Formaldehyde Market Size 2025-2029

The formaldehyde market size is forecast to increase by USD 2.59 billion at a CAGR of 5.7% between 2024 and 2029.

- The market is driven by the expansion of the construction industry, which significantly utilizes formaldehyde as a building material in insulation, adhesives, and plywood production. Additionally, the market is witnessing a trend towards diversification into new end-user industries, such as automotive, textiles, and pharmaceuticals, broadening the application scope and potential growth opportunities. Manufacturing processes for UF resins involve injection molding and waste management to minimize environmental impact. However, the market faces challenges from stringent regulatory frameworks, particularly in developed regions, which impose strict controls on formaldehyde emissions and limit its use in certain applications due to health concerns.

- Companies seeking to capitalize on market opportunities must navigate these regulatory hurdles and explore alternative production methods or low-emission technologies to meet evolving consumer demands and maintain market competitiveness. The market is evolving, with a strong focus on life cycle management, product design, and the implementation of control measures to minimize risks and promote a more sustainable future. Green building materials, such as formaldehyde detectors, are increasingly preferred due to their reduced environmental impact and improved health and safety.

What will be the Size of the Formaldehyde Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the market, sustainability initiatives are gaining momentum as manufacturers prioritize waste reduction and sustainable procurement. This shift is influencing the adoption of manufacturing processes that minimize formaldehyde emissions and promote the use of renewable resources in the circular economy. Industrial hygiene and health risks are also driving the market, with a focus on emergency response and exposure assessment. Sustainability-conscious businesses are integrating formaldehyde absorbers and scavengers into their supply chain sustainability efforts. Environmental science and risk management are key areas of research, with a growing emphasis on green chemistry and the development of bio-based materials and low-formaldehyde resins.

- Chemical engineering and polymer chemistry are at the forefront of these advancements, as companies strive to reduce their environmental footprint and protect both workers and consumers. Quality control and exposure monitoring are essential components of formaldehyde mitigation strategies, with testing methods and prevention measures playing crucial roles in ensuring product stewardship and regulatory compliance.

How is this Formaldehyde Industry segmented?

The formaldehyde industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Urea formaldehyde

- Phenol formaldehyde

- Polyoxymethylene

- Paraformaldehyde

- Others

- End-user

- Construction

- Automotive

- Agriculture

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The urea formaldehyde segment is estimated to witness significant growth during the forecast period. Urea formaldehyde (UF) resins, a thermosetting resin derived from the reaction of urea and formaldehyde, are widely utilized for their cost-effective and versatile properties in various industrial applications. Primarily, UF resins are employed as binding agents in the production of engineered wood products, such as particle board, medium-density fiberboard (MDF), and plywood, which are extensively used in construction, furniture manufacturing, and interior design. In addition to wood adhesives, UF resins are also used in molding compounds for electrical fittings, household items, and decorative laminates. The heat-resistant, rigid, and dimensionally stable properties of UF resins make them suitable for applications demanding durability and precision.

Ventilation systems and air filtration are crucial components in managing indoor air quality, mitigating potential health effects associated with formaldehyde exposure. Product labeling and carbon footprint assessments are essential for consumer transparency and brand loyalty. UF resins are also used in the production of phenol-formaldehyde resins, melamine-formaldehyde resins, and thermoplastic resins, which offer product differentiation and emission reduction. Life cycle assessments are conducted to evaluate the environmental impact of UF resins and identify opportunities for improvement.

The Urea formaldehyde segment was valued at USD 2.76 billion in 2019 and showed a gradual increase during the forecast period.

The Formaldehyde Market is undergoing a pivotal shift as industries prioritize sustainability and health-conscious innovation. The demand for formaldehyde-free alternatives is rising, driven by stricter environmental regulations, growing environmental consciousness, and heightened concerns for public health. Manufacturers are exploring advanced resin synthesis techniques and employing formaldehyde scavengers to minimize emissions without compromising performance. Innovations rooted in material science are enabling more effective material selection that balances durability, safety, and ecological impact. Simultaneously, the focus on worker protection and consumer protection is pushing industries to reevaluate production processes and end-product safety.

Exposure limits to formaldehyde, a byproduct of UF resin production, are strictly regulated to ensure health and safety. Thermosetting resins, including UF resins, are subjected to emission testing to adhere to formaldehyde emission standards. Automotive parts, building materials, and consumer products incorporate UF resins due to their excellent bonding properties. Bio-based resins are emerging as sustainable alternatives to UF resins, reducing the environmental impact of traditional manufacturing processes. Testing methods, such as mass spectrometry and gas chromatography, are employed to analyze the composition and quality of UF resins.

