Fragrance Ingredients Market Size 2025-2029

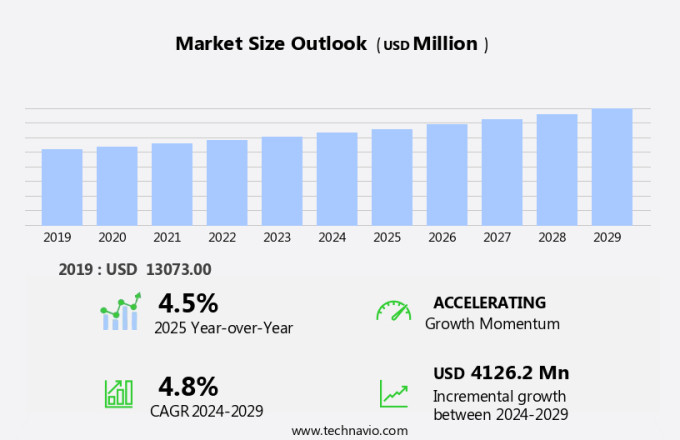

The fragrance ingredients market size is forecast to increase by USD 4.13 billion at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for cosmetic products and the preference for natural ingredients. The cosmetics industry's expansion is driven by factors such as rising consumer awareness and disposable income. Natural ingredients, which are free from synthetic chemicals, are gaining popularity due to their health benefits and eco-friendliness. The natural segment of the market is expected to grow significantly due to the increasing awareness of health and wellness, and the desire for eco-friendly and organic products. However, the market faces challenges, including the low shelf life of fragrance ingredients and the high cost of natural ingredients compared to synthetic ones. Producers must innovate and find solutions to overcome these challenges to cater to evolving consumer preferences and ensure market growth. The market trends and analysis report provides a comprehensive study of these factors and their impact on the market.

What will be the Size of the Fragrance Ingredients Market During the Forecast Period?

- The fragrance ingredients industry encompasses a diverse range of aromatic products derived from various natural and synthetic sources. Natural fragrance ingredients, including extracts from fruits, flowers, trees, herbs, and spices, have gained increasing popularity due to their organic appeal. In contrast, synthetic compounds offer consistency and affordability, making them a staple in consumer goods such as cosmetics, household cleaning supplies, and toiletries. Despite the benefits of natural fragrance ingredients, synthetic ingredients continue to dominate the market. However, concerns regarding potential toxic effects on human skin have led to a growing demand for safer alternatives. Organic fragrances and herbal fragrances are emerging as viable options, offering consumers a more natural and health-conscious choice.

- Moreover, the fragrance ingredients industry caters to various applications, including fine fragrance items, incense sticks, laundry, and candles. The market dynamics are influenced by several factors, including consumer preferences, regulatory requirements, and technological advancements. As the demand for natural and organic fragrance ingredients continues to rise, the industry is expected to witness significant growth in the coming years. In conclusion, the fragrance ingredients industry is a dynamic and evolving market, driven by consumer trends and regulatory demands. The use of natural and organic fragrance ingredients is gaining momentum, offering a more sustainable and health-conscious alternative to synthetic compounds. The industry serves a wide range of applications, from fine fragrance items to household products, making it a diverse and exciting sector to watch.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Personal care

- Fabric care

- Hair care

- Others

- Type

- Essential oils

- Aroma chemicals

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Spain

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

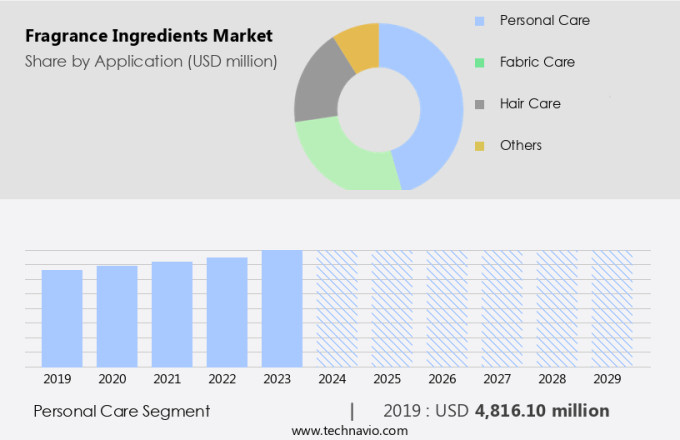

- The personal care segment is estimated to witness significant growth during the forecast period.

The personal care market, including fragrance ingredients, is experiencing notable expansion due to the burgeoning e-commerce sector. Technological advancements enable consumers to conveniently purchase a diverse array of personal care products online. The increasing recognition of the advantages of personal care items, coupled with the escalating prevalence of skin and hygiene concerns, fuels market growth. Furthermore, the global proliferation of salons and spas underscores the significance of beauty and personal grooming. This market encompasses segments such as eco-friendly fragrance ingredients, room fresheners, soap, detergents, hair care, and more. The market is categorized into natural and synthetic segments, with the natural segment gaining traction due to consumer preferences for sustainable and health-conscious options.

Get a glance at the market report of share of various segments Request Free Sample

The personal care segment was valued at USD 4.82 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds the largest share in the global fragrance ingredients industry, driven by factors such as the presence of key companies, increasing demand for fragrances in personal care industries, new product launches, and rising disposable income. The US, in particular, contributes significantly due to the presence of numerous fragrance ingredient suppliers and substantial investments in research and development. companies are focusing on creating safer and more effective fragrance ingredients, catering to the growing preference for natural and organic compounds. Fragrance ingredients find applications in various end-use sectors, including fine fragrances, cosmetics, and household products. Key fragrance ingredients include fixatives, oleoresins, distillates, fractions, concretes, absolutes, and petrochemicals. Incense sticks and odors are other emerging segments.

Market Dynamics

Our fragrance ingredients market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Fragrance Ingredients Market?

Growing demand for cosmetic products is the key driver of the market.

- The market is experiencing notable growth due to the increasing demand for aromatic products in various consumer goods and cosmetics. Natural fragrance ingredients, such as essential oils derived from plants, flowers, fruits, vegetables, and spices, are gaining popularity due to their eco-friendly and organic attributes. However, synthetic compounds derived from chemicals are also widely used due to their affordability and long-lasting fragrance. The fragrance ingredients industry caters to various segments, including Personal Care, Household cleaning supplies, Hair Care, Fabric Care, and aromatherapy in the cosmetic industry. Perfumes, essential oils, room fresheners, soap, detergent, and deodorants are some of the major applications.

- In addition, fragrance ingredients are used in hospitals, medical emergency services, hand sanitizers, and renewable ingredients for perfumery. On the other hand, the synthetic segment is expected to maintain its dominance due to its cost-effectiveness and wide usage in mass-market products. Skin care products, such as shampoo, shower gel, fine fragrances, and signature scents, are major contributors to the growth of the market. However, concerns regarding the toxic effects of certain fragrance ingredients, such as allergies, lung irritation, and dermatitis, are driving the demand for eco-friendly and renewable ingredients.

What are the market trends shaping the Fragrance Ingredients Market?

Growing preference for natural ingredients is the upcoming trend in the market.

- The market encompasses a wide range of aromatic products, including essential oils, extracts, oleoresins, distillates, fractions, concretes, and absolutes. Natural fragrance ingredients derived from plants, fruits, flowers, trees, and spices are gaining popularity due to increasing consumer awareness of the potential toxic effects of synthetic compounds and chemicals on human skin. Natural fragrance ingredients are used in various consumer goods, such as perfumes, essential oils, shampoo, shower gel, fine fragrances, soap, detergent, aromatherapy, and cosmetic products. Brands are responding to this trend by investing in research and development to create innovative natural fragrance solutions. Natural fragrance ingredients, such as sandalwood, vetiver, rose, neroli, cinnamon orange clove, and amber, are used as top tones, mid-tones, and base tones in perfumes and fine fragrance items.

- Moreover, natural fragrance ingredients are also used in home care items, such as room fresheners, candles, and laundry, and in eco-friendly perfumes and cleanliness products. The fragrance ingredients industry is segmented into natural and synthetic segments. The natural segment includes renewable ingredients, such as plant extracts, while the synthetic segment includes petrochemicals and synthetic compounds. The natural segment is expected to grow at a significant rate due to increasing consumer demand for eco-friendly and sustainable products. Moreover, natural fragrance ingredients have therapeutic applications and are used to alleviate anxiety and stress. However, some natural fragrance ingredients, such as citrus oils, can cause allergies and lung irritation, and some consumers may experience dermatitis from certain fragrance ingredients.

What challenges does Fragrance Ingredients Market face during the growth?

Low shelf life is a key challenge affecting the market growth.

- The market encompasses a wide range of aromatic products, including essential oils and synthetic compounds. Natural fragrance ingredients, derived from plants, herbs, and fruits, are gaining popularity due to increasing consumer preference for eco-friendly and organic fragrances. Essential oils, such as citrus, herbal, and floral extracts, are used as top, mid, and base notes in perfumes, aromatherapy, and various consumer goods. Top notes, like lemon, orange, and clove, are highly volatile and evaporate quickly, while base notes, such as sandalwood, vetiver, and rose, are less volatile and provide a long-lasting fragrance. However, the lower shelf life of essential oils may negatively impact their demand and the growth of the market.

