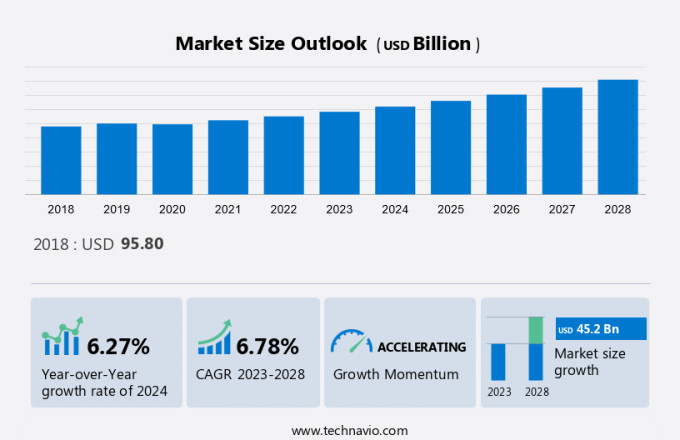

Furniture Logistics Market Size 2024-2028

The furniture logistics market size is forecast to increase by USD 45.2 billion, at a CAGR of 6.78% between 2023 and 2028. Market growth relies on several factors, including the increasing demand for furniture in residential and commercial settings, the rising disposable income among consumers in emerging economies, and the growing inclination towards modular furniture and customized designs. The surge in furniture requests across diverse domains underscores its significance in enhancing living and working environments, propelling market expansion. Additionally, the escalating disposable income in emerging nations amplifies purchasing power, driving demand for quality furniture products. Moreover, the mounting preference for modular furniture and personalized designs reflects evolving consumer tastes and lifestyle preferences, spurring innovation within the industry. These interconnected elements collectively contribute to the expansion of the furniture market, catering to diverse needs and driving innovation in design and functionality.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics

In the dynamic landscape of e-commerce, Furniture Logistics emerges as a vital component, navigating the complexities of network design and project logistics. From cargo insurance to storage solutions and last-mile delivery, it ensures seamless operations in delivering premium quality furniture. Embracing sustainable logistics practices and leveraging digitalization and data analytics, the industry optimizes inventory management and enhances efficiency. With the aid of delivery drones and autonomous vehicles, it addresses the challenges of network planning and real-time tracking systems, ensuring timely deliveries. As the furniture industry intersects with economic corridors and tourism, Furniture Logistics plays a pivotal role, supported by green logistics practices and innovative technologies like RFID tags. In presentations and business plans, it pitches a vision of streamlined operations and unparalleled customer satisfaction. Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver - Increasing demand for furniture from the residential and commercial sectors

This is due to increasing consumer disposable income, economic growth, and rising levels of urbanization along with changing lifestyle patterns of the middle class who seek furniture pieces that meet their personal style and taste. For instance, consumers who are environmentally conscious are increasingly demanding eco-friendly furniture.

Moreover, workplaces are transforming due to the recognition of the importance of productive and collaborative work environments, in which furniture plays a part and influences interaction and productivity. There is also greater ease of furniture shopping through e-commerce platforms with a wide variety of furniture designs, styles, prices, features, and the option of doorstep delivery services as well. Hence, these factors are likely to result in the growth of the global furniture logistics market during the forecast period.

Significant Market Trends - Rising usage of advanced technology to optimize supply chain management

Automation, AI, and predictive analytics are transforming supply chain management and optimization, improving the efficiency of their core business activities. For instance, IKEA has cut costs by 20% by dependence on automated systems, such as warehouse management systems (WMS) to streamline their processes and manage their warehouse operations.

Further, AI-based forecasting systems can analyze sales data and trends, incorporate customer feedback, and forecast demand with greater accuracy. Yet another innovation, predictive analytics can also result in massive cost savings by utilizing weather forecasts, traffic data, and social media trends. It then forecasts demand, reducing delivery times and providing a better customer experience. Hence all the above factors are likely to propel the growth of the market during the forecast period.