Regional Analysis

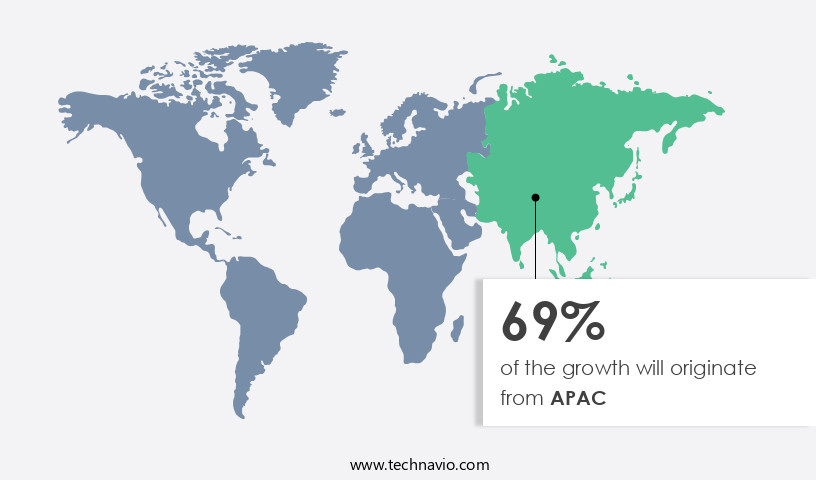

APAC is estimated to contribute 61% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is characterized by robust demand in key sectors, including construction, automotive, textiles, and agriculture, particularly in the Asia-Pacific (APAC) region. China, as the largest producer and consumer of formaldehyde, drives market growth due to rapid industrialization, urbanization, and a strong manufacturing base. In 2024, China produced over 30 million vehicles, accounting for approximately 33% of global output, increasing the demand for polyoxymethylene (POM) resins used in automotive applications. Regulatory shifts and technological innovations are also shaping the market, with a focus on emission reduction, waste management, and the adoption of green building materials.

Urea-formaldehyde and phenol-formaldehyde resins dominate the market, with thermosetting resins, melamine-formaldehyde resin, and bio-based resins gaining traction due to their environmental benefits. Manufacturing processes, such as injection molding and emission testing, are essential in ensuring product quality and safety. Consumer preferences for low-emission, sustainable alternatives are influencing market trends, with formaldehyde detectors and air filtration systems becoming increasingly important. The market is expected to continue evolving, with a focus on product differentiation, life cycle assessment, and the adoption of thermoplastic resins.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Formaldehyde market drivers leading to the rise in the adoption of Industry?

- The construction industry's continued growth serves as the primary catalyst for market expansion. The global construction industry's ongoing expansion serves as a significant driver for formaldehyde demand, primarily in the manufacture of engineered wood, insulation materials, and coatings. The United Nations projects that urbanization will continue to accelerate, with over half of the world's population currently residing in urban areas and this figure projected to reach 68% by 2050. Developing economies, such as India, are spearheading this trend, with the government investing approximately USD 122 billion in infrastructure development during the fiscal year 2023-2024. Formaldehyde is extensively used in manufacturing processes like injection molding and thermosetting resins, including urea-formaldehyde resin.

- Injection molding is a common manufacturing technique used to produce parts with complex geometries, while thermosetting resins are essential in various industries, including automotive parts production. Effective waste management and emission testing are crucial aspects of the market. Exposure limits to formaldehyde have been established to ensure safety in the workplace and the environment. Bio-based resins are gaining popularity as an alternative to traditional formaldehyde-based resins due to their eco-friendly nature and reduced environmental impact. The market is influenced by various factors, including the construction industry's growth, manufacturing processes, and the increasing demand for eco-friendly alternatives. Understanding these dynamics can help businesses adopt effective pricing strategies and optimize their supply chain operations.

What are the Formaldehyde market trends shaping the Industry?

- The trend in the market is shifting towards diversification into new end-user industries. The market is witnessing a significant expansion into new industries beyond its traditional applications in construction and automotive. This shift is fueled by technological advancements and the strategic imperative to reduce reliance on mature sectors that face regulatory constraints and market saturation. One of the most promising emerging sectors is the agrochemical industry.

- Proper ventilation systems are essential for maintaining indoor air quality and minimizing exposure to formaldehyde in building materials. The environmental impact of formaldehyde production and use is a growing concern, leading to the exploration of substitute materials. Distribution networks play a critical role in ensuring the efficient and safe transportation and handling of formaldehyde and its derivatives, such as formaldehyde resin. As agricultural systems intensify to meet global food security demands, particularly in developing regions, the demand for formaldehyde-based agrochemicals is increasing. In the testing industry, mass spectrometry and gas chromatography are commonly used methods to detect and quantify formaldehyde in various matrices.

How does Formaldehyde market face challenges during its growth?

