Game Streaming Market Size 2024-2028

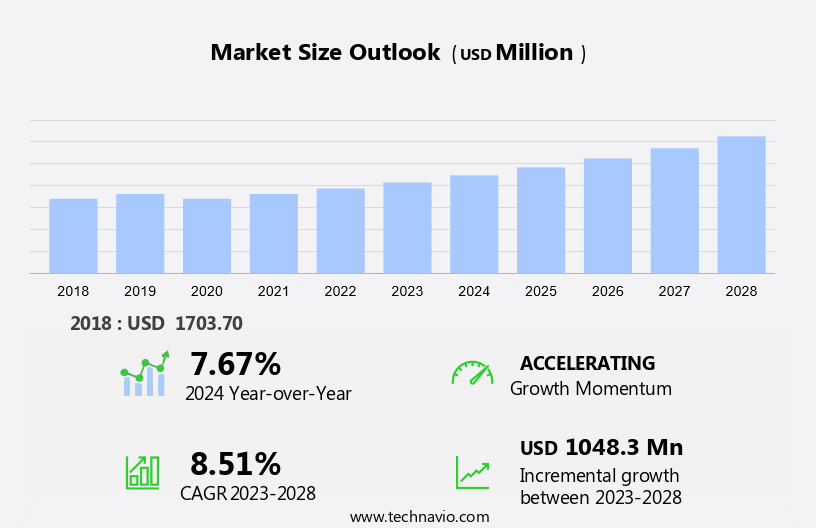

The game streaming market size is forecast to increase by USD 1.05 billion at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends. One notable trend is the increasing popularity of eSports tournaments, which have gained massive followings and sponsorships from major brands. Another trend is the growing demographic of women gamers, who now represent a substantial portion of the gaming community. Additionally, the health benefits of gaming, such as improved cognitive function and stress relief, are increasingly being recognized. These factors, among others, are fueling the growth of the market. However, challenges remain, including the need for high-speed internet connections and the potential for addiction and negative health effects. Despite these challenges, the market is poised for continued expansion as technology advances and gaming becomes more mainstream.

What will be the Size of the Game Streaming Market During the Forecast Period?

- The market is experiencing significant growth and transformation, driven by the growth in popularity of game streaming services and the mobile gaming sector. Major players in this market include Facebook Gaming and YouTube Gaming, which leverage their extensive user bases to offer live streaming and on-demand content. Cloud gaming platforms, such as Microsoft xCloud and Google Stadia, are revolutionizing the industry by enabling users to play high-quality games without the need for expensive hardware. Traditional gaming companies, like PlayStation and Xbox, have entered the fray with their respective streaming services, PlayStation Plus and Xbox Game Pass. The market's size is projected to expand as technological development and infrastructure improvements facilitate smoother delivery of streaming content.

- Content acquisition remains a key focus, with popular titles like League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire attracting large audiences. Content creation and monetization options are also crucial, with streaming platforms providing tools and monetization options for content creators to engage their audiences effectively. The role of the YouTube network and other live streaming tools in this ecosystem cannot be overlooked, as they offer a significant reach and influence on consumer behavior. Overall, the market is poised for continued growth and innovation, fueled by the intersection of technological advancements and evolving consumer preferences.

How is this Game Streaming Industry segmented and which is the largest segment?

The game streaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Revenue Stream

- In-game advertising

- Subscription

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Revenue Stream Insights

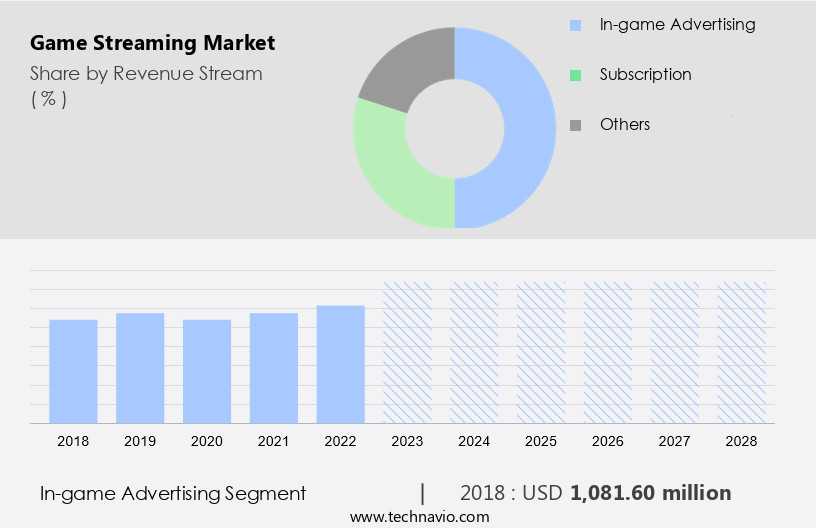

- The in-game advertising segment is estimated to witness significant growth during the forecast period.

