Fintech Market Size 2025-2029

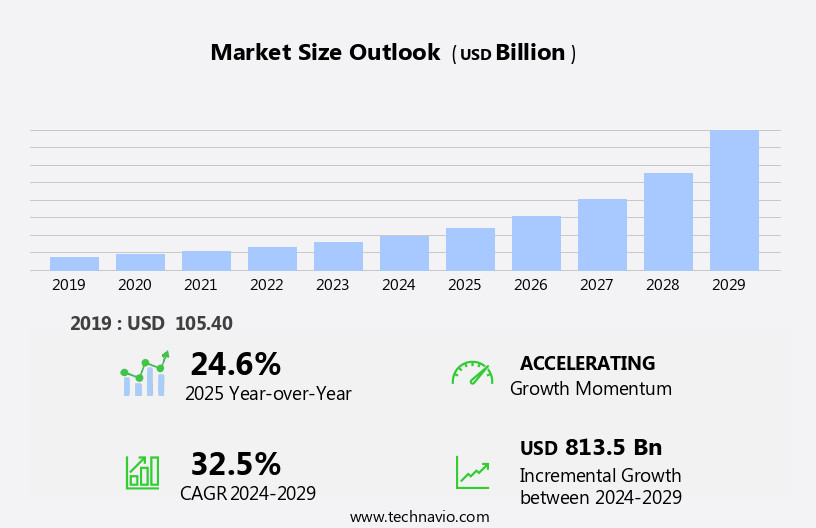

The fintech market size is forecast to increase by USD 813.5 billion, at a CAGR of 32.5% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven primarily by the influence of digitalization. Traditional financial institutions are increasingly adopting digital technologies to streamline operations, enhance customer experience, and expand their reach. This shift is leading to increased competition and disruption in the financial services industry. However, the market is not without challenges. The growing popularity of fintech solutions has raised concerns around privacy and security of personal information. As more financial transactions move online, ensuring the protection of sensitive data becomes paramount. Companies must invest in robust cybersecurity measures to mitigate risks and build trust with their customers.

- Additionally, navigating regulatory complexities and maintaining compliance with evolving regulations is a significant challenge for fintech players. These obstacles require strategic planning and innovative solutions to capitalize on the market's potential while addressing the concerns of stakeholders. Companies seeking to succeed in this dynamic market must focus on delivering secure, user-friendly, and innovative fintech solutions to meet the evolving needs of consumers and businesses.

What will be the Size of the Fintech Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with new technologies and applications emerging across various sectors. Open banking APIs enable seamless data sharing between financial institutions and third-party providers, revolutionizing account aggregation and investment management platforms. Regtech compliance solutions streamline regulatory reporting and KYC/AML procedures, while artificial intelligence (AI) and machine learning algorithms power advanced credit scoring models and fraud detection systems. Transaction processing is optimized through automated trading systems and mobile wallets, facilitating financial inclusion and microfinance solutions. Big data analytics and quantitative analysis tools provide valuable insights for portfolio optimization and risk management. Cybersecurity measures, including network security, data encryption, and biometric authentication, safeguard sensitive financial information.

Regulatory frameworks and compliance audits ensure adherence to data privacy regulations and insurtech solutions. Peer-to-peer lending and digital lending platforms offer alternative financing options, while incident response planning and disaster recovery planning ensure business continuity. Vulnerability assessments and penetration testing fortify security protocols, and blockchain technology offers secure, decentralized transaction processing. Cloud computing solutions and wealth management tools streamline financial operations, while API security and risk management tools mitigate potential threats. Remittance services and algorithmic trading enable efficient cross-border transactions, and interoperability standards facilitate seamless data exchange between different platforms. Cryptocurrency integration and predictive analytics offer innovative solutions for the future of fintech.

How is this Fintech Industry segmented?

The fintech industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- End-user