MajorMarket Challenge - High cost of transportation and logistics

The high cost of transportation directly impacts the profitability of the global furniture logistics market and is due to the large costs of transporting large, bulky, and often fragile furniture items across long distances. One more factor that adds to this cost is the rising cost of fuel which results in transportation costs increasing even further. As a result, the end price that the consumer bears is also increased.

Additionally, the cost of heavy transport equipment such as large trucks, cranes, forklifts, and loading docks and the cost of manual labor used in the transportation process is also high increasing the total logistics costs. Hence, these features of furniture transportation are likely to negatively impact the global furniture logistics market during the forecast period

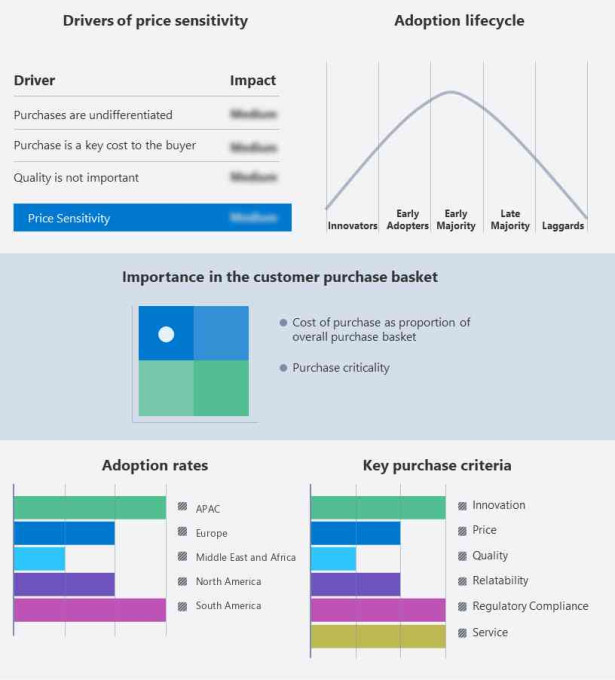

Key Market Customer Landscape

The market forecast report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Anton Rohr GmbH and Co. KG - The company offers furniture logistics services such as cabinet furniture logistics, upholstered furniture logistics, and warehouse logistics.

- D.B. GROUP Spa - The company offers furniture logistics solutions such as FCL and LCL sea and air consignments, and daily departures for Europe and Russia.

The research report also includes detailed analyses of the competitive landscape of the market and information about 21 market companies, including:

- ASHLEY LOGISTICS SOLUTIONS LTD.

- Asian Logistics Agencies Srl

- Barrett Distribution Centers

- Bocker Maschinenwerke GmbH

- CITYXFER

- ColliCare Logistics AS

- DACHSER and KOLB

- DB Schenker

- Deutsche Post AG

- FOCUS FURNITURE LOGISTICS

- Gebr. Roggendorf GmbH

- Homepack Smart Logistics

- Noatum Holdings SLU

- Rohlig Logistics GmbH and Co. KG.

- Savino Del Bene Spa

- Trans.INFO Sp z o o

- Trasporti Internazionali Transmec SPA

- Warehouse Specialists, LLC

- Xp log

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

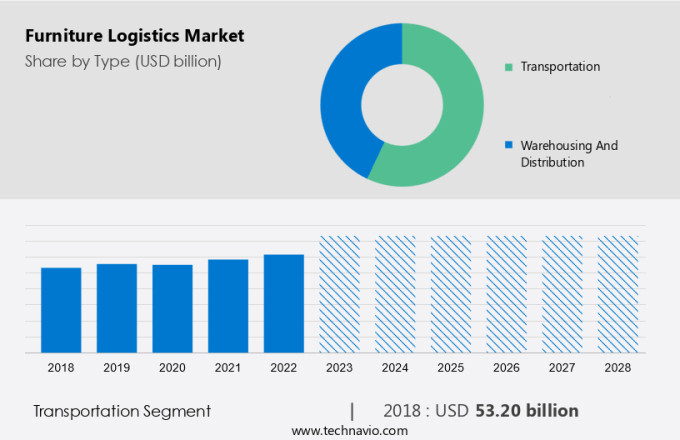

By Type

The market share growth by the transportation segment will be significant during the forecast period. Out of the various modes of transportation available, air transportation is preferred for the long-distance transportation of high-value, low-volume furniture items. Sea transportation is also a cost-effective method for the transportation of large shipments of furniture, especially for large shipments. When it comes to domestic transportation, land transportation by road and rail is preferred.