- Furthermore, the fragrance ingredients industry caters to various sectors, including personal care, household cleaning supplies, and fine fragrances. The natural segment of the market is witnessing significant growth due to increasing consumer awareness and demand for eco-friendly and allergy-friendly fragrance ingredients. Renewable ingredients, such as bio-based fragrance ingredients, are increasingly being used to reduce the reliance on petrochemicals and synthetic compounds. In the personal care segment, essential oils are used in shampoo, shower gel, and skin care products, while in the household segment, they are used in room fresheners, soap, and detergents. Fragrance ingredients are also used in aromatherapy, hospitals, medical emergency services, hand sanitizer, and various other applications.

Exclusive Customer Landscape

The fragrance ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AARAV Flavors and Fragrances Pvt. Ltd. - The company offers fragrance ingredients such as essential oils, aroma chemicals, and natural extracts.

The fragrance ingredients market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Aromatics Inc.

- BASF SE

- BRENNTAG SE

- CPL Aromas

- Ernesto Ventos SA

- Fine Fragrances

- Firmenich SA

- Givaudan SA

- Huabao International Holdings Ltd.

- International Flavors and Fragrances Inc.

- Joh. Vogele KG.

- Kalpsutra Chemicals Pvt. Ltd.

- La Scenteur Fragrance Technology Pvt. Ltd.

- Risdon International

- Robertet SA

- S H Kelkar and Co. Ltd.

- Sensient Technologies Corp.

- Symrise Group

- V. Mane Fils

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The fragrance ingredients industry is a vibrant and diverse market that caters to various consumer goods and personal care applications. This sector encompasses a wide range of aromatic products, including natural fragrance ingredients derived from plants, flowers, fruits, and spices, as well as synthetic compounds produced in laboratories. Aromatic products have been an integral part of human civilization for centuries, serving both functional and aesthetic purposes. The use of natural fragrance ingredients, such as essential oils, oleoresins, distillates, fractions, concretes, and absolutes, dates back to ancient times. These ingredients are sourced from various vegetable, fruit, flower, and tree segments, and their extraction methods range from simple expression to complex steam distillation and solvent extraction.

Moreover, the fragrance ingredients industry is segmented into natural and synthetic segments. Natural fragrance ingredients are derived from renewable resources and are often perceived as eco-friendly and safe. They include essential oils, herbal fragrances, and extracts from fruits, flowers, trees, and spices. Natural fragrance ingredients are widely used in various applications, such as perfumes, essential oils, aromatherapy, and fine fragrance items. Synthetic fragrance ingredients, on the other hand, are chemically produced in laboratories. They offer several advantages, such as longer lasting fragrance, consistent quality, and lower cost. However, they have raised concerns regarding their potential toxic effects on human skin and the environment.

In addition, synthetic fragrance ingredients are used in various consumer goods, including room fresheners, soap, detergents, hair care, personal care, fabric care, and household cleaning supplies. The fragrance ingredients industry caters to various applications, including aromatherapy, perfumery, cosmetics, and household goods. Perfumes and essential oils are popular fine fragrance items, while room fresheners, soap, and detergent are common household items. In the cosmetic industry, fragrance ingredients are used in various personal care products, such as shampoo, shower gel, and fine fragrances. Hospitals and medical emergency services also use fragrance ingredients in hand sanitizers and other hygiene products. The use of eco-friendly fragrance ingredients is gaining popularity due to increasing consumer awareness and concern for the environment.

Furthermore, renewable ingredients, such as plant extracts and bio-based fragrance ingredients, are being explored as alternatives to synthetic fragrance ingredients. These eco-friendly fragrance ingredients offer several benefits, such as reduced carbon footprint, biodegradability, and sustainability. The fragrance ingredients industry is subject to various regulations and standards to ensure the safety and quality of the products. The use of certain fragrance ingredients, such as petrochemicals and fixatives, has raised concerns regarding their potential toxic effects on human health and the environment. Therefore, it is essential to ensure that fragrance ingredients are safe for use and do not cause allergies, lung irritation, or dermatitis.

In conclusion, the market is a dynamic and diverse industry that caters to various applications and consumer preferences. The use of natural and synthetic fragrance ingredients continues to evolve, with a growing emphasis on eco-friendly and renewable ingredients. The industry is subject to various regulations and standards to ensure the safety and quality of the products, and consumer awareness and preferences play a significant role in driving market trends.

|

Fragrance Ingredients Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 4.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, Canada, UK, China, Germany, Italy, France, Japan, Spain, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch