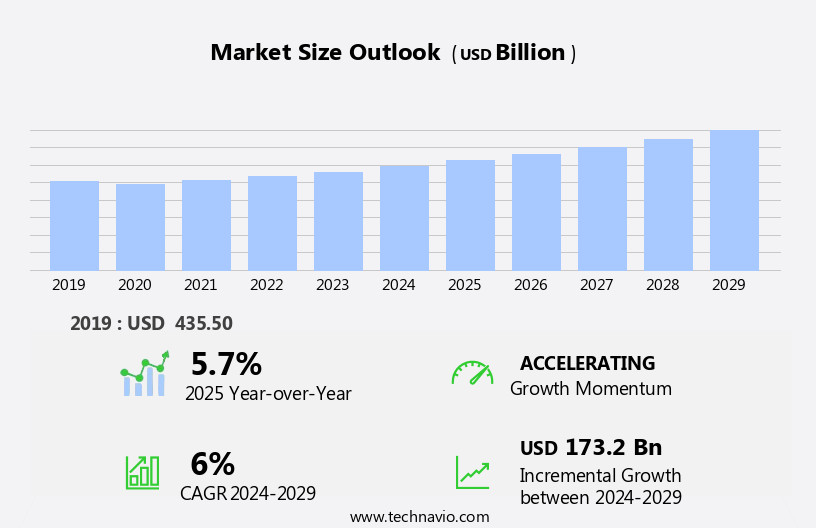

Flooring Market Size 2025-2029

The flooring market size is forecast to increase by USD 173.2 billion, at a CAGR of 6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expansion of the construction industry in both residential and commercial sectors. Smart cities and the increasing popularity of sustainable and eco-friendly building materials are key trends shaping the market. In particular, there is a rising demand for waterproof flooring solutions, including luxury vinyl tiles (LVT) and vinyl flooring, due to their durability and low maintenance requirements. However, the market faces challenges due to the volatility in raw material prices, which can impact the profitability of flooring manufacturers and retailers.

- As a result, companies must effectively manage their supply chains and explore alternative sourcing strategies to mitigate the risks associated with price fluctuations. To capitalize on market opportunities and navigate challenges, flooring businesses should focus on innovation, sustainability, and cost optimization. By offering waterproof flooring solutions that cater to evolving consumer preferences and implementing efficient supply chain management practices, companies can differentiate themselves and thrive in this dynamic market.

What will be the Size of the Flooring Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with various sectors incorporating innovative flooring solutions to meet the demands of modern structures. Luxury vinyl tile (LVT) and resilient flooring are gaining popularity due to their easy-to-install techniques and functional value. However, the market's dynamics are not limited to these offerings. Construction waste management is a significant concern, with the industry striving to minimize waste emissions. Linoleum sheets and carpet tiles, as sustainable alternatives, offer a solution. Meanwhile, flooring systems are being designed with floor insulation for energy efficiency and acoustic environment enhancement. Hospital buildings and residential structures require specific flooring types, such as resilient flooring for hospitals and wood flooring for homes.

Manufacturing operations, on the other hand, prioritize durability and safety, often opting for rubber flooring. Recent times have seen a focus on environmental impact, with the use of recyclable materials and innovative construction techniques. Regulatory frameworks and guidelines are shaping the market, ensuring adherence to eco-friendly practices. Functional value and aesthetic appeal are essential considerations, with LVT, vinyl sheets, and ceramic tiles catering to diverse design preferences. The market's continuous unfolding is driven by rising population and disposable income, leading to increased construction projects and demand for various flooring types. In the commercial sector, innovative flooring solutions like soft coverings and natural stone are being employed for their unique properties.

The market's evolving patterns reflect the industry's commitment to meeting the ever-changing needs of various sectors.

How is this Flooring Industry segmented?

The flooring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Non-residential

- Type

- Non-resilient flooring

- Resilient flooring

- Soft cover flooring

- Material

- Ceramic

- Wood

- Vinyl

- Carpet

- Laminate

- Stone

- Cork

- Linoleum

- Construction Type

- New Construction

- Renovation & Remodeling

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

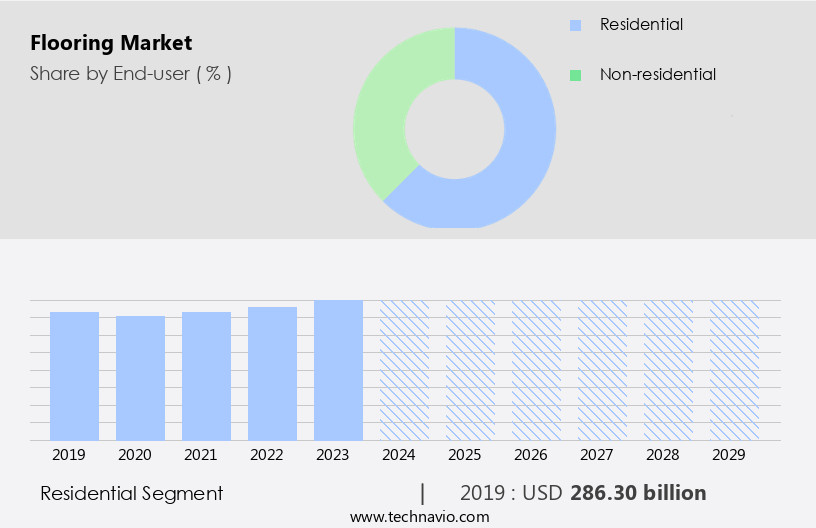

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant activity and evolving trends as population growth accelerates, particularly in urban areas. With the world's population projected to reach approximately 8.2 billion by November 2024, residential construction is on the rise. Urbanization is driving this trend, as demand for new residential units, especially in high-density regions such as APAC and MEA, increases. Rural-to-urban migration is a major factor fueling this growth, leading to increased investments in multifamily housing projects in urban areas. Easy-to-install flooring techniques, including luxury vinyl, vinyl sheets, and laminate flooring, are gaining popularity due to their cost-effectiveness and versatility.

However, environmental concerns, such as waste emissions from manufacturing operations and construction projects, are becoming increasingly important. The VCT business and other non-resilient flooring options are facing intense competition from resilient flooring alternatives, such as luxury vinyl tile and carpet tiles, which offer better functional value and floor design options. Regulatory frameworks are also impacting the market, with a focus on recyclable materials and sound absorption in commercial flooring applications. Innovative construction methods, such as the use of natural stone, rubber flooring, and artificial turf, are gaining traction in both residential and hospital buildings. Floor insulation and aesthetic appeal are also key considerations in flooring design.

Operational costs, including flooring disposal and floor covering maintenance, are becoming increasingly important factors in the decision-making process for construction projects. As disposable income grows, homeowners and businesses are investing in high-quality flooring options that offer long-term value. The market for flooring systems is expected to remain competitive, with a focus on sustainability, durability, and functionality.

The Residential segment was valued at USD 286.30 billion in 2019 and showed a gradual increase during the forecast period.

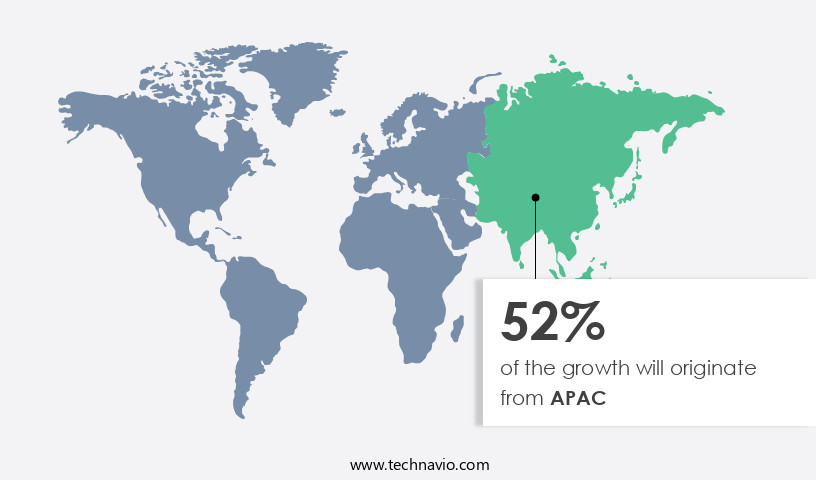

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing residential and commercial construction activities in the region. China, India, and Japan are leading contributors to the market's expansion, with China's economic slowdown notwithstanding. Other Southeast Asian countries, such as Singapore, Hong Kong, Vietnam, and Malaysia, are exhibiting promising potential for rapid growth in the building sector. Government initiatives like China's One Belt One Road Initiative and India's Make in India initiative, along with five-year plans focusing on constructional activities in Malaysia and Vietnam, are driving this growth. Easy-to-install flooring techniques, including luxury vinyl, vinyl sheets, and laminate flooring, are gaining popularity due to their cost-effectiveness and environmental benefits.

