Frozen Fish And Seafood Market Size 2024-2028

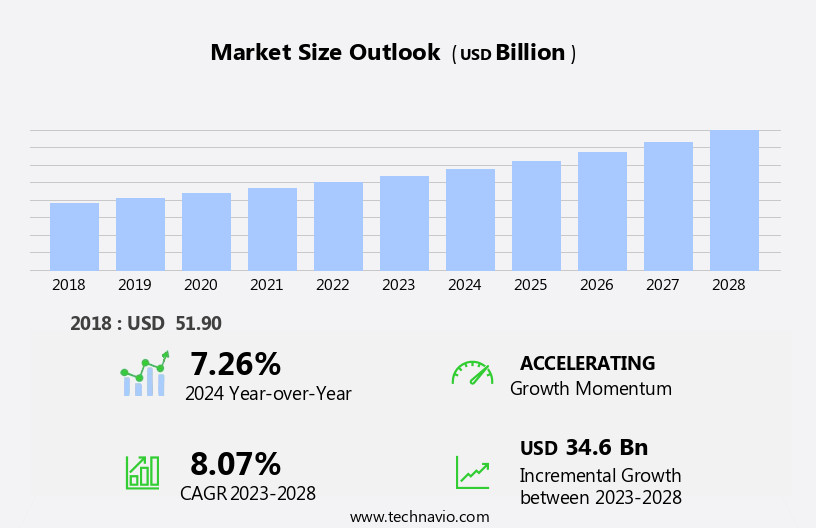

The frozen fish and seafood market size is forecast to increase by USD 34.6 billion at a CAGR of 8.07% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for convenience and innovation in packaging solutions. Consumers are increasingly turning to frozen fish and seafood as a convenient alternative to fresh options, particularly in regions with limited access to fresh seafood or for those seeking to reduce food waste. Moreover, advancements in frozen food technology have led to improved packaging methods, ensuring the preservation of taste, texture, and nutritional value. However, this market is not without challenges. Stiff competition from fresh and canned fish and seafood presents a significant hurdle for market growth.

- Consumers often perceive fresh options to be of higher quality and more authentic in taste. Additionally, the perception of frozen food as less healthy than fresh alternatives can limit market penetration. Companies in the market must focus on addressing these consumer perceptions through targeted marketing and product innovation to capitalize on the growing demand for convenience and expand their market share.

What will be the Size of the Frozen Fish And Seafood Market during the forecast period?

- The market in the United States is a dynamic and expanding sector, driven by several key factors. Consumer lifestyle trends, such as health consciousness and convenience, have fueled the demand for high-quality, convenient, and time-saving food options. The market's size is substantial, with a significant portion of seafood and fish being consumed in frozen form. Microorganisms and food wastage are critical considerations in the frozen fish and seafood industry. Premium seafood companies are investing in advanced technologies to ensure the freshness and safety of their products. Culinary applications, such as meal planning and culinary experimentation, continue to drive innovation in the market.

- The frozen seafood products segment, including fish, shellfish, and aquatic delicacies, is a major contributor to the market's growth. The availability of a diverse range of offerings, from The Sirena's premium offerings to High Liner Foods' value-added options, caters to various consumer preferences and budgets. The frozen seafood market is a global industry, with export destinations spanning the globe. reports that the market is expected to grow at a steady pace, driven by increasing consumer awareness of the nutritional benefits of seafood, particularly its high protein content. The Frozen Food Leaders Association's Seafood Expo showcases the latest trends and innovations in the industry, attracting industry professionals and buyers from around the world.

- The MRFR database and other market research providers provide valuable insights into the market's size, growth, and direction.

How is this Frozen Fish And Seafood Industry segmented?