- Banking

- Insurance

- Securities

- Others

- Application

- Fraud monitoring

- KYC verification

- Compliance and regulatory support

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

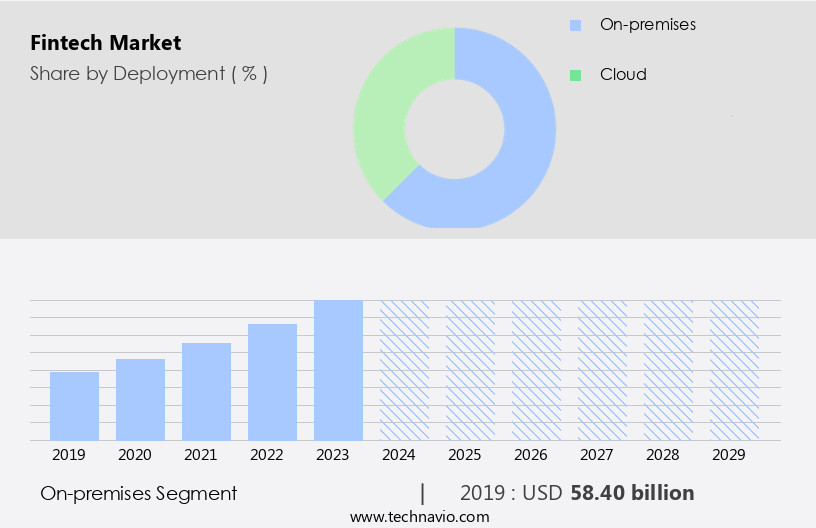

The on-premises segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of innovative technologies and services, including high-frequency trading, account aggregation, regtech compliance, compliance audits, artificial intelligence, regulatory reporting, investment management platforms, behavioral biometrics, credit scoring models, fraud detection systems, transaction processing, mobile wallets, microfinance solutions, quantitative analysis, financial inclusion, kyc/aml procedures, payment processing fees, portfolio optimization, cybersecurity measures, compliance training, peer-to-peer lending, vulnerability assessment, data analytics platforms, biometric authentication, disaster recovery planning, regulatory frameworks, data encryption, insurtech solutions, security protocols, customer onboarding, open banking APIs, underwriting processes, automated trading systems, penetration testing, payment gateways, business continuity planning, financial reporting, network security, big data analytics, transaction monitoring, blockchain technology, security awareness training, cloud computing solutions, wealth management tools, API security, risk management tools, remittance services, algorithmic trading, incident response planning, digital lending platforms, interoperability standards, financial modeling, crowdfunding platforms, data privacy regulations, cryptocurrency integration, machine learning algorithms, predictive analytics, digital identity verification, and risk assessment models.

These entities are transforming the financial industry by enhancing efficiency, improving customer experience, and ensuring regulatory compliance. High-frequency trading enables real-time market analysis and automated trading decisions, while account aggregation offers a consolidated view of customers' financial data. Regtech compliance solutions streamline regulatory reporting and automate KYC/AML procedures. Artificial intelligence and machine learning algorithms power advanced fraud detection systems and credit scoring models. Cybersecurity measures, including biometric authentication and data encryption, protect sensitive information. Cloud computing solutions and APIs facilitate seamless integration and data sharing, while blockchain technology ensures secure and transparent transactions. The market is also witnessing the emergence of insurtech solutions, digital lending platforms, and cryptocurrency integration, among others.

Despite the numerous benefits, challenges such as data privacy regulations, cybersecurity threats, and the need for robust compliance training persist. Overall, the market continues to evolve, driven by technological advancements and the growing demand for innovative financial solutions.

The On-premises segment was valued at USD 58.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

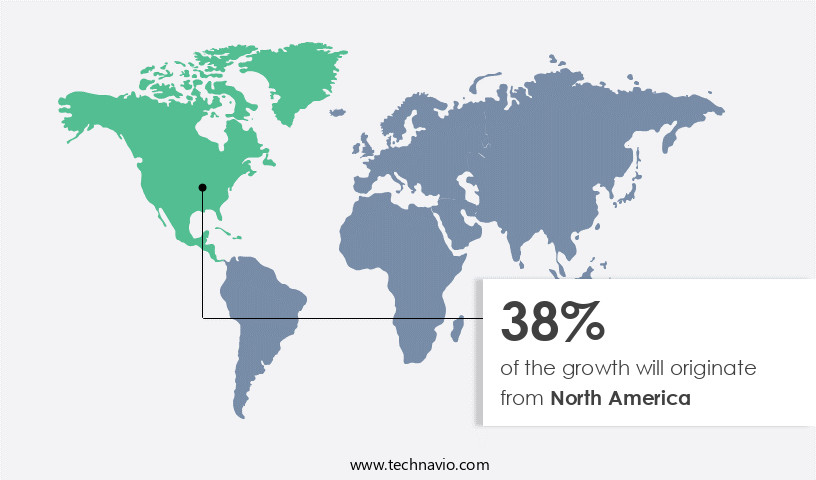

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing significant growth, fueled by the immense potential for expansion and the rapid adoption of advanced technologies. Blockchain technology, in particular, is driving innovation across various industries, attracting financial market startups to transform business and operational models. SMEs are also contributing to this growth, particularly in countries like China and India, which are leading the way in distributed ledger technology (DLT) adoption. DLT platforms, combined with increasing internet and smartphone penetration, have enabled the BFSI sector to introduce innovative solutions. Account aggregation, regulatory reporting, and investment management platforms are being enhanced through artificial intelligence (AI) and machine learning algorithms for improved efficiency and accuracy.

Behavioral biometrics, credit scoring models, and fraud detection systems are also being integrated to ensure better customer experience and security. Cybersecurity measures, compliance training, and regulatory frameworks are essential components of the fintech landscape, with companies implementing robust security protocols, data encryption, and vulnerability assessments. Peer-to-peer lending, digital identity verification, and risk assessment models are streamlining underwriting processes and automating transaction monitoring. Open banking APIs, payment gateways, and business continuity planning are ensuring seamless payment processing and disaster recovery. Insurtech solutions, wealth management tools, and risk management tools are leveraging big data analytics and predictive analytics for personalized offerings and enhanced customer experience.

Digital lending platforms, interoperability standards, and financial modeling are transforming the financial services industry, while remittance services and algorithmic trading are optimizing transaction processing and portfolio management. The market is continuously evolving, with emerging trends such as cryptocurrency integration, data privacy regulations, and cloud computing solutions shaping the future of financial services. Companies are focusing on API security, incident response planning, and cybersecurity awareness training to address the evolving threat landscape. As the market matures, collaboration and interoperability between various players will be crucial for sustainable growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is revolutionizing the financial industry by leveraging technology to deliver innovative solutions for banking, investments, payments, and insurance. Fintech companies are transforming traditional financial services through blockchain technology, artificial intelligence, and machine learning. They offer services such as peer-to-peer lending, robo-advisory, mobile payments, and digital wallets. Fintech startups are disrupting the status quo by providing more accessible, affordable, and convenient financial services. Consumers and businesses benefit from fintech's streamlined processes, real-time transactions, and personalized experiences. The fintech landscape is continuously evolving, with new players entering the market and existing ones expanding their offerings. This market is shaping the future of finance, making it more efficient, transparent, and inclusive.

What are the key market drivers leading to the rise in the adoption of Fintech Industry?

- The significant impact of digitalization plays a pivotal role in driving the growth of the market.

- The market is experiencing significant growth due to the increasing adoption of digital processes and the proliferation of smart-connected devices. With the Internet of Things (IoT) revolution, the number of machine-to-machine (M2M) communications is surging, enabling financial service providers to manage, monitor, and maintain connected devices more effectively. This trend is expected to continue, driven by the need for enhanced data security and real-time decision-making capabilities. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, cybersecurity measures, and regulatory frameworks are critical concerns for FinTech companies. To address these challenges, businesses are investing in advanced cybersecurity measures, such as vulnerability assessments, data encryption, biometric authentication, and disaster recovery planning.

- In addition, data analytics platforms and insurtech solutions are becoming increasingly popular for portfolio optimization and risk management. Compliance training, security protocols, and customer onboarding are essential components of a robust FinTech infrastructure. Peer-to-peer lending platforms and payment processing systems are also transforming the financial services landscape, offering lower fees and more personalized services. As the market continues to evolve, businesses must stay abreast of the latest trends and technologies to remain competitive.

What are the market trends shaping the Fintech Industry?

- The increasing recognition of blockchain technology is a significant market trend. This emerging technology is gaining considerable professional and public attention.

- The market is experiencing a notable shift towards the implementation of blockchain technology, which is gaining widespread acceptance due to its numerous advantages. Blockchain, known as the global leader in digital wallets, is increasingly being adopted by financial institutions for tasks such as authentication and document verification within the banking system. This technology streamlines in-house money transactions and optimizes cost structure settlements, leading to substantial savings for banks. Blockchain's ability to streamline transactions and reduce processing time and resources is a significant benefit. By utilizing this technology, financial institutions can reduce transaction processing costs, resulting in billions in savings.

- The technology's security features, including encryption and decentralization, also enhance network security and financial reporting, ensuring data integrity and reducing the risk of fraud. Moreover, the integration of open banking APIs, automated trading systems, and payment gateways with blockchain technology further enhances efficiency and security. Penetration testing, business continuity planning, and security awareness training are essential practices that complement the use of blockchain technology to ensure robust security. Additionally, cloud computing solutions and big data analytics enable financial institutions to leverage the power of data for transaction monitoring and wealth management tools. Overall, the adoption of blockchain technology in fintech is a game-changer, offering numerous benefits and driving innovation in the financial sector.

What challenges does the Fintech Industry face during its growth?

- The growth of the industry is significantly impacted by the heightened concerns surrounding the privacy and security of personal information, which poses a major challenge.

- The market expansion in developing nations faces challenges due to consumer unfamiliarity with online payment technologies, despite high Internet penetration. This hinders market growth. To address this, policymakers and industry leaders must promote fintech platforms through targeted initiatives. Fintech companies collect and utilize customer data for personalized advertising and targeted services. Risk management tools, such as algorithmic trading and predictive analytics, are essential for fintech businesses. Incident response planning and digital identity verification are crucial for maintaining data privacy and security. Interoperability standards facilitate seamless integration between digital lending platforms, remittance services, and cryptocurrency systems. Machine learning algorithms and data privacy regulations are key market drivers.

- Fintech companies must prioritize risk assessment models and incident response planning to mitigate potential risks. Crowdfunding platforms and financial modeling tools offer innovative financing solutions for businesses and individuals. As the fintech landscape evolves, market dynamics will continue to shift, with a focus on enhancing user experience and ensuring regulatory compliance.

Exclusive Customer Landscape

The fintech market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fintech market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fintech market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acorns Advisers LLC - As a leading fintech innovator, we specialize in payment processing solutions, enabling businesses to streamline transactions and optimize financial operations. Our advanced technology ensures secure, efficient, and customizable payment processing for various industries. By leveraging cutting-edge technology and adhering to industry regulations, we deliver seamless payment experiences to our clients, enhancing their customer engagement and boosting operational efficiency. Our commitment to innovation and excellence sets us apart in the competitive fintech landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acorns Advisers LLC

- Adyen NV

- Affirm Holdings Inc.

- AlphaSense Inc.

- Avant LLC

- Barker Brooks Communications Ltd.

- CLYDE TECHNOLOGIES INC.

- DMI Infotech Solutions Pvt. Ltd.

- Earnest Fintech

- FinTech Sandbox Inc.

- Fundrise LLC

- Google LLC

- International Business Machines Corp.

- Microsoft Corp.

- PayPal Holdings Inc.

- SIGMOIDAL LLC

- SoFi Technologies Inc.

- Stripe Inc.

- Upstart Network Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fintech Market

- In January 2024, PayPal announced the acquisition of Honey Science Corporation, a leading digital savings and rewards platform, for approximately USD4 billion. This strategic move aimed to strengthen PayPal's consumer offerings and expand its presence in the digital payments and consumer finance sector (PayPal Press Release, 2024).

- In March 2024, Mastercard and Nubank, the largest digital bank in Latin America, announced a partnership to launch a new co-branded credit card. This collaboration marked Mastercard's entry into the Brazilian market and expanded Nubank's product portfolio (Mastercard Newsroom, 2024).

- In May 2024, Stripe raised a USD600 million funding round at a valuation of USD95 billion. This funding round was led by Sequoia Capital Global Equities and Fidelity Management & Research Company (Stripe Press Release, 2024).

- In February 2025, the European Union's Digital Operational Resilience Act (DORA) came into effect. This regulation aimed to enhance the operational resilience of the financial sector and imposed new cybersecurity requirements on financial institutions and third-party service providers (European Commission, 2025).

Research Analyst Overview

- In the dynamic the market, change management plays a crucial role as new technologies and business models reshape the financial industry. Testing and QA ensure the reliability and security of fintech solutions, addressing ethical considerations and data governance concerns. The economic impact of fintech is significant, driving financial literacy and improving user experience (UX) through microservices architecture, serverless computing, and API management. Fintech startups secure venture capital to gain competitive advantage, innovating in areas such as investment strategies, blockchain interoperability, and responsible AI.

- Social impact is a growing consideration, with fintech solutions addressing globalization of finance, digital transformation, and consumer adoption. Agile development and DevOps practices enable system integration and regulatory scrutiny, shaping the future of fintech.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fintech Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.5% |

|

Market growth 2025-2029 |

USD 813.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.6 |

|

Key countries |

US, China, India, Japan, Canada, UK, Germany, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fintech Market Research and Growth Report?

- CAGR of the Fintech industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fintech market growth of industry companies

We can help! Our analysts can customize this fintech market research report to meet your requirements.