The market experienced substantial growth in 2021, with in-game advertising emerging as the largest segment. This trend is anticipated to continue during the forecast period, fueled by the increasing popularity of social media and mobile gaming. In-game advertising integrates advertisements into desktop and mobile games through various formats such as ads, clips, billboards, and backdrop displays. These non-interruptive advertisements offer a smoother gaming experience for players while delivering stronger audio-visual effects for viewers. As the mobile gaming sector continues to expand, driven by smartphone penetration rates and the availability of high-speed connectivity, game streaming services like Facebook Gaming, YouTube Gaming, Microsoft xCloud, Google Stadia, PlayStation Plus, Xbox Game Pass, League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire are investing in strategic efforts to enhance their content delivery and monetization options.

Key technological developments, including the deployment of 5G networks by providers such as Optus and Pentanet, are further boosting the growth of the market. Content creators leverage live streaming tools like those offered by the YouTube network to engage audiences and monetize their content through platforms like Social Blade, where influencers like Germán Alejandro (JuegaGerman) and Garmendia Aranis have amassed significant followings.

Get a glance at the Game Streaming Industry report of share of various segments Request Free Sample

The in-game advertising segment was valued at USD 1.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

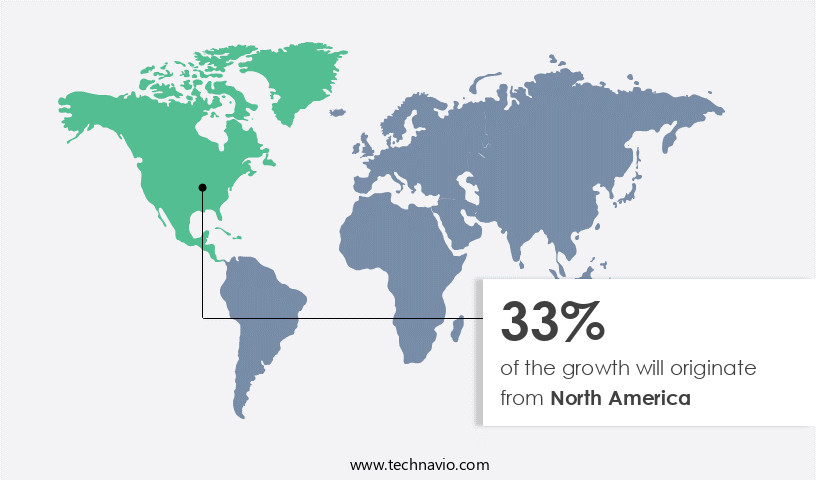

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American region dominates The market in 2023, driven by high-speed internet access and increased demand for at home entertainment due to lockdowns. The US market leads the way with significant revenue generation and popular game streaming services such as Steam Link, Remotr, and Rainway. Major companies' presence and penetration fuel the market's growth. In North America, cloud gaming, including services like Microsoft xCloud, Google Stadia, and PlayStation Plus, as well as mobile gaming on platforms like Facebook Gaming, YouTube Gaming, and mobile games such as League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire, are strategic efforts to expand market reach. The integration of 5G networks from providers like Optus and Pentanet enhances delivery and content creation capabilities. Monetization options, audience engagement, and live streaming tools, including YouTube network and social media platforms, provide opportunities for content creators using tools like Streamlabs, Germán Alejandro, and Garmendia Aranis.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Game Streaming Industry?

Increasing popularity of eSports tournaments is the key driver of the market.

- The market is experiencing significant growth due to the increasing popularity of eSports tournaments. These tournaments, which involve professional gamers competing in multiplayer video games through online platforms, have gained a massive following worldwide. The removal of time and location constraints makes eSports accessible to a global audience. Major technology companies, including Intel, MSI, and Logitech, are sponsoring these tournaments, attracted by the large prize pools and the potential to engage with the gaming community. The trend is driven by the widespread adoption of mobile devices and high-speed internet access, enabling cloud gaming and streaming on the go.

- Content creation and delivery through streaming platforms like Facebook Gaming, YouTube Gaming, Microsoft xCloud, Google Stadia, PlayStation Plus, Xbox Game Pass, and League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire are key market dynamics. Monetization options for content creators, audience engagement through live streaming tools, and strategic efforts to leverage 5G networks by providers like Optus and Pentanet further fuel market growth. Content creators benefit from tools and monetization options provided by streaming platforms and social media networks, such as YouTube and Social Blade, to engage their audiences and generate revenue. The visual style and local content characteristics of console games and mobile games continue to attract a diverse audience, driving the growth of the market.

What are the market trends shaping the Game Streaming Industry?

Growing popularity of gaming among women is the upcoming market trend.