The frozen fish and seafood industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food processing industry

- Food service provider

- Retail and household

- Animal feed and pet food

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Germany

- Spain

- APAC

- China

- North America

- US

- South America

- Middle East and Africa

- Europe

By End-user Insights

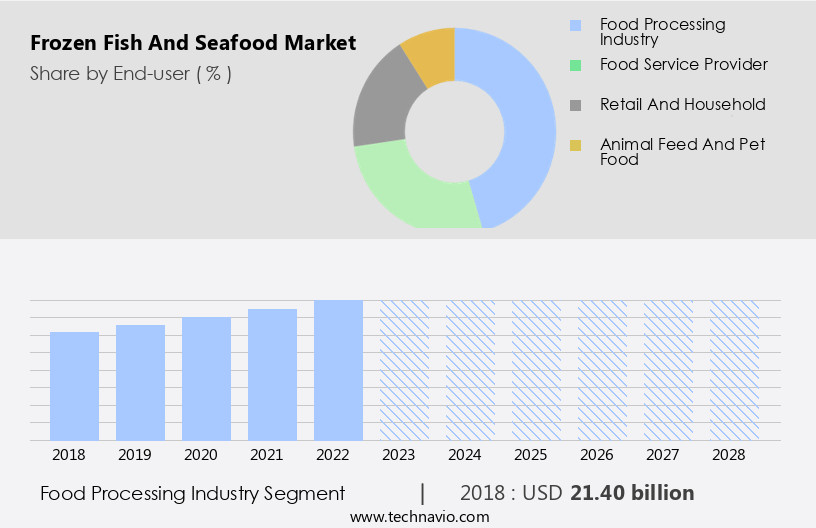

The food processing industry segment is estimated to witness significant growth during the forecast period.

The market encompasses the production and distribution of a diverse range of products, including fish fillets, shrimp, surimi, and crab meat. Processing techniques involve freezing, canning, packaging, and value-additions like marination, breading, and seasoning. This segment significantly contributes to market growth, transforming raw seafood into convenient, ready-to-eat options. Food processing companies prioritize innovation in processing technologies, sustainable practices, and new product development to cater to health-conscious consumers and regulatory requirements. Microorganisms are carefully managed during processing to ensure food safety assurance. Sustainability is a key focus, with companies adhering to sustainable fishing practices, eco-friendly fishing methods, and minimizing seafood wastage.

Shelf life is extended through packaging technologies, preserving the nutritious qualities of aquatic delicacies. Essential nutrients, such as minerals, proteins, vitamins, and omega-3 fatty acids, are preserved, making seafood a nutritious option. Culinary innovations and convenience are driving factors, with time-saving food options and convenience stores increasing the availability of frozen seafood products. Frozen fish and seafood companies cater to various retail channels, including departmental stores, B2B, and export destinations. Consumer lifestyles and demand for sustainable, lower-priced options have led to the growth of the market. The industry also includes the production of frozen mollusks, pre-cooked seafood, and ready-to-eat seafood.

Despite the convenience and benefits, food waste remains a concern, particularly in the raw frozen segment. The frozen food leader, High Liner Foods, and other players in the market are addressing this issue through defrosting processes and cold storage facilities.

Get a glance at the market report of share of various segments Request Free Sample

The Food processing industry segment was valued at USD 21.40 billion in 2018 and showed a gradual increase during the forecast period.