Get a glance at the market contribution of various segments Request Free PDF Sample

The transportation segment showed a gradual increase in the market share of USD 53.20 billion in 2018. Companies are seeking out innovations to further optimize transportation and delivery, to ensure fast, cost-effective, and environmentally friendly services to their customers, such as Amazon investing in electric vehicles (EVs) for transporting furniture. Hence, the above factors are likely to boost the growth of this segment of the global furniture logistics market during the forecast period.

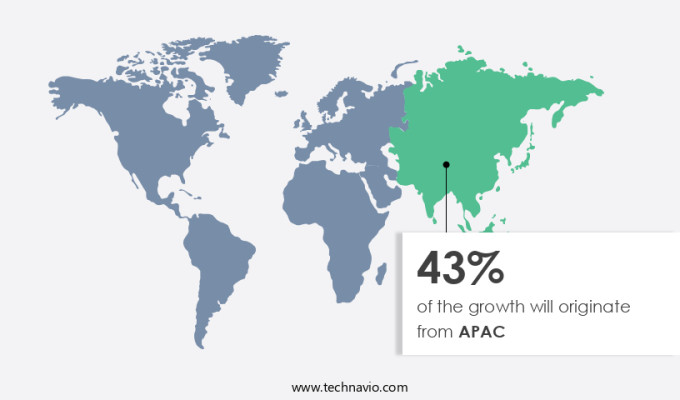

By Region

For more insights on the market share of various regions Request Free PDF Sample now!

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period. APAC is a huge global player in the global furniture logistics market with some of the world's largest economies including China, Japan, and India. Part of the reason this is observed is due to the high population in this region with more than four billion people living in the region and forming a large market for furniture manufacturers and retailers. Particularly, China and India have seen an increase in the disposable income of their middle-class population, low labor costs, and various furniture outlets. Furthermore, the shifting trend towards E-commerce is also likely to propel the growth of the regional furniture logistics market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- Transportation

- Warehousing

- Distribution

- End-user Outlook

- Furniture factory

- Furniture distributor

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also interested in below market reports:

-

Online Furniture Market: Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, UK, Germany - Size and Forecast

-

India - Office Furniture Market: Analysis by End-user, Distribution Channel, and Product - Forecast and Analysis

-

Furniture Market: Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, Japan, UK - Size and Forecast

Market Analyst Overview

In the ever-evolving realm of e-commerce, Furniture Logistics emerges as a cornerstone, integrating freight forwarding and customs brokerage to streamline operations. With a focus on warehouse infrastructure and core capabilities, logistics providers cater to the growing demand for goods and services in the digital era. As consumer behavior shifts towards Internet furniture sales, logistics machines and route optimization software optimize efficiency in delivery networks. The real estate industry plays a pivotal role, providing essential office spaces for logistics operations and brick-and-mortar stores. Leveraging data and analytics, the industry embraces digitization to enhance performance and meet the demands of luxury furniture consumers. By understanding spending power and trends, Furniture Logistics aligns with consumer preferences, ensuring timely delivery of raw materials and finished products. Amidst the focus on energy efficiency and sustainability, the market continues to innovate, driven by its core strengths and commitment to improvement.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 45.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.27 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 43% |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anton Rohr GmbH and Co. KG, ASHLEY LOGISTICS SOLUTIONS LTD., Asian Logistics Agencies Srl, Barrett Distribution Centers, Bocker Maschinenwerke GmbH, CITYXFER, ColliCare Logistics AS, D.B. GROUP Spa, DACHSER and KOLB, DB Schenker, Deutsche Post AG, FOCUS FURNITURE LOGISTICS, Gebr. Roggendorf GmbH, Homepack Smart Logistics, Noatum Holdings SLU, Rohlig Logistics GmbH and Co. KG., Savino Del Bene Spa, Trans.INFO Sp z o o, Trasporti Internazionali Transmec SPA, and Warehouse Specialists, LLC |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.