However, intense competition among manufacturers and suppliers poses a challenge. Waste emissions from manufacturing operations and construction projects are a concern, necessitating regulatory guidelines and the use of recyclable materials in commercial flooring. Functional value, floor design, and aesthetic appeal are essential factors influencing consumer preferences. Resilient flooring, such as rubber and vinyl, are increasingly being used in hospital buildings and residential buildings for their durability and sound absorption properties. Wood flooring, ceramic tiles, natural stone, and carpet tiles are other popular flooring options. The rising population and disposable income have led to an increase in construction projects, further fueling the demand for flooring systems.

Flooring waste is a significant issue, and floor covering manufacturers are focusing on innovative construction methods and recycling initiatives to address it. Innovative construction techniques, such as the use of artificial turf and floor insulation, are also gaining traction in the market. Regulatory frameworks are becoming stricter, emphasizing the importance of sound absorption and acoustic environments in commercial and residential buildings. Overall, the market in APAC is dynamic and evolving, presenting numerous opportunities for businesses in the sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of products and services, from resilient and hardwood options to ceramic, stone, and luxury vinyl tiles. Consumers seek flooring solutions that are not only aesthetically pleasing but also durable, easy to maintain, and eco-friendly. Flooring types like engineered hardwood, laminate, and cork offer affordability and versatility, while luxury vinyl plank (LVP) and porcelain tile cater to those desiring a high-end, sophisticated look. Sustainable flooring options, such as bamboo and reclaimed wood, are gaining popularity due to their eco-conscious appeal. Installation methods, including glue-down, nail-down, and floating, vary depending on the specific flooring type. Understanding the unique benefits of each flooring option is crucial when making informed decisions for residential and commercial applications.

What are the key market drivers leading to the rise in the adoption of Flooring Industry?

- The global construction industry's robust expansion is the primary catalyst fueling market growth.

- The market experiences significant growth due to the expansion of the construction industry, which is a major end-user. The construction sector has seen a steady increase since 2009, with Europe witnessing its most significant growth in the last five years. The residential sector's continuous investment in Europe drives this growth. The Netherlands, Denmark, and Germany are predicted to lead the construction industry's growth during the forecast period in Europe. Similarly, the North American construction industry is also undergoing healthy growth, with residential construction being the fastest-growing segment. Easy-to-install flooring techniques, such as luxury vinyl and laminate flooring, contribute to the market's growth due to their affordability and versatility.

- However, the market faces intense competition, with various flooring types, including vinyl, non-resilient, ceramic tiles, and artificial turf, vying for market share. The environmental impact of waste emissions from flooring production and installation is a growing concern, and efforts are being made to minimize these emissions through sustainable manufacturing processes. Operational costs and environmental considerations are essential factors influencing the choice of flooring materials in both residential and commercial applications. The market's dynamics are shaped by these factors, making it an exciting and evolving space for businesses in the VCT industry.

What are the market trends shaping the Flooring Industry?

- The trend in the market is shifting towards waterproof options due to increasing demand. Waterproof flooring is a popular choice for homeowners and businesses seeking durable and maintenance-friendly flooring solutions.

- The market is witnessing significant growth due to the increasing demand for functional value and innovative flooring solutions. Key players in the industry, such as Mohawk Industries and Gerflor, are responding to this trend by introducing waterproof features in their vinyl flooring offerings. This includes the use of WPC (wood plastic composite) technology, which provides enhanced water resistance, stain and dent resistance, and high cleanability. With the growing popularity of open floor plans and integrated indoor-outdoor living spaces in modern homes, waterproof flooring has become a preferred choice for areas prone to moisture, spills, and accidents. These floors are designed to withstand moisture exposure, ensuring a longer product lifespan and reduced replacement costs for homeowners.

- In addition, the use of floor insulation and resilient flooring systems, such as linoleum sheets and carpet tiles, is gaining popularity in both hospital buildings and residential construction due to their durability and energy efficiency. Overall, the market is expected to continue its growth trajectory, driven by the demand for functional value, floor design innovation, and sustainable flooring solutions.

What challenges does the Flooring Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the growth of the flooring industry. This issue, stemming from the unpredictability of costs for essential inputs, can hinder industry expansion and profitability.

- The market has experienced price fluctuations due to the rising costs of raw materials, particularly wood, ceramics, and vinyl. This trend can be attributed to a demand-supply imbalance and volatility in input and transportation costs. The US, as a significant exporter of lumber, struggles to meet the increased demand in markets like China and Southeast Asia. For instance, in 2023, the US lumber market witnessed significant price volatility. The demand for soft coverings, natural stone, resilient flooring, and vinyl sheets continues to grow, driven by factors such as aesthetic appeal, construction projects, and the increasing population.

- Additionally, the acoustic environment is becoming an essential consideration in flooring choices, leading to increased demand for specific flooring types. Despite these market dynamics, consumers with disposable income remain willing to invest in high-quality flooring solutions for their homes and businesses.

Exclusive Customer Landscape

The flooring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flooring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flooring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Armstrong Flooring, Inc. - The company showcases an extensive selection of flooring solutions, encompassing Natralis, Morning Dove, Lost Empire Engineered Tile Amber Sagebrush, West Wood Engineered Tile Putty, and Artisan Forge Engineered Tile White Vague.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armstrong Flooring, Inc.

- Balta Group NV

- Beaulieu International Group

- Congoleum Corporation

- Forbo International SA

- Gerflor Group

- Interface, Inc.

- Kronoflooring GmbH

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc. (Berkshire Hathaway Inc.)

- Tarkett S.A.

- The Dixie Group, Inc.

- Välinge Innovation Sweden AB

- Victoria plc

- VolkerWessels NV

- Wellmade Flooring

- Wonder Rugs Mills, Inc.

- Yorkwood Floors

- Zhongguo Huazhou Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Flooring Market

- In January 2024, Mohawk Industries, a leading flooring manufacturer, announced the launch of their new luxury vinyl tile (LVT) product line, RevWood Plus, featuring enhanced waterproof technology. This innovation addresses the growing demand for waterproof flooring solutions (Mohawk Industries Press Release, 2024).

- In March 2024, Shaw Industries, another major player in the flooring industry, formed a strategic partnership with LG Chem to develop and commercialize flooring products using LG Chem's lithium-ion batteries. This collaboration aims to create eco-friendly, rechargeable flooring that can store and release energy, contributing to the development of smart homes (Shaw Industries Press Release, 2024).

- In May 2024, Tarkett, a global flooring and sports surfaces company, completed the acquisition of Forbo's Flooring Systems division. This acquisition expanded Tarkett's product portfolio and strengthened its position in the European market, increasing its market share by approximately 10% (Tarkett Press Release, 2024).

- In February 2025, the European Union passed the Circular Economy Action Plan, which includes a flooring sector roadmap to promote sustainable flooring production, recycling, and disposal. This initiative aims to reduce the environmental impact of the flooring industry by setting targets for recycled content in flooring products and establishing a European Flooring Alliance to drive innovation and collaboration (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of products, including soundproof, anti-slip, and commercial carpet options. Sustainability is a significant trend, with tufted carpet designs and eco-friendly flooring solutions gaining popularity. Flooring implementation varies from engineered wood and carpet flooring to luxury vinyl tile and innovative materials like cork and bamboo. Commercial carpet maintenance is crucial for ensuring longevity and aesthetic appeal. Resilient flooring and durable coverings offer superior performance for high-traffic workspaces. Fire-resistant flooring and waterproof options cater to safety concerns.

- Flooring production continues to evolve, with a focus on low-maintenance, affordable, and modern designs. Flooring installation services ensure seamless implementation, while flooring maintenance tips help extend product life. Warranty and design are essential considerations for business buyers. The competition in the market remains fierce, with numerous players offering a wide array of floor solutions to meet diverse client needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Flooring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 173.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flooring Market Research and Growth Report?

- CAGR of the Flooring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flooring market growth of industry companies

We can help! Our analysts can customize this flooring market research report to meet your requirements.