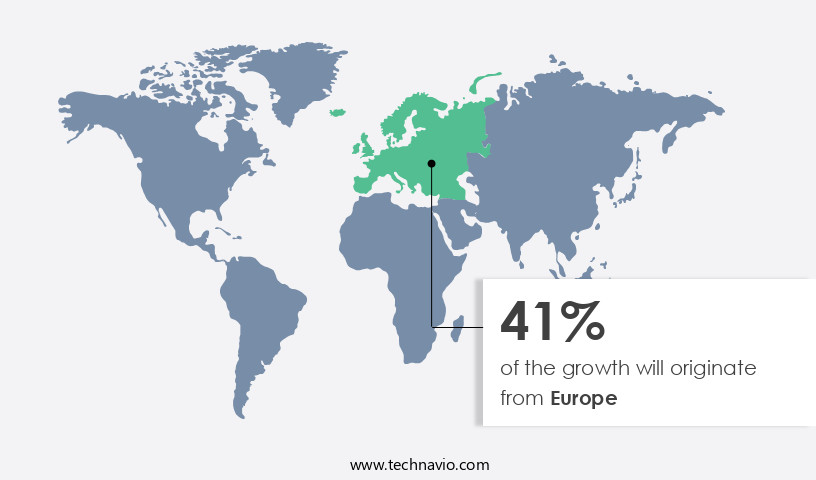

Regional Analysis

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European the market is experiencing growth due to the increasing demand for nutritious and sustainable seafood options. This trend is driven by consumer lifestyles that prioritize health consciousness and responsible food choices. Sustainability is a key factor in the market, with a focus on sustainable fishing practices and eco-friendly production methods. Seafood Expo events and fish farming bodies promote sustainable seafood options, reducing seafood wastage and ensuring food safety assurance. High Liner Foods and other frozen food leaders offer diverse product offerings, including frozen fish, mollusks, and crustaceans, with varying protein content and essential nutrients like omega-3 fatty acids.

Shelf life and packaging technologies enable the availability of time-saving food options for busy consumers. Culinary innovations and convenience have led to the popularity of pre-cooked seafood and ready-to-eat options. The market is subject to regulatory requirements and consumer expectations for transparency and traceability. Food safety concerns and product recalls have increased the importance of food safety assurance and the use of powder seaweed extracts as natural preservatives. Sustainable practices, such as cold storage facilities and transportation infrastructure, are essential to maintaining the quality and freshness of frozen seafood products. Despite these advancements, challenges remain, including food waste in the raw frozen segment and the need for defrosting processes.

The market is also influenced by environmental issues and the availability of shellfish and other aquatic delicacies in underdeveloped countries. Overall, the European the market is a dynamic and evolving industry, driven by consumer preferences and the need for sustainable and health-conscious options.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Frozen Fish And Seafood Industry?

- Growing desire for convenience is the key driver of the market.

- The demand for convenience foods, including frozen fish and seafood, is on the rise due to the busy lifestyles of consumers. companies in this market recognize the importance of convenience in making their products appealing to consumers, who are increasingly opting for packaged items. Whitefish species such as pollock, Alaska pollock, and pangasius are popular choices for convenience food products. Advancements in refrigeration technology, the growing number of single-person and smaller households, and an increasing number of working women contribute to the increasing demand for these types of convenient food options.

What are the market trends shaping the Frozen Fish And Seafood Industry?

- Innovation in frozen fish and seafood packaging is the upcoming market trend.

- The market is experiencing significant growth due to the increasing consumer preference for protein-rich, nutrient-dense foods. Seafood's high content of vitamins, minerals, and essential fatty acids has made it a popular choice for health-conscious consumers. To maintain the quality and freshness of fish and seafood, proper packaging is essential. This not only prevents spoilage but also attracts consumers with its eye-catching designs. In fact, companies are recognizing the importance of packaging in the market and offering various frozen fish and seafood options in appealing packaging.

- For instance, Lidl, a leading retailer, introduced eco-friendly packaging made from ocean-bound plastic in February 2020 for their seafood products in the UK. This innovative approach not only benefits the environment but also caters to consumers' demand for sustainable and high-quality seafood.

What challenges does the Frozen Fish And Seafood Industry face during its growth?

- Stiff competition from fresh and canned fish and seafood is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to increasing health consciousness and the convenience offered by these products. Consumers prefer frozen and canned fish and seafood for their long shelf life and ease of use. However, the perception that frozen food lacks the nutritional value of fresh produce is a challenge for market growth. indicates a global trend towards healthier eating, with a rise in the incidence of health issues such as diabetes, allergies, digestive disorders, and obesity. This shift in consumer behavior is driving demand for convenient, nutritious food options, including frozen fish and seafood.

- Despite the convenience and long shelf life, consumers often view frozen fish and seafood as less fresh than their fresh counterparts. However, advancements in freezing technology have significantly improved the quality and nutritional value of frozen fish and seafood, making them a viable alternative to fresh produce. In , the market is poised for growth due to increasing health consciousness, convenience, and advancements in freezing technology. While the perception of frozen food as less fresh remains a challenge, ongoing research and innovation in the industry are addressing this concern, making frozen fish and seafood a popular and nutritious choice for consumers.

Exclusive Customer Landscape

The frozen fish and seafood market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the frozen fish and seafood market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, frozen fish and seafood market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Austevoll Seafood ASA - The company specializes in the distribution of high-quality frozen fish and seafood, including salmon, catering to discerning consumers seeking authentic, sustainably sourced options. Our extensive selection ensures versatility for various culinary applications, providing a premium dining experience at home.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Austevoll Seafood ASA

- Faroese Seafood

- Freiremar SA

- Grieg Seafood ASA

- Lee Fish

- Lee Fishing Co.

- Metro Seafood Ltd.

- Midseas Ltd.

- Mowi ASA

- Nutreco N.V.

- Ocean Fresh Seafood

- Pescafresh

- Seattle Fish Co.

- Surapon Foods Public Co. Ltd.

- Tassal Group

- Tesco Plc

- Trident Seafoods Corp.

- Tropic Star Seafood Inc.

- True World Foods LLC

- Wm Morrison Supermarkets Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to experience significant growth due to the increasing demand for responsible food choices and nutritious options. Sustainability is a key factor driving this trend, as consumers become more conscious of the impact of their dietary decisions on ocean ecosystems. Frozen fish and seafood offer several advantages over fresh alternatives. Their longer shelf life allows for greater availability and accessibility, reducing food wastage. Additionally, advancements in packaging technologies and transportation methods enable the preservation of essential nutrients, including minerals and vitamins. The frozen fish market is diverse, encompassing a wide range of species from microorganisms to larger aquatic delicacies.

Frozen mollusks, crustaceans, and fish are popular choices, providing a rich source of protein and omega-3 fatty acids. Sustainable practices, such as eco-friendly fishing and fish farming, are increasingly important considerations for both producers and consumers. Consumer lifestyles have also influenced the market. Convenience is a major factor, with ready-to-eat and pre-cooked options becoming increasingly popular. Time-saving food options cater to busy consumers, while meal planning and culinary innovations offer new and exciting ways to incorporate frozen seafood into daily meals. Regulatory requirements and food safety assurance are essential aspects of the market. Ensuring compliance with regulatory standards and implementing food safety measures are crucial for maintaining consumer trust and confidence.

The market is a dynamic and competitive landscape. Leading companies are investing in sustainable practices, innovative packaging technologies, and culinary applications to differentiate themselves from competitors. databases provide valuable insights into production capacity, consumer trends, and competitive landscape. Despite the many advantages of frozen fish and seafood, challenges remain. Food safety concerns and product recalls can negatively impact consumer trust and market growth. Sustainable sourcing and responsible production methods are essential to mitigate these risks and maintain the long-term viability of the market. In , the market is a dynamic and growing industry, driven by consumer demand for nutritious, sustainable, and convenient food options.

Advancements in technology and transportation infrastructure, combined with a focus on responsible sourcing and production, will continue to shape the market's future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.07% |

|

Market growth 2024-2028 |

USD 34.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.26 |

|

Key countries |

US, France, Germany, China, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Frozen Fish And Seafood Market Research and Growth Report?

- CAGR of the Frozen Fish And Seafood industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the frozen fish and seafood market growth of industry companies

We can help! Our analysts can customize this frozen fish and seafood market research report to meet your requirements.