- The stringent regulatory frameworks pose a significant challenge to the growth of the industry, imposing mandatory compliance requirements that businesses must adhere to in a professional and knowledgeable manner. The market is subject to increasing regulatory pressure due to the health risks associated with this chemical. The International Agency for Research on Cancer (IARC) classifies formaldehyde as a Group 1 carcinogen, and long-term exposure can lead to nasopharyngeal cancer and leukemia. In response, governments and environmental agencies worldwide have implemented strict regulations to limit formaldehyde use, particularly in consumer products such as furniture, construction materials, and textiles. In the US, the Environmental Protection Agency (EPA) enforces the Formaldehyde Emission Standards for Composite Wood Products Rule, which mandates low emission thresholds for particleboard, medium-density fiberboard, and hardwood plywood. Brand loyalty plays a significant role in the market, with consumers increasingly demanding green building materials and sustainable alternatives.

- Formaldehyde detectors and air filtration systems are becoming essential tools for ensuring indoor air quality and reducing occupational exposure. Industry trends indicate a growing focus on quality control and product labeling to help consumers make informed purchasing decisions. Health effects and environmental concerns are driving innovation in the market, with companies developing new technologies and alternative chemicals to meet regulatory requirements and consumer demand. These trends are expected to continue, shaping the market landscape in the coming years.

Exclusive Customer Landscape

The formaldehyde market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the formaldehyde market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, formaldehyde market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aadhunik Industries - The company specializes in providing a range of formaldehyde resins, including phenolic thermosetting resin and synthetic phenolic resins.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aadhunik Industries

- Abelin Polymers

- ARIHANT SOLVENTS AND CHEMICALS

- Balaji Formalin Pvt. Ltd.

- BASF SE

- Capital Resin Corp.

- Celanese Corp.

- Central Drug House P. Ltd.

- ELIM Chem Pvt. Ltd

- Kanoria Chemicals and Industries Ltd.

- Kunnathan Polymers Pvt. Ltd

- L.N. Bakelite Pvt ltd

- MERU CHEM PVT. LTD.

- NM Enterprises

- Pandora Industries

- RXChemicals

- Simalin Chemical Industries Pvt. Ltd.

- Vechem Organics Pvt. Ltd.

- Vizag Chemical International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Formaldehyde Market

- In January 2024, BASF, a leading chemical producer, announced the expansion of its formaldehyde production capacity at its Verbund site in Ludwigshafen, Germany. This â¬100 million investment aimed to increase production by 300,000 metric tons per year, strengthening BASF's position as a major player in the market (BASF press release, 2024).

- In March 2024, INEOS Styrolution, the world's leading styrenics supplier, entered the market by acquiring the formaldehyde business of INEOS Oxide. This strategic move expanded INEOS Styrolution's product portfolio and enabled the company to offer integrated solutions to its customers (INEOS Styrolution press release, 2024).

- In May 2024, the European Chemicals Agency (ECHA) approved the renewal of the authorization for the use of formaldehyde in the production of resins, adhesives, and other applications. This decision ensured the continued availability of formaldehyde-based products in the European market (ECHA press release, 2024).

- In April 2025, LG Chem, a leading global chemical company, launched a new formaldehyde-free resin, PU ReBorn, at the ChinaCoat exhibition in Shanghai. This innovative product, made from renewable resources, marked a significant step forward in the market towards more sustainable solutions (LG Chem press release, 2025).

Research Analyst Overview

The market continues to evolve, driven by dynamic market forces and shifting consumer preferences. Formaldehyde, a versatile chemical compound, finds applications in various sectors, including manufacturing processes for thermosetting resins, injection molding, and waste management. Strict formaldehyde emission standards are a constant concern for industries, leading to the development of green building materials and formaldehyde detectors. Brand loyalty plays a significant role in the market, with consumers increasingly demanding eco-friendly and health-conscious alternatives. Urea-formaldehyde resin and phenol-formaldehyde resin are being replaced by bio-based resins, which offer reduced occupational exposure and improved indoor air quality. Industry trends reflect a growing emphasis on emission reduction and safety standards.

Emission testing methods, such as mass spectrometry and gas chromatography, are increasingly being used to ensure compliance with formaldehyde emission standards. Air filtration systems and ventilation systems are also gaining popularity to maintain optimal indoor air quality. The market's continuous evolution is also influenced by health effects concerns and the search for sustainable alternatives. Life cycle assessment and product differentiation are key factors in the market, with consumers favoring products with lower carbon footprints and minimal environmental impact. Quality control remains a critical aspect of the market, with stringent regulations and testing methods ensuring product safety and reliability.

Product labeling is also essential, enabling consumers to make informed choices based on their preferences and health concerns. The market is a dynamic and evolving landscape, shaped by ongoing market activities and shifting consumer demands. Formaldehyde emission standards, brand loyalty, green building materials, formaldehyde detectors, occupational exposure, industry trends, health effects, sustainable alternatives, quality control, air filtration, product labeling, and other factors continue to shape the market's trajectory.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Formaldehyde Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

228 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 2.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, Russia, France, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Formaldehyde Market Research and Growth Report?

- CAGR of the Formaldehyde industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the formaldehyde market growth of industry companies

We can help! Our analysts can customize this formaldehyde market research report to meet your requirements.