- The mobile gaming sector has witnessed significant growth, attracting a more diverse gaming audience. Traditionally, males have dominated the gaming industry. However, the emergence of mobile gaming has led to an increase in female gamers. As of 2021, around 45% of US gamers are female, a figure projected to rise. This demographic shift is expected to positively impact gaming sales, including merchandise, software, and hardware. Game streaming services, such as Facebook Gaming and YouTube Gaming, have contributed to the expansion of the gaming audience. Technological development and infrastructure improvements, including high-speed connectivity, have facilitated the growth of cloud gaming platforms like Microsoft xCloud and Google Stadia. Popular mobile games like PUBG Mobile, Clash Royale, and Free Fire have attracted a massive following, with female gamers accounting for a significant portion.

- Console games, such as PlayStation and Xbox, have also seen an increase in female players, with franchises like League of Legends, Dota 2, and Grand Theft Auto reporting growth in this demographic. Content creation and delivery through streaming platforms on the YouTube network have become essential tools for monetization and audience engagement. Content creators like Germán Alejandro (JuegaGerman) and Garmendia Aranis have amassed large followings, demonstrating the potential for monetization In the gaming industry. As the gaming industry continues to evolve, strategic efforts to cater to the needs of the growing female gaming population, such as local content creation and delivery, will be crucial for success. The advent of 5G networks and the increasing smartphone penetration rate are expected to further fuel the growth of mobile gaming.

What challenges does the Game Streaming Industry face during its growth?

Effects of gaming on health is a key challenge affecting the industry growth.

- The mobile gaming sector is experiencing significant growth, with game streaming services such as Facebook Gaming and YouTube Gaming gaining popularity. Technological development and infrastructure advancements have enabled cloud gaming through platforms like Microsoft xCloud and Google Stadia. Subscription services like PlayStation Plus and Xbox Game Pass offer access to console games on mobile devices, expanding the market. Mobile games, including League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire, have high engagement levels. The increasing smartphone penetration rate and high-speed connectivity are fueling the market's growth. Strategic efforts from content creators, utilizing live streaming tools like those on the YouTube network, are monetizing their audiences through platforms like Social Blade and tools provided by Germán Alejandro, Garmendia Aranis, and JuegaGerman.

- However, concerns about health issues, such as physical inactivity, eye strain, and unhealthy eating patterns, are limiting gaming hours for some individuals. As a result, the market dynamics are shifting towards creating local content that caters to diverse visual styles and audience engagement. Content creation, delivery, and monetization options remain crucial for market growth. The advent of 5G networks from providers like Optus and Pentanet is expected to further enhance the gaming experience and expand the market.

Exclusive Customer Landscape

The game streaming market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the game streaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, game streaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Bigo Technology

- BoomTV Inc.

- Douyu Network Technology Co. Ltd.

- Genvid Holdings Inc.

- GosuGamers

- Hatch Entertainment Oy

- Meta Platforms Inc.

- Mobcrush Streaming Inc.

- Netflix Inc.

- NVIDIA Corp.

- Omlet Inc.

- Parsec Cloud Inc.

- Sliver VR Technologies Inc.

- Sony Group Corp.

- SOOP Co. Ltd.

- Viki

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, as technological development and infrastructure advancements have made cloud gaming more accessible to a wider audience. This trend is particularly noticeable In the mobile gaming sector, where game streaming services have gained traction among consumers seeking to play high-quality games on their mobile devices. Internet access has become a crucial factor In the proliferation of game streaming services. With the increasing availability of high-speed connectivity, users can now enjoy real-time, seamless gameplay experiences without the need for extensive downloads or large storage capacities. This has led to an influx of new players In the market, including tech giants such as Facebook Gaming and YouTube Gaming. The strategic efforts of these companies to acquire content and engage with content creators have been instrumental In their success. They have provided creators with tools and monetization options, enabling them to reach larger audiences and generate revenue through live streaming and other channels. The YouTube network, for instance, has become a popular platform for content creators, with prominent figures such as Germán Alejandro and Garmendia Aranis (Juegagerman) amassing millions of followers.

The visual style and local content characteristics of streaming platforms have also played a role In their appeal. For instance, console games have found a new audience on mobile devices, with titles such as League of Legends, Dota 2, PUBG Mobile, Clash Royale, and Free Fire attracting millions of players. These games offer a more interactive experience than traditional mobile games, making them a viable alternative for those seeking a more engaging gaming experience. The emergence of 5G networks is expected to further fuel the growth of the market. Optus and Pentanet, among others, have already begun rolling out 5G services in various regions, promising faster download and upload speeds, lower latency, and more stable connections. These advancements will enable game streaming services to offer even more realistic and responsive gameplay experiences, potentially attracting even more users to the platform.

Thus, the market is poised for continued growth, driven by technological development, infrastructure improvements, and the strategic efforts of major players. The availability of high-speed connectivity and the appeal of console games on mobile devices have made game streaming an increasingly popular option for gamers worldwide. As 5G networks become more widespread, we can expect to see even more innovation and growth in this exciting and dynamic market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 1.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Game Streaming Market Research and Growth Report?

- CAGR of the Game Streaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the game streaming market growth of industry companies

We can help! Our analysts can customize this game streaming market research report to meet your requirements.