Colombia Fruit and Vegetable Market Forecast 2022-2026

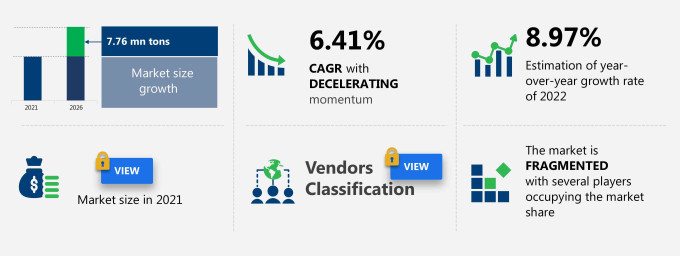

The fruit and vegetable market share in Colombia is expected to increase by 7.76 million tons from 2021 to 2026, at a CAGR of 6.41%.

The market report also offers information on several market players, including Alnattural SAS, Bron Fruit, CI Agrofrut SA, Del Monte Food Inc., Fruti Reyes, FRUVECO S.A., Greenyard NV, KING FRUITS COMPANY S.A.S., and Listo & Fresco Ltda. among others.

What will be the Fruit and Vegetable Market Size in Colombia During the Forecast Period?

Download the Free Report Sample to Unlock the Market Size in Colombia for the Forecast Period and Other Important Statistics

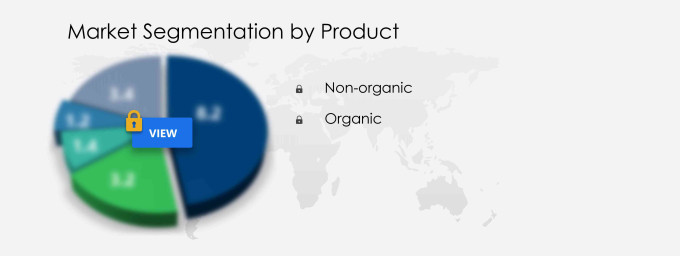

"Most fruits and vegetables that are available in Colombian supermarkets and shops are non-organic in nature"

Market Dynamics

The strong distribution networks driving the Colombian fresh produce sector is notably driving the market growth in Colombia, although factors such as increased chances of food contamination may impede the market growth. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Market Driver

The strong distribution networks driving the Colombian fresh produce sector is one of the key drivers supporting the market growth in Colombia. With the changing food preferences, consumers in Colombia are willing to pay higher prices for a variety of products that are fresh, high quality, tasty, safe, and convenient. On the other hand, hypermarkets and supermarkets have recently focused on integration. Almacenes Exito, CarullaVivero, Carrefour, Supertiendas Olimpica, Alkosto, Makro, Cafam, Colsubsidio, La 14, Surtifruver are the major hypermarkets in Colombia. Thus, these retail chains are expanding rapidly, thereby strengthening the distribution links for fresh produce, including fruit and vegetables, in the domestic market.

Key Market Trend

The rising demand for smart agricultural practices is another factor supporting the market growth in Colombia. Practices such as precision farming are anticipated to provide high returns for agricultural products used at full potential. The use of modern technologies such as mapping software, variable rate technology (VRT), yield mapping software, and data management software in agricultural operations can help improve land fertility and profitability, promote sustainable agriculture, maximize productivity, and reduce the costs related to agricultural activities. Improving business efficiency through process automation and increasing output through reduced agricultural costs are two crucial factors that promote the deployment of smart agricultural tools. Such factors may drive the market growth during the forecast period.

Significant Market Challenge

The increased chances of food contamination is hindering the market growth in Colombia. Fresh produce, including fruits and vegetables, have higher chances of containing bacteria, viruses, and others especially if they are cultivated non-organically using chemicals and fertilizers. As a result, certain people are likely to get sick or to have a severe illness. These contaminants have several ways of entering the supply chain and making fruits and vegetables unfit for human consumption. Thus, long-term exposure can affect the human immune system and adversely affect normal development or cause cancer. Such increased chances of food contamination may hinder the market growth during the forecast period.

This market in Colombia analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the market growth and trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Who are the Major Fruit and Vegetable Market Companies In Colombia?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alnattural SAS

- Bron Fruit

- CI Agrofrut SA

- Del Monte Food Inc.

- Fruti Reyes

- FRUVECO S.A.

- Greenyard NV

- KING FRUITS COMPANY S.A.S.

- Listo & Fresco Ltda.

This statistical study of the market in Colombia encompasses successful business strategies deployed by the key vendors. The market in Colombia is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Del Monte Food Inc. - The company offers products such as canned fruits and vegetables.

The market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the packaged foods and meats market include the following core components:

- Inputs

- Inbound logistics

- Primary processing

- Secondary and tertiary processing

- Outbound logistics

- End-customers

- Marketing and sales

- Services

- Innovations

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Product Segments in the Fruit and Vegetable Market in Colombia?

To gain further insights on the market contribution of various segments Request for a FREE sample

The market share growth by the non-organic segment will be significant during the forecast period. Fruit and vegetables that are non-organic usually include those that are cultivated traditionally, with most of them grown with the use of fertilizers and pesticides, while some may also be genetically modified. Most fruits and vegetables that are available in supermarkets and shops are non-organic. Such easy availability of non-organic fruits and vegetables may drive the segment growth during the forecast period.

Market Analyst Overview

The Market encompasses a wide range of products, including bananas, mangoes, pineapples, papayas, strawberries, avocados, potatoes, tomatoes, peppers, and onions. These products are essential components of a balanced diet, contributing to nutritional balance for consumers. In the agricultural sector, farmers play a crucial role in producing these fruits and vegetables. To support farmers, credit schemes are often implemented to help them invest in their crops and increase their yield.

Consumer groups play a significant role in driving the consumption of fruits and vegetables, with preferences varying for bananas, lemons, limes, berries, oranges, and pineapples. Additionally, the market for minimally processed juices, beverages, and smoothies is growing, reflecting consumer food preferences for healthy and convenient options. Retail food players, distributors, and retailers are key players in the distribution channels for fresh produce. The market is also influenced by organizations like the Food and Agriculture Organization (FAO), which provide insights and guidance on market trends and metrics such as metric tons of produce exported. Export markets play a crucial role in the demand for fruits and vegetables, driving the need for quality products and sustainable farming practices, reducing reliance on agrochemicals.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 6.41% |

|

Market growth 2022-2026 |

7.76 mn tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

8.97 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alnattural SAS, Bron Fruit, CI Agrofrut SA, Del Monte Food Inc., Fruti Reyes, FRUVECO S.A., Greenyard NV, KING FRUITS COMPANY S.A.S., and Listo & Fresco Ltda. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market research report has not included the data you are looking for, you can reach out to our analysts and get customized segments. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2022 and 2026

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch