cost control, allergen management, and menu engineering are crucial for maintaining profitability. Sales forecasting and price optimization help manage peak demand. Social media marketing and online reputation management are essential for effective brand management. Restaurant design, labor management, and supply chain management are ongoing concerns. Dietary restrictions and menu customization cater to diverse customer needs. Technology adoption, from point-of-sale systems to data analytics, is transforming the industry. Limited service restaurants, casual dining, and full service restaurants each face unique challenges and opportunities. The fast casual dining sector continues to unfold, with ongoing patterns and applications across various aspects of the industry.

How is this Fast Casual Restaurants Industry segmented?

The fast casual restaurants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- North American cuisine

- Italian

- Mexican

- Others

- Channel

- Dine-in

- Takeaway

- Type

- Franchised

- Standalone

- End-User

- Health-Conscious

- Family-Oriented

- Young Professionals

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The north american cuisine segment is estimated to witness significant growth during the forecast period. Fast casual dining is a thriving sector in the US market, with millions of consumers, particularly millennials, opting for quick, fresh, and convenient meal options daily. According to industry estimates, approximately one-third of children and teenagers in the US, Canada, and select Asian and European countries consume sandwiches, burgers, or similar quick-serve foods daily, contributing significantly to their dietary needs. In response, fast casual restaurants in the US, UK, and Australia have expanded their menus to include healthier options, recognizing the demand for nutritious meals among this demographic. The fast casual dining industry is also leveraging technology to streamline operations and enhance customer experience.

The North American cuisine segment was valued at USD 46.80 billion in 2019 and showed a gradual increase during the forecast period. Mobile ordering and recipe management systems facilitate efficient food preparation and menu customization, while online ordering, delivery services, and sales forecasting enable restaurants to optimize peak demand and manage inventory effectively. Social media marketing and online reputation management help build brand awareness and engage with customers, while employee training programs ensure consistent food quality and customer service. Food safety, hygiene standards, and allergen management are crucial aspects of fast casual dining, with menu engineering and ingredient sourcing playing a significant role in maintaining operational efficiency and controlling food costs. Franchise models and technology adoption have enabled rapid expansion and growth for many fast casual chains, with community engagement and customer loyalty programs fostering long-term relationships and repeat business.

Fast casual restaurants are also embracing digital marketing, data analytics, and peak demand management to optimize pricing and attract new customers. Sales growth, customer retention, and brand management are key priorities for this sector, with kitchen equipment, table service, and store layouts designed to create an immersive and harmonious dining experience. Menu engineering and promotional offers cater to dietary restrictions and diverse palates, ensuring a broad customer base. The fast casual dining market is characterized by a strong focus on operational efficiency, customer satisfaction, and innovation. From menu customization and food safety to technology adoption and community engagement, fast casual restaurants are continually evolving to meet the changing needs and preferences of consumers.

Regional Analysis

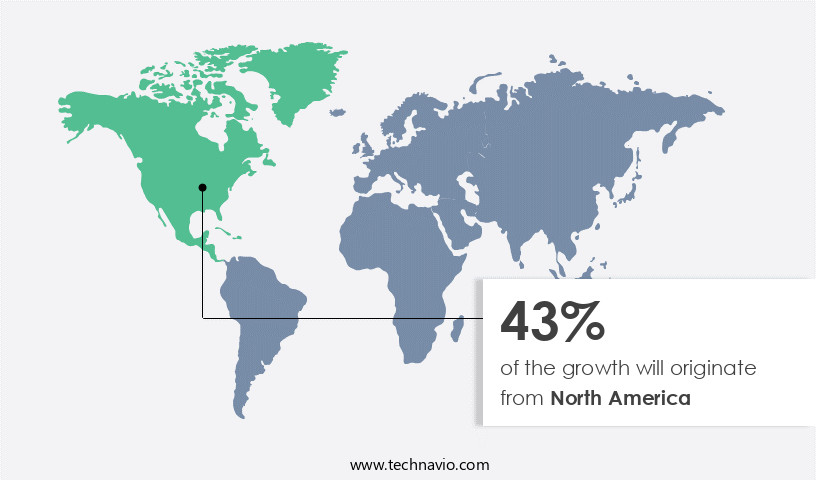

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Fast casual dining in North America is experiencing a significant trend towards customization, particularly among millennial consumers. Bowls have emerged as a popular solution to cater to this demand, offering a visually appealing presentation and flexibility for customers to personalize their meals. Chipotle Mexican Grill is an exemplary fast casual restaurant that capitalizes on this trend. Their extensive food offerings in bowls enable customers to easily substitute one ingredient for another, benefiting both the customers and the restaurant's operational efficiency. This customization option enhances customer satisfaction and loyalty while streamlining food preparation processes. Additionally, fast casual restaurants are employing various marketing strategies, such as online ordering, delivery services, and social media marketing, to expand their reach and engage with their audience.

Seasonal menus and menu engineering further contribute to sales growth and brand awareness. Other essential aspects of the fast casual dining market include operational efficiency, waste management, employee training, supply chain management, labor management, food cost control, and food safety. Restaurant franchising, technology adoption, and community engagement are also crucial elements in the industry's evolution. Fast casual restaurants continue to innovate, offering menu customization, sales forecasting, and customer loyalty programs to cater to diverse dietary restrictions and preferences. The market's focus on digital marketing, data analytics, and peak demand management ensures a seamless customer experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving food industry, the market continues to thrive, offering consumers a unique blend of affordability, convenience, and quality. These establishments, characterized by their self-service or order-at-the-counter model, prioritize fresh, made-to-order meals using high-quality ingredients. Fast casual restaurants cater to diverse palates, with menus featuring a range of options from salads and sandwiches to bowls, wraps, and flatbreads. Sustainability and customization are key trends in this market, with many restaurants offering locally sourced, organic, and gluten-free choices. Technology integration, including mobile ordering and contactless payment, enhances the customer experience. The market is poised for continued growth, appealing to health-conscious consumers seeking a more personalized and efficient dining experience.

What are the key market drivers leading to the rise in the adoption of Fast Casual Restaurants Industry?

- The significant demand for innovation and customization in food menus serves as the primary market driver, fueling the industry's growth.

- Fast casual restaurants have gained significant traction in the market due to evolving consumer preferences. Millennials, in particular, seek innovative and exotic-flavored food with customization options based on dietary restrictions or calorie intake. This trend is driven by the increasing importance of health and wellness, as well as food allergies. Effective supply chain management and labor management are crucial for fast casual restaurants to maintain food cost control. Restaurant design plays a vital role in creating an immersive and harmonious dining experience. Social media marketing is essential for online reputation management and reaching a wider audience.

- Allergen management is a key consideration for catering to diverse consumer needs. Menu customization and sales forecasting help restaurants meet consumer demands and optimize operations. Hygiene standards are non-negotiable for maintaining customer trust and safety. Kitchen equipment is a significant investment for fast casual restaurants, requiring ongoing maintenance and replacement. The fast casual restaurant market is dynamic and competitive, with a focus on meeting evolving consumer preferences, optimizing operations, and maintaining high standards for food quality and safety.

What are the market trends shaping the Fast Casual Restaurants Industry?

- Chef-driven fast casual restaurant franchises are gaining significant popularity in the current market, representing an emerging trend in the food industry. These establishments offer high-quality meals prepared by professional chefs, combining the convenience of fast food with the culinary expertise of a formal dining experience.

- Fast casual restaurants, a segment of the quick service industry, are experiencing significant growth due to several market dynamics. Notable figures like Steve Ells and Chipotle Mexican Grill are often credited for spearheading this trend. The millennial generation's foodie culture and social media influence have contributed to the increasing popularity of these establishments. Chef-driven fast casual restaurants prioritize customer service, employee retention, and community engagement through locally sourced ingredients and table service where available. Franchise models enable expansion while maintaining brand consistency. Technology adoption streamlines inventory management and staff management, ensuring efficient operations. Health inspections and brand management are crucial aspects of this industry.

- Chef-driven fast casual restaurants offer high-quality food at fast casual prices, making them attractive to health- and taste-conscious consumers. The focus on training and kitchen optimization allows franchisees to replicate the chef-crafted fare effortlessly. The chef-driven fast casual restaurant market is thriving, with a strong emphasis on quality, innovation, and operational efficiency. The integration of technology and the shift towards local sourcing further enhances the dining experience for customers. Franchising remains a popular growth strategy, enabling expansion while preserving brand identity.

What challenges does the Fast Casual Restaurants Industry face during its growth?

- The growth of the food industry is significantly impacted by rigorous competition from quick-service restaurants, presenting a major challenge.

- Fast casual dining has emerged as a popular choice for consumers seeking a more immersive and harmonious dining experience, with a focus on healthier, freshly prepared meals. Millennials, in particular, are the primary target demographic, as they prioritize food safety and ingredient sourcing over the traditional quick-service restaurant model. To cater to this trend, fast casual restaurants are engineering their menus to offer healthier options, while maintaining the convenience of counter service. Moreover, price optimization, peak demand management, and digital marketing strategies are essential components of the fast casual dining business model. Customer loyalty programs and promotional offers further enhance the dining experience and foster repeat business.

- Data analytics plays a crucial role in menu engineering and price optimization, allowing restaurants to effectively manage inventory and adjust offerings based on consumer demand. The fast casual dining sector continues to evolve, with a focus on creating a casual, yet engaging atmosphere that appeals to the modern consumer. By prioritizing food safety, ingredient sourcing, and customer experience, fast casual restaurants are setting themselves apart from traditional quick-service establishments and positioning themselves for long-term success.

Exclusive Customer Landscape

The fast casual restaurants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fast casual restaurants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fast casual restaurants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Chipotle Mexican Grill - This company specializes in serving a diverse menu, including burritos, burrito bowls, quesadillas, salads, tacos, sides, and drinks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chipotle Mexican Grill

- Panera Bread

- Panda Restaurant Group

- Five Guys Holdings

- Firehouse Restaurant Group

- Blaze Pizza

- MOD Pizza LLC

- Noodles & Company

- Shake Shack

- Sweetgreen

- Potbelly Sandwich Works

- Zoes Kitchen

- Cava Group Inc.

- Wingstop Inc.

- Jimmy John's

- Jersey Mike's Subs

- Tropical Smoothie Cafe

- Qdoba Mexican Eats

- Smashburger

- Dig Inn

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fast Casual Restaurants Market

- In January 2024, Chipotle Mexican Grill, a leading fast casual restaurant chain, announced the launch of its new digital ordering platform, Chipotle Digital Lines, in partnership with DoorDash. This collaboration aimed to reduce wait times for digital orders and improve the overall customer experience (Chipotle Press Release, 2024).

- In March 2024, Panera Brands, the parent company of Panera Bread and Au Bon Pain, completed the acquisition of the European fast casual chain, Paul, for €1.1 billion. This strategic move expanded Panera Brands' international presence and diversified its offerings (Panera Brands Press Release, 2024).

- In April 2025, Starbucks Corporation revealed its plans to invest USD1.3 billion in its global growth over the next three years, with a focus on expanding its delivery and digital capabilities. This significant investment underscores Starbucks' commitment to digital transformation and enhancing the customer experience (Starbucks Press Release, 2025).

- In May 2025, Shake Shack and Grubhub announced a multi-year partnership to further develop Shake Shack's digital and delivery capabilities. The collaboration includes the integration of Shake Shack's menu onto Grubhub's platform and the rollout of Shake Shack's delivery to more markets (Shake Shack Press Release, 2025).

Research Analyst Overview

- In the fast casual restaurant market, technology integration plays a pivotal role in enhancing operational efficiency and customer experience. Pricing strategies are carefully formulated to cater to diverse customer segments and optimize revenue management. Lease agreements are negotiated meticulously to balance affordability and prime real estate locations. Waste reduction strategies, such as supply chain optimization and energy efficiency, are essential for sustainability initiatives and reducing operating expenses. Market positioning and brand positioning differentiate restaurants, while franchise operations and employee satisfaction ensure consistent customer experience. Seating capacity and table turnover rate are critical factors in managing customer traffic during peak hours.

- Value proposition and competitive advantage are key drivers of success in this competitive landscape. Expansion strategies are data-driven, with location analysis and risk management informing decisions. Customer segmentation and marketing campaigns are essential for targeting specific demographics. Sustainability initiatives, such as waste reduction and energy efficiency, not only benefit the environment but also contribute to a positive brand image. Effective revenue management, including off-peak hour promotions and pricing strategies, maximizes earnings. Franchise operations and employee satisfaction are crucial for maintaining a strong competitive advantage. Competition analysis and data-driven decision making are essential for adapting to market trends and staying ahead of the competition.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fast Casual Restaurants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.1% |

|

Market growth 2025-2029 |

USD 181.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fast Casual Restaurants Market Research and Growth Report?

- CAGR of the Fast Casual Restaurants industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fast casual restaurants market growth of industry companies

We can help! Our analysts can customize this fast casual restaurants market research report to meet your requirements.