Fire Sprinkler Pipes Market Size 2024-2028

The fire sprinkler pipes market size is forecast to increase by USD 5.58 billion at a CAGR of 7% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing applications in various industries, including commercial and residential buildings, manufacturing units, and industrial facilities. Technological advancements in fire sprinkler systems, such as the integration of fire suppression systems and the use of fire-resistant materials, are driving market growth. From a construction perspective, the housing and commercial sectors are significant consumers of fire sprinkler pipes and fittings. However, the high maintenance cost associated with fire sprinkler pipes remains a challenge for market growth. Regular inspections and timely replacement of old pipes are essential to ensure the effective functioning of fire sprinkler systems and prevent potential fire hazards. Overall, the market is expected to continue its growth trajectory, driven by the increasing awareness of fire safety and the need for advanced fire detection and suppression technologies.

What will be the Size of the Fire Sprinkler Pipes Market During the Forecast Period?

- The market encompasses the production and supply of carbon steel and ductile iron pipes used in fire safety systems. These pipes are integral to fire pipeline networks, transporting water or other fire suppressants to extinguish flames in various settings. The market caters to diverse industries, including mining and petrochemicals, where the risk of fire is high due to the presence of flammable materials. Infrastructure spending on fire protection systems continues to rise as governments and businesses prioritize fire safety and risk management.

- Fire safety regulations, such as the Fire Safety Act, mandate the installation of fire sprinkler systems in commercial and residential buildings. Innovations like hi-fog technology enhance the efficiency of these systems, ensuring rapid fire suppression. Welded and seamless pipes are popular choices due to their durability and resistance to corrosion. The oil and gas sector also relies on fire sprinkler systems to safeguard infrastructure projects and prevent catastrophic fires. Overall, the market is driven by the growing demand for advanced fire safety solutions and the increasing awareness of the importance of fire risk management.

How is this Fire Sprinkler Pipes Industry segmented and which is the largest segment?

The fire sprinkler pipes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial

- Residential

- Industrial

- Material

- Steel

- Copper

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- APAC

By Application Insights

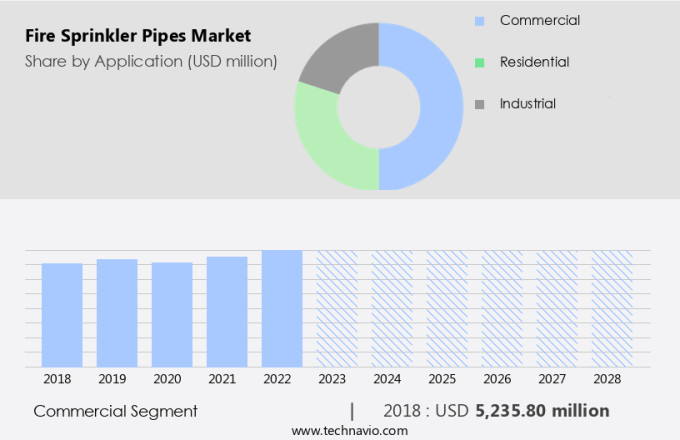

- The commercial segment is estimated to witness significant growth during the forecast period.

The market in commercial sectors is experiencing notable growth due to increasing safety regulations and inspection demands. Previously, Chicago's regulations prohibited installing sprinklers in elevator hoistways or machine rooms to protect first responders from potential power outages caused by water damage. However, recent IDPH citations for CMS-eligible healthcare facilities underscore the importance of complete fire suppression systems. Carbon steel and ductile iron pipes are commonly used for fire safety pipelines, while fittings ensure proper water distribution. Fire safety pipe systems include HI-FOG technology and thermal radiation technology, which minimize water damage and enhance fire protection. Mining, petrochemical, and infrastructure sectors also rely on fire sprinkler systems to mitigate fire risks.

Wet pipe, dry pipe, deluge, pre-action systems, and fire safety audits are integral components of these systems. Fire safety acts and risk management strategies further highlight the importance of strong fire protection systems. Seamless steel pipes and welded pipes offer durability and resistance to fire, while epoxy adhesives ensure pipe longevity. The oil and gas industry, infrastructure projects, and green initiatives contribute to market growth. Building safety regulations and insurance requirements mandate the implementation of advanced fire safety technologies, such as gas-based suppression systems and smoke detection technologies.

Get a glance at the Fire Sprinkler Pipes Industry report of share of various segments Request Free Sample

The commercial segment was valued at USD 5.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

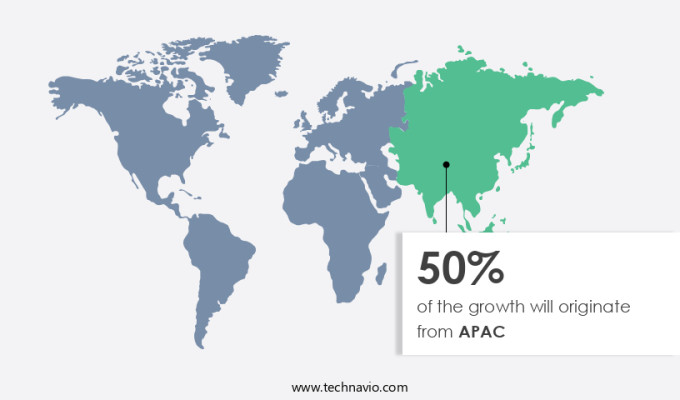

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia-Pacific region is experiencing significant growth due to increasing urbanization, infrastructure development, and industrial activities. India, in particular, is a key market driver, projected to become the world's third-largest economy by 2030, leading to a rise in the construction of high-rise buildings and industrial facilities. Fire safety is a critical concern In these structures, necessitating the use of advanced fire protection systems. The Fire Safe Build India (FSBI) exhibition, held in Mumbai in February 2024, highlighted the importance of passive fire protection solutions. Organized by Nuernberg Messe India, the event brought together industry experts, professionals, and innovators to showcase the latest advancements and products in fire safety.

Key offerings included carbon steel and ductile iron fire safety pipes, fittings, fire pipelines, and fire safety systems utilizing HI-FOG technology and thermal radiation technology. The market encompasses seamless steel pipes, welded pipes, and various pipe materials such as CPVC, used in wet pipe systems, dry pipe systems, deluge systems, pre-action systems, and fire safety audits. The construction perspective includes commercial places, residential buildings, and infrastructure projects. Fire safety is a crucial component of infrastructure development, with regulations and insurance requirements mandating safety measures. The market also caters to sectors like mining, petrochemicals, oil and gas, and Fire Safety Act, and risk management.

Market Dynamics

Our fire sprinkler pipes market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fire Sprinkler Pipes Industry?

Growing applications of fire sprinkler pipes is the key driver of the market.

- The market encompasses a wide range of products used in fire sprinkler systems, including carbon steel and ductile iron pipes. These fire safety pipes are essential for protecting structures against fire-related incidents involving flammable materials in various industries, such as mining, petrochemicals, and oil and gas. Fire sprinkler systems employ various technologies like HI-FOG and thermal radiation, which require specific pipe types, such as seamless steel pipes and welded steel tubes. Additionally, fire safety audits are crucial for ensuring building safety regulations and insurance requirements are met. Market growth is driven by factors like infrastructure spending, housing demand, and commercial places' increasing need for fire protection systems.

- The demand for energy-efficient buildings under initiatives like the Green Deal Initiative further boosts the market. Fire safety, risk management, and the Fire Safety Act are significant considerations in the selection of fire sprinkler pipes. Product finishes, such as epoxy adhesives, are essential for ensuring the pipes' durability and resistance to corrosion. The market caters to various applications, including wet pipe systems, dry pipe systems, deluge systems, pre-action systems, and gas-based suppression systems. Smoke detection technologies and water distribution patterns are also critical factors influencing the market. Raw material manufacturers play a vital role in supplying high-quality materials for the production of fire sprinkler pipes.

What are the market trends shaping the Fire Sprinkler Pipes Industry?

Technological advancements in fire sprinklers is the upcoming market trend.

- The market is experiencing notable growth due to the increasing demand for fire safety in various sectors, including mining, petrochemical, and commercial places. Fire sprinkler systems are essential components of fire protection systems, and their demand is driven by building safety regulations, insurance requirements, and the need for risk management in light of the Fire Safety Act. Fire sprinkler pipes are available in various materials such as carbon steel, ductile iron, seamless steel pipe, and welded steel tube, among others. Fire safety audits are crucial in ensuring the effectiveness of fire sprinkler systems. The market for fire safety fittings and accessories, including CPVC, is also growing in tandem.

- Wet pipe systems, dry pipe systems, deluge systems, pre-action systems, and HI-FOG technology are some of the popular fire sprinkler systems. Technological advancements, such as thermal radiation technology, gas-based suppression systems, smoke detection technologies, and water distribution patterns, are revolutionizing the market. Energy-efficient buildings and infrastructure development initiatives, such as the Green Deal Initiative, are also driving demand for fire safety and fire protection systems. Fire safety is a critical concern for both residential and commercial buildings. Infrastructure spending on fire safety and infrastructure projects is increasing, leading to a rise in demand for fire safety products and services.

What challenges does the Fire Sprinkler Pipes Industry face during its growth?

High maintenance cost for fire sprinkler pipes is a key challenge affecting the industry growth.

- Fire sprinkler pipes are essential components of fire safety systems in various industries and buildings, including mining, petrochemical, and commercial places. The primary materials used for manufacturing fire sprinkler pipes are carbon steel and ductile iron, while fire pipeline fittings are made from CPVC or brass. Fire safety pipes come in different types, such as wet pipe systems, dry pipe systems, deluge systems, pre-action systems, and HI-FOG technology or thermal radiation technology. Fire safety audits are crucial for maintaining the effectiveness and compliance of fire protection systems. From a construction perspective, infrastructure spending on fire safety and infrastructure development is increasing due to housing demand, commercial building construction, and the Green Deal Initiative promoting energy-efficient buildings.

- Fire safety, risk management, and building safety regulations mandate regular inspections and repairs to prevent fire-related incidents and property damage. Gas-based suppression systems and smoke detection technologies also play a vital role in fire safety. Water distribution patterns in wet-pipe and dry-pipe sprinkler systems significantly impact their performance during a fire emergency.

Exclusive Customer Landscape

The fire sprinkler pipes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fire sprinkler pipes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fire sprinkler pipes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aliaxis Holdings SA

- API Group Corp.

- Aquatherm LP

- ASC Engineered Solutions

- IPEX BRANDING INC.

- JM Eagle Inc

- Johnson Controls International Plc.

- Mueller Water Products Inc

- NIBCO INC.

- Spears Manufacturing Co.

- Tata Steel Ltd.

- The Lubrizol Corp.

- The Reliable Automatic Sprinkler Co. Inc.

- The Supreme Industries Ltd.

- Uponor Corp.

- Victaulic Co.

- Viking Group Inc.

- Zekelman Industries

- Zurn Elkay Water Solutions Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fire sprinkler pipes play a crucial role in fire safety systems, safeguarding structures and their occupants from the devastating effects of fire. These pipes are engineered to transport water or other fire suppressing agents to the point of ignition, thereby containing and extinguishing fires. Two primary materials used In the production of fire sprinkler pipes are carbon steel and ductile iron. Carbon steel pipes offer several advantages, including high strength, durability, and corrosion resistance. They are commonly used in high-risk industries such as mining and petrochemicals, where the potential for fire is high. The manufacturing process for carbon steel pipes involves melting the raw material, shaping it into pipes using various methods, and applying protective coatings.

Moreover, ductile iron pipes, on the other hand, are known for their superior strength and flexibility. They are often used in fire pipeline applications where there is a need for high water flow rates and pressure. The manufacturing process for ductile iron pipes involves melting the raw material, casting it into molds, and quenching and tempering it to achieve the desired properties. Fire safety pipe fittings are essential components of fire sprinkler systems, ensuring the proper connection and sealing of pipes. These fittings come in various types, including threaded, welded, and compression fittings, among others. The selection of the appropriate fitting depends on factors such as the type of pipe, the application, and the pressure requirements.

Furthermore, fire pipeline systems are designed to deliver water or other fire suppressing agents to the point of ignition. These systems can be categorized into wet pipe systems, dry pipe systems, deluge systems, pre-action systems, and others. Wet pipe systems are the most common type, where water is constantly present In the pipes, ready to be discharged upon the detection of fire. Dry pipe systems, on the other hand, contain air or nitrogen In the pipes, which is displaced by water upon the activation of the system. Fire safety is a critical concern in both commercial and residential buildings.

|

Fire Sprinkler Pipes Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market Growth 2024-2028 |

USD 5.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, China, India, Germany, UK, France, Japan, Brazil, South Korea, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fire Sprinkler Pipes Market Research and Growth Report?

- CAGR of the Fire Sprinkler Pipes industry during the forecast period

- Detailed information on factors that will drive the Fire Sprinkler Pipes market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fire sprinkler pipes market growth of industry companies

We can help! Our analysts can customize this fire sprinkler pipes market research report to meet